Tennessee Personal Property Tax Rate

Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Personal Property Taxes aka.

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

67-5-5012 defines the term commercial and industrial tangible personal property as follows.

Tennessee personal property tax rate. Business Tangible Personal Property Assessment All business tangible personal property is subject to an ad valorem tax under Tennessee law. Business tangible personal property is defined as movable touchable property used in a business including furniture computers machinery tools supplies raw materials vehicles scrap billboards. Comptroller of the Treasury Jason E.

To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification. Property is classified based on how the property is used. The average effective property tax rate in Tennessee is 064.

Download Personal Property Brochure. Personal property that are separately itemized on the customers invoice or other sales document are not part of the sales price of the property and are not subject to tax. Counties in Tennessee collect an average of 068 of a propertys assesed fair market value as property tax per year.

One of the most common tests used to differentiate personal property from real property is whether it is moveable personal or affixed real. Personalty Taxes are taxes that are based on temporary or moveable property such as furnishings office machines computers telephones vehicles and other such items that are used by a company or a person to operate a business. The assessed value of a property varies according to whether the property is classified as farmresidential property 25 of fair market value commercialindustrial property 40 or public utility property 55.

In Tennessee personal property is assessed at 30 of its value for commercial and industrial property and 55 of its value for public utility property. The Assessors Office now allows Business Owners to file their assets online. Business Tax Rates 15 Tax on Dominant Business Activity 15 The Minimum Tax 16.

Taxation of Car and Boat Sales. In Tennessee Tangible Personal Property is assessed at 30 of its value for commercial and industrial property. Statutory assessment percentages are applied to appraised property values.

Submit a report online here or. The median annual property tax paid by homeowners in Tennessee is 1220 about half the national average. The value of assets that you own and use in your business or profession is also assessed for tax purposes.

Between spouses siblings lineal relatives parents and children grandparents and grandchildren great grandparents and great grandchildren or spouses of. Median property tax is 93300. This interactive table ranks Tennessees counties by median property tax in dollars percentage of home value and percentage of median income.

The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by your county commission at 320 per hundred of assessed value. Counties and cities may add another 15 to 275 to the total of either rate. Personal property such as goods chattels and other articles of value that are capable of manual or physical possession and machinery and equipment that are.

Tennessee has some of the lowest property taxes in the US. Typically automobile and boat sales in Tennessee are subject to sales or use tax. Personal Property Taxes 25 Certain Special School District Taxes 25 Property Transferred to a Government Entity 25.

Tennessee sales and use tax rule 1320-05-01-25 Insurance policies such as accident collision and guaranteed auto protection GAP covering motor vehicles or boats are not. To figure the tax simply multiply the ASSESSED VALUE 25000 by the TAX RATE 320 per hundred dollars assessed. Subject to Tennessee taxes will be subject to.

Click Here to file. The state rate is 7 on tangible property prescription drugs are exempt and 6 on food and food ingredients. Tangible Personal Property is filed by a All partnerships corporations other business associations not issuing stock and individuals operating for profit as a business or profession including manufacturers except those whose property is entirely assessable by the Comptroller of the Treasury per Tennessee Code Annotated TCA 67-5-903.

Then multiply the product by the tax rate. The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000. The few exceptions to this rule are when vehicles or boats are sold.

Tennessees sales tax rate is one of highest in the nation.

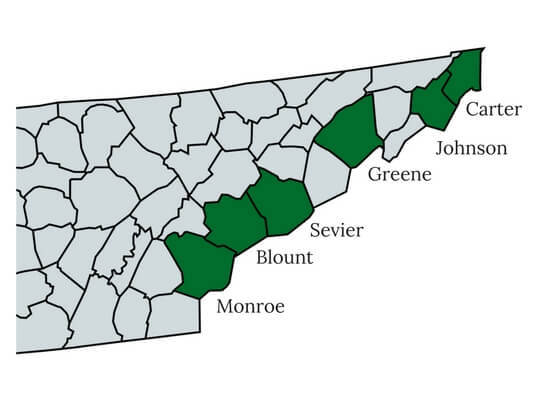

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

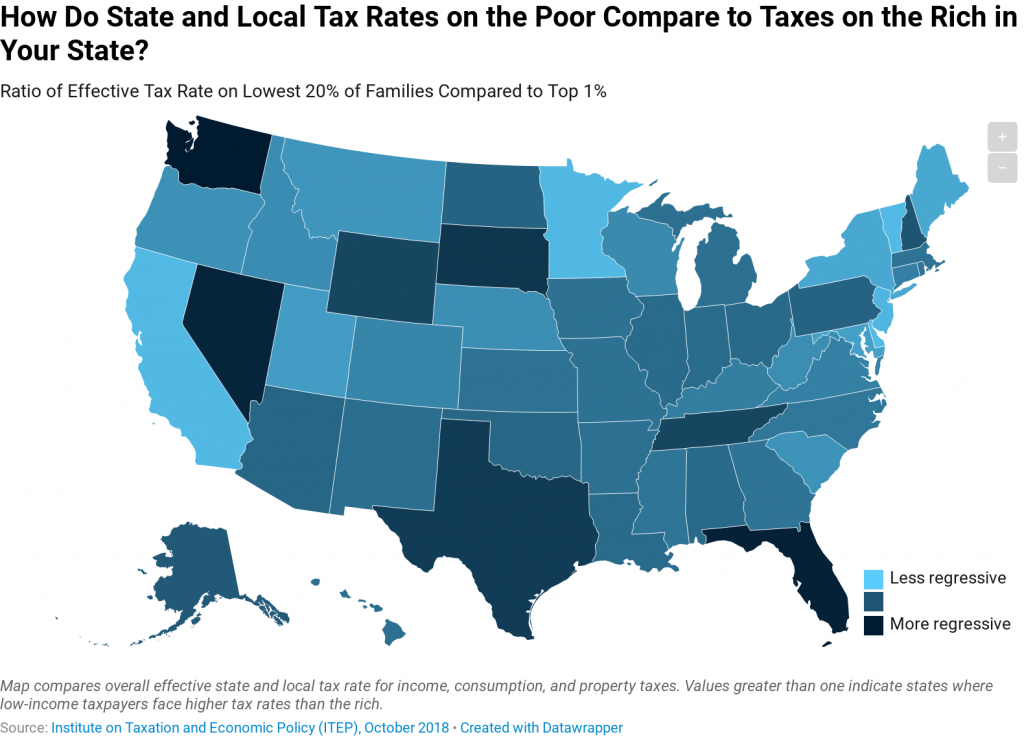

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

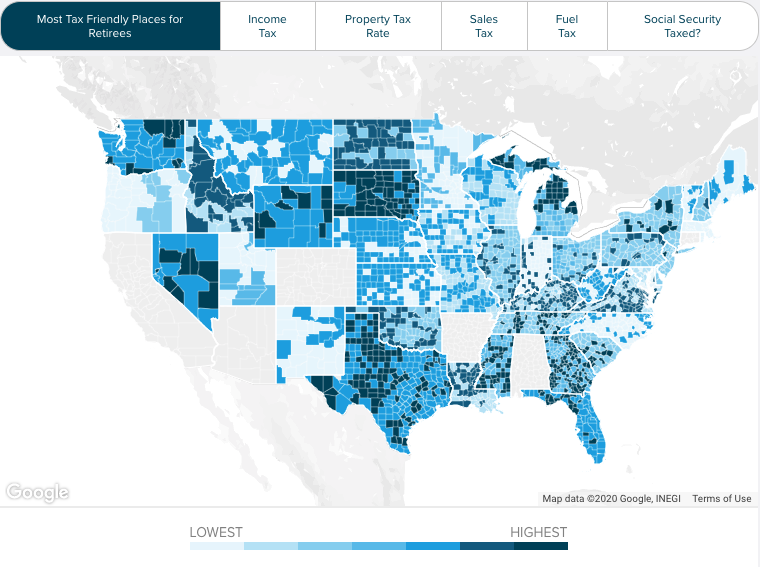

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

State Income Tax Rates Vary Gfrom Zero Up To More Than 13 But A Valid Comparison Has To Also Check Other Taxes In Each State Income Tax Income Tax

State Income Tax Rates Vary Gfrom Zero Up To More Than 13 But A Valid Comparison Has To Also Check Other Taxes In Each State Income Tax Income Tax

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Property Tax Relief Property Tax Relief Tax

Property Tax Relief Property Tax Relief Tax

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

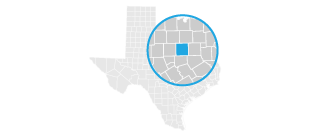

Weakley County Assessor Of Property Tax Rates

Weakley County Assessor Of Property Tax Rates

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

How Much You Really Take Home From A 100k Salary In Every State Income Tax Salary Tax

How Much You Really Take Home From A 100k Salary In Every State Income Tax Salary Tax

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home