Farm Property Tax Credit Ontario

Qualifying property includes real property and quota used in a farming business as well as shares in a family farm corporation or. The purchaser would remit the tax using either the GST 60 GSTHST Return for Acquisition of Real Property or if using the land primarily in commercial activities their regular GSTHST return.

Ontario Interactive Digital Mediatax Credits Oidmtc Evamax Group Digital Media Interactive Digital

Ontario Interactive Digital Mediatax Credits Oidmtc Evamax Group Digital Media Interactive Digital

Each individual taxpayer is entitled to realize 750000 of capital gains tax-free on qualifying farm property during their lifetime.

Farm property tax credit ontario. One of the ways the Government of Ontario supports agriculture is through the Farm Property Class Tax Rate Program also known as the Farm Tax Program If you are eligible for the Farm Tax Program your farmland is taxed at no more than 25 per cent of your municipalitys residential property tax rate. Under the new tax policy farm properties satisfying the eligibility requirements are identified for the Farm Property Class and are taxed at 25 of the municipal residential tax rate. An individual who owns farm property land or building an interest in a family farm partnership or shares in a family farm corporation may be able to claim a 1000000 lifetime capital gains exemption LCGE when the farm property is sold.

An exemption may apply. These losses can be carried back 3 years or forward 20 years and can only be deducted against farming income. 1-888-247-4999 or by email at.

The actual capital gains deduction is 50 of the capital gains exemption. Starting January 1998 the Farm Tax Rebate Program was replaced by a new Farm Property Taxation Policy for farm properties. The Ontario Energy and Property Tax Credit is a personal tax credit funded by the Province of Ontario and implemented to help individuals with low- to moderate-income with the sales tax on energy as well as their property taxes.

The reduction of the farm tax rate below the long-term rate of 25 per cent of the residential rate has to be changed at county councils. In this case the registered purchaser is required to remit the tax directly. Through the program eligible farmland owners receive a reduced property tax rate.

The basic property tax credit for individuals under age 65 is 250. OFA recommends farmers contact OMAFRAs Farm Property Class Tax Rate Program at 1-877-424-1300 after any land title change on farmland to ensure the farmlands property tax status remains correct. Amount of credit Property tax credit amount.

OFA has been advocating for the elimination of the land transfer tax on within-family farm sales. Ontario farmers are starting to get tax relief from the massive increases in the value of their land but the amount of tax relief varies. As a part-time farmer the maximum amount you can claim in any one year is 17500.

The Ontario Energy and Property Tax Credit is one of the three credits that make up the Ontario Trillium Benefit. The Farm Property Class Tax Rate Program Farm Tax Program is one of the ways the province of Ontario supports agriculture. You are not required to collect the tax as the purchaser has to self-assess.

The Ontario Ministry of Agriculture Food and Rural Affairs administers the Farm Property Class Tax Rate Program and has an annual responsibility to determine and report eligible properties to the Municipal Property Assessment Corporation MPACMPAC assesses all properties in Ontario including farms. The basic property tax credit for individuals age 65 or older is 625. You cannot claim a property tax credit for more than one Ontario residence such as a.

The farm residence and one acre of land surrounding it will continue to be taxed as part of the residential. Farm Tax Program transitions from OMAFRA to Agricorp. Beginning on February 25 2019 program inquiries can be directed to Agricorp at.

The farm business on your property has a valid FBR number. Hobby Farms and Tax Breaks Your agribusiness is considered to be a hobby farm if farming is not run as a business but for personal reasons. Ontario farm businesses that gross 7000 or more in annual farm income are required by law to register their businesses with Agricorp each year under the Farm Business Registration FBR program.

Eligible farmland is classified in the farm classification.

Tax Tips For Farmers From The Canada Revenue Agency

Tax Tips For Farmers From The Canada Revenue Agency

Does It Still Make Sense To Incorporate A Farm Canola Digest

Does It Still Make Sense To Incorporate A Farm Canola Digest

When A Cra Notice Of Assessment Arrives Fbc Canadian Money Small Business Tax Infographic

When A Cra Notice Of Assessment Arrives Fbc Canadian Money Small Business Tax Infographic

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Barn Restoration Center For Rural Affairs Barn Old Barns Country Barns

Barn Restoration Center For Rural Affairs Barn Old Barns Country Barns

Farmland Rental Agreements Factors To Consider Farms Com

Farmland Rental Agreements Factors To Consider Farms Com

Capital Gains Exemption Eases Farmland Sale On Retirement The Western Producer

Capital Gains Exemption Eases Farmland Sale On Retirement The Western Producer

How To Start A Small Farm Farm Plans Family Farm Farm

How To Start A Small Farm Farm Plans Family Farm Farm

How To Determine If You Re A Farmer For Tax Purposes

Selling Farmland Tax Consequences Landthink

Selling Farmland Tax Consequences Landthink

Why Bill Gates Is The Biggest Owner Of Farmland Millionacres

Why Bill Gates Is The Biggest Owner Of Farmland Millionacres

Best Tax Tips For Students And First Time Filers Income Tax Tax Deadline Tax Forms

Best Tax Tips For Students And First Time Filers Income Tax Tax Deadline Tax Forms

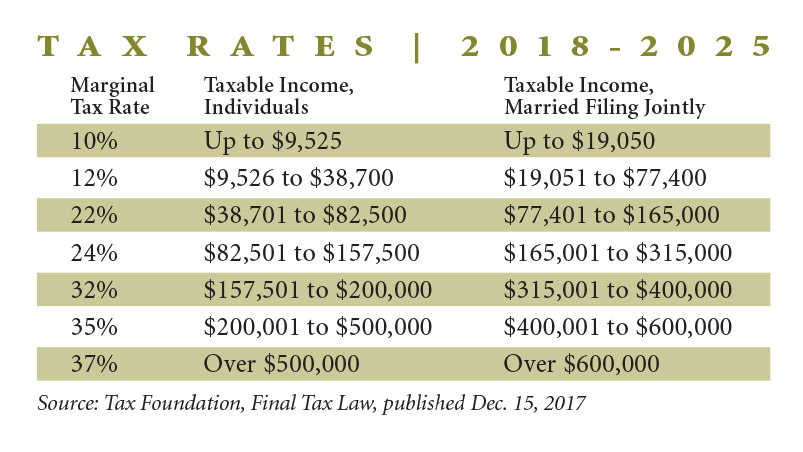

Pass Through Tax Rules Seen Raising Some Farm Tax Bills 2017 11 03 Agri Pulse

Pass Through Tax Rules Seen Raising Some Farm Tax Bills 2017 11 03 Agri Pulse

What The New Tax Law Means For Agriculture And Rural Landowners

What The New Tax Law Means For Agriculture And Rural Landowners

Piecing Together The Farmland Tax Puzzle Ontario Federation Of Agriculture

Piecing Together The Farmland Tax Puzzle Ontario Federation Of Agriculture

Property Tax Rebate For Farm Properties In Ontario

Image Archive Sherbino 2 Texas Wind Farm Wind Energy Energy Industry

Image Archive Sherbino 2 Texas Wind Farm Wind Energy Energy Industry

The 2017 Free Tax Software Roundup For Canadians Www Redflagdeals Com Income Tax Return Income Tax Tax Deadline

The 2017 Free Tax Software Roundup For Canadians Www Redflagdeals Com Income Tax Return Income Tax Tax Deadline

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home