Property Tax Rate Nashville Tn

Mortgage tax is paid by the debtor to the county Register of Deeds or the Tennessee Secretary of State depending on the property transferred Tenn. The current Davidson County property tax rate is 3155 per 100 of assessed value in the Urban Services District and 2755 per 100 in the General.

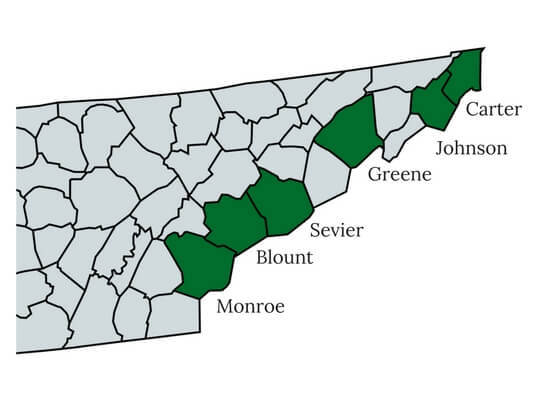

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tennessee has one of the lowest median property tax rates in the United States with only nine states collecting a lower.

Property tax rate nashville tn. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Delinquent Property Tax Sale. 2 days agoNASHVILLE Tenn.

2 days agoNashville Mayor John Cooper has announced that Davidson County property owners will see a large tax rate cut adding that the 34 property tax. There is a 100 processing fee for taxes paid with an E-Check. Nashville council members adopted a 34 property tax hike and approved a spending plan that increases funding for.

62500 X 03788 23675. This will give you the propertys Assessment Value. These fees are not retained by Metropolitan Government.

What is Nashvilles property tax rate. Counties in Tennessee collect an average of 068 of a propertys assesed fair market value as property tax per year. Nashville approves new budget with 34 tax hike more funds for police schools.

The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by the Metro Council at 4221 Urban Services District or 3788 General Services District per hundred of assessed value. Keep my Tennessee Home. 62500 X 3788100 23675.

NASHVILLE TN WSMV - Nashville property owners recall last summer when the property tax rate went up to 34. 250000 X 25 62500. The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000.

In Nashville the property tax rate is 4221 per 100 of assessed value. Keep my Tennessee Home. Comptroller of the Treasury Jason E.

The budget in effect on July 1 increases Davidson Countys property tax rate by 1066 per 100 of assessed value. WKRN Nashville Mayor John Cooper announced he is proposing a reduction in the property tax rate. Important - There is a 255 processing fee 200 minimum charge for taxes paid with a credit or debit card.

068 of home value. Important - There is a 255 processing fee 200 minimum charge for taxes paid with a credit or debit card. Multiply the Assessment Value times the Tax Rate.

Recordation tax is collected by the county register of deeds and remitted to the Department of Revenue. There is a 100 processing fee for taxes paid with an E-Check. 250000 and with the 2020 GSD Tax Rate.

Multiply the Appraised Value times the Assessment Ratio. This just months after a 34 property. Submit a report online here or.

These fees are not retained by Metropolitan Government. Delinquent Property Tax Sale. If you have questions about how property taxes can affect your overall financial plans a.

But as Nashvilles Mayor John Cooper broke on News4 Friday morning that rate is. Comptroller of the Treasury Jason E. 3788 per 100 of assessed value or 03788.

Submit a report online here or. To figure the tax simply multiply the assessed value 25000 by the tax rate of 4221 or 3788 per hundred dollars assessed. Tax amount varies by county.

This moves the rate from 3155 to 4221 per 100 of assessed value. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. 2 days agoNashvilles property tax rate after a controversial 34 increase last year will be lowered next year because of a reappraisal requirement mandated by state law.

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

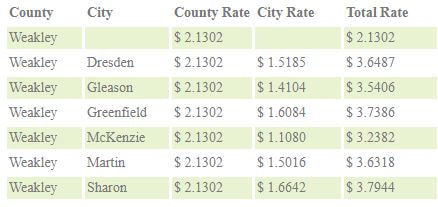

Weakley County Assessor Of Property Tax Rates

Weakley County Assessor Of Property Tax Rates

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

Tax Rates Calculator Property Assessor Of Nashville Davidson County Tn

Davidson County Tn Sales Tax Rate Rating Walls

Davidson County Tn Sales Tax Rate Rating Walls

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Nashville Mayor Vows Property Tax Decrease Nashville Tn Patch

Nashville Mayor Vows Property Tax Decrease Nashville Tn Patch

Davidson County Tn Sales Tax Rate Rating Walls

Davidson County Tn Sales Tax Rate Rating Walls

Davidson County Tn Sales Tax Rate Rating Walls

Davidson County Tn Sales Tax Rate Rating Walls

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Historical Tennessee Tax Policy Information Ballotpedia

Historical Tennessee Tax Policy Information Ballotpedia

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Metro Council Approves 34 Percent Property Tax Increase As Part Of New Budget News Wsmv Com

Metro Council Approves 34 Percent Property Tax Increase As Part Of New Budget News Wsmv Com

Tennessee Now Has Highest Sales Tax Nationwide

Tennessee Now Has Highest Sales Tax Nationwide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home