Personal Property Tax Massachusetts Leased Car

The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be charged by the state every year. If you are a lessee and your vehicle is garaged in one of the following states you may be responsible for paying state or local property taxes.

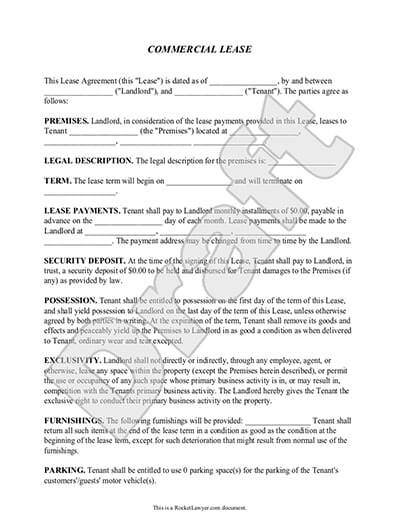

Free Commercial Lease Free To Print Save Download

Free Commercial Lease Free To Print Save Download

2 2001 would continue to be taxed.

Personal property tax massachusetts leased car. Section 2B Certain types of interest or ownership taxable. View transcript of Learn about Property Taxes. To qualify for the exemption you must timely file an affidavit with the leasing.

Any leased vehicles contracted before Jan. Tangible or physical property that you can move easily is personal property. To learn more see a full list of taxable and tax-exempt items in Massachusetts.

The property tax is collected by the tax collectors office in the countycity in which the vehicle is registered. Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. The taxing collector dictates the tax amount owed and the timing of the invoices.

Business Personal Property Taxes. MASSACHUSETTS Privately owned and leased vehicles are subject to Massachusetts excise tax which municipalities levy based on a vehicles value and a statutorily determined tax rate. These links will take you to the revenue or tax department web site for your state.

Personal property is assessed separately from real estate where it is located. Massachusetts has a sales and use tax on buying or transferring motor vehicles. Personal property tax is based on a percentage of the vehicles value.

Additionally you can look up the business with the Better Business Bureau to access any reviews and complaints. However the state has an effective vehicle tax rate of 26. ExciseProperty tax calculated based on the whole value of the vehicle is billed annually or prorated the first year and paid directly by the leasing company to.

Some states have annual property taxes that apply to leased vehicles. To find out about any complaints that have been filed with the Attorney Generals Office against the dealership you intend to buy or lease from visit the consumer complaint page on our website or contact the consumer hotline 617 727-8400. The tax is calculated by multiplying the assessed value of the property by the personal property tax rate of the city or town.

The rate is also determined by the local municipalities so it varies from one area to another according to the state. In addition cities that passed an ordinance before Jan. All tangible personal property is assessed in the city or town where it is located.

Business Personal Property Taxes. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The party obliged to pay the tax on a leased vehicle is specified in the lease.

We assume no responsibility for the accuracy. This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. ASSESSMENT OF LOCAL TAXES Section 1 Repealed 1963 160 Sec.

It is not designed to address all questions which may arise nor to address complex issues in detail. It is typically assessed annually although the lease agreement and state laws govern when you will owe any personal property tax on your leased vehicle and when it must be paid. Section 2A Real property.

1 2002 could opt to tax personal leased vehicles. Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and Orleans Parish Louisiana. Section 2 Property subject to taxation.

Tangible personal property includes. This guide provides general information about Massachusetts tax laws and Department of Revenue policies and procedures. Massachusetts Property and Excise Taxes Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown.

Nothing contained herein supersedes alters or otherwise changes any provision of the. The law was effective on Jan. If the property has a temporary location as of January 1 its assessed at the owners place of business.

In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. Generally the owner of taxable personal property situated in any community must file a return known as the Form of List or State Tax Form 2 with the local board of assessors of that community on or before March 1 prior to the fiscal year to which the tax relates listing the taxable property. SalesUSE tax in Massachusetts is not calculated on the whole value of the vehicle but is calculated using your monthly payment.

Chairs used by a barbershop furniture in a dentists office and poles. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. SalesUSE Tax in MA is Based on a 625 Rate Throughout the state and is billed into your monthly payment on a lease.

A single personal property assessment is made for all taxable personal property of the owner located in the city or town. If you pay personal property tax on a leased vehicle you can deduct that expense on your federal tax return. Section 2C Real estate sold by governmental or exempt entities.

Responsible for paying the tax.

Rental Lease Agreement Templates Free Real Estate Forms Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Rental Lease Agreement Templates Free Real Estate Forms Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Rent To Own Agreement Create A Free Lease To Own Lease Agreement

Rent To Own Agreement Create A Free Lease To Own Lease Agreement

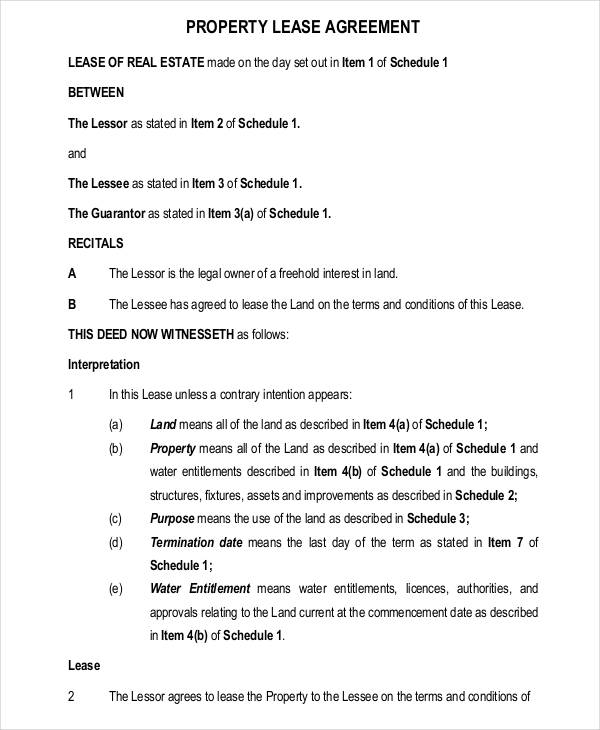

Free 60 Lease Agreement Forms In Pdf Ms Word

Free 60 Lease Agreement Forms In Pdf Ms Word

Free Maine Rental Lease Agreement Templates Word Rtf

Free Maine Rental Lease Agreement Templates Word Rtf

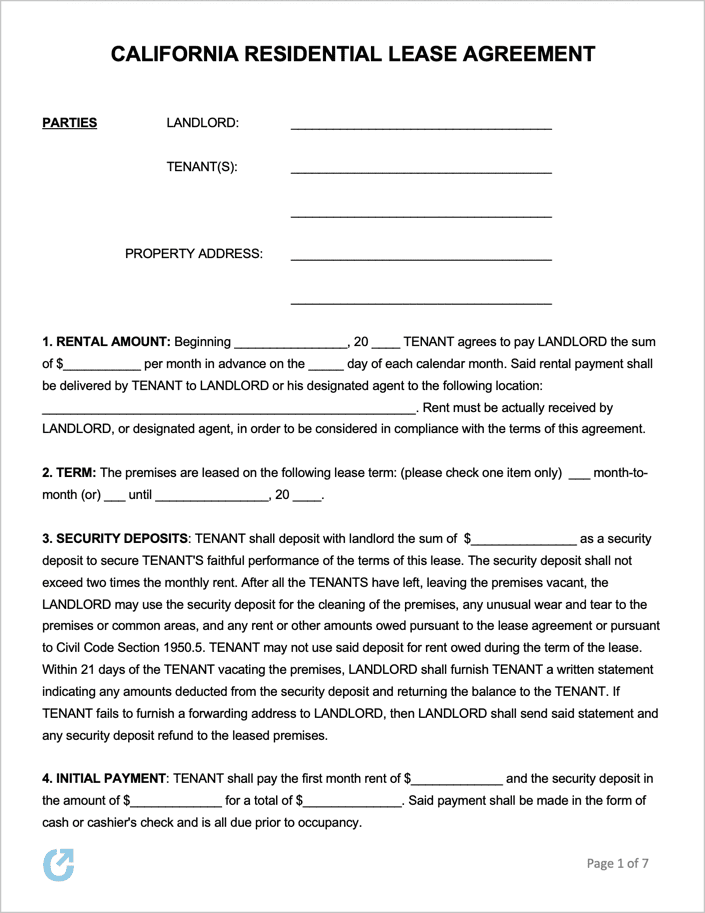

Free California Rental Lease Agreement Templates Pdf Word Rtf

Free California Rental Lease Agreement Templates Pdf Word Rtf

New Lease Introduction Ez Landlord Forms Being A Landlord Landlord Tenant Letter Template Word

New Lease Introduction Ez Landlord Forms Being A Landlord Landlord Tenant Letter Template Word

Maryland Residential Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Edi Lease Agreement Being A Landlord For Sale Sign

Maryland Residential Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Edi Lease Agreement Being A Landlord For Sale Sign

Printable Vehicle Purchase Agreement Unique Massachusetts Motor Vehicle Purchase Contract Purchase Order Template Templates Purchase Agreement

Printable Vehicle Purchase Agreement Unique Massachusetts Motor Vehicle Purchase Contract Purchase Order Template Templates Purchase Agreement

Autozone In Gardner Ma For Sale 1m Cre Commercialrealestate Autozone Investment Investmentproperty Commercial Real Estate House In The Woods Lease

Autozone In Gardner Ma For Sale 1m Cre Commercialrealestate Autozone Investment Investmentproperty Commercial Real Estate House In The Woods Lease

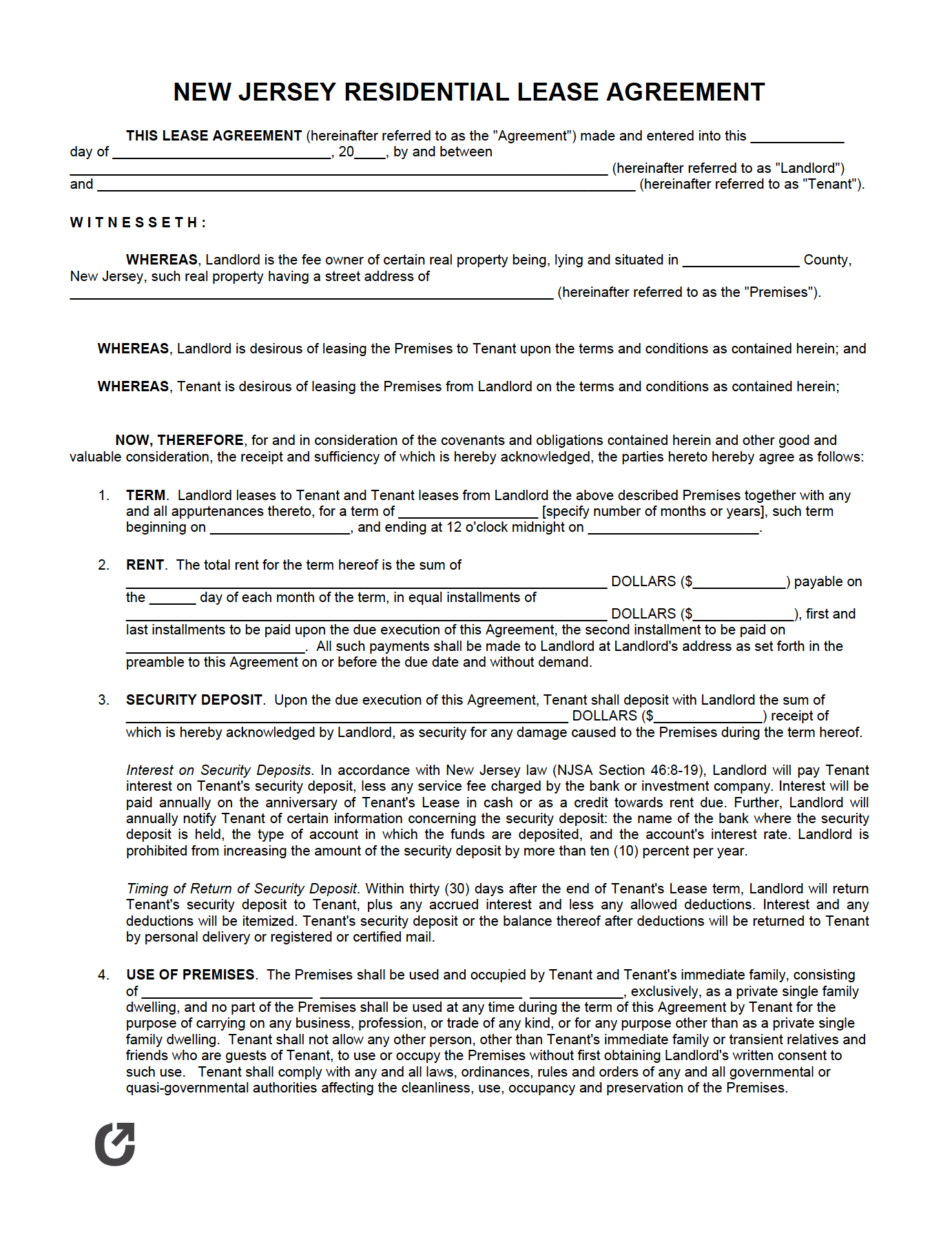

Free New Jersey Rental Lease Agreement Templates Pdf Word

Free New Jersey Rental Lease Agreement Templates Pdf Word

Free 60 Lease Agreement Forms In Pdf Ms Word

Free 60 Lease Agreement Forms In Pdf Ms Word

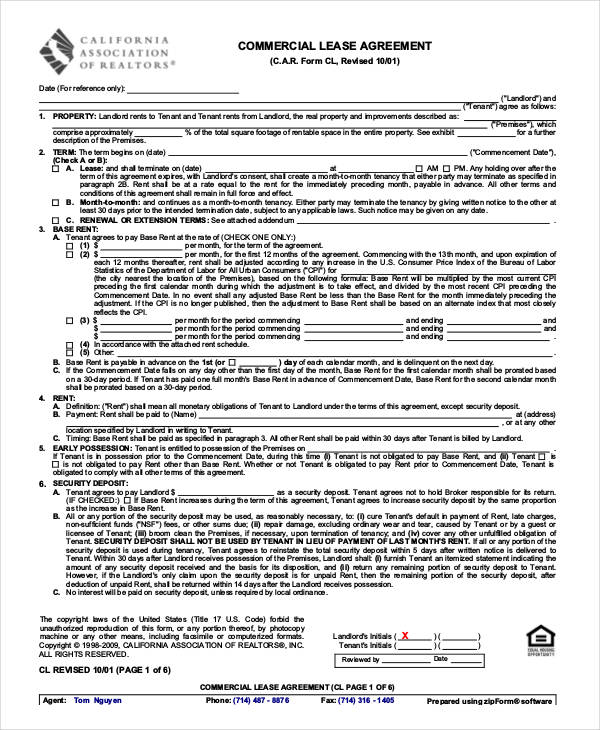

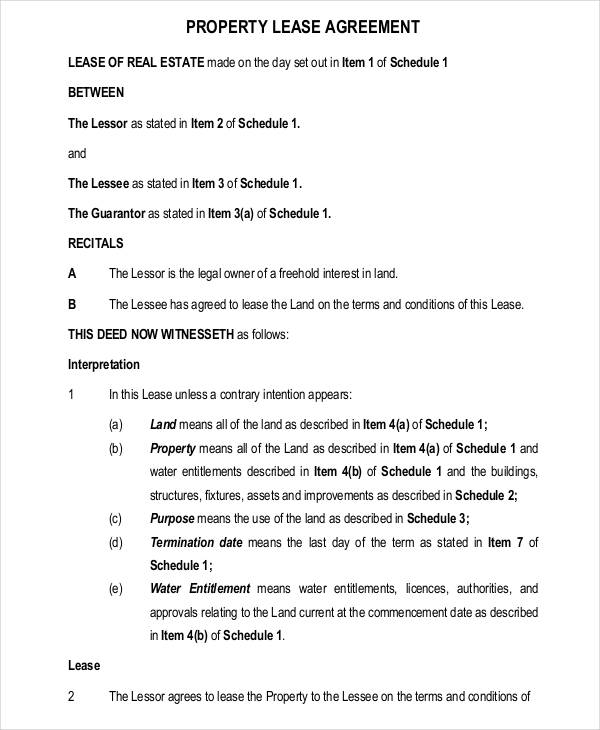

Commercial Lease Agreement Free Business Lease Word Pdf

Commercial Lease Agreement Free Business Lease Word Pdf

Property Management Forms Contract Rental Documents Ezlandlordforms Rental Property Management Being A Landlord Property Management

Property Management Forms Contract Rental Documents Ezlandlordforms Rental Property Management Being A Landlord Property Management

Landlord S Notice Of Non Renewal Of Lease To Tenants With Sample Being A Landlord Rental Agreement Templates Lease

Landlord S Notice Of Non Renewal Of Lease To Tenants With Sample Being A Landlord Rental Agreement Templates Lease

Assignment Of Lease Definition And Explanation Propertyshark Com

Assignment Of Lease Definition And Explanation Propertyshark Com

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home