How Much Is Property Tax In Kansas For A Car

20000 0171 bagnell miller county. Use this calculator to estimate the property tax due on a new vehicle purchase.

Most Expensive School Districts For Jackson Clay Cass Platte And Ray County Taxpayers Kansas City Business Jour Kansas City School District Jackson School

Most Expensive School Districts For Jackson Clay Cass Platte And Ray County Taxpayers Kansas City Business Jour Kansas City School District Jackson School

Your appraised value is the basis for your property taxes but actual tax rates apply to a different number.

How much is property tax in kansas for a car. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. Sales tax receipt if Kansas Dealer. Every person owning or holding real property or tangible personal property on Jan.

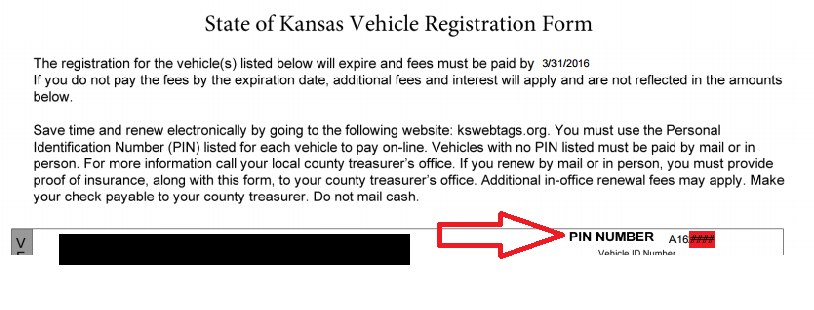

There are also local taxes up to 1 which will vary depending on region. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Payment for registration fees see Kansas Vehicle Registration Fees below and the personal property tax if required.

For fees on trucks with gross weight of over 16000 pounds call the Kansas County Treasurers Office Property tax paid at time of registrationtitle application exceptions Heavy Trucks Trailers and Motorcycles. Married Filing Joint or Qualified Widow er 1260000. Property tax must be paid at time of registrationtitle application exceptions Heavy Trucks Trailers and Motorbikes 6.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. I have attached a checklist of common Itemized Deductions to help you look for more deductions and maximize you Tax Return. Remember to convert the sales tax percentage to decimal format.

Kansas Real Estate Ratio Study Reports Permanent Administrative Regulations. DO NOT push any buttons and you will get an information operator. You can find these fees further down on the page.

List of Kansas cities and their changes up to 15. 106 is the highest possible tax rate Shawnee Mission Kansas The average combined rate of every zip code in Kansas is 7936. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

Increase 1565 ballwin x2 st louis county. If you believe your home has been over-appraised you can talk to your county appraiser or you can file an official appeal within 30 days. A Kansas car registration certificate is valid for 1 year except for new vehicles.

You pay tax on the sale price of the unit less any trade-in or rebate. 0170 avondale clay county kansas city zoological district. View solution in original post.

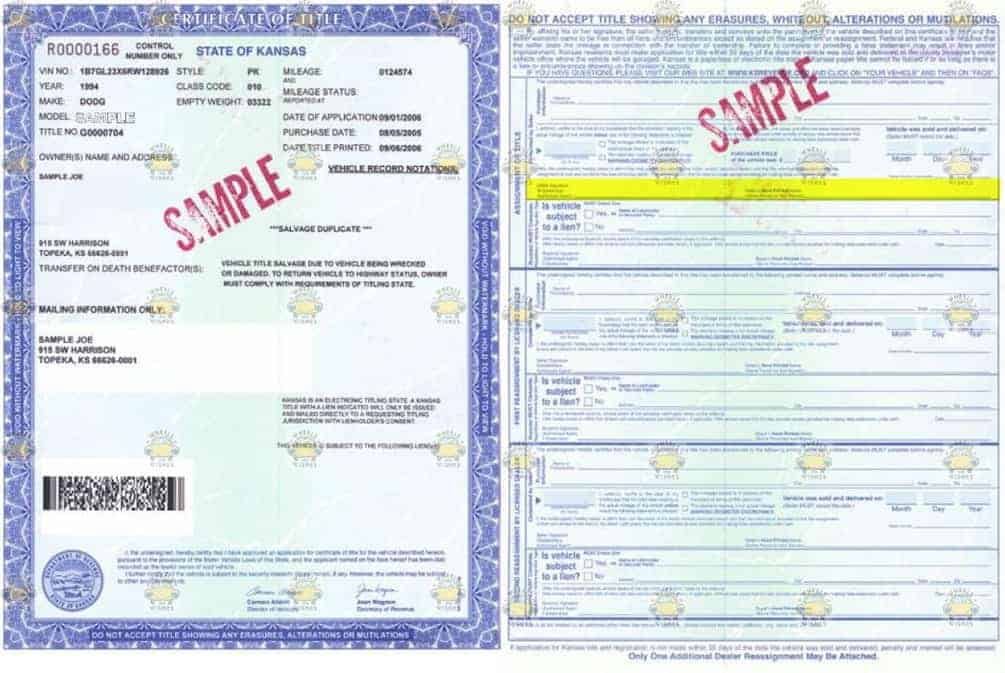

Kansas 105 county treasurers handled vehicle registration tags and renewals. Vehicle Property Tax Estimator. Application for a certificate of title and registration must be made through the local county treasurers office where the vehicle is garaged.

35000 0175 ballwin st louis county. Article 4 Real Estate Ratio Study Register of Deeds Compliance - Directive 03-041. If they are not paid tax warrants are issued by the 15th of July.

Modernization Fee is 400. Some changes has been made in Kansas for county city andor special rates in current quarter of 2021 compared to 2020 Q4. Kansas State Law KSA 19-547 requires delinquent personal property to be advertised in October and a publication fee of 15 will be assessed.

Head of Household 930000. Call Appraisers Office for estimates. If out of state dealer County will collect tax and a bill of sale or invoice is required.

Title and Tag Fee is 1050. While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004.

All warrants must be paid at the Johnson County Treasurers Office. The Median Kansas property tax is 162500 with exact property tax rates varying by location and county. 1 of any calendar year shall be liable for taxes with exemptions for certain properties such as those for charitable educational and religious purposes.

1564 ballwin x1 st louis county 43880. This will start with a recording. The treasurers also process vehicle titles and can register vehicles including personalized license plates.

New vehicle registrations are valid from the time of purchase to the time of your required registrationrenewal which is based on the first. Married Filing Separate 630000. A dealer reassignment Form TR-127 may be attached to an MSO when a franchised dealer.

Multiply the net price of your vehicle by the sales tax percentage. Delinquent personal property tax notices are mailed in June. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

20000 0173 bakersfield ozark county ozark county ambulance district. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Property Tax Assessment Procedure.

Free Kansas Bill Of Sale Forms Pdf

Free Kansas Bill Of Sale Forms Pdf

What Is The Washington State Vehicle Sales Tax New Cars Cars For Sale Car Dealer

What Is The Washington State Vehicle Sales Tax New Cars Cars For Sale Car Dealer

Floridians Pay In Taxes And Insurance In Coastal Areas Affordable Health Insurance Health Care Insurance Insurance Quotes

Floridians Pay In Taxes And Insurance In Coastal Areas Affordable Health Insurance Health Care Insurance Insurance Quotes

Pay Vehicle Tax Registration Crawford County Ks

Pay Vehicle Tax Registration Crawford County Ks

Kansas Department Of Revenue Division Of Vehicles Kansas Personalized And Disabled Personalized Plates

Kansas Department Of Revenue Division Of Vehicles Kansas Personalized And Disabled Personalized Plates

Kansas Vehicle Donation Title Questions

Kansas Vehicle Donation Title Questions

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Kansas Department Of Revenue Division Of Vehicles Kansas Personalized And Disabled Personalized Plates

Kansas Department Of Revenue Division Of Vehicles Kansas Personalized And Disabled Personalized Plates

Kansas Car Registration Everything You Need To Know

Kansas Car Registration Everything You Need To Know

Https Www Sedgwickcounty Org Media 28292 St28vl Pdf

Kansas City Personal Injury Firm Personal Injury Personal Injury Attorney Kansas City

Kansas City Personal Injury Firm Personal Injury Personal Injury Attorney Kansas City

2 People Killed In Single Vehicle Wreck Near K 5 And Marxen Road News Police Police Cars Police Car Lights

2 People Killed In Single Vehicle Wreck Near K 5 And Marxen Road News Police Police Cars Police Car Lights

Just Listed Great Buy On This All Brick Duplex In Southwest Springfield 4139 South Parkhill Court Springfield Springfield Missouri Remax Property Finder

Just Listed Great Buy On This All Brick Duplex In Southwest Springfield 4139 South Parkhill Court Springfield Springfield Missouri Remax Property Finder

Kansas Car Registration Everything You Need To Know

Kansas Car Registration Everything You Need To Know

Kansas City To Study Electric Scooters And Bikes Personal Injury Attorney Spinal Cord Injury Personal Injury

Kansas City To Study Electric Scooters And Bikes Personal Injury Attorney Spinal Cord Injury Personal Injury

Kansas Motor Vehicle Power Of Attorney Form Tr 41 Power Of Attorney Form Power Of Attorney Power

Kansas Motor Vehicle Power Of Attorney Form Tr 41 Power Of Attorney Form Power Of Attorney Power

The Transportation User Fee Has Become Popular Revenue Raising Tool For Municipal Politicians Nationwide Boosting Proper Increase Sales Property Tax Revenue

The Transportation User Fee Has Become Popular Revenue Raising Tool For Municipal Politicians Nationwide Boosting Proper Increase Sales Property Tax Revenue

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home