Jackson County Property Tax Bill Search

Taxes are a lien against the real estate and remains with the property not the specific owner of that property. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance.

Wisconsin County Tax Land Records Blog Wi Com Government Website Records Wisconsin

Wisconsin County Tax Land Records Blog Wi Com Government Website Records Wisconsin

Find historical receipts and current receipts.

Jackson county property tax bill search. The Jackson County WI Geographic Information Web Server provides online access to geographic and assessment record info currently maintained by Jackson County WI for individual parcels of property. You may begin by choosing a search method below. Map Group Parcel Special Interest Subdivision Block Lot SHOW ONLY UNPAID.

Bills are generally mailed and posted on our website about a month before your taxes are due. Continue to PayIt Login. Find and link your properties through a simple search.

Since the information displayed appears exactly as it. The Tax Collector may use enforced collections to secure payment of 2020 property tax bills. However this material may be slightly dated which would have an impact on its accuracy.

View an Example Taxcard View all search methods. When the linked parcel is displayed click Im Done. Property tax information last updated.

Pay your property taxes or schedule future payments. The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. The Chancery Clerk serves as the Custodian of Public Land Records.

Taxes are assessed on personal property owned on January 1 but. January 31 2021 - Last day of the 2021 listing period. Account information is subject to updates corrections and reversals.

If a tax bill is not received by December 10 contact the Collectors Office at 816-881-3232. Enter street number followed by street name. Property Taxes Property taxes for Real and Personal Property are generally mailed in October and have a normal due date of December 20.

Click Link Account and Pay Property Tax. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Tax bills are mailed once a year with both installments remittance slips included Spring and Fall.

January 6 2021 - Unpaid 2020 property tax bills become delinquent 2 interest accrues additional 34 each month thereafter. Street Address must be entered for a Property Address search. January 5 2021 Last day to pay 2020 property tax bills.

Access Your Property Tax Bill. Partial payments on taxes are accepted through the due date but not after. Please return after 1245 AM when the system will be available.

The maps and data are for illustration purposes and may not be suitable for site-specific decision making. Jackson County - GA makes every effort to produce and publish the most accurate information possible. From the Dashboard select the account you want a receipt for.

An asterisk may be used in the street number to provide a list of addresses on a block. No Reminder billing will be submitted for the Fall installment. No warranties expressed or implied are provided for the data herein its use or its.

If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232. Based on the January 1 2019 ownership taxes are due and payable the following year in two equal installments. The Billing History is displayed.

The Tax Commissioners Office in Jefferson is the only location in Jackson County for handling motor vehicle transactions and the billing and collecting of mobile home timber and property taxes for the County. Personal Property Business Business personal property refers to furniture fixtures machinery equipment and inventory located within businesses. The information provided in these databases is public record and available through public information requests.

Tax account look up is for informational purposes only and does not constitute a municipal tax search. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Any errors or omissions should be reported for investigation.

Enter the required information for your selection. We apologize for any inconvenience. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

An official app of Jackson County Missouri. Our office hours are Monday through Friday 800 am. This website will close at 1100 pm.

Tax Bill Search Tax Collector FAQs The Jackson County Tax Collectors Office is responsible for the timely collection and disposition of real and personal property taxes within Jackson County. This includes maintaining indices creating volumes receiving filing fees and maintaining records. The Tax Search and Payment system is taken offline nightly from 1130 PM until 1245 AM for end-of-day processing.

Last day for timely filing of abstracts listing forms extension requests and. The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021. Jackson Township is not responsible for erroneous interpretation of the records or for changes made after the look up.

Tax Maps - GIS Online. We are closed New Years Day Memorial Day Independence Day. However sometimes bills are delayed in being mailed and then the delinquent date would be the day after the due date stated on your bill.

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Real Estate And Tax Data Search Fond Du Lac County

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Jackson County Mo Property Tax Calculator Smartasset

Jackson County Mo Property Tax Calculator Smartasset

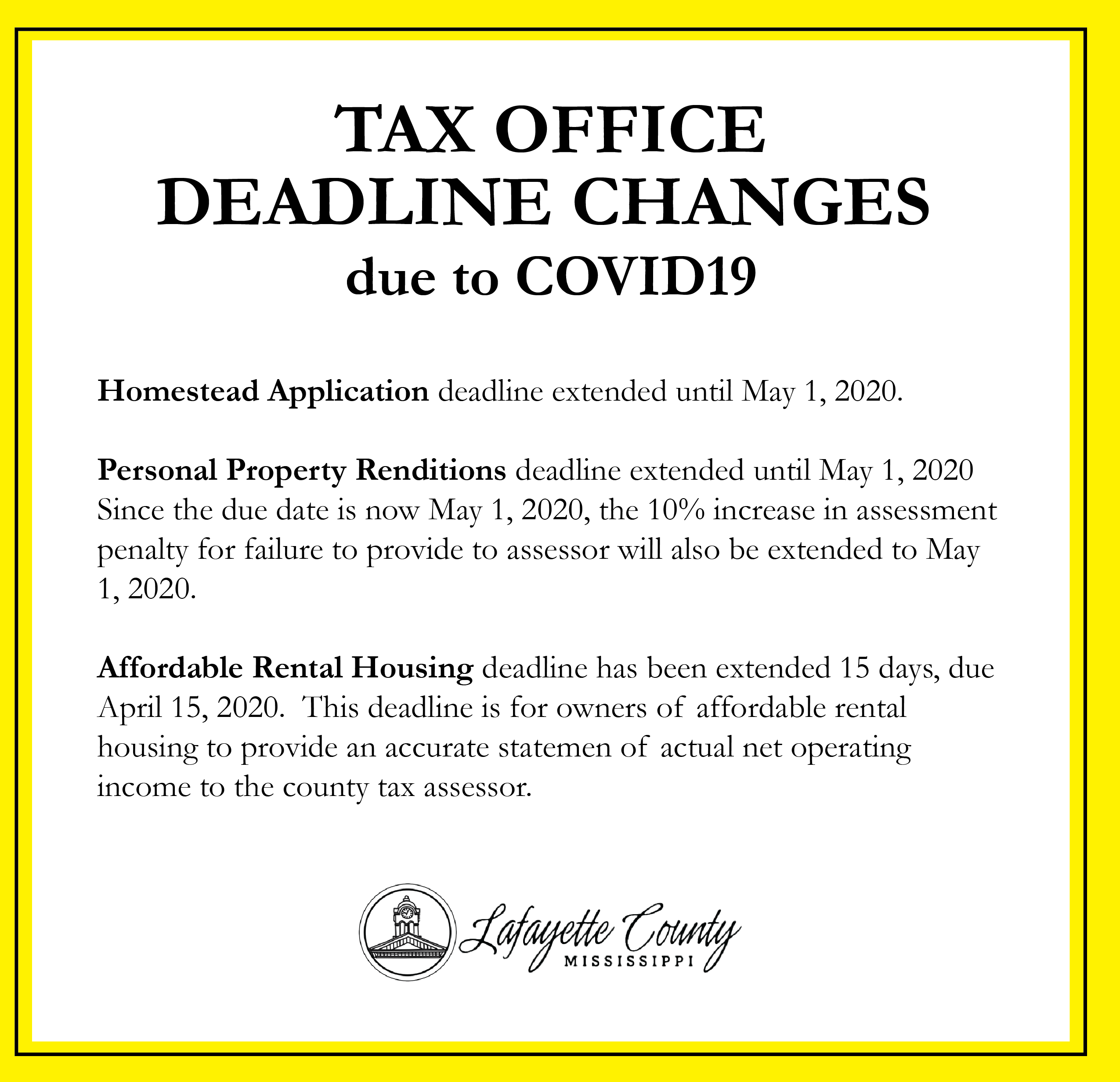

Tax Assessor Collector Lafayette County

Tax Assessor Collector Lafayette County

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Delinquent Property Tax Sale Greene County Ga

Assessment Notices Jackson County Mo

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Tax Assessor Collectors Brazoria County Appraisal District

Tax Assessor Collectors Brazoria County Appraisal District

North Ravenswood West Virginia Mapio Net West Virginia Virginia Ravenswood

North Ravenswood West Virginia Mapio Net West Virginia Virginia Ravenswood

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Tax Bills Are Being Delivered Jackson County Mo

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home