Lowest Property Tax In Massachusetts

This is above the national average which is 107. The Massachusetts Department of Revenue has released the average household property tax bill for all Massachusetts towns for fiscal year 2015.

For the most up to date tax rates please visit the Commonwealth of Massachusetts.

Lowest property tax in massachusetts. Census Bureau data to determine real-estate property tax rates and applying assumptions based on national auto-sales data to determine vehicle property tax rates. For your reference I provided the 2016 Massachusetts Property Tax Rates By Town in the table below. Remember the 2018 rate is estimated but usually predictive and accurate and isnt finalized until the later half of the year.

Middlesex County collects the highest property tax in Massachusetts levying an average of 435600 104 of median home value yearly in property taxes while Berkshire County has the lowest property tax in the state collecting an average tax of 238600 115 of median home value per year. For example property tax in one state may be much lower but personal income tax may be much higher. Incorporating all areas the states average effective tax rate is 117.

In fact the median annual property tax payment is 4899. Tax rates are set locally by cities and towns in Massachusetts with total rates generally ranging from 1 to 2 10 to 20 mills. The lowest residential tax rate belongs to the town of Chilmark which is located on Marthas Vineyard.

Its tax rate is at 288. Other nearby towns such as Edgartown Nantucket and Aquinnah are all among the top 10 in the state for the lowest tax rates. The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value.

The ten states with the lowest property tax rates are. Massachusetts Property and Excise Taxes Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. Vehicle Property Tax.

The median residential tax rate for the 344 communities with available information as. For each state we assumed all residents own the same car. But we can break down the states with the lowest taxes based on tax type.

351 rows Map of 2020 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free. Unfortunately all states have property taxes. Once you know the rate to get the taxes for the house in question you divide the ASSESSED VALUE not market value by 1000 and then multiply by the rate.

We examined data for cities and counties collectively accounting for at least 50 percent of the states population and extrapolated this to the state level using weighted averages based on population size. Luckily 28 states have property tax rates below 100. Massachusetts property real estate taxes are calculated by multiplying the propertys value by the locations real estate tax.

Residential tax rates decreased on average in Massachusetts for 2020. The exact property tax levied depends on the county in Massachusetts the property is located in. Here are the 50 communities with the lowest property.

A Toyota Camry LE four-door sedan 2020s highest. Town Residential Commercial Year Abington. 341 rows Most towns in western Massachusetts with assessed home values lower.

In order to determine the states with the highest and lowest property taxes WalletHub compared the 50 states and the District of Columbia by using US. View transcript of Learn about Property Taxes. Social for Massachusetts Property and.

This is no different from most other New England states like New Hampshire Vermont Maine Connecticut and. 338 rows Below youll find the tax rates for Massachusetts towns.

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Quality Measu Healthcare Education Health Care American Healthcare

Ahrq Logo Comparison Of The 50 States And The District Of Columbia Across All Health Care Quality Measu Healthcare Education Health Care American Healthcare

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

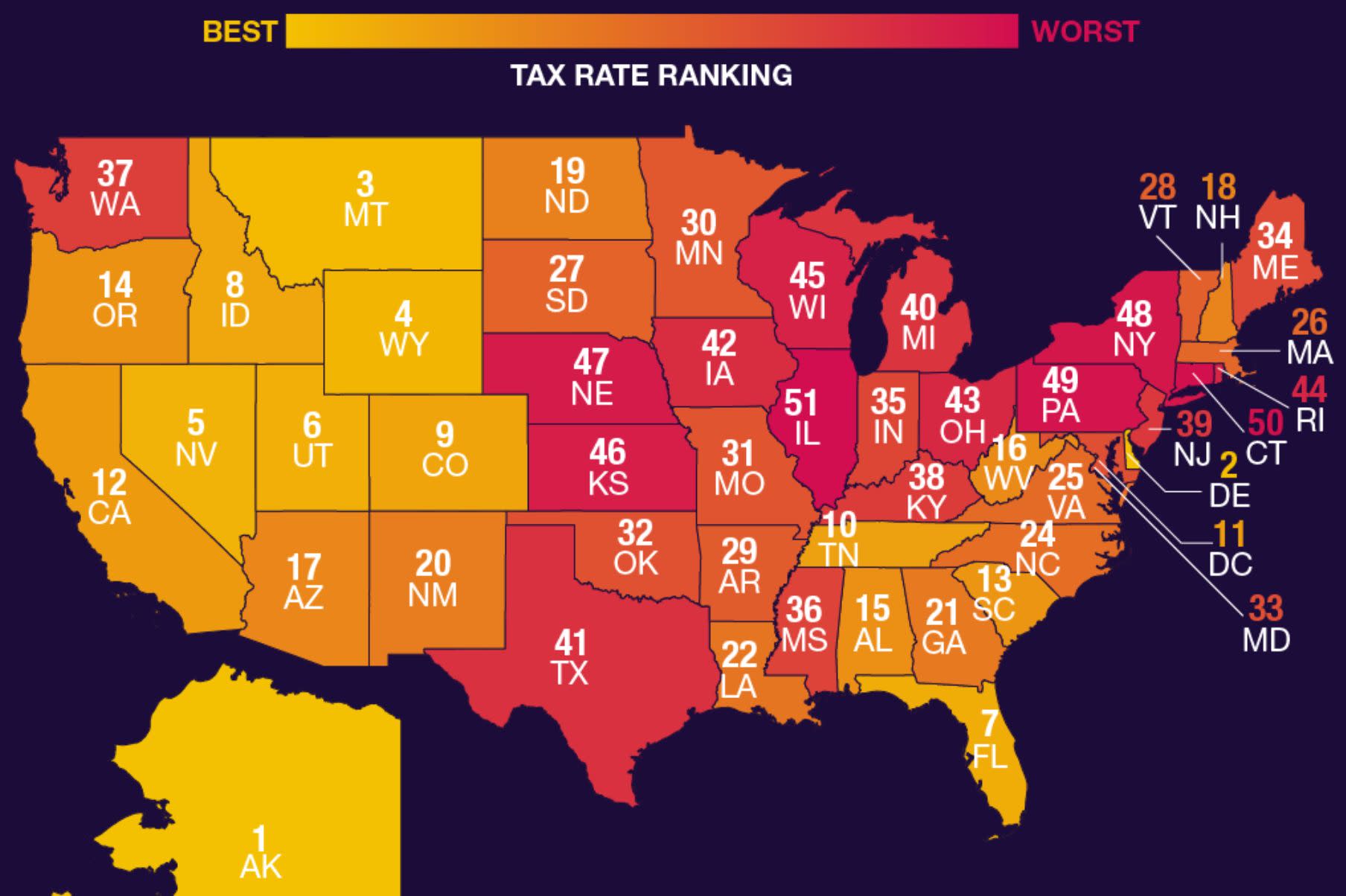

The Best And Worst U S States For Taxpayers

The Best And Worst U S States For Taxpayers

Chart 2 Alaska Tax Burden By Type Of Tax Fy 1959 To 2015 Jpg Types Of Taxes Burden Low Taxes

Chart 2 Alaska Tax Burden By Type Of Tax Fy 1959 To 2015 Jpg Types Of Taxes Burden Low Taxes

Chart 4 South Dakota Local Tax Burden By County Fy 2015 Jpg South Dakota Dakota Burden

Chart 4 South Dakota Local Tax Burden By County Fy 2015 Jpg South Dakota Dakota Burden

Chart 4 Georgia Local Tax Burden By County Fy 2016 Jpg Burden Tax Georgia

Chart 4 Georgia Local Tax Burden By County Fy 2016 Jpg Burden Tax Georgia

Chart 3 Illinois State And Local Tax Burden Vs Major Industry Fy 2016 Jpg Burden Tax Educational Service

Chart 3 Illinois State And Local Tax Burden Vs Major Industry Fy 2016 Jpg Burden Tax Educational Service

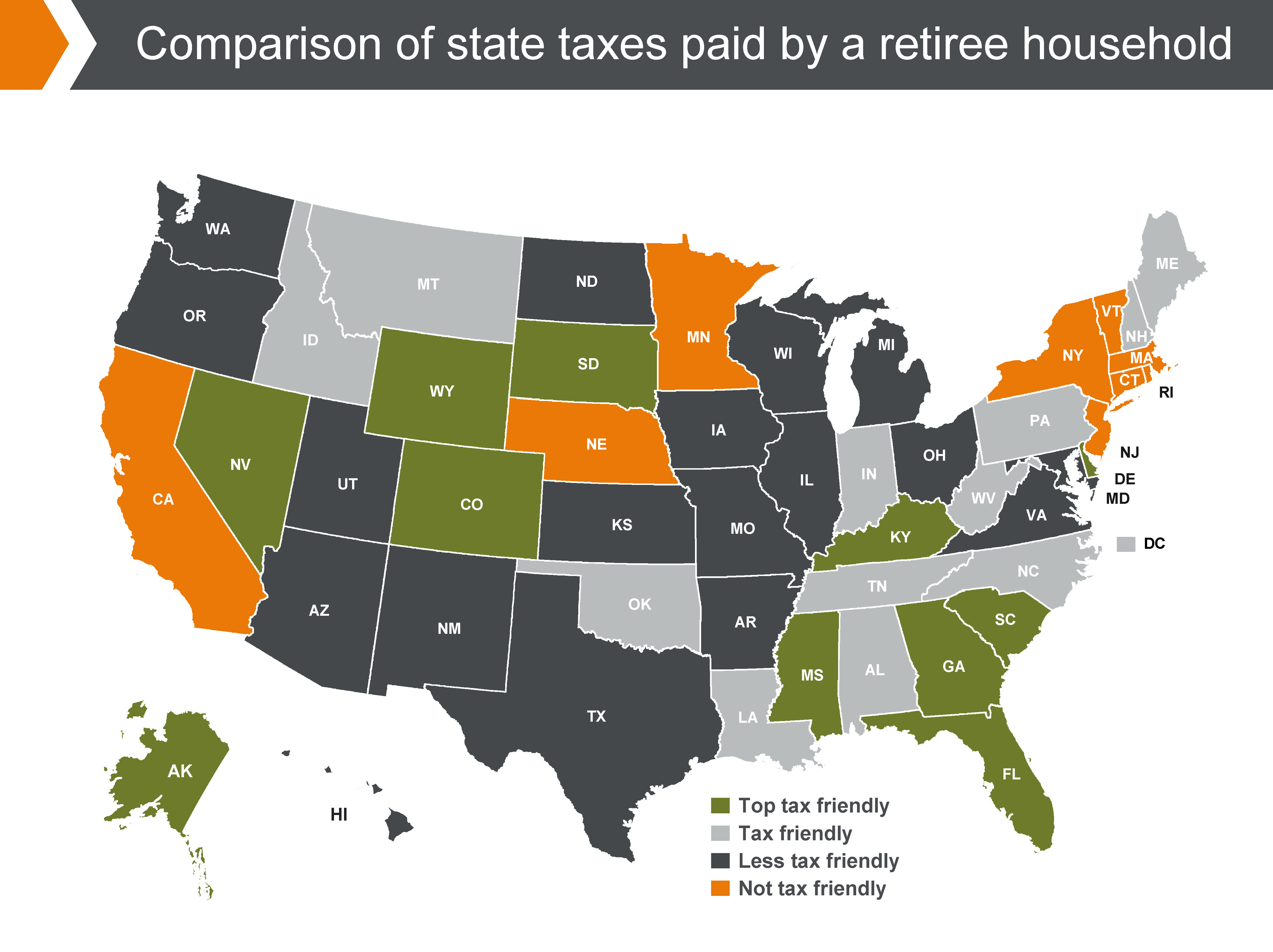

States With The Highest And Lowest Taxes For Retirees Money

States With The Highest And Lowest Taxes For Retirees Money

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado S Low Property Taxes Colorado Fiscal Institute

Trying To Get The Lowest Mortgage Rate In Massachusetts Lowest Mortgage Rates Mortgage Interest Rates Mortgage Payoff

Trying To Get The Lowest Mortgage Rate In Massachusetts Lowest Mortgage Rates Mortgage Interest Rates Mortgage Payoff

Lighthouses Of Massachusetts By Kraig Laconia Lighthouse New Hampshire

Lighthouses Of Massachusetts By Kraig Laconia Lighthouse New Hampshire

Amazon Prime Continues To Be A Cash Cow For Jeff Bezos Charts Business Insider First Time Home Buyers Amazon Prime Real Estate Trends

Amazon Prime Continues To Be A Cash Cow For Jeff Bezos Charts Business Insider First Time Home Buyers Amazon Prime Real Estate Trends

Mass Towns With Lowest Property Tax Bills

Mass Towns With Lowest Property Tax Bills

The Cities With The Highest And Lowest Property Taxes Real Estate Qconline Com

The Cities With The Highest And Lowest Property Taxes Real Estate Qconline Com

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Where The Highest And Lowest Property Taxes Are Vacation Spots Places Vacation

Where The Highest And Lowest Property Taxes Are Vacation Spots Places Vacation

Where Utility Bills Are Highest And Lowest In The United States United States Geothermal Electricity Cost

Where Utility Bills Are Highest And Lowest In The United States United States Geothermal Electricity Cost

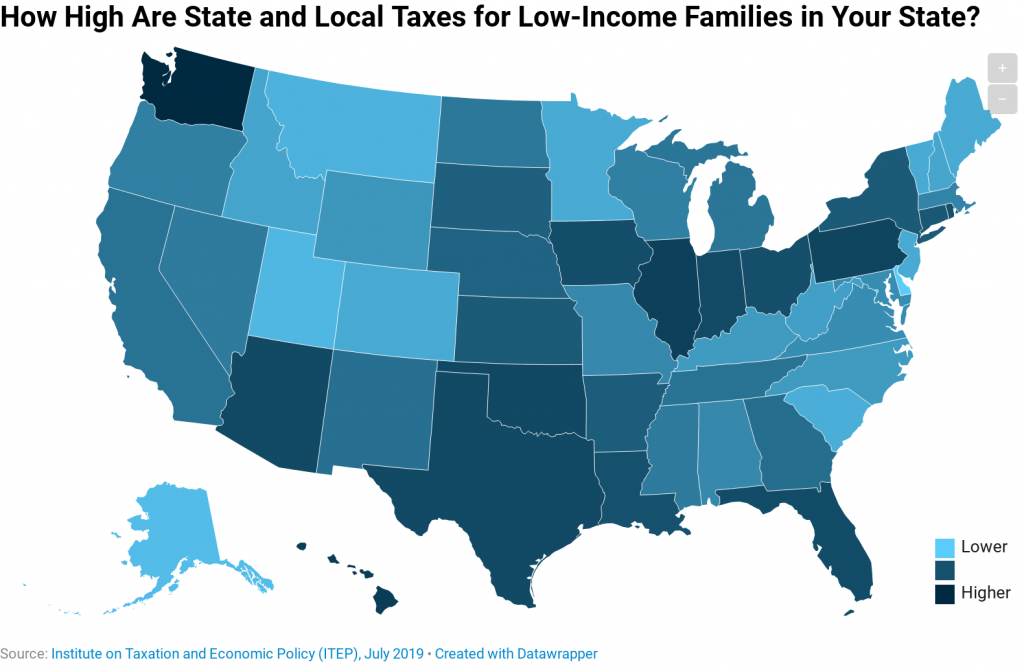

Which States Have The Highest Tax Rates For Low Income People Itep

Which States Have The Highest Tax Rates For Low Income People Itep

Who Pays America S Highest And Lowest Property Taxes Property Tax Mortgage Payoff Real Estate Information

Who Pays America S Highest And Lowest Property Taxes Property Tax Mortgage Payoff Real Estate Information

Labels: massachusetts, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home