How To Calculate Property Tax Levy

While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator. The result will be the maximum new tax you would pay.

Montana Property Taxes Montana Property Tax Example Calculations

Montana Property Taxes Montana Property Tax Example Calculations

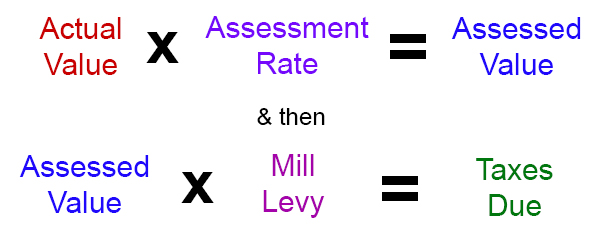

Property taxes are based on the ASSESSED VALUATION.

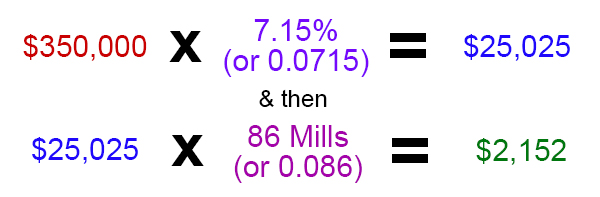

How to calculate property tax levy. For example if your home is assessed at 100000 and the levy rate in your tax district is 1454067946. Property tax rates in Texas are recalculated each year after. Assessed Value 100000 1000 x 1454067946 Levy Rate 145407 Tax Bill.

Multiply 0005 by 418000 to get 2090 in city property tax. Tax levy budget - revenues To determine the tax rate the taxing jurisdiction divides the tax levy by the total taxable assessed value of all property in the jurisdiction. A schedule will be created listing each year and a total tax amount.

For comparison the median home value in Florida is 18240000. Multiply the levy millage by 001. Careers Work With Us.

The assessed value estimates the reasonable market value for. To put it all together take your assessed value and subtract any applicable exemptions for which youre eligible and you get the taxable value of your property. So if your home is worth 200000 and your property tax.

Levy rates budget requests are multiplied by each 1000 of assessed value to determine your tax bill. Municipalities collect real estate taxes also known as property taxes to fund municipal operations public schools roads police and firemen. Enter the number of years you want to calculate property taxes.

Add together your results to determine your total annual property tax. 254 rows Texas Property Tax Rates. Coronavirus - COVID-19 Keep Yourself Safe.

Multiply this number times the assessed valuation. The ESTIMATE tax calculator allows what if scenarios so you can estimate what your property taxes might be if you purchased or acquired a piece of property in Bernalillo County. Calculating Property Tax Levies Most municipal tax authorities calculate the total property tax levy for the locale by projecting the needs of the county or city as a whole for that year then.

Longview Hotel Occupancy Taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The assessed value in this year is the value you entered above.

For example if the assessed value of your property is 200000 and the levy rate is 13 per thousand dollars of value. Weather Alerts Sign-up for Notifications. The state currently pays 10 of property taxes plus an additional 25 for owner-occupied properties.

Starting Year The starting year of the years you want to calculate. You can estimate what your property taxes will be if you know the assessed value of your property and the tax levy rate. Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property.

The millage rate is the amount per 1000 of. Because tax rates are generally expressed as per 1000 of taxable assessed value the product is multiplied by 1000. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900.

This is an ESTIMATED tax calculation based on the latest mill rate set by state and local governments. Agenda Center Public Notices and Agendas. Mandatory Local Debt Reporting.

Eg if the levy is 42 mills the result is 0042. Multiply the assessed value by the mill levy which is listed under the tax unit the property is located and then divide by 1000 to estimate the property tax. Comprehensive Annual Financial Report CAFR Tax Rates and Info.

Assessed value mill levy tax bill. Concluding the example add 4180 to 2090 to get 6270 in. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Taxes In Rochester Mn Domaille Real Estate

Property Taxes In Rochester Mn Domaille Real Estate

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Understanding California S Property Taxes

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest

Property Tax Definition Uses And How To Calculate Thestreet

Property Tax Definition Uses And How To Calculate Thestreet

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

The Cook County Property Tax System Cook County Assessor S Office

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Property Taxes Explained Klickitat County Wa

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home