Property Tax Statement Jefferson County Colorado

04152021 2021 Treasurer Property Records Search Jefferson County CO. Smallwood in a statement.

The Cook County Property Tax System Cook County Assessor S Office

04152021 2021 Treasurer Property Records Search Jefferson County CO.

Property tax statement jefferson county colorado. The Jefferson County Assessors Office provides quality customer service by being courteous respectful and informative while identifying describing and valuing all property within Jefferson County in a fair ethical accurate and professional manner. The Property and Taxes center is the place to find the main areas for residents to find information they need from multiple Jefferson County departments divisions and elected offices on both property and what is needed for taxes. Assessed value for commercial and business personal property 29 of actual value.

Assessed value for residential property 715 of actual value. Information current as of. Deadlines First Half property taxes are due April 30th.

The County Treasurer does NOT. Personal Property Tax Form Tax Year 2015 Composite Factors Table New Short Form ADV-40S for reporting Business Personal Property that totals 10000 or less in value. 2021 Assessor Property Records Search Jefferson County CO.

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1 assessment date. The tax roll is certified mid-January of each year. Down menu on the next payment screen.

Statement Levy Information Tax Statement Levy Explanation Paying Property Taxes Under Protest. All other debit cards are charged at 25 395. Wearing a face mask is recommended.

Pursuant to 39-3-1195 2 b I the personal property minimum filing exemption threshold exemption amount for tax years 2020 and 2020 is 7900 or less in total actual value. The Sheriffs Office collection of the 2020 Taxes starts on November 2 2020. You can search your Real Estate Taxes by Property ID Owner Name or Property Address and Personal Property Taxes by Business Tax Number or Business Name.

If taxes have not been paid a corrected tax notice is sent by the Treasurer. For further information regarding payment of taxes interest paid on refunds etc contact the county treasurer at 303-271-8330. Taxes are Impacted by the voters and county commissioners.

Jefferson County Tax Collector JT. Raise or lower taxes. Colorado County Appraisal District COVID Response Policy.

The Colorado County Appraisal District is HIGHLY RECOMMENDING taxpayers to please use the drop box mail or make your property tax payments online and try to use electronic means of. Click the button below to search Property Records. If the tax dollar amount to be abated per year is 10000 or more the abatement must be approved by the Colorado Property Tax Administrator.

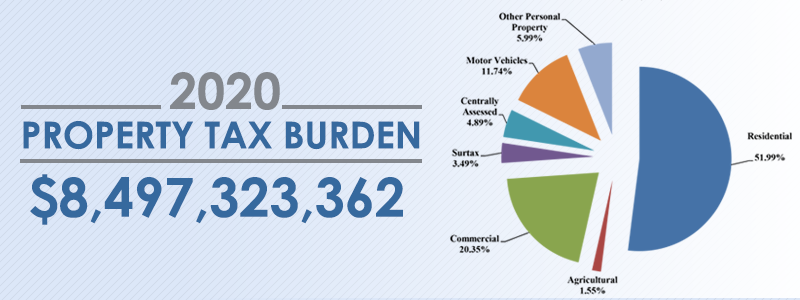

Your ASSESSED value is then multiplied by the current MILL LEVY to arrive at the property tax due. CCAD is limiting 5 people in the lobby at a time and taking safety precautions. Second half are due October 31st of each year.

Information current as of. 2021 Assessor Property Records Search Jefferson County CO. Jefferson County has published a list of property owners who are late paying their property taxes.

Yearly median tax in Jefferson County The median property tax in Jefferson County Colorado is 1805 per year for a home worth the median value of 259300. E-check We do not accept HR Block cards as they require a 30 day hold. Jefferson County collects on average 07 of a propertys assessed fair market value as property tax.

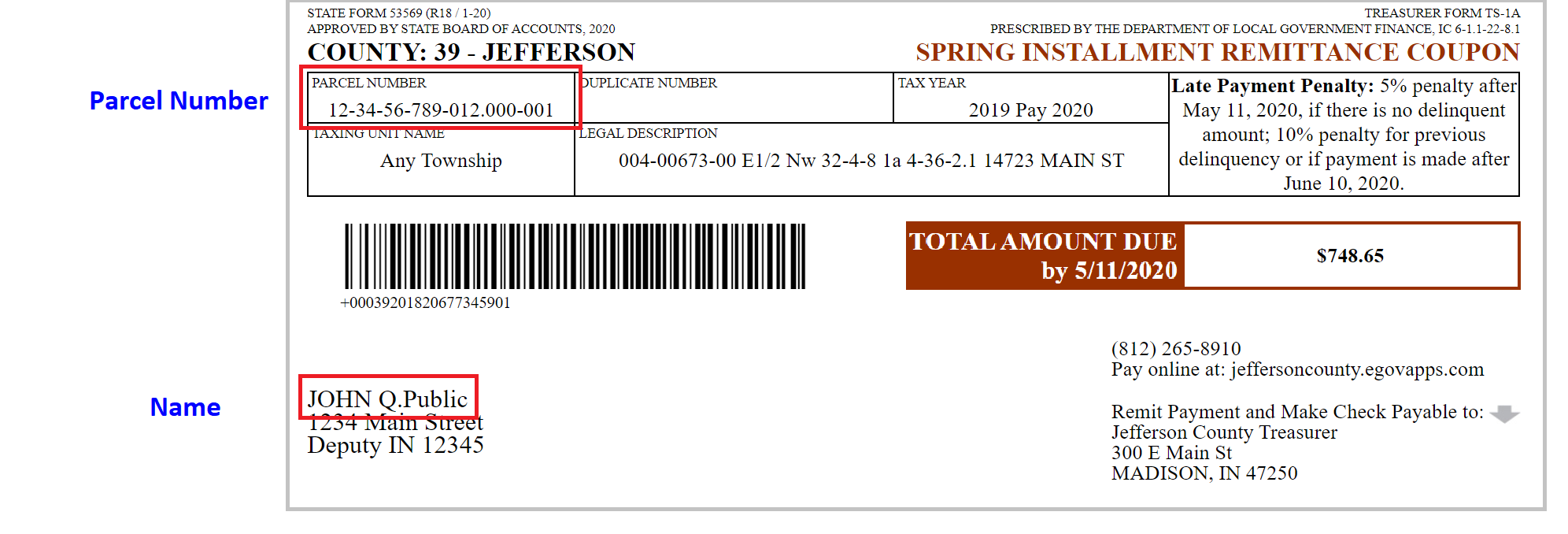

Visa Debit for Property Taxes only not Water Sewer Assessments You must select Visa Debit in drop. The Jefferson County Treasurer collects property taxes invest funds disburses money to cities and districts and acts as county banker. Amounts owed for each year are available online in late January of each year.

Florida Property Tax H R Block

Florida Property Tax H R Block

Notifications From The Treasurer Jefferson County Co

![]() Property Tax Jefferson County Tax Office

Property Tax Jefferson County Tax Office

Alabama Quitclaim Deed Form Quitclaim Deed Will And Testament Sample Resume

Alabama Quitclaim Deed Form Quitclaim Deed Will And Testament Sample Resume

Appeal Property Tax 2015 Copernicus Center Property Tax Tax Appealing

Appeal Property Tax 2015 Copernicus Center Property Tax Tax Appealing

Notifications From The Treasurer Jefferson County Co

My Property Tax Bill Keeps Going Up Why Does Jeffco Need To Ask For Money Jefferson County Co

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home