Newport Kentucky Property Tax Rate

By law you are required to change your address with the Rhode Island DMV within 10 days of moving. Home Appreciation in Newport is up 102.

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

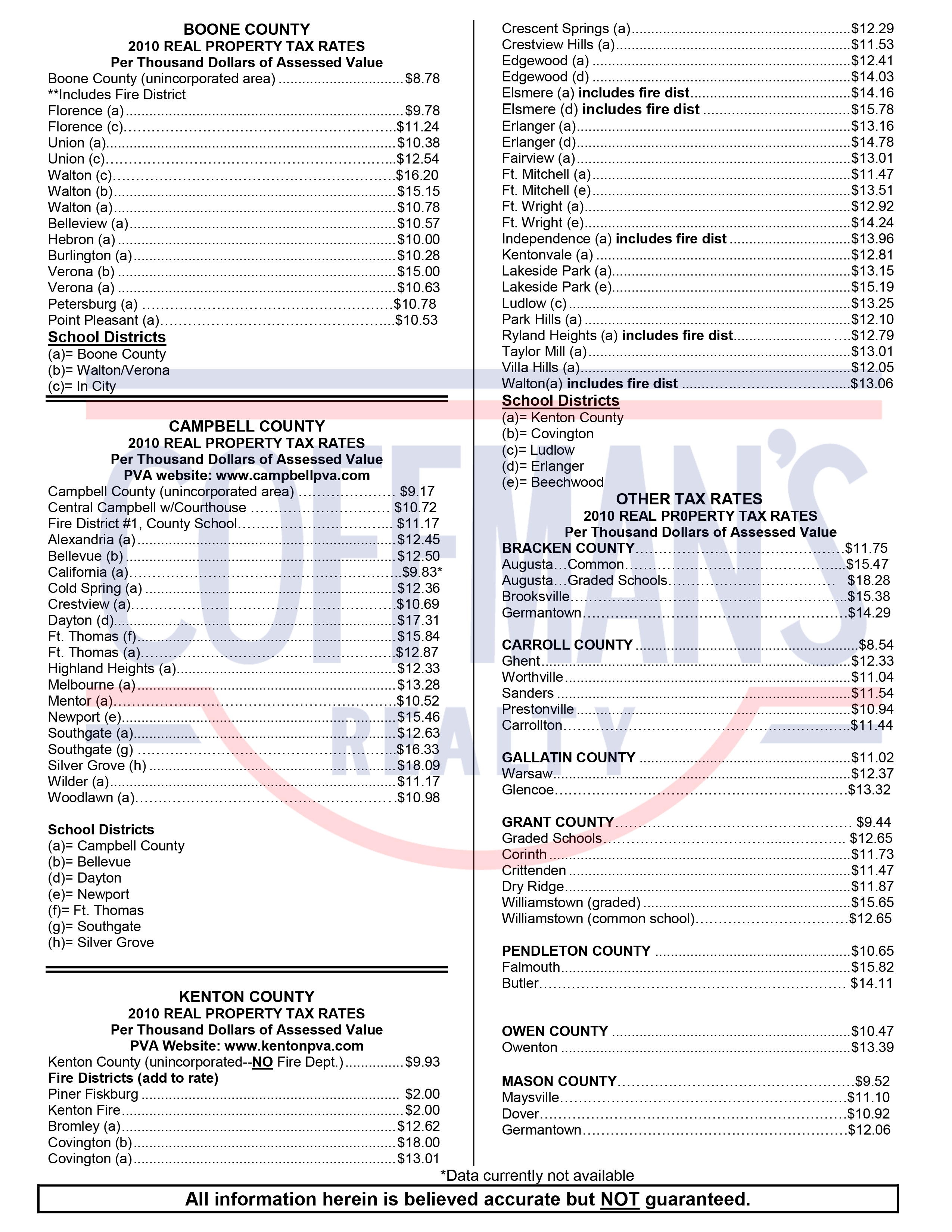

980 The property tax rate shown here is the rate per 1000 of home value.

Newport kentucky property tax rate. Local Property Tax Rates. The assessment of property setting property tax rates and the billing and. City tax bills are mailed each year by late September.

The purpose of a property tax is to fairly distribute the necessary tax burden among all property owners based upon the market value of their property. Tax Rates for Newport KY. The Newport sales tax rate is.

Wind speeds 207-260 mph tornado 63 miles away from the city. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median. For additional information see.

The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. In order to impose this tax the. If the tax rate is 1400 and the home value.

Property taxes in Kentucky are relatively low. In fact the typical homeowner in. Newport uses the County assessment as this is the more cost-effective option for the City to obtain the needed information.

Newport Kentucky 41071 Phone 859-292-3871 Fax 859-292-0353. The Tax Assessors Office functions under the laws of Rhode Island and Ordinances established by the Newport City Council. The median home cost in Newport is 113400.

Federal income taxes are not included Property Tax Rate. Average Age of Homes - The median age of Newport real estate is 78 years old The Rental Market in Newport. These bills include the property taxes levied by the City and by the Newport Board of Education.

Newport Kentucky calculates its property taxes by requiring property owners to pay a set percentage of the appraised value. Nonresidents who work in Newport also pay a local income tax of 250 the same as the local income tax paid by residents. Find Campbell County residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past sales deeds.

2020 Kenton County Tax Rates. 2019 tax bills are for vehicles registered during the 2018 calendar year. Residents of Newport pay a flat city income tax of 250 on earned income in addition to the Kentucky income tax and the Federal income tax.

On 431974 a category F4 max. The fee for a Bar ID is 42. 2020 Campbell County Tax Rates.

The County sales tax rate is. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. Free Campbell County Assessor Office Property Records Search.

Northern Kentucky Tri-ED 300. 2020 Boone County Tax Rates. Contact 8592923680 for questions about Bar IDs.

While the property tax rate varies considerably across different parts of the country they fall into the 1-5 range. The Assessment Process 2. 072 of home value.

Assessments estimate the Fair Market Value each December 31st. Tax amount varies by county. The minimum combined 2021 sales tax rate for Newport Kentucky is.

Wind speeds 261-318 mph tornado 118 miles away from the Newport city center killed 3 people and injured 210 people. 600 The total of all income taxes for an area including state county and local taxes. The Sheriffs role is ONLY to collect the tax.

According to Rhode Island General Law all property subject to taxation shall be assessed at its Fair Market Value. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. Property taxes are gathered nearly always by state county and local governments.

Various sections will be devoted to major topics such as. This is the total of state county and city sales tax rates. 600 The total of all sales taxes for an area including state county and local taxes Income Taxes.

Newport-area historical tornado activity is slightly above Kentucky state averageIt is 64 greater than the overall US. 121 rows Good news. The Kentucky sales tax rate is currently.

Please contact the Newport Police to initiate the background check for this process. Home appreciation the last 10 years has been 237. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision.

Vehicles registered in Newport RI are taxed for the PREVIOUS calendar year ie. On 431974 a category F5 max. How Property Tax is Calculated in Newport Kentucky.

This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky.

Https Www Northernkentuckyusa Com Wp Content Uploads 2020 Campbell County Tax Rates Pdf

Jillians Covington Street View Covington Ky

Jillians Covington Street View Covington Ky

Kentucky Fha Hud Homes For 100 Down Hud Homes Fha Kentucky

Kentucky Fha Hud Homes For 100 Down Hud Homes Fha Kentucky

Kentucky Property Tax Bill Image Page 1 Line 17qq Com

Kentucky Property Tax Bill Image Page 1 Line 17qq Com

Tractor Supply In Munfordville Kentucky For Sale 1 2m Cre Commercialrealestate Tractorsupply Tractor Supply Company Commercial Real Estate City Model

Tractor Supply In Munfordville Kentucky For Sale 1 2m Cre Commercialrealestate Tractorsupply Tractor Supply Company Commercial Real Estate City Model

Kentucky Property Taxes By County 2021

Kentucky Property Tax Bill Image Page 1 Line 17qq Com

Kentucky Property Tax Bill Image Page 1 Line 17qq Com

Welcome Linkedin Home Buying First Time Home Buyers Home Buying Tips

Welcome Linkedin Home Buying First Time Home Buyers Home Buying Tips

191 Halcomb Ct Mount Washington Ky 40047 Bullitt County Hud Homes Case Number 201 379486 Hud Homes For Sale Hud Homes For Sale Hud Homes Fha Mortgage

191 Halcomb Ct Mount Washington Ky 40047 Bullitt County Hud Homes Case Number 201 379486 Hud Homes For Sale Hud Homes For Sale Hud Homes Fha Mortgage

Zebra Sharks Show Their Stripes At Aquarium Newport Aquarium Zebra Shark Shark Swimming

Zebra Sharks Show Their Stripes At Aquarium Newport Aquarium Zebra Shark Shark Swimming

Kentucky Department Of Revenue

What First Time Home Buyers Need To Know From Rocket Mortgage Infographic In 2021 First Time Home Buyers Buying First Home Home Buying Process

What First Time Home Buyers Need To Know From Rocket Mortgage Infographic In 2021 First Time Home Buyers Buying First Home Home Buying Process

Https Revenue Ky Gov News Publications Property 20tax 20rate 20books Property 20tax 20rate 20book 202018 Pdf

Https Revenue Ky Gov Forms 61a207 P 1 20 2020 Pdf

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Battery Hooper Days Coming To Fort Wright Photo Bernie O Bryan Of Raises A U S Flag In Costume As Union Civil War General Lew Civil War Generals Hooper Fort

Battery Hooper Days Coming To Fort Wright Photo Bernie O Bryan Of Raises A U S Flag In Costume As Union Civil War General Lew Civil War Generals Hooper Fort

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home