Home Renovation Tax Credit 2020 Quebec

You were resident in Québec on December 31 2020. All of these could potentially increase your return this year.

The Home Office Tax Deduction For Canada Mileiq Canada

The Home Office Tax Deduction For Canada Mileiq Canada

Completing your tax return.

Home renovation tax credit 2020 quebec. You were at least 70 on December 31 2020. 30 for property placed in service after December 31 2016 but before January 1 2020 26 for property placed in service after December 31 2019 but before January 1 2021. To claim this amount you must not have lived in another home that you or your spouse or common-law partner owned in any of the previous four years ie.

2021 Jul 01 2020 by Aly. Dont leave money on the table know the tax deductions and credits in Canada available to you in 2020. Eligible expenses include the cost of labour and professional services building materials fixtures equipment rentals and permits.

A 2016 to a 2020 purchase before the qualifying home was bought. The 30 tax credit applies to both labor and installation costs. Carefully planned renovations not only make your home more comfortable but they can increase its value too.

Learn about income tax returns consumption taxes and the programs and credits for individuals self-employed persons and members of a partnership. Quebec Refundable Tax Credit for Eco-Friendly Home Renovation. Works affecting a homes envelope.

Under this non-refundable tax credit Saskatchewan homeowners may save up to 2100 in provincial income tax by claiming a 105 per cent tax credit on up to 20000 of eligible home renovation expenses. Ontario Healthy Homes Renovation Tax Credit for Seniors - Refundable - was available for 2012 to 2016 tax years. You may be able to claim the 5000 home buyers amount on your tax return if you bought a qualifying home in 2020.

Renovating your home is one of the wisest investments you can make. You may be entitled to a refundable tax credit for expenses related to home-support services if you meet both of the following conditions. In 2018 2019 and 2020 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to.

Seniors who qualify can claim up to 10000 worth of eligible home improvements on their tax return. When there is. Here is a list of renovation works recognized by the RÉNOVERT credit.

The New Brunswick Seniors Home Renovation Tax Credit is a refundable personal income tax credit for seniors and family members who live with them. Remember to file away and keep all. A maximum of 10000 per year in eligible expenses can be claimed for a qualifying individual.

The home renovation tax credit is just one of several tax incentives your home improvements may qualify you for. The credit has a similar provincial version called The Home Renovation Tax Credit in British Columbia and New Brunswick. The amount of money they get back for these expenses is calculated as 10 of the eligible expenses claimed.

Even if you dont qualify at least you can reduce your taxable gain when you sell the home by the cost of the renovations. Home Renovation Tax Credit Under this non-refundable tax credit Saskatchewan homeowners may save up to 2100 in provincial income tax by claiming a 105 per cent tax credit on up to 20000 of eligible home renovation expenses. You must apply for this tax credit during the tax year that you have them installed.

New Brunswick Seniors Home Renovation Tax Credit - Refundable. Here are seven of the most common home renovation-related tax deductions in Canada. Your Situation Low income owner parent student support payments Income Tax Return Online filing deadline line-by-line help.

Tax Deductions Credits and Expenses in Canada for Home Renovations. Ontario Seniors Home Safety Tax Credit - Refundable - for 2021 only. For example if you spend 20000 on installing new solar panels you would get a credit for 6000.

Claim 5000 on your tax return. To claim home accessibility expenses complete line 31285 for Home accessibility expenses on the Worksheet for the Return and report the amount from line 4 of your worksheet on line 31285 of your tax return. Of course renovations can be expensive but did you know that there are all kinds of programs that will help foot the bill.

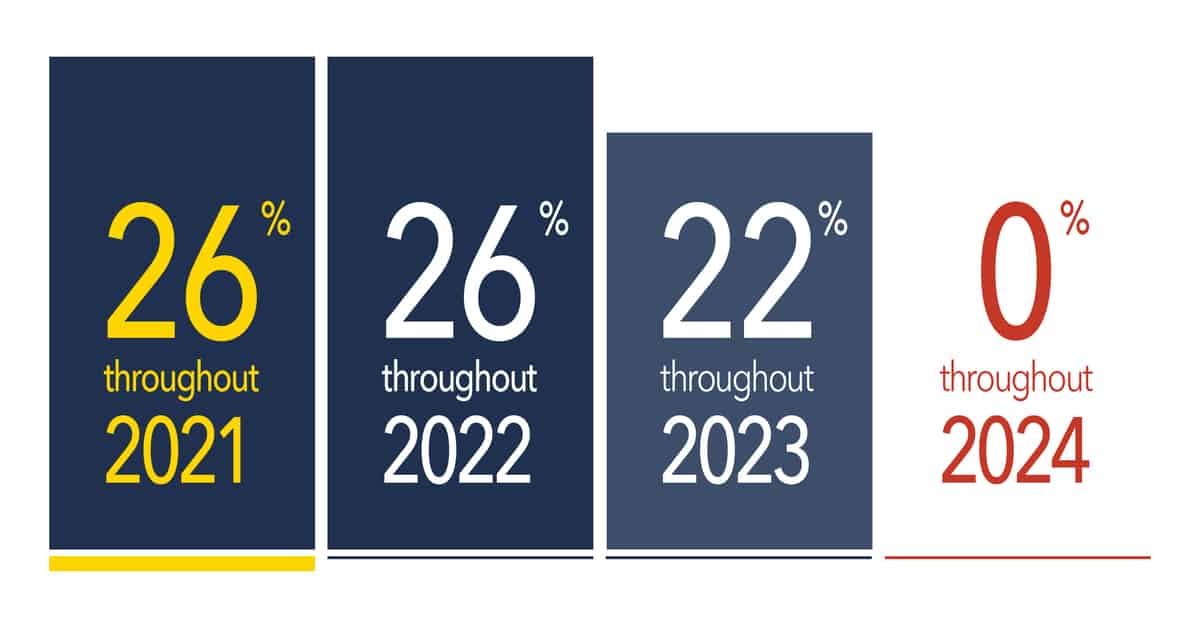

This credit offers 20 after the first 2500 up to a total of 10000. You can claim three applicable percentages for the Residential Renewable Energy Tax Credit. Here are some of the best tax benefits rebates and grants you can get for renovating in.

There are no maximum limits on the amount refunded other than for fuel cells. RÉNOVERT is a home renovation tax credit available until March 31 2019. BC Home Renovation Tax Credit for Seniors and Persons With Disabilities - Refundable.

If you have incurred expenses to modify your home to accommodate the changing needs of a senior or a disabled family member you may qualify for the Home Accessibility Tax Credit HATC in your federal tax return. However if your home-renovation projects include the installation of energy-generating equipment then you may get some relief by claiming a tax credit.

The Federal Geothermal Tax Credit Your Questions Answered

The Federal Geothermal Tax Credit Your Questions Answered

Home Office Tax Deduction 2018 Canada All You Need To Know Mileiq Canada

Home Office Tax Deduction 2018 Canada All You Need To Know Mileiq Canada

The Homeowners Guide To Tax Credits And Rebates

The Homeowners Guide To Tax Credits And Rebates

Top 5 Home Renovation Rebates And Tax Credits For 2020 Renco

Top 5 Home Renovation Rebates And Tax Credits For 2020 Renco

The Home Office Tax Deduction For Canada Mileiq Canada

The Home Office Tax Deduction For Canada Mileiq Canada

Delean Can T Figure Out Where To Claim Work From Home Expenses You Re Not Alone Montreal Gazette

Delean Can T Figure Out Where To Claim Work From Home Expenses You Re Not Alone Montreal Gazette

Tax Deductions For Vacation Homes Depend On How Often You Use It

Tax Deductions For Vacation Homes Depend On How Often You Use It

The Homeowners Guide To Tax Credits And Rebates

The Homeowners Guide To Tax Credits And Rebates

Owning Two Homes Automatically Has Tax Implications Montreal Gazette

Owning Two Homes Automatically Has Tax Implications Montreal Gazette

Buying A First Home What Tax Credits Are Available In Quebec Xpertsource Com

Buying A First Home What Tax Credits Are Available In Quebec Xpertsource Com

10 Tax Breaks When You Own A Home Infographic If Youre Searching For Information On Tax Benefits Of Owning A Real Estate Home Buying Process Buying First Home

10 Tax Breaks When You Own A Home Infographic If Youre Searching For Information On Tax Benefits Of Owning A Real Estate Home Buying Process Buying First Home

Free Energy Audits Net Zero Home Grants Interest Free Home Retrofit Loans Canada Ecohome

Free Energy Audits Net Zero Home Grants Interest Free Home Retrofit Loans Canada Ecohome

Use Your Tax Refund To Buy Your Dream Home Tax Refund Investing Tax Return

Use Your Tax Refund To Buy Your Dream Home Tax Refund Investing Tax Return

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Top 5 Home Renovation Rebates And Tax Credits For 2020 Renco

Top 5 Home Renovation Rebates And Tax Credits For 2020 Renco

What Home Improvements Are Tax Deductible

What Home Improvements Are Tax Deductible

Tax Deductions In Canada For Home Improvements You Can Claim In 2020

Tax Deductions In Canada For Home Improvements You Can Claim In 2020

The Homeowners Guide To Tax Credits And Rebates

The Homeowners Guide To Tax Credits And Rebates

Labels: credit, home, renovation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home