Michigan Homestead Property Tax Credit 2020

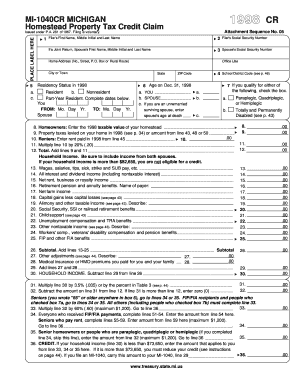

We last updated Michigan Form MI-1040CR in February 2021 from the Michigan Department of Treasury. This form is for income earned in tax year 2020 with tax returns due in April 2021We will update this page with a new version of the form for 2022 as soon as it is made available by the Michigan government.

Michigan Homestead Property Tax Credit Form 2018 Property Walls

Michigan Homestead Property Tax Credit Form 2018 Property Walls

You can download or print current or past-year PDFs of Form MI-1040CR directly from TaxFormFinder.

Michigan homestead property tax credit 2020. For the 2020 income tax returns the individual income tax rate for Michigan taxpayers is 425 percent and the personal. Use summer and winter property tax statements for the tax year in question no matter when the taxes were paid. This booklet contains information for your 2021 Michigan property taxes and 2020 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program.

This number is entered on line 42 with a maximum of 1200. Get more information on Homestead. Michigan may also allow you to e-file your Form 1040CR instead of mailing in a hard copy which could result in your forms being received and processed.

LANSING MichWorking families and individuals with household resources of 60000 or less a year may be eligible for a Homestead Property Tax Credit according to the Michigan Department of Treasury. Your homestead is located in Michigan You were a Michigan resident at least six months of 2019 Youwnour o y Michigan homestead and property taxes wereevied l in. To get back to this entry in TurboTax follow these steps.

What You Should Know. Who May Claim a Property Tax Credit. The Michigan Homestead Property Tax Credit For Senior Filers.

If you are referring to Michigans Form MI-1040CR then these details will be entered in the State interview. You can print other Michigan tax forms here. Senior Filer take the number from line 35 which is the difference between 35 of total household resources and total property taxes paid and multiply it by a reducing factor based on their total household resources.

Verify the correct statements were used. Address where you lived on December 31 2020 if different than reported on line 1 Number Street City State ZIP Code. You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes andor service fees were levied.

The filing deadline to receive a 2020 property tax credit is April 15 2025. Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements. Village taxes may be included on the homestead property tax credit.

To avoid penalty and interest if you owe tax postmark your return no later than April 15 2021. EFile your Michigan tax return now. We last updated the Homestead Property Tax Credit Claim in February 2021 so this is the latest version of Form MI-1040CR fully updated for tax year 2020.

Some functions of this site are disabled for browsers blocking jQuery. You should complete the Michigan Homestead Property Tax Credit Claim MI-1040CR to see if you qualify for the credit. Harrison County Courthouse 200 West Houston Suite 108 PO Box 967 Marshall Texas 75671 903-935-8411 903-935-5564 fax.

In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following. More about the Michigan Form MI-1040CR-7 Instructions Individual Income Tax Tax Credit TY 2020 Form MI-1040CR-7 Instructions requires you to list multiple forms of income such as wages interest or. You may qualify for a homestead property tax credit if all of the following apply.

If the Taxable value is up to 135000 and Household Resources including the Economic Impact Payments is up to 60000 the Property Tax Credit can be claimed for up to 1200. Youaylaim m c a property tax credit if all of the following apply. Be sure to include the Taxable Value.

For the 2020 tax year use the 2020 summer and the 2020. For more information about the Michigan Income Tax see the Michigan Income Tax page. You or your spouse if married are disabled or.

Homesteads with a taxable value greater than 135000 are not eligible for this credit. You or your spouse if married have earned income during the year. When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes.

Average tax credit was 669 for the 2019 tax year. For the 2020 Tax Year. 24 rows Homestead Property Tax Credit Claim.

Address of homestead sold moved from during 2020 Number Street City State ZIP Code. You or your spouse if married are 62 years of age or older at the end of 2020. We last updated Michigan Form MI-1040CR-7 Instructions in February 2021 from the Michigan Department of Treasury.

If you file a Michigan income tax return your credit claim should be included with your MI-1040 return and filed by April 15 2021 to be considered timely. Taxes Site - Forms and Instructions Browsers that can not handle javascript will not be able to access some features of this site. This form is for income earned in tax year 2020 with tax returns due in April 2021We will update this page with a new version of the form for 2022 as soon as it is made available by the Michigan.

Mi 1040cr 2 Fill Online Printable Fillable Blank Pdffiller

Mi 1040cr 2 Fill Online Printable Fillable Blank Pdffiller

Michigan Homestead Property Tax Credit Form 2017 Property Walls

Michigan Homestead Property Tax Credit Form 2017 Property Walls

Fillable Online Michigan 2015 1040cr Forms Fax Email Print Pdffiller

Fillable Online Michigan 2015 1040cr Forms Fax Email Print Pdffiller

Homestead Property Tax Credit Information Abc 10 Cw5

Homestead Property Tax Credit Information Abc 10 Cw5

Https Parktownship Org Wp Content Uploads Poverty Exemption Policy And Guidelines Added 1 25 2021 Pdf

Working Families Individuals Eligible For Homestead Property Tax Credit Newsnet Northern Michigan

Important Tax Credits Michigan Free Tax Help

Mi 1040cr Fill Online Printable Fillable Blank Pdffiller

Mi 1040cr Fill Online Printable Fillable Blank Pdffiller

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

Applying For The Michigan Homestead Property Tax Credit Advancing Smartly

Applying For The Michigan Homestead Property Tax Credit Advancing Smartly

Michigan S Homestead Credit Mi Cottage Tax Services

Michigan S Homestead Credit Mi Cottage Tax Services

Https Www Michigan Gov Documents Taxes Mi 1040cr 5 711881 7 Pdf

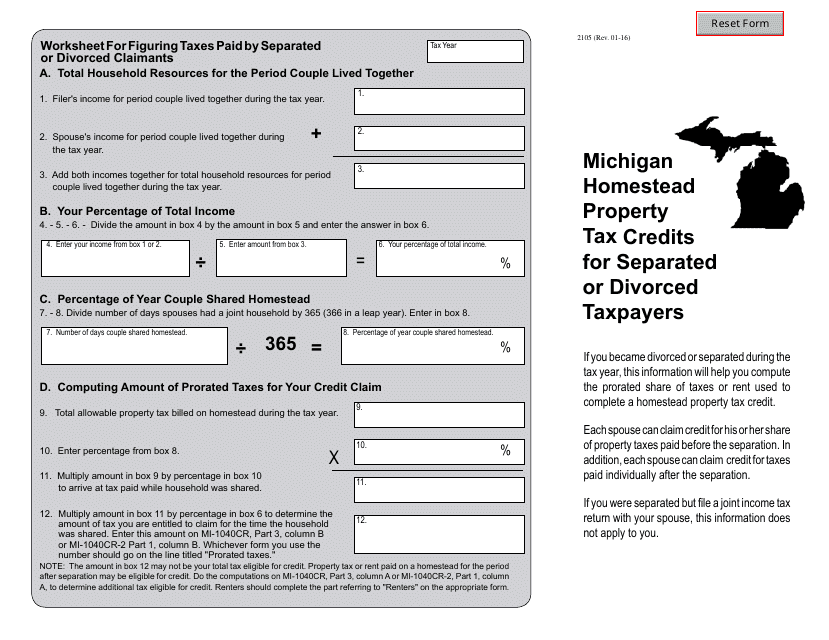

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

2014 Michigan Homestead Property Tax Credit Form Property Walls

2014 Michigan Homestead Property Tax Credit Form Property Walls

Http Origin Sl Michigan Gov Documents Taxes Mi 1040cr 711858 7 Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home