Property Tax Homestead Exemption Arkansas

Cemeteries used exclusively as such. As of Wednesday Arkansas homeowners are eligible for an increase of 25 or 375 per parcel in their homestead property tax credit under a law enacted in.

Blue Metal Roof Wilmington Nc Jpg 500 250 Metal Roof Houses Blue Roof House Roof

Blue Metal Roof Wilmington Nc Jpg 500 250 Metal Roof Houses Blue Roof House Roof

3 cemeteries used exclusively as such.

Property tax homestead exemption arkansas. And 6 buildings and grounds and material used exclusively for charity Ark. But homestead exemptions also have two important flaws. But if you were eligible for a homestead tax exemption of 50000 the taxable value of your home would drop to 150000 meaning your tax bill would drop to 1500.

A person aged 65 or older. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Homeowners in Arkansas may receive a homestead property tax credit of up to 375 per year.

Also if you are 65 years of age or older or disabled you may be eligible for an assessment freeze on the taxable value of your property. This freeze can be waived in case of substantial improvements to your homestead. Public property used exclusively for public purposes.

If your primary residence is in Benton County you may be eligible for up to 375 homestead tax credit regardless of age or financial status. Pay-by-Phone IVR 1-866-257-2055. The Homestead Credit is a credit of up to 35000 off of your tax statement if you qualify.

To qualify you must own a home and it must be your principal place of residence. To keep things simple lets say the assessed value of your home is 200000 and your property tax rate is 1. Arkansas disabled veterans who have been awarded special monthly compensation by.

Additional exemptions might be available for farmland green space veterans or others. The full text of Act 141 can be accessed HERE. Arkansas Statute 26-3-306 provides tax exemption for homestead and personal property owned by the disabled veteran and with restrictions the surviving spouse and minor dependent children for.

A modest broad-based flat dollar homestead exemption available to homeowners of all ages can significantly improve a states property tax system. Want to avoid paying a 10 late penalty. Homestead Exemptions The Benton County Tax Assessor can provide you with an application form for the Benton County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners.

4 school buildings and apparatus. Homestead exemptions are a progressive approach to property tax relief. The homestead property may be owned by a revocable or irrevocable trust.

The homestead shall not exceed the sum of two thousand five hundred dollars 2500 in value but in no event shall the homestead be reduced to less than one-quarter 14 of an acre of. Be sure to pay before then to avoid late penalties. Churches used as such.

Also known as Amendment 79 it was passed by the voters in November 2000 and allows eligible homeowners to receive up to a 375 credit on their real estate tax bill. Your property tax bill would equal 2000. Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes effective 1 January 2018.

The credit is applicable to the homestead which is defined as the dwelling of a person used as their principal place of residence. The credit applies to the home and up to one acre the house sits on. Amendment 79Arkansas Property Tax Exemption for Seniors.

What is the Homestead Tax Credit. Use DoNotPays Straightforward Guide to Property Tax Exemptions and Appeals. Provisions in Amendment 79 will also freeze the current assessed value for taxpayers that are either disabled or 65 years or older.

School buildings and apparatus. Heres how the Homestead Credit is calculated. What property in Arkansas is exempt from taxation.

To request an application please send an email to the Homestead Administrator or call 479271-1037. The statewide property tax deadline is October 15. 1 day agoWhile the property tax credit is implemented this way in Arkansas in Maryland the homestead property tax credit limits the increase in the taxable assessment and in.

Arkansas military retirement pay is exempt from state taxes. Certain organizations and real estate qualify for property tax exemptions under the Arkansas Constitution including. 5 libraries and grounds used exclusively for school purposes.

Online payments are available for most counties. Amendment 79 freezes the assessed value of a homestead property whose owner is. 1 public property used exclusively for public purposes.

First they exclude renters who tend to have lower incomes. 66 rows Thus homestead exemptions can provide asset protection from creditors for at least. Homestead and Personal Property Tax Exemption.

Each family is allowed only one homestead credit in the State. 2 churches used as such.

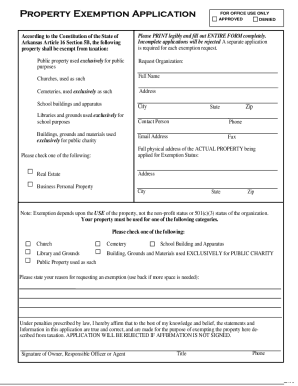

Https Garlandcounty Org Documentcenter View 527 Homestead Credit Application Form Pdf

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

7 No Fail Exterior Paint Colors House Paint Exterior Exterior House Colors Exterior Paint Colors For House

7 No Fail Exterior Paint Colors House Paint Exterior Exterior House Colors Exterior Paint Colors For House

Arkansas Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Arkansas Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Solar Property Tax Exemptions Explained Energysage

Solar Property Tax Exemptions Explained Energysage

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

What Are The Qualifications For The Homestead Exemption For Disabled Veterans 11 Listens Thv11 Com

What Are The Qualifications For The Homestead Exemption For Disabled Veterans 11 Listens Thv11 Com

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Https Www Arkleg State Ar Us Calendars Attachment Committee 109 Agenda 131 File Exhibit C Dec 6 Arkansas Property Taxes Pdf

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home