What Is The Property Tax Exemption For Over 65 In Florida

If you are 65 years of age or older were living on your homestead property as of Jan. The existing exemption not exceeding 50000 to any person who has the legal or equitable title to real estate and maintains thereon the permanent residence of the owner and who has attained age 65 and whose household income does not exceed 31100.

Https Escambiataxcollector Com Document Property Tax Benefits For Active Duty Military And Veterans

It is granted to those applicants who possess title to real property and are bona fide Florida residents living in the dwelling and making it their permanent home on January 1.

What is the property tax exemption for over 65 in florida. Floridas constitution provides for a 25000 exemption which is deducted from a propertys assessed value if the owner qualifies. Applicants who timely file by March 1 possess title to the real property and are bona fide Florida residents living in the dwelling and making it their permanent home as of January 1 qualify for the exemption. This exemption applies to all property taxes including those related to your school district.

A person may be eligible for this exemption if he or she meets the following requirements. This is an additional exemption of up to 25000 which may be adopted by the county and cities for qualified persons age 65 and over. Exemption for longtime limited-income seniors.

Or An exemption equal to the assessed value of the property to an owner who has title to real. If you are 65 years old or older and have had a permanent Florida residence for at least 25 years you might be entitled to a 100 exemption. Exemptions and special classifications in Escambia County.

The tax savings from a 40000 exemption where this tax rate is 2 would be 800. You must meet the minimum age for a senior property tax exemption The person claiming the exemption must live in the home as their primary residence The. The senior property tax exemption is just 8000 in Cook County Illinois and this is actually an increase up from 5000 in 2018.

Your eligibility for this exemption depends on the county or city where you live and your income must be below a specified limit. If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled homeowners the owner must choose one or the other for school district taxes. For the first 50000 in assessed value of your home up to 25000 in value is exempted.

Any taxing unit including a city county school or special district may offer an exemption of up to 20 percent of a residence. You pay full taxes on any value between 25000 and 50000. Still not a bad chunk of change.

Property Tax Exemptions Available to Limited-Income Seniors in Florida If youre 65 or older who youve lived in Florida for at least 25 years you may be eligible for up to 100 percent property tax exemptions. Homestead Exemption is a constitutional benefit of up to a 50000 exemption removed from the assessed value of your property. Regular Homestead Exemption Additional Homestead Exemption Over 65 Senior Homestead Exemption WidowWidower Exemption Medical Disability Exemption Veteran Partial Disability Exemption Total Disability Exemption Veterans Total Disability Exemption Veterans Discount Military Homestead Exemption Assessment Reduction for.

You have to make application for the exemption between January 1 of the previous year and March 1 of the year you want the exemption. If you receive the over 65 or surviving spouse deduction you will receive a reduction in your homes assessed value of 12480 or half the assessed value whichever is less. And Cook County does things a bit differently so its technically not an exemption but its a bit of a tax break all the same.

The owner cannot receive both exemptions. The Martin County Board of Commissioners adopted an additional homestead exemption of 25000 of assessed value to be exempted from county taxes for. An exemption not exceeding 50000 to any person who has the legal or equitable title to real estate maintains permanent residence on the property is 65 or older and whose household income does not exceed the household income limitation.

Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and Form DR-501SC see section 1960752 Florida Statutes. The lower the assessed value of your home the smaller your property tax bill. 1 of the year you file for this exemption and had household income less than the amount set by the Florida Department of Revenue about 30000 you may be eligible for.

Over 65 or Surviving Spouse Deduction. There are some limits to this exemption though including You must live in certain areas of the sate.

Thinking Of Investing In Florida Real Estate Short Term Rentals In 2019 Here Are The 10 Best Places In Vacation Homes In Florida Vacation Home Florida Rentals

Thinking Of Investing In Florida Real Estate Short Term Rentals In 2019 Here Are The 10 Best Places In Vacation Homes In Florida Vacation Home Florida Rentals

Http Images Kw Com Docs 1 2 6 126353 1237575345962 Requirements For Homestead Exemption Pdf

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

How To Calculate Property Taxes Real Estate Scorecard

How To Calculate Property Taxes Real Estate Scorecard

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax South Dakota States

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax South Dakota States

How Do I Register For Florida Homestead Tax Exemption

How Do I Register For Florida Homestead Tax Exemption

Florida Property Taxes Your Guide To Filing For Homestead Exemption

Florida Property Taxes Your Guide To Filing For Homestead Exemption

Exemptions Hardee County Property Appraiser

Exemptions Hardee County Property Appraiser

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

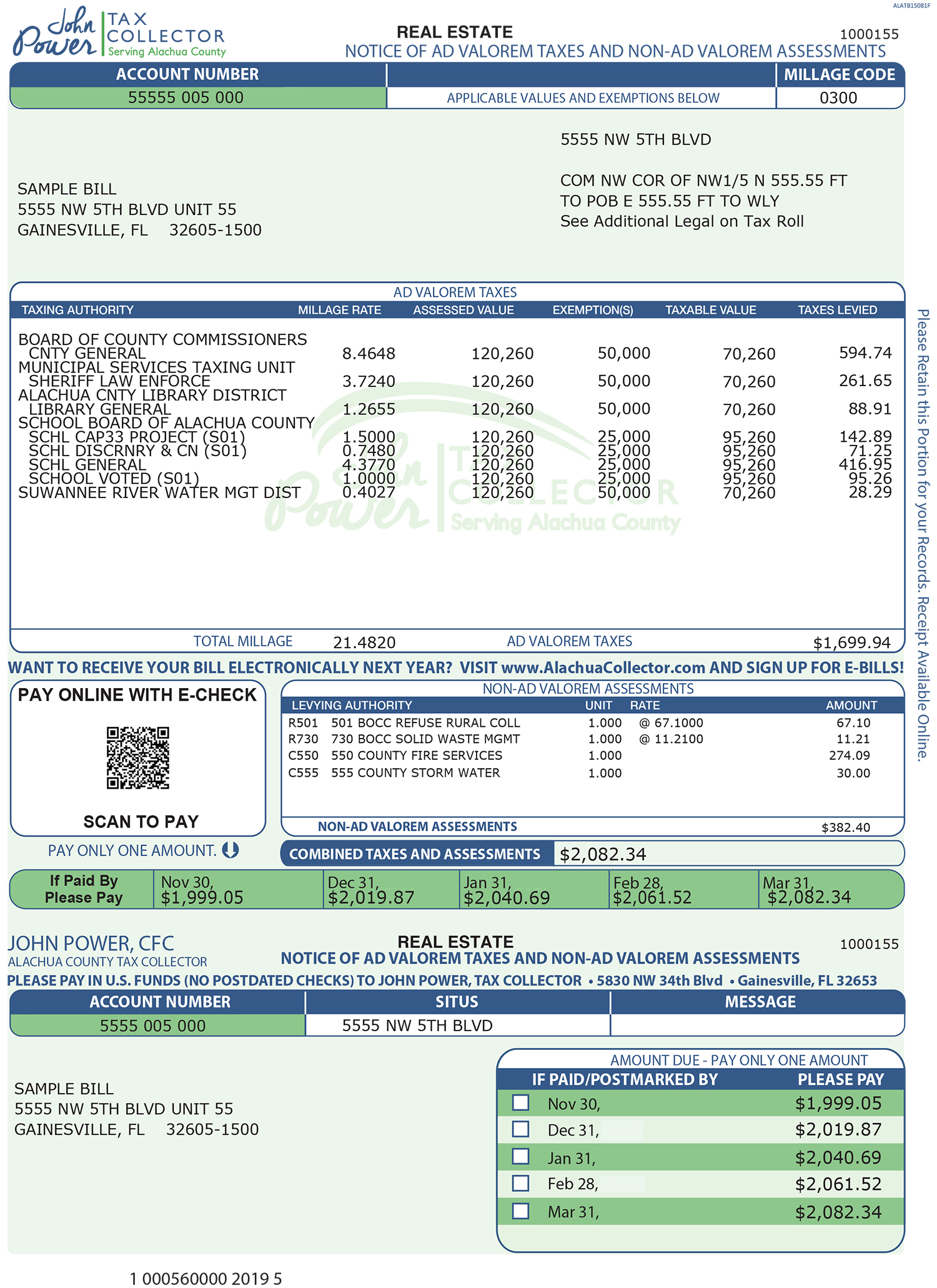

A Guide To Your Property Tax Bill Alachua County Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Https Www Polkpa Org Downloads Files Life Events Pdf V 0002

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

How To File A Homestead Exemption Collier County Florida Saving Money On Property Taxes

How To File A Homestead Exemption Collier County Florida Saving Money On Property Taxes

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home