Kentucky Vehicle Property Tax Rate

Motor Vehicle Renewal of 10000 lb Plates or Greater. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

WalletHub a personal finance website analyzed all 50 states and the District of Columbia in terms of real estate and vehicle property taxes to rank which states have the largest property tax load.

Kentucky vehicle property tax rate. Online KENTUCKY Vehicle Registration Renewal Portal. The median property tax in Logan County Kentucky is 554 per year for a home worth the median value of 87500. The state tax rate for non-historic vehicles is 45 cents per 100 of value.

TurboTax will allow you to input multiple lines so list your car twice- once for each of these figures. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Leased vehicles cannot be renewed online. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky. In fact the typical homeowner in.

Where can I find my Vehicle Identification Number VIN. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year. Kentucky Revised Statute Section 64012 as amended by House Bill 537 mandates the following fee changes.

Search tax data by vehicle identification number for the year 2020. You can find the VIN. Kentucky ranks 23rd in the nation in terms of the lowest real estate property tax rate at 086.

Processing Fees Payment Methods. Historic motor vehicles are subject to state taxation only. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees.

For vehicles that are being rented or leased see see taxation of leases and rentals. Non-historic motor vehicles are subject to full state and local taxation in Kentucky. Kentucky VIN Lookup Vehicle Tax paid in 2020.

551 PM EST February 22 2019. Kentucky Revised Statute Section 64012 as amended by House Bill 537 mandates the following fee changes. 121 rows Good news.

Since both of the tax charges you described are based on the cars value you may deduct both figures in Kentucky. Vehicles must be currently insured with a company that is registered with the Kentucky Department of Insurance to be eligible to renew online. Please enter the VIN.

Logan County has one of the lowest median property tax rates in the country with only two thousand three hundred seven of the 3143 counties collecting a lower property tax than Logan County. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including all additional equipment and.

KENTUCKY MOTOR VEHICLE TAX MOTAX In a nutshell you pay personal property taxes on a percentage of the states assessed value of your vehicle. Not all states collect an annual property tax on motor vehicles but Kentucky is one of them. Tax amount varies by county.

Property taxes in Kentucky are relatively low. Logan County collects on average 063 of a propertys assessed fair market value as property tax. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker.

Motor Vehicle Title Application. 17 6 sales tax. 15 rows In Kentucky a property is valued at 100 of fair market value as of January 1 of each year.

AVIS which contains ownership records and various facts on motor vehicles is maintained by the Kentucky Transportation Cabinet. Usage Tax Fees. The car registration and personal property taxes deduction is allowed when you are taxed based on the value of the car.

Please allow 5-7 working days for online renewals to be processed. The vehicles renewed must have unexpired registrations. Andrea Ash John Charlton Mary Lyons Published.

Motor vehicles are assessed through a centralized system supported by the Automated Vehicle Information System AVIS. The owner of the vehicles cannot have overdue property taxes on any other vehicles they own. KRS 1322201a The person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year.

The state tax rate for historic motor vehicles is 25 cents per 100 of value. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online KENTUCKY Vehicle Registration Renewal Portal. Motor Vehicle Title Application.

Motor Vehicle Plates Greater than 10000 lbs. 1st Free 2nd 1000. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year.

Kansas Motor Vehicle Power Of Attorney Form Tr 41 Power Of Attorney Form Power Of Attorney Power

Kansas Motor Vehicle Power Of Attorney Form Tr 41 Power Of Attorney Form Power Of Attorney Power

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Kentucky Motor Vehicle Power Of Attorney Form Power Of Attorney Form Motor Car Power Of Attorney

Kentucky Motor Vehicle Power Of Attorney Form Power Of Attorney Form Motor Car Power Of Attorney

Https Revenue Ky Gov News Publications Motor 20vehicle 20tax 20rate 20books 20162015motorvehicletaxratebook Pdf

The Key To Earning A Perfect Credit Score Magnifymoney Credit Score Mortgage Loans Usda Loan

The Key To Earning A Perfect Credit Score Magnifymoney Credit Score Mortgage Loans Usda Loan

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What Are Closing C Mortgage Loans Loan Mortgage Loan Officer

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What Are Closing C Mortgage Loans Loan Mortgage Loan Officer

Why You Don T Need An 800 Credit Score For A Kentucky Mortgage Loan Approval Credit Score Credit Repair Business Credit Repair Companies

Why You Don T Need An 800 Credit Score For A Kentucky Mortgage Loan Approval Credit Score Credit Repair Business Credit Repair Companies

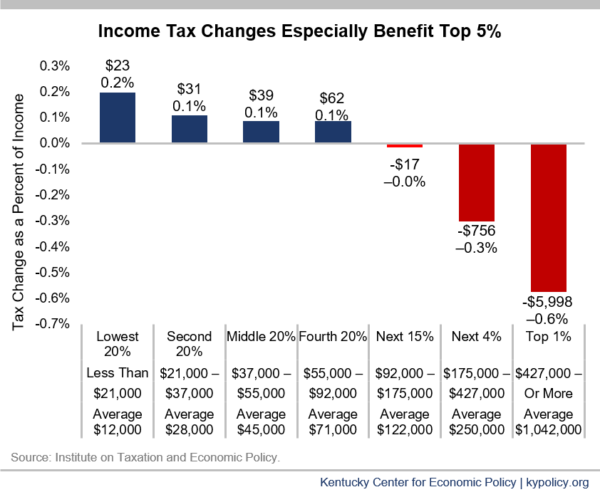

Kentucky S Tax Structure Is Not Fair Kentuckians For The Commonwealth

Kentucky S Tax Structure Is Not Fair Kentuckians For The Commonwealth

Kentucky Fha Single Unit Condo Approvals Fha Kentucky Buying A Condo

Kentucky Fha Single Unit Condo Approvals Fha Kentucky Buying A Condo

Kentucky Sales Tax Small Business Guide How To Start An Llc

Kentucky Sales Tax Small Business Guide How To Start An Llc

Ohio Co Woman Injured In Accident Surfky News Accident Hydroplane Hopkins County

Ohio Co Woman Injured In Accident Surfky News Accident Hydroplane Hopkins County

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

4 Things Every Borrower Needs To Get Approved For A Mortgage Loan In Kentucky Fha Va Khc Conventional Mortgage Loan In 2018 Mortgage Loans Mortgage Lenders Preapproved Mortgage

4 Things Every Borrower Needs To Get Approved For A Mortgage Loan In Kentucky Fha Va Khc Conventional Mortgage Loan In 2018 Mortgage Loans Mortgage Lenders Preapproved Mortgage

Va Loan Pros And Cons Va Mortgage Loans Va Loan Loan Rates

Va Loan Pros And Cons Va Mortgage Loans Va Loan Loan Rates

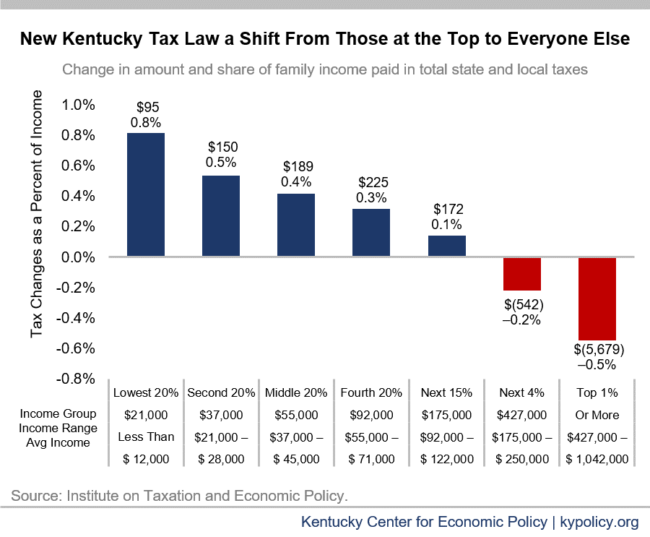

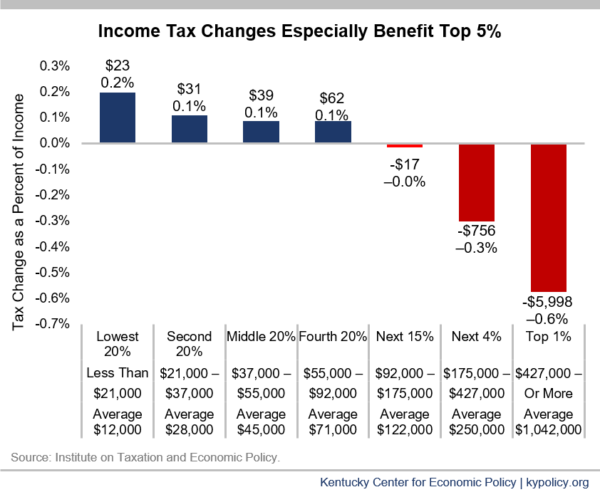

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

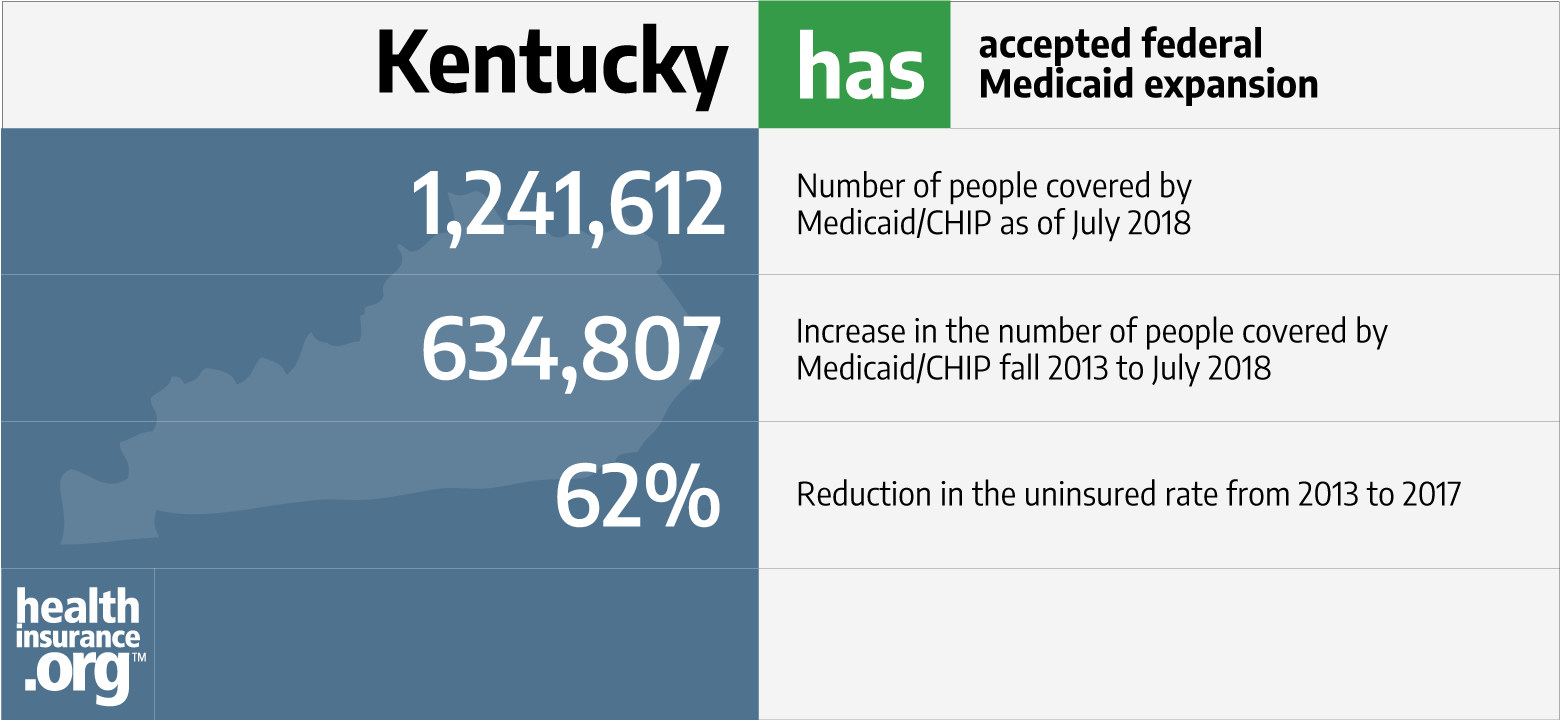

Kentucky And The Aca S Medicaid Expansion Healthinsurance Org

Kentucky And The Aca S Medicaid Expansion Healthinsurance Org

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing Usda Loan Kentucky Usda Mortgage Lender For Rural Housing L Usda Loan Mortgage Loans Usda

What Is The Mortgage Insurance Premium On A Kentucky Rural Housing Usda Loan Kentucky Usda Mortgage Lender For Rural Housing L Usda Loan Mortgage Loans Usda

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home