Queens Ny Property Tax Due Dates

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Data and Lot Information.

Are You Looking For Professional Tax Services In Queens Ny If Yes Than We Can Provide You Best Services Tax Preparation Tax Preparation Services Tax Services

Are You Looking For Professional Tax Services In Queens Ny If Yes Than We Can Provide You Best Services Tax Preparation Tax Preparation Services Tax Services

For more information see N-21-1 Announcement Regarding Extension of the Deadline to File Personal Income Tax Returns for Tax Year 2020.

Queens ny property tax due dates. The real property tax rate for fiscal year 2021 covering the period of July 1 2020 to June 30 2021 is 08471 per 100 of assessed value. Tentative Roll Date is May 1 in most communities but confirm the date with your assessor - also see our Property tax calendar. Property Records ACRIS Deed Fraud Alert.

This is called a grace period. Application for Real Property Tax Exemption for Capital Improvements to Residential Buildings in Certain Towns Town of Evans Erie County RP-421-m Fill-in RP-421-m-Ins Instructions Application for Real Property Tax Exemption for Certain New or Substantially Rehabilitated Multiple Dwellings. See sample report.

559 pm Eastern time on December 24 2020. SEE Detailed property tax report for 69-04 228 St Queens NY. If you pay your property taxes quarterly you are entitled to pay interest-free if you pay by the 15th July 15 October 15 January 15 or April 15.

The assessor must mail the information to you no later than five. Receiver of Taxes 742 Bay Road Queensbury NY 12804. Queens County has one of the highest median property taxes in the United States and is ranked 171st of the 3143 counties in order of median property taxes.

The request must be made no later than 15 days prior to Tentative Roll Date. You can find the description of your property on our website. NYC is a trademark and service mark of the City of New York.

Request for extension of time to file April 15 2021. When contacting Queens County about your property taxes make sure that you are contacting the correct office. Income tax return April 15 2021.

You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. Is due December 28 2020. Note that special filing deadlines apply in certain instances.

Queens County collects on average 061 of a propertys assessed fair market value as property tax. Queens County Ny Property Tax Due Dates. The deadline for filing a Request for Review is March 15 for Class 1 properties and April 1 for all other properties.

Postmarked December 23 2020. Property Tax Bills Payment Information Tax Rates Requirement to Pay by Electronic Funds Transfer EFT Requirement Due Dates Overdue Balances Late Payments Refunds Credits Update Property Billing Information Lien Sales Violations Other Agency Charges. Property tax bill for 712020 to 6302021.

Is due January 27 2021. March 1 in most communities Due date for exemption applications. You can file a written request for a list of your property the assessed value and the time and place for hearing grievances.

New York State Real Property Tax Laws govern tax collection. Property Bills Payments. Property Tax Bills.

RP-421-n Fill-in RP-421-n-Ins Instructions. The United States Post Office Postmark date determines whether a payment is on time. Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF.

The median property tax in Queens County New York is 2914 per year for a home worth the median value of 479300. Any payment postmarked on or before the due date will be considered timely. July 1 and January 1.

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. These records can include Queens County property tax assessments and assessment challenges appraisals and income taxes. If the last day of the grace period falls on a weekend or a federal holiday the payment is due the next business day.

May 1 in most communities Tentative assessment roll is made available to the public. Sales tax reduction of times the 2 homestead reimbursement annual yield includes the property tax allocations public utility and tangible personal property reimbursements from the state of ohio hamilton county auditor dusty rhodes property search Amazing facts that ohio dog law the state of ohio. Payment is due on.

Filing due dates for your 2020 personal income tax return. It is important to remember that asking for a Finance Review is not a substitute for appealing your. On or around this date assessment impact notices are sent to property owners in municipalities conducting reassessments 2.

You can call the Queens County Tax Assessors Office for assistance at 212-504-4080Remember to have your propertys Tax ID Number or Parcel Number available when you call. Use our property tax estimator to calculate the tax owed. Queens County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Queens County New York.

We Deals In Every Kind Of Professional Tax Services In Ny And We Provide Professional Tax Services In Ny You Can Fi Tax Services Tax Preparation Services Tax

We Deals In Every Kind Of Professional Tax Services In Ny And We Provide Professional Tax Services In Ny You Can Fi Tax Services Tax Preparation Services Tax

Looking For The Professional Tax Services In Queens Ny By Which You Can Easily Prepare Your Tax Forms Fi Tax Services Tax Preparation Tax Preparation Services

Looking For The Professional Tax Services In Queens Ny By Which You Can Easily Prepare Your Tax Forms Fi Tax Services Tax Preparation Tax Preparation Services

Ace Tax Services Inc Offer Online Tax Preparation And In Person Tax Preparation Financial Services And In Tax Preparation Income Tax Preparation Online Taxes

Ace Tax Services Inc Offer Online Tax Preparation And In Person Tax Preparation Financial Services And In Tax Preparation Income Tax Preparation Online Taxes

Ace Tax Services Provides Best Tax Preparation In Queens At Competitive Prices Https Acetaxservices C Tax Preparation Tax Preparation Services Tax Services

Ace Tax Services Provides Best Tax Preparation In Queens At Competitive Prices Https Acetaxservices C Tax Preparation Tax Preparation Services Tax Services

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

If You Need Tax Professionals In Queens Than You Can Easily Find The Best Solutions As Ace Tax Services A Tax Preparation Tax Services Tax Preparation Services

If You Need Tax Professionals In Queens Than You Can Easily Find The Best Solutions As Ace Tax Services A Tax Preparation Tax Services Tax Preparation Services

If You Are Facing A Problems In Making Your Tax Related Work And Not Able To Complete It Alone Or Need Free Tax Filing Tax Preparation Services Tax Preparation

If You Are Facing A Problems In Making Your Tax Related Work And Not Able To Complete It Alone Or Need Free Tax Filing Tax Preparation Services Tax Preparation

Ace Tax Services Deals In All Kind Of Tax Services In Queens Ny So If You Need Tax Services Then You Can Tax Services Tax Preparation Services Tax Preparation

Ace Tax Services Deals In All Kind Of Tax Services In Queens Ny So If You Need Tax Services Then You Can Tax Services Tax Preparation Services Tax Preparation

Best And Worst States For Taxes Tax Deductions Travel Nursing Pay Tax Return

Best And Worst States For Taxes Tax Deductions Travel Nursing Pay Tax Return

We Deals With Tax Services In Queens Ny So If Tax Payers Wants To Pay Their Professional Tax Services Queens Ny Then The Tax Questions Filing Taxes Income Tax

We Deals With Tax Services In Queens Ny So If Tax Payers Wants To Pay Their Professional Tax Services Queens Ny Then The Tax Questions Filing Taxes Income Tax

Ace Tax Services Inc Is Experienced In All Aspects Of Tax Preparation Planning Compliance And Negotiat Tax Services Tax Preparation Tax Preparation Services

Ace Tax Services Inc Is Experienced In All Aspects Of Tax Preparation Planning Compliance And Negotiat Tax Services Tax Preparation Tax Preparation Services

Appropriate Tax Software Makes It Trouble Free For You To E File Your State Tax Return And Use The Correct State Tax Forms Income Tax Tax Payment Tax Services

Appropriate Tax Software Makes It Trouble Free For You To E File Your State Tax Return And Use The Correct State Tax Forms Income Tax Tax Payment Tax Services

Jamaica Queens Ny Property Photo For 166 25 Jamaica Avenue Queens Ny 11432 Jamaica Queens Nyc Queens Ny

Jamaica Queens Ny Property Photo For 166 25 Jamaica Avenue Queens Ny 11432 Jamaica Queens Nyc Queens Ny

Are You Eligible To File Your Taxes For Free Income Tax Return Tax Return Filing Taxes

Are You Eligible To File Your Taxes For Free Income Tax Return Tax Return Filing Taxes

Why Entrepreneurs Should Work On Taxes Before The End Of The Year Due Small Business Tax Business Tax Business Tax Deductions

Why Entrepreneurs Should Work On Taxes Before The End Of The Year Due Small Business Tax Business Tax Business Tax Deductions

Ace Tax Services Deals In Tax Filing In Queens Ny And We Have Countless Numbers Of Happy Clients With Us In The Regio Tax Services Tax Preparation Filing Taxes

Ace Tax Services Deals In Tax Filing In Queens Ny And We Have Countless Numbers Of Happy Clients With Us In The Regio Tax Services Tax Preparation Filing Taxes

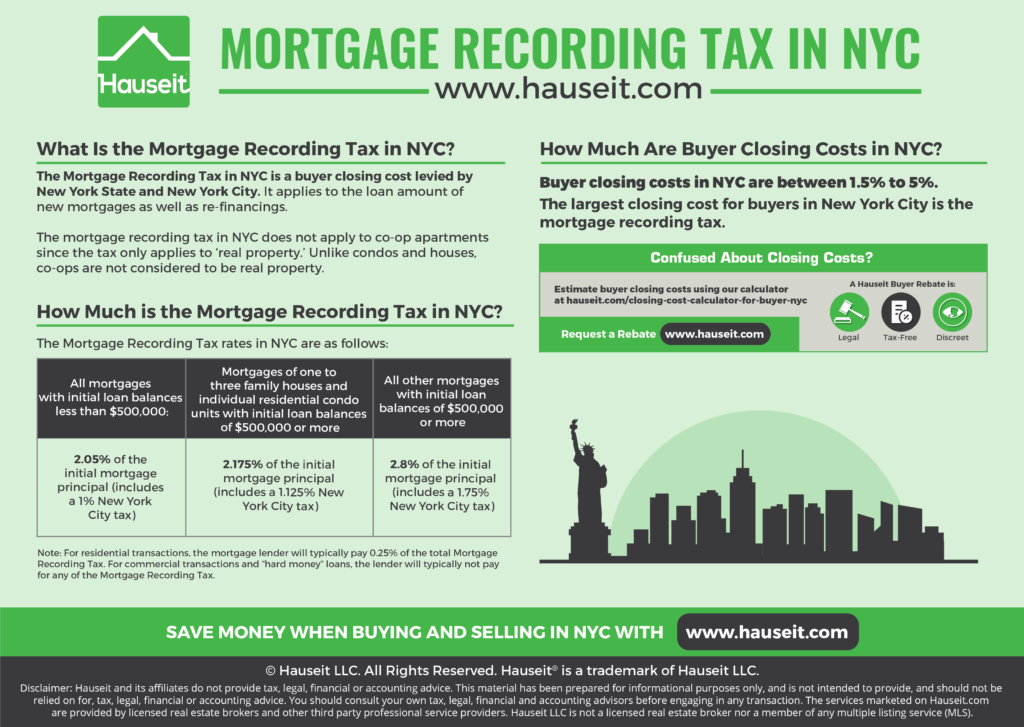

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit

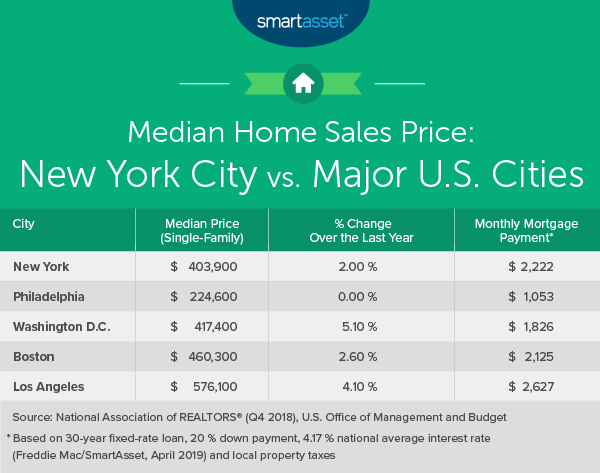

What Is The True Cost Of Living In New York City Smartasset

What Is The True Cost Of Living In New York City Smartasset

Queens Property Tax Records Queens Property Taxes Ny

Queens Property Tax Records Queens Property Taxes Ny

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home