Property Tax Value Lower Than Purchase Price

Taxability in the hand of Seller If the immovable property is considered as a capital asset. So if 119000 is the market value that likely would be the new assessed value.

This is the case until the property sells.

Property tax value lower than purchase price. Here is the math to calculate future estimated taxes. You pay taxes on what the county assesses your home at. If you are purchasing below market ie.

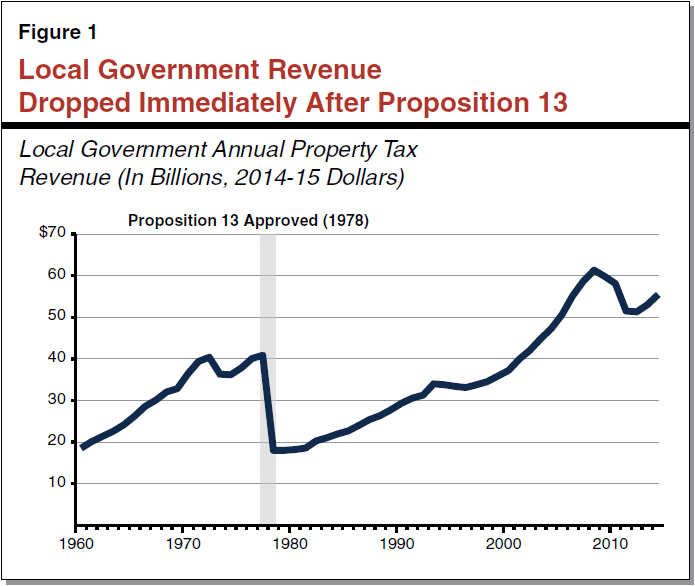

However I got reset back to my original purchase price plus an extra 18 increase for the latest calendar year. In other areas such as California property-tax assessment values begin with your purchase price and typically increase about 2 percent annually regardless of the actual value of your home. Mills1000 x Taxable Value Property Taxes Due 380001000 x 120000 4560.

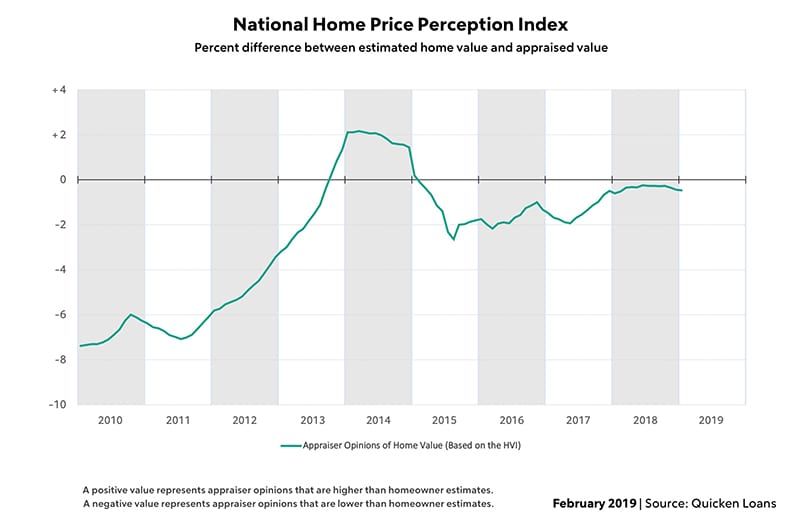

A propertys market value is what that property might sell for regardless of what its assessed or appraised values are. The IRS lets you know that you must base the depreciable value of the rental property on what you actually paid for the property or the FMV whichever is lower on the date of conversion. The assessed value is very different than the fair market value FMV.

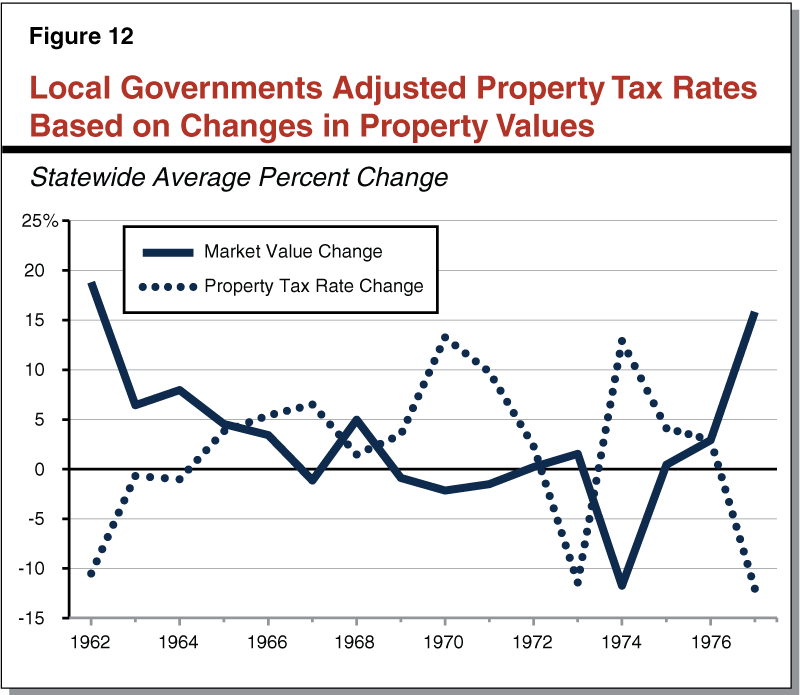

Think of assessed value as the tax value. After the property is sold the. Once the assessed value is determined property taxes are charged back to the current property owner based on a percentage rate.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. In Denver for instance assessed value is 29 percent of market value. Fair Market Value FMV is an estimate of the market value of the property.

Veronica is right on. A 270000 higher assessed property value leads to roughly 3000 more in property tax a year. Assessments can be higher or lower than FMV.

Other states use an assessment rate that is a percentage of the market value. So if your property is assessed at 300000 and your local government sets your tax. If your house is worth 100000 the value for property taxes is 29000.

What is market value. Some states use 100 of the market value to determine how much a homeowner will pay in property taxes. Mills1000 x State Equalized Value Future Property Taxes Due 380001000 x 150000 5700.

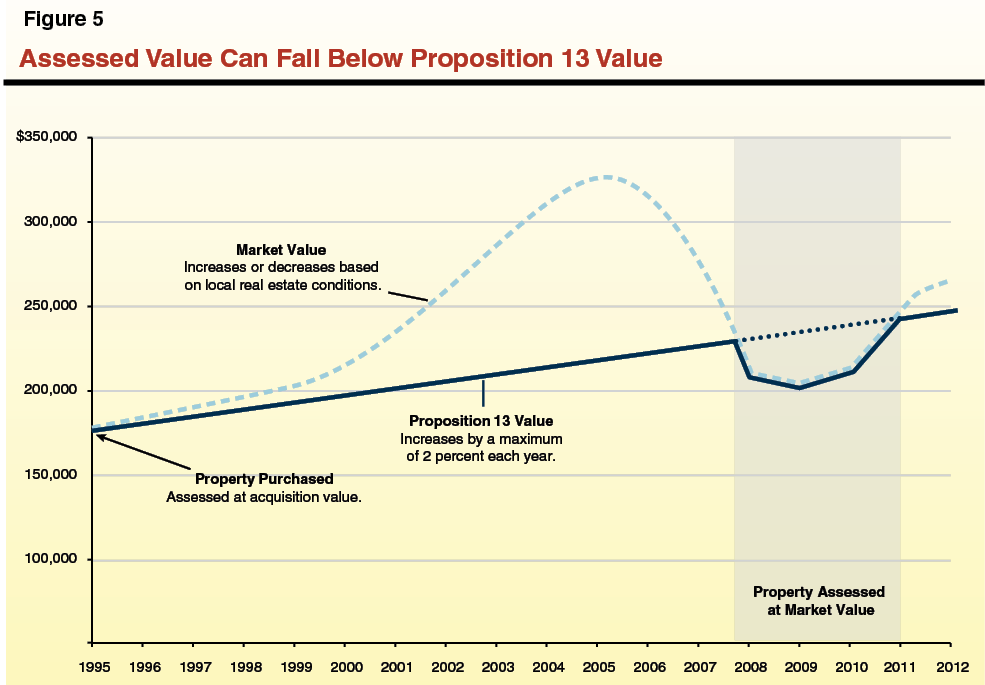

Prop 13 usually allows for only a 2 maximum property tax increase per year. I would make sure that you check with your realtor or an appraiser before purchasing a home the county has assessed for considerably less than you are paying. Market value is the estimated price that a house will sell for within a projected period of time that is considered reasonable.

House values tend to change over time though meaning that the lower the value of the home the lower. When someone buys real estate the assessor assigns a value that is equal to the purchase price or acquisition value After that the propertys assessed value can only increase by two percent or the rate of inflation whichever is lower. Property taxessometimes referred to as millage taxes are a tax levied on property most typically real estate property by county governments.

2 The specific rules in each state are complex. The assessed value is based on the market value for the property at the time of purchase. Because the rates are determined county by county youll find a pretty large variance in property tax rates across the country from averages as high as 189 New Jersey to averages as low as 018 Louisiana.

County assessors use Proposition 13 rules to determine the value of real property. If this property is listed at 400000 but there are no recent comps that have sold for more than 300000 buyers might consider the price of this property. Non-mls distressed sale tax auction from a relative etc the assessed value may be higher than the price paid if it would have sold for a higher amount on the open market ie.

Threshold amounts vary between 500 and 40000 and the tax rates range between 1 and 18. For example a property could have an assessed tax value of 200000. Property taxes are calculated based on the assessed value of a house.

For example in a state with an assessment rate of 80 a home with a market value of 182000 would have an assessed value of 145600. If any immovable property is sold below the stamp duty value or circle rate then such case will fall under Section 50C Section 43CA Section 56 2 x and double taxation shall apply on the difference in the stamp duty value and transfer price. If the property you are trying to sell or buy was appraised for lower than the asking price however you might be able to work with the mortgage lender to have a second appraisal completed.

Once the property is transferred to the new owner and the taxable value is uncapped and reset to the SEV. You can utilize a realtor or an appraiser to assist you when the values are reassessed by the appraisal district.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home