How Property Tax Is Calculated In Pcmc

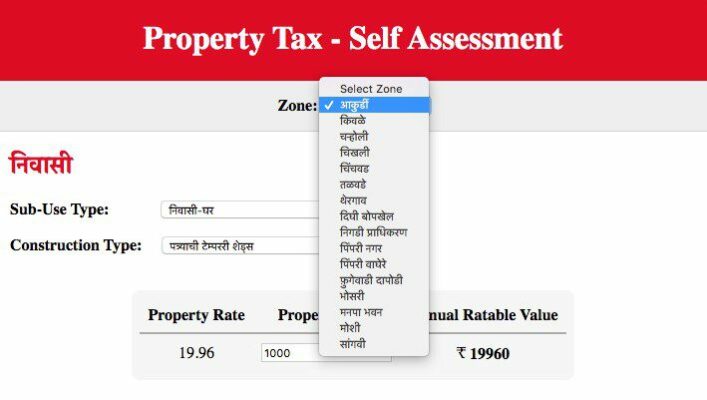

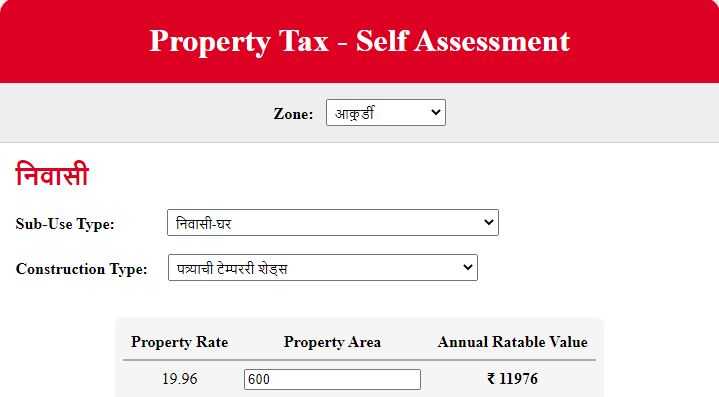

Visit the PCMC Property Tax-Self Assessment Portal. Property tax Capital value Tax Rate Capital Value Base property value built up area type of building type of use age of the property floor of the property.

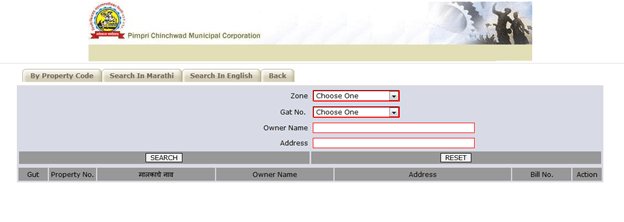

Pimpri Chinchwad Municipal Corporation Pcmc Property Tax Paying Property Tax Online

Pimpri Chinchwad Municipal Corporation Pcmc Property Tax Paying Property Tax Online

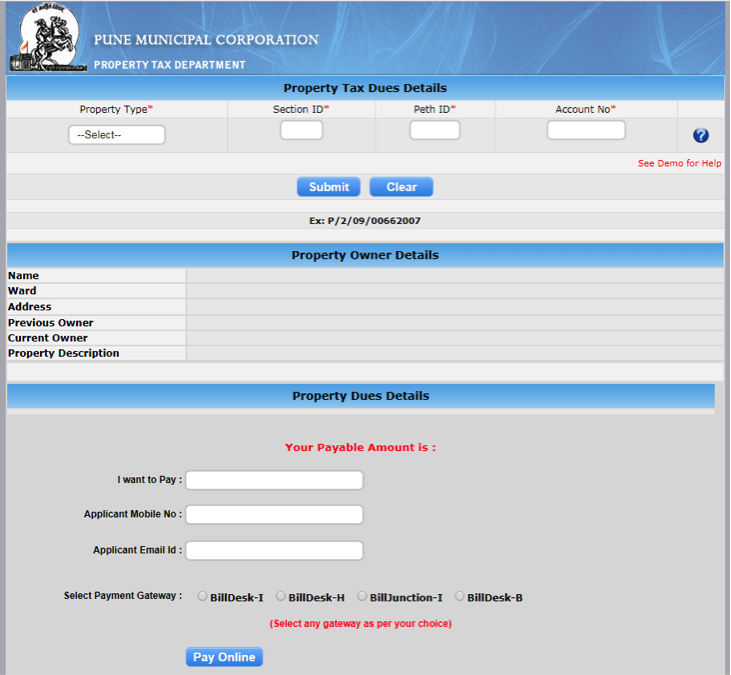

The PCMC calculates its property tax values following the same one as in Mumbai.

How property tax is calculated in pcmc. So this is a calculation that you can do for yourself as well. So it calculates the property tax amount on the ready reckoner value which is determined by the market value of the property. It may be a ready reckoner employed by the revenue department used to calculate the stamp duty.

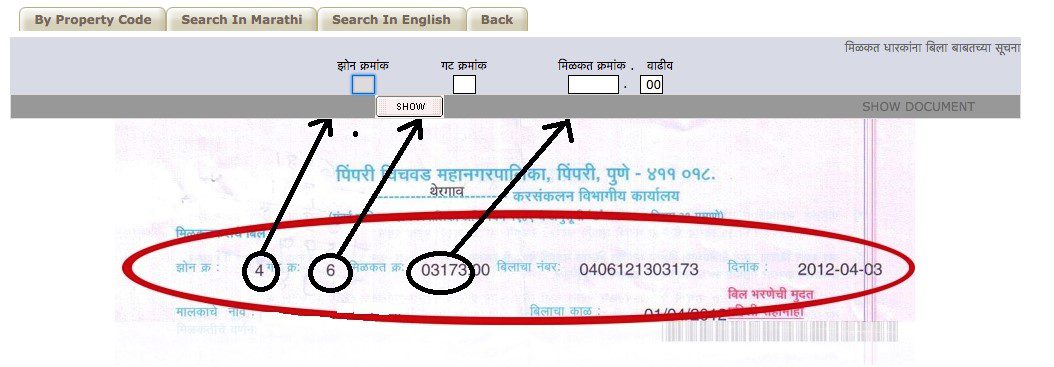

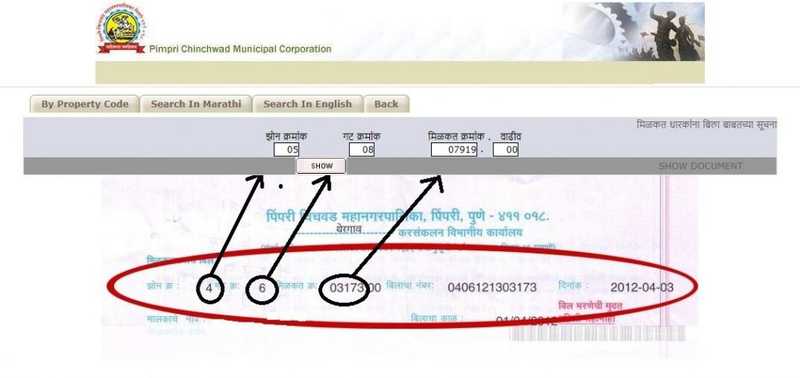

Pimpri Chinchwad Property Tax is calculated by PCMC by taking into account the following factors. 3 Enter the property number and click SHOW button. If debit is made from bank account and receipt is not.

4 Undertaking for rebate in Property tax for Womens owned property. The PCMC property tax is calculated as a percentage of the propertys actual value which is based on the ready reckoner analysis or Circular rate used to. Affidavit format for rebate in Property tax for Womens owned property.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Property tax is calculated based on the following factors. A capital value-based system for property tax calculation is.

The GHMC uses the following formula to calculate property tax. Within each state we assigned every county a score between 1 and 10 with 10 being the best based on the average scores of the districts in each county. Property tax in Kolkata.

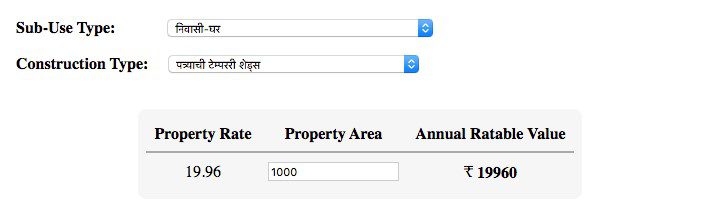

Property tax in PCMC has to be paid by all personsinstitutions who ownpossess landbuildings within the limits of PCMC. Property Tax Capital Value X Rate of Tax Where Capital value Base value X Built-up area X Use category X type of building X age factor X Floor factor. 1 Built-up area of the property 2 Annual rateable value of the property per square feet 3 Type of construction 4 Type of property.

So if your home is worth 200000 and your property tax rate is. Connectivity or technical problem please check your. The method of calculation is as follows.

Select the sub-use type construction type and. So the amount is calculated based on that. The tax on property is applicable to almost all the properties and vacant lands inside the Municipal corporation boundaries.

Application form for rebate in Property tax for Womens owned property. Tax Head use Total headname headresidential headnon_residential headindustrial headtotal Total. Property Tax Capital Value x Tax Rate.

Property tax is calculated along the basis of effective carpet area of the property. Annual property tax Plinth area x Monthly rental value per sq ft x 12 x 017 030 depending on MRV and based on slab rate of taxation 10 per cent depreciation 8 per cent library cess. Pune Property Tax Calculator Property tax constitutes a percentage of the real value of a property which is established using a ready reckoner also used by the revenue department to calculate stamp duty.

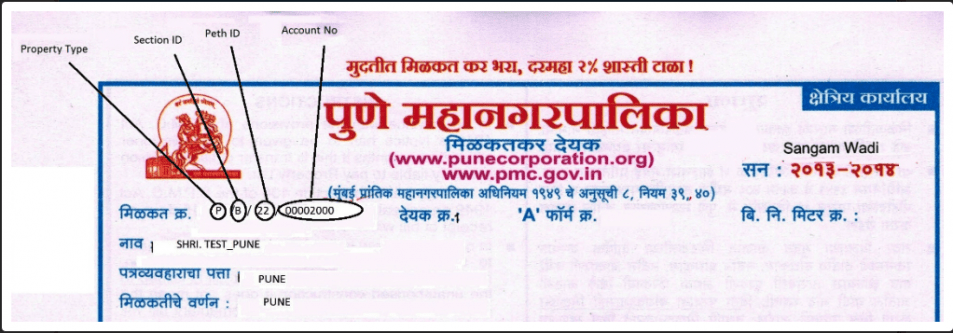

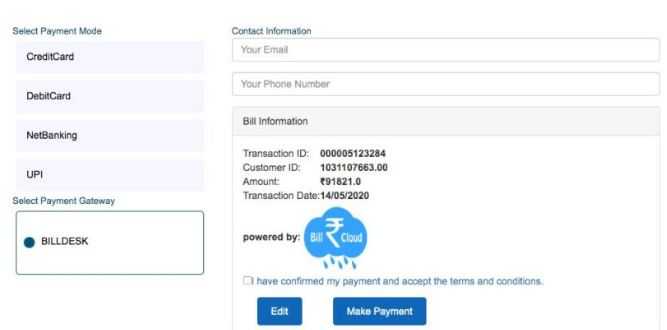

It is assessed on the basis of built-up area of the propertybuilding. 4 Check the details of your property then click on MAKE PAYMENT. Property Tax Department PMC.

Bank account for debit and then proceed for next e-payment. And while property tax is calculated we should consider the following points such as built-up area of the property type of property-residentialnon-residentialmixedmiscellaneous industrialopen land annual value of the propertysq-ft in the area where the property is situated type of construction-simple constructionRCC constructionshedding. 2 Please click on the link Property bill.

About Ratable value of property. While making e-payment if receipt is not generated due. If you want to manually calculate the property tax then you can use the following formula.

Peth Name Construction Year Construction Type Property Carpet AreaSqFt Mobile Number. Generated then please check update with PCMC. Go To Home.

Then we calculated the change in property tax value in each county over a five-year period. Choose the zone and scroll down if you want to calculate property tax as a resident or NRI or for commercial. Here is a step-by-step procedure to calculate your property tax.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their homes purchase price by 125. The property tax in Pune is identified as the actual property value percentage. Rates applicable per Sq-Ft for property Tax for the year 2013-14.

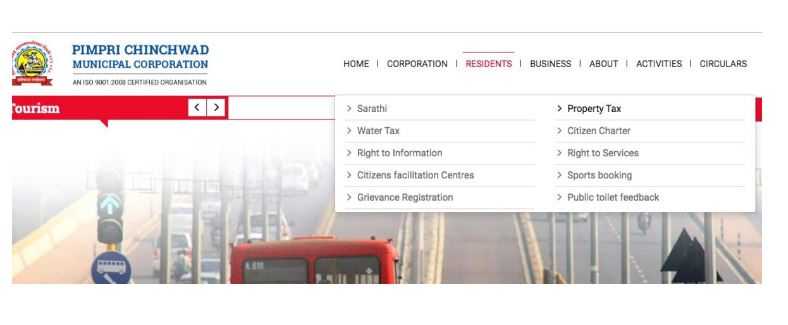

1 Visit Corporations website wwwpcmcindiagovin e-services Click on Property tax water tax link. Property tax is applicable for all propertiesopen lands within the limits of PCMC. This incorporates the base rate of 1 and additional local taxes which are usually about 025.

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pcmcindia Gov In Online Payment Of Pcmc Property Tax Pimpri Chinchwad Municipal Corporation Check Rebate On Property Tax Download E Receipt Against Online Payment Onlinepropertytax Com

Pcmcindia Gov In Online Payment Of Pcmc Property Tax Pimpri Chinchwad Municipal Corporation Check Rebate On Property Tax Download E Receipt Against Online Payment Onlinepropertytax Com

Property Tax In Pune Municipal Corporation Download Receipt

Property Tax In Pune Municipal Corporation Download Receipt

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Pcmc Property Tax Online Payment 2019 Property Walls

Pcmc Property Tax Online Payment 2019 Property Walls

Pcmc Property Tax Online Payment 2019 Property Walls

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

A Step By Step Guide For Paying Pcmc Online Property Tax

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home