How Long Can You Go Without Paying Property Taxes In Missouri

If you lose your home to a tax sale in Missouri you can reclaim it by paying a specific amount. With adverse possession a third party must publicly occupy and maintain a property for a significant period of time usually two to five years or more including paying property taxes.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

If the decedent dies with a valid will then the property is distributed according to the will.

How long can you go without paying property taxes in missouri. Within one year after the sale and up until the deed is issued if it was sold at a first or second offering or within 90 days if the property was sold at a third offering. If you continue not to pay the purchaser can file a petition with the court to foreclose on your property and take ownership of it. The successful bidder at the sale pays off the past-due amounts and gets a lien on the property.

Auctions are held on the first Monday of April or the last Monday of August. If a person dies without a will then Missouris probate law dictates how the decedents assets are. In Mississippi if you dont pay your real estate taxes on time the tax debt will be sold at a county tax auction.

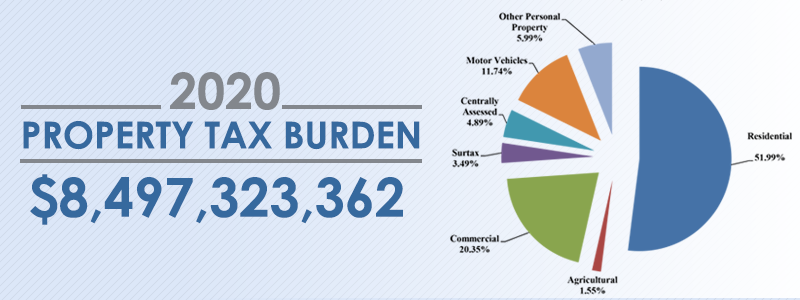

Taxes that remain unpaid after December 31st may have a suit filed upon them and will incur additional associated fees. If no one bids at the auction the debt is struck. All Personal Property Taxes are due by December 31st of each year.

You usually have a period of years before this last step occurs but during this time more property taxes continue to accrue. As with the federal deadline extension Missouri wont charge interest on unpaid balances between April 15 and July 15 2020. Your home then gets sold at an auction to.

Missouri residents now have until July 15 2020 to file their state returns and pay any state tax they owe for 2019. The Missouri Department of Revenue received more than 238000 electronic payments in 2020. You dont need to do anything to get this extension.

Or maybe youre a billionaire and you dont have to concern yourself with paying property taxes. A federal tax lien on real estate or personal property lasts for 10 years unless refiled and could continue after the property is sold. Its automatic for all Missouri taxpayers.

However making payments will not stop the Collector of Revenue from filing suit on a delinquent account per Missouri State Statute. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year. The Department also received more than 26 million electronically filed returns in 2020.

After a set period of time typically anywhere from six months to two years depending on where you live if your taxes are still unpaid the taxing authoritys tax lien gives them the right to foreclose on your property. No 95 Feb 16 1966 concluding that non-resident military personnel stationed in Missouri may obtain a certificate of no tax due often called a waiver from the collector and license their cars in Missouri without paying property tax on them. Probate is the legal process that occurs after a person the decedent dies with or without a valid will.

They have lots of ways to get around paying property taxes legally you know If you want to learn why they dont pay property taxes read this piece I found. Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. Missouri Probate and Estate Tax Laws.

Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County.

Online No Tax Due System Information

Online No Tax Due System Information

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Missouri Income Tax Rate And Brackets H R Block

Missouri Income Tax Rate And Brackets H R Block

Online No Tax Due System Information

Online No Tax Due System Information

How School Funding S Reliance On Property Taxes Fails Children Npr

Https Dor Mo Gov Forms 426 Pdf

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home