Are Property Taxes Postponed Indiana

Holcomb signed EO 20-23 that provides for an automatic extension of time until June 15 2020 to file personal property tax returns that. Assessment of Personal Property.

The information provided in these databases is public record and available through public information requests.

Are property taxes postponed indiana. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax. Due to ongoing public health concerns related to the COVID-19 pandemic the 2020 Property Tax Sale originally scheduled for March 25 and 26 2021 has been cancelled. For best search results enter a partial street name and partial owner name ie.

Property Taxes in Marion County. Use Address Example. Taxpayers who do not pay property taxes by the due date receive a penalty.

Property tax is a tax on real estate mobile homes and business personal property. Sign up to have your Tax Statement emailed to you instead of using traditional mail. Holcomb ordered the suspension of the deadline for submitting property tax exemption applications from April 1 2020 to June 30 2020.

The answers provided will be general in nature as many. If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid tax. Use this section of the website to pay your property taxes and to learn about property tax rates deductions and exemptions how property taxes are used and other frequently asked questions.

The official website of Delaware County Indiana. If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid tax. Search for your property.

FirstNameJohn and LastName Doe OR. 100 W Main St OR. The Marion County Treasurers Office and the Marion County Auditors Office are currently reviewing options to conduct both a postponed 2020 tax sale and a 2021 tax sale later this year likely in the 4th quarter.

Learn about personal property tax guidelines and access important forms for filing taxes. Indiana property taxes are due twice a yearin May and November. Wayne County Treasure Cathy Williams announced the.

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. 124 Main rather than 124 Main Street or Doe. Under an executive order signed by Indiana Gov.

Property taxes are due May 11 but penalties for late payments will not begin for 60 days. January 25 2017. Use 18 Digit Parcel Number Example.

AD RICHMOND Ind. Indiana Governor Eric J. Pay Your Property Taxes.

Are property taxes delayed in Indiana. Pay Your Property Taxes or View Current Tax Bill Make a one-time full or partial payment. If you have an account or would like to create one Click Here.

Residents who do not pay property taxes by the due date receive a penalty. Eric Holcomb all 92 Indiana counties have been ordered to waive late payment penalties regarding property taxes. View and print Assessed Values including Property Record Cards.

It should be noted that Indiana does not impose interest on late property tax payments. 183335552227774003 Numbers Only Please use only 1 Search Option at a time. The Marion County Treasurers Office will be practicing social distancing methods to prevent the potential spread of COVID-19 Coronavirus until further notice.

A property is eligible to be sold at a tax sale when the prior years spring installment of property taxes remains unpaid. Indiana Code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the County Treasurer. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax.

The Indiana Department of Local Government Finance DLGF issued an executive order on March 20 2020 which provides an automatic payment extension without penalty for spring 2020 real and personal property tax payment installments that are normally due on or before May 11 2020. Use First Name Last Name Example. The extension is for 60 days to July 10 2020.

Auction sales are held at the Clark County Government Center Room 418 in Jeffersonville Indiana. Search by address Search by parcel number. Please utilize digital resources and online payment options available by.

STATE OF INDIANA Page 1 of 13 INDIANA GOVERNMENT CENTER NORTH 100 NORTH SENATE AVENUE N1058B INDIANAPOLIS IN 46204 PHONE 317 232-3777 FAX 317 974-1629 DEPARTMENT OF LOCAL GOVERNMENT FINANCE Frequently Asked Questions. Division 1 of the Revenue and Taxation Code including sections 7552 26105 2618 2922 2705 and 4103is suspended until May 6 2021 to the extent that it requires a tax collector to impose penalties costs or interest for the failure to pay taxes on property on the secured or unsecured roll or to pay a supplemental bill before the date and time such taxes became delinquent and a tax collector shall. This service only accepts one-time full or partial payments.

Hoosiers Needing Extra Cash Can Search Indiana S Unclaimed Property Database Government And Politics Nwitimes Com

Hoosiers Needing Extra Cash Can Search Indiana S Unclaimed Property Database Government And Politics Nwitimes Com

442 Market Street Real Estate Outdoor Structures Home

442 Market Street Real Estate Outdoor Structures Home

Marion County Property Taxes Are Being Sent But Many Have Extra Time To Pay Before The Due Date Fox 59

Marion County Property Taxes Are Being Sent But Many Have Extra Time To Pay Before The Due Date Fox 59

Lake Porter County Officials Prepare As May Property Tax Installment Is Bumped To July Chicago Tribune

Lake Porter County Officials Prepare As May Property Tax Installment Is Bumped To July Chicago Tribune

Hoosiers Needing Extra Cash Can Search Indiana S Unclaimed Property Database Government And Politics Nwitimes Com

Hoosiers Needing Extra Cash Can Search Indiana S Unclaimed Property Database Government And Politics Nwitimes Com

The Sale Of Distressed Properties And The Role Of Renew Indianapolis Renew Indianapolis

The Sale Of Distressed Properties And The Role Of Renew Indianapolis Renew Indianapolis

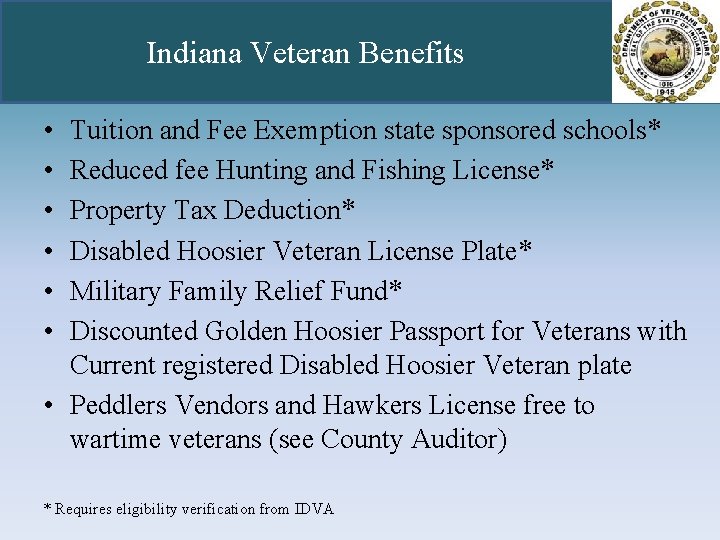

Indiana Department Of Veterans Affairs Indiana Department Of

Indiana Department Of Veterans Affairs Indiana Department Of

Treasurer Wells County Indiana

Treasurer Wells County Indiana

The Riviera Of The Middle West Indiana Beach Is Gone For Good The Observer

The Riviera Of The Middle West Indiana Beach Is Gone For Good The Observer

Johnson County Treasurer Welcome To Johnson County

Johnson County Treasurer Welcome To Johnson County

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Indiana News Wthi Tv Wabash Valley News Weather Sports Breaking News

Indiana News Wthi Tv Wabash Valley News Weather Sports Breaking News

Property Tax Bills Still Due May 11 But There Is Some Relief For Those Struggling Wthr Com

Property Tax Bills Still Due May 11 But There Is Some Relief For Those Struggling Wthr Com

Indiana State Tax Information Support

Indiana State Tax Information Support

Hamilton Co Ind Will Have To Adjust As Covid 19 Hurts City Revenues

Property Owners Get 60 Day Grace Period To Pay Taxes Penalty Free Lake County News Nwitimes Com

Property Owners Get 60 Day Grace Period To Pay Taxes Penalty Free Lake County News Nwitimes Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home