How Is Property Tax Calculated In Hawaii

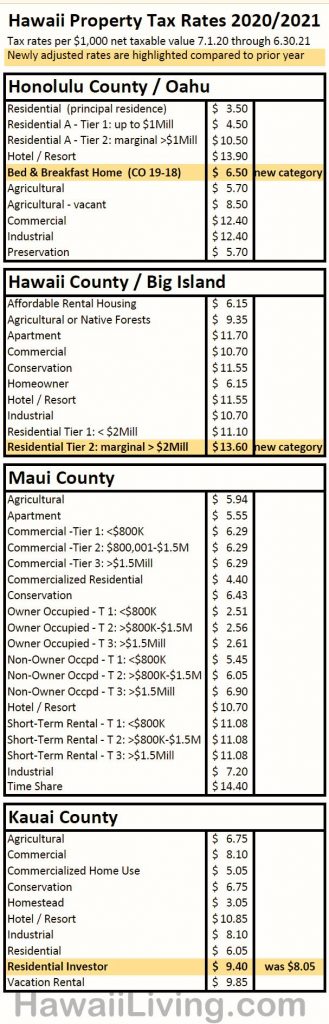

However because of high home values average annual property tax payments in Hawaii are 1871 which ranks in the middle of the pack among states. For the 2020-2021 Fiscal Year below are property Tax Rates broken down by Island and Class.

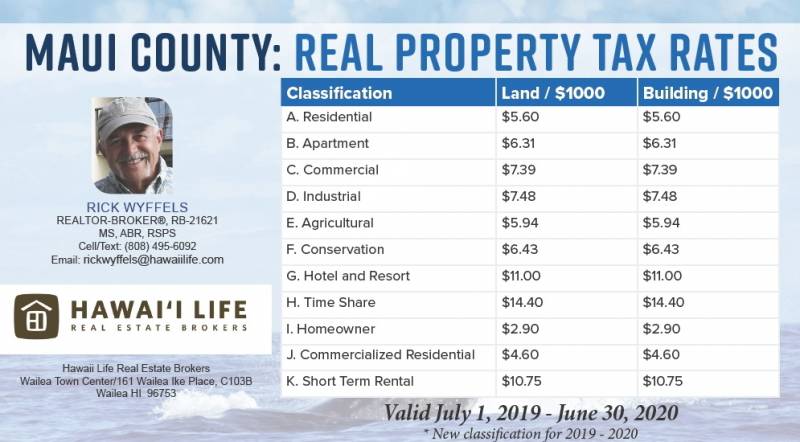

Property Tax Maui Maui Real Estate Property Tax Maui

Property Tax Maui Maui Real Estate Property Tax Maui

5425 divide by 12 452 month----- Property Tax Example II -----Assessed value.

How is property tax calculated in hawaii. To arrive at the assessed value an. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. These are some of the lowest tax rates in the country.

Box 1530 Honolulu Hawaii 96806-1530. Tax amount varies by county. Instead an appraiser from the Honolulu tax office will typically analyze five comparable properties sold prior to July 1 of that tax year.

So if your home has a taxable value of 500000 your annual tax bill would be 1750. Once Hawaii homeowners add up their two exemptions and deduct it from the assessed value they calculate their property tax by multiplying the reduced assessed value by 615 00615 for residential properties. That is just over 610ths of 1 of a discounted assessed value.

If you are married you should make separate estimated tax payments for yourself and your spouse even if you will be filing a joint. The Hawaii State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Hawaii State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. ----- Property Tax Example I -----Assessed value.

Hawaii Property Tax Rates. Disclaimer This site was designed to provide quick and easy access to real property tax assessment records and maps for properties located in the County of Hawaii and related general information about real property tax procedures. The median property tax in Hawaii is 132400 per year for a home worth the median value of 51760000.

Information and answers to the most commonly asked questions. 500 multiply by 1085 5425 annual 3. County of Hawaii Real Property Tax Office.

You may also complete Form N-200V Individual Income Tax Payment Voucher and mail the voucher to the Hawaii Department of Taxation Attn. 44386 effective January 1 2019 December 31 2019 and 47120 effective January 1 2020 December 31 2030 County of Kauai. Real Property Taxes - How to Calculate.

The states average effective property tax rate annual taxes as a percentage of home value is just 028 the lowest of any US. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property. The median property tax on a 55900000 house is 586950 in the United States.

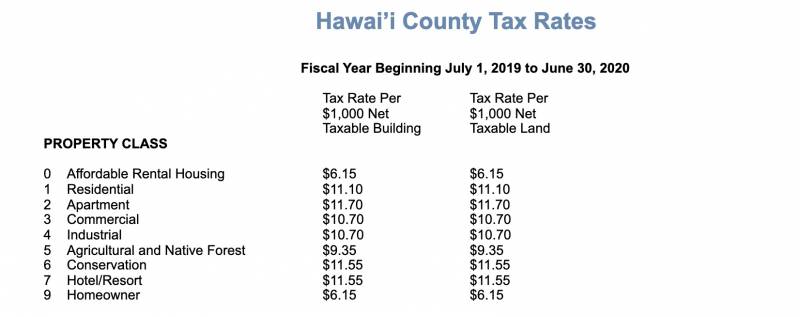

Hawaii is ranked number thirty four out of the fifty states in order of the average amount of property taxes collected. The median property tax on a 55900000 house is 145340 in Hawaii. PROPERTY CLASS 0 Affordable Rental Housing 615 615 1 Residential Portion valued less than 2 million 1110 1110 Portion valued at 2 million and more 1360 1360 2 Apartment 1170 1170 3 Commercial 1070 1070 4 Industrial 1070 1070 5 Agricultural and Native Forest 935 935 6 Conservation 1155 1155 7 HotelResort 1155 1155 9 Homeowner 615 615 Chapter 19 Article 11 Section 19-90 of the Hawaii.

Dedicating your hotelresort zoned condotel for residential use will lower your property tax rate effective July 1 st 2020. Listed information does not include all of the information about every property located in this County. County of Hawaii.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Honolulu County. The median property tax on a 55900000 house is 156520 in Honolulu County. Our Hawaii Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Hawaii and across the entire United States.

47120 effective January 1 2019 December 31 2030. This will reduce your property tax rate to the lower Residential Rate 35 if your property is assessed below 1Mill or to the Residential Rate A 45105 if your property is assessed at 1Mill or above. Rates noted are per 1K of assessed value.

Hawaii has one of the lowest five property taxes for homeowners in the US - ask us about current property tax rates. Counties list property tax rates per 1000 in taxable value. However you will no longer be able to rent out your unit as a short-term.

That translates to a tax rate of 0035 35 divided by 1000. Counties in Hawaii collect an average of 026 of a propertys assesed fair market value as property tax per year. The Hawaii Department of Revenue is responsible for publishing the latest Hawaii State Tax.

Condominium Projects Impacted by Ord 17-13 updated 20190827. For example the residential rate in Honolulu County is 35. On October 1 the assessed value from the appraiser will be used to calculate property taxes due the following fiscal year July 1 to June 30.

500000 divide by 1000 500.

New Hawaii Property Tax Rates 2020 2021

New Hawaii Property Tax Rates 2020 2021

Property Taxes 2019 2020 Maui County Maui Real Estate Ocean Front Property Oceanfront Living

Property Taxes 2019 2020 Maui County Maui Real Estate Ocean Front Property Oceanfront Living

Honolulu Property Tax 2020 21 Fiscal Year

New Hawaii Property Tax Rates 2020 2021

New Hawaii Property Tax Rates 2020 2021

Hawaii County Proposes Luxury Property Tax Increase Hawaii Real Estate Market Trends Hawaii Life

Hawaii County Proposes Luxury Property Tax Increase Hawaii Real Estate Market Trends Hawaii Life

Honolulu Property Tax 2020 21 Fiscal Year

Honolulu Property Tax 2020 21 Fiscal Year

Https Files Hawaii Gov Dbedt Economic Data Reports Property Tax Report 2017 Pdf

Hawaii County Proposes Luxury Property Tax Increase Hawaii Real Estate Market Trends Hawaii Life

Hawaii County Proposes Luxury Property Tax Increase Hawaii Real Estate Market Trends Hawaii Life

Delaware State Sales Tax And Rates Sales Tax Delaware State Inheritance Tax

Delaware State Sales Tax And Rates Sales Tax Delaware State Inheritance Tax

A Guide To Hawaii State Sales Tax Sales Tax Tax Holiday Tax

A Guide To Hawaii State Sales Tax Sales Tax Tax Holiday Tax

Hawaii Has The Lowest Property Tax Rates In The Us Wailea Realty Corp

Hawaii Has The Lowest Property Tax Rates In The Us Wailea Realty Corp

Real Property Taxes On Maui Hawaii Real Estate Market Trends Hawaii Life

Real Property Taxes On Maui Hawaii Real Estate Market Trends Hawaii Life

Maui Property Taxes And Tax Information Georgie Hunter

Maui Property Taxes And Tax Information Georgie Hunter

County Of Hawai I Real Property Tax Office

County Of Hawai I Real Property Tax Office

Maui Property Taxes And Tax Information Georgie Hunter

Maui Property Taxes And Tax Information Georgie Hunter

Hawaii Property Tax Calculator Smartasset

Hawaii Property Tax Calculator Smartasset

Honolulu Property Tax 2020 21 Fiscal Year

Harpta Maui Real Estate Real Estate Marketing Taxact

Harpta Maui Real Estate Real Estate Marketing Taxact

Labels: calculated, hawaii, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home