Can I Apply For Texas Homestead Exemption Online Collin County

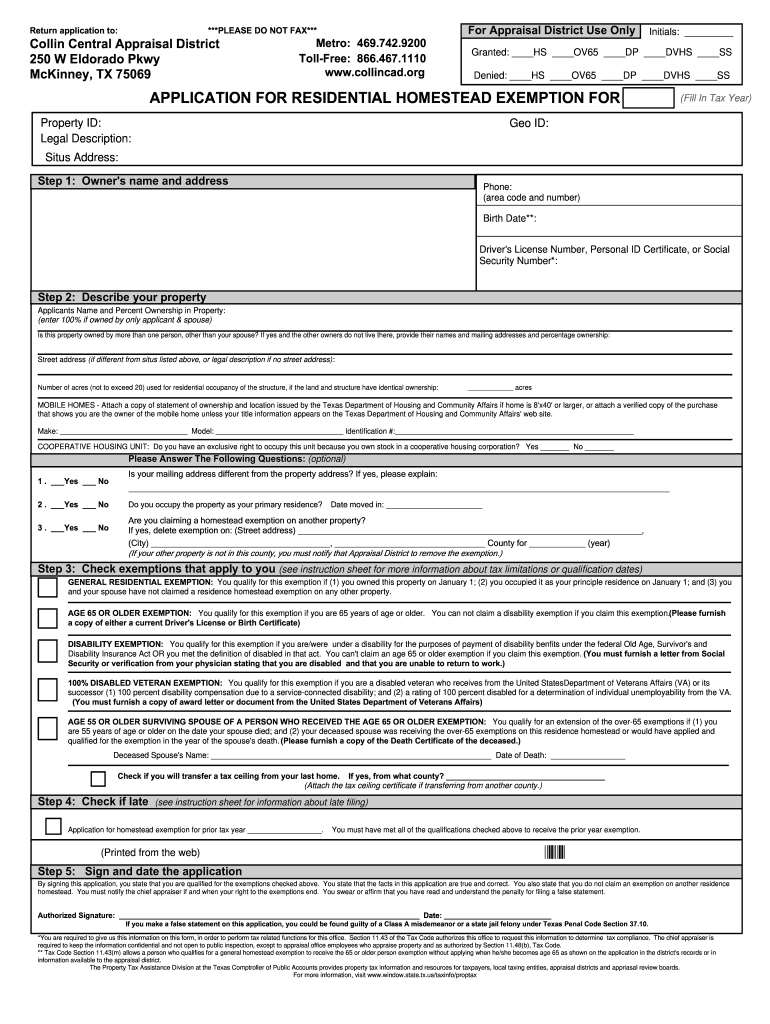

Download Form You can download the homestead exemption form with the following link. There is no fee to file the homestead exemption form.

What You Need To Know About Homestead Exemptions Robson Resales

For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in of the year for which you are requesting an exemption.

Can i apply for texas homestead exemption online collin county. If you qualify for an age 65 and over homestead exemption provided in Tax Code 1113c delinquency date for the taxes on the homestead. Save or instantly send your ready documents. If your other property is not in Collin County you must notify that counties Appraisal District to remove the exemption.

Central Appraisal District of Collin County 250 W. To apply for the homestead exemption download and print the Residential Homestead Exemption Application and mail the completed application to. Please refer to the Comptrollers publication Texas Property Tax Exemptions PDF for more information about these exemptions.

Application for Exemption for Vehicle Used to Produce Income and for Personal Activities. You may have an application mailed to you by calling our Customer Service Department at 469 742-9200. If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax.

Easily fill out PDF blank edit and sign them. The date of occupancy on your residence. Wise County.

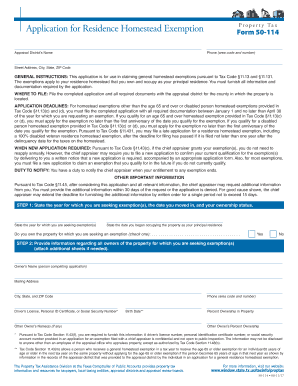

This application is for use in claiming residence homestead exemptions pursuant to Tax Code Sections 1113 11131 11132 11133 11134 and 11432. Application for September 1 Inventory Appraisal. If you bought a home in 2019 in North Texas here is a way to save some money each year you live in the houseHomestead exemption will save you on your proper.

Application for homestead exemption for prior tax year _____. The typical delinquency date is February 1. Most of these exemptions have specific application forms that can be found through the exemption forms link in the box above.

Tax Year Prop ID. If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will receive only the local-option exemption. Complete TX Application for Residential Homestead Exemption - Collin County online with US Legal Forms.

If you do not have Adobe Acrobat Reader software on your computer you may download a free copy below. Do all homes qualify for an exemption. On another residence homestead in Texas and that you do not claim a residence homestead exemption on a residence homestead outside of Texas.

Simply as an example if a home were assessed by the county at 200000 and the home owner received a 20000 exemption they would be taxed on 180000 for their homestead. Application for Exemption of Goods Exported from Texas and three associated forms Freeport Exemption Application for Exemption of Goods in Transit. A Texas homeowner may file a late county appraisal district homestead exemption application if they file no later than one year after the date taxes become delinquent.

2020 TAX RATES AND EXEMPTIONS KEY. To submit the homestead application utilizing the mobile app you will need 4 items. If you apply for an Over Age 65 Exemption or a Disabled Person.

The application must be applied for on or before April 30th. HOMESTEAD EXEMPTION 25000 Collin County Collects for These Entities. Please contact the Collin County Central Appraisal District for additional information regarding exemptions or to apply for an exemptions at 469-742-9200.

Eldorado Pkwy McKinney TX 75069. The typical delinquency date is February 1. The exemptions apply only to property that you own and occupy as your principal place of residence.

Exemption applications can be downloaded from here. Application for Pollution Control Property Tax Exemption. The Automatic Exemption Texas tax law says seniors can use form 50-114 to apply for a 10000 school property tax exemption.

Applications are also available through the CCAD Customer Service department and may be picked up between 800AM and 500PM M-F. The above Collin County appraisal district form is in Adobe Acrobat PDF format. Download Homestead Exemption Application.

See filing deadline info on page 2. You apply by submitting Property Tax Form 50-114 available online. All three locations listed below accept Property Tax payments.

Homestead You can now electronically file your residential homestead exemption online utilizing the HCAD Mobile App. Texas law allows for a number of exemptions for charitable organizations and businesses.

Application For Residence Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Application For Residence Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Title Tip How To File For Your Homestead Exemption

Title Tip How To File For Your Homestead Exemption

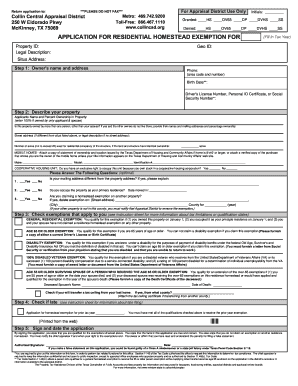

Collin County Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Collin County Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

6 Tips On Filing A 2017 Homestead Exemption Dfw Bhgre Homecity

6 Tips On Filing A 2017 Homestead Exemption Dfw Bhgre Homecity

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

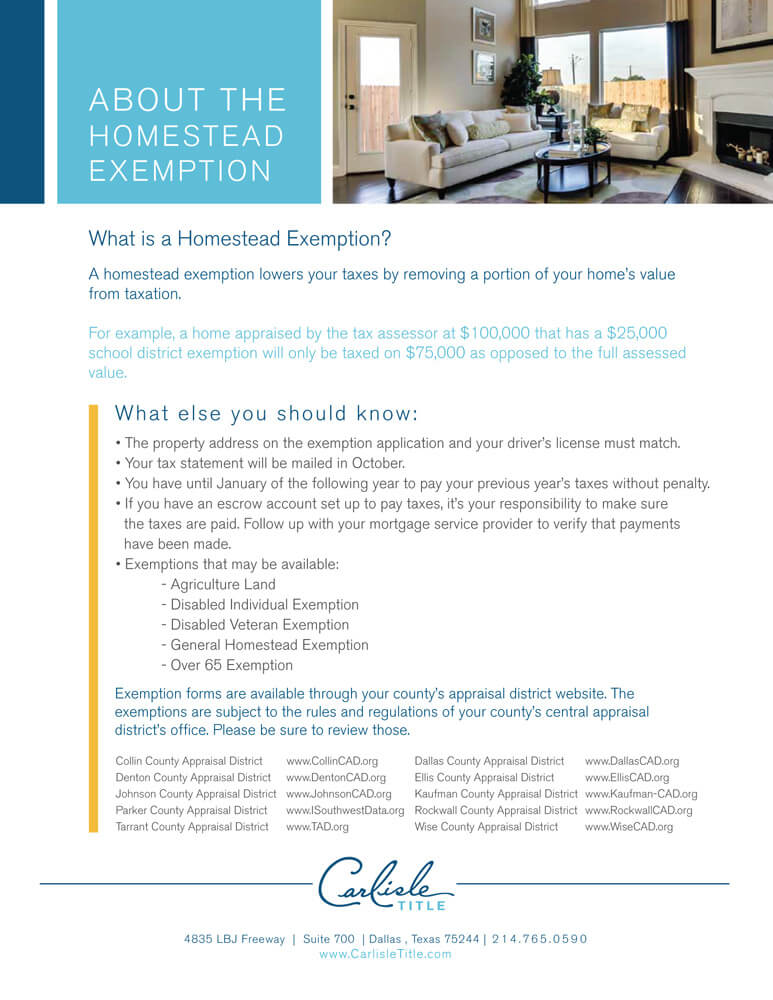

Homestead Exemption Carlisle Title

Homestead Exemption Carlisle Title

What You Need To Know About Homestead Exemptions Robson Resales

Make Sure You Apply For Your 2020 Homestead Exemption Minteer Real Estate Team

Make Sure You Apply For Your 2020 Homestead Exemption Minteer Real Estate Team

Homestead Exemptions What You Should Know Minteer Real Estate Team

Homestead Exemptions What You Should Know Minteer Real Estate Team

Https Www Republictitle Com Wp Content Uploads 2020 01 Tax Information For New Homeowners 2020 Pdf

Tax Information For New Homeowners Republic Title

Tax Information For New Homeowners Republic Title

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Texas Property Taxes Homestead Exemption Explained Carlisle Title

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

How To Fill Out Homestead Exemption Form Texas Homestead Exemption Harris County Youtube

How To File Homestead Exemption Collin County Youtube

How To File Homestead Exemption Collin County Youtube

Http Alamofeeattorney Com Wp Content Uploads 2020 01 Filing For Texas Tax Exemption Pdf

6 Things To Know About Filing A 2017 Homestead Exemption

6 Things To Know About Filing A 2017 Homestead Exemption

Collin County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Collin County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

How To File Homestead Exemption In Texas 2021 Youtube

How To File Homestead Exemption In Texas 2021 Youtube

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home