Travis County Property Tax Bill 2021

You will be able to find. 31 falls on a weekend in 2021 the delinquency date will be a little different for.

Proposed Coronavirus Relief Legislation Titled Consolidated Appropriations Act 2021 Would Extend 179d And 45l Energy Efficiency Incentives Ics Tax Llc

Proposed Coronavirus Relief Legislation Titled Consolidated Appropriations Act 2021 Would Extend 179d And 45l Energy Efficiency Incentives Ics Tax Llc

Property Owners Encouraged to File for Their Homestead Exemptions in the New Year January 4 2021.

Travis county property tax bill 2021. 198 of home value. April 15 - Appraisal Notice letters arrive at your property. Travis County collects on average 198 of a propertys assessed fair market value as property tax.

Property tax bill 2021. Tax rate for fiscal 2021. 2020 Appraisal Notices On Their Way to Travis County Property Owners April 10 2020.

Travis Central Appraisal District is responsible for fairly determining the value of all real and business personal property within Travis County Texas. The numbers are important because theyre used to calculate property taxes. The Texas Constitution guarantees taxpayers the right to view an estimate of their tax bill before tax rates are adopted added Crigler.

The median property tax in Travis County Texas is 3972 per year for a home worth the median value of 200300. By Kevin Clark April 15 2021. Proposed Tax Rates Now Available Online for Travis County Property Owners August 7 2020.

We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Travis Central Appraisal District Extends Property Owner Rendition Deadline to May 15 March. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices USPAP.

AUSTIN KXAN As the local housing market changes dramatically hundreds of thousands in Travis County are getting their home appraisals from the Travis Central Appraisal District for this year. Yearly median tax in Travis County. As appraisals roll out Travis County homeowners can expect surging values and higher tax bills - Flipboard.

Learn More Pay Property Taxeslaunch. Travis County has one of the highest median property taxes in the United States and is ranked 69th of the 3143 counties in order of median property taxes. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County.

Learn more about property tax breaks and current and delinquent property. Learn more about property taxes and foreclosed property sales. As Travis County homeowners get the 2021 property appraisal notices for their home over the coming weeks they will confront the double-edged sword that is Austins housing marketThe values of their properties are soaring which can be great if yo.

Learn how you can pay current property taxes. Learn how you can pay delinquent property taxes. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County.

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. Travis County property tax impact. 1 day agoAs Travis County homeowners get the 2021 property appraisal notices for their home over the coming weeks they will confront the double-edged sword that is Austins housing market.

374 cents per 100 of taxable value. In Travis County property taxes support 127 local government agencies including 21 cities 16 emergency districts the county the hospital district the junior college 54 municipal utility districts 1 road district 15 school districts and 17 water control improvement districts. According to the tax office property taxes are due when a property owner receives their bill but because Jan.

Easily look up your property tax account what you owe print a receipt and pay your property taxes online. The numbers are important because theyre used to calculate property taxes. Pay property taxes by phone with a credit card.

Visit the TxDMV COVID-19 page for information. May 15 - The deadline to file your tax protest for Travis County is May 15 2021 or 30 days after you received your appraisal notice letter. Learn More Pay Property Taxeslaunch.

The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. This year TCAD says it has reached 413403. Travis Countys median home value was 354622.

Travis County property owners can expect to receive a postcard regarding the website in the mail in the coming days. The Tax Office collects fees for a variety of State and local government agencies and proudly registers voters in Travis County. AprilMay - Appraisal review board begins hearing protests from property owners.

Informal meetings are being offered on a first come first served basis from April 13 2021 to May 30 2021.

Https Www Roundrocktexas Gov Wp Content Uploads 2020 12 Fy 2021 Budget Book Compressed For Web 1 Pdf

Webinars Travis Central Appraisal District

Pflugerville Isd Projects 14 3m Budget Shortfall In 2021 22 Due To Covid 19 Community Impact Newspaper

Pflugerville Isd Projects 14 3m Budget Shortfall In 2021 22 Due To Covid 19 Community Impact Newspaper

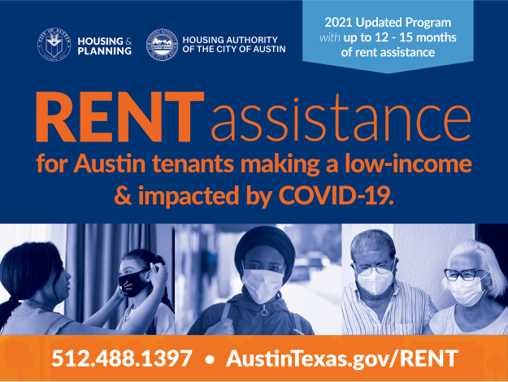

Will Covid 19 Impact 2020 Property Tax Valuations In Texas Austin Business Journal

Will Covid 19 Impact 2020 Property Tax Valuations In Texas Austin Business Journal

Tcad 2021 Budget Approved For 20 2 Million The Austin Bulldog

Tcad 2021 Budget Approved For 20 2 Million The Austin Bulldog

2021 Midwinter Conference Program By Texas Association Of School Administrators Issuu

2021 Midwinter Conference Program By Texas Association Of School Administrators Issuu

Austin Voters Ask How Much With Project Connect Raise My Taxes Austonia

Austin Voters Ask How Much With Project Connect Raise My Taxes Austonia

Sandy City Journal January 2021 By The City Journals Issuu

Sandy City Journal January 2021 By The City Journals Issuu

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

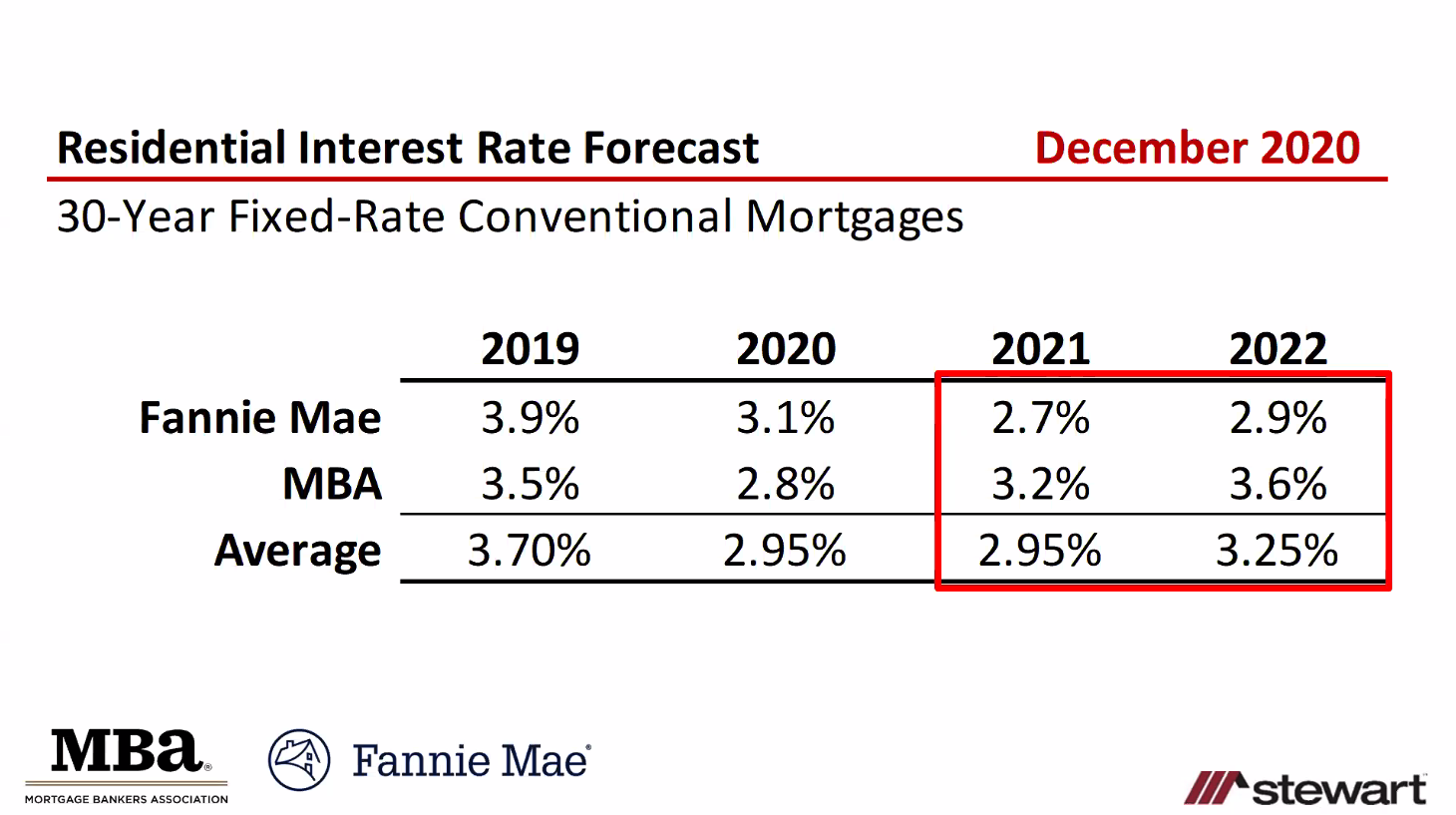

Houston Housing Market 2021 Forecast What To Expect In Real Estate This Year

Houston Housing Market 2021 Forecast What To Expect In Real Estate This Year

Webinars Travis Central Appraisal District

Spring Summer 2021 Color Trends Pantone

Spring Summer 2021 Color Trends Pantone

Https Www Co Walker Tx Us Egov Apps Document Center Egov View Item Id 4510

.png)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home