Property Tax Due Dates Contra Costa County

The Tax Collectors Office is located at 625 Court St. FEBRUARY 15 - Deadline to file exemption claims timely and receive full exemption on Secured Property Tax bills collected in upcoming fiscal year.

Contra Costa County Ca Official Website

Nearly all counties across the state have agreed to waive penalties for late payments though if you can demonstrate youve been impacted by the COVID-19 emergency and cant pay right now.

Property tax due dates contra costa county. The 2nd installment of secured property taxes is due no later than Friday April 10 2020 the Contra Costa county agency stated. Homeowners landlords and businesses in the nine Bay Area counties and across the state must submit their payment for the first installment of. Todays Date is 4112021.

If delinquency date falls on a weekend or holiday the delinquency date is the next business date. According to county auditor-controller Bob Campbell of the estimated 21 billion in property tax billed by Contra Costa County to property owners this fiscal year about 238 million was. Contra Costa County collects on average 071 of a propertys assessed fair market value as property tax.

Treasurer-Tax Collector mails out original secured property tax bills. Contra Costa Countys web site says people should not drop off payments at the tax collectors offices or the county building. First installment of secured taxes payment deadline.

Yearly median tax in Contra Costa County. Save Article Property taxes are still due on April 10 in most California counties despite the fact that county offices are closed. Alameda County April 10 deadline COVID-19 penalty waiver possible Contra Costa County April 10.

A 10 late filing penalty will be applied if a statement is not received by May 7. FEBRUARY 1 - Second installment due on Secured Tax Bills. Tax Lien date affects the upcoming fiscal year January.

With the Tax Collectors Office limited to. The balance due including any penalty is as of 04102021. To assist in the issuance and administration of the Tax and Revenue Anticipation Notes and other bond programs.

The purpose of the Property Tax Division is. APRIL 1 - Due date of filing annual business property statement. The second installment is due on February 1 and delinquent if.

The median property tax in Contra Costa County California is 3883 per year for a home worth the median value of 548200. See Property Tax Publications. The first installment is due November 1 and delinquent if not paid by December 10.

For complete details on property tax payment where you live click your county below. According to State law property tax bills must be mailed by November 1 each year and the bills must allow for two installments. Contra Costa County has one of the highest median property taxes in the United States and is.

10 to pay without penalty. The balance due including any penalty is as of 03272021. Taxpayers have until Dec.

Payments can be made online or by mail. A 10 penalty is added January 1. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in the county.

071 of home value. Second installment of real estate taxes is DUE DELINQUENT after 500 PM on April 10. The Tax Collectors Office cannot guarantee uninterrupted availability of.

Accuracy of the information may be affected by pending payments or corrections. While we have no legal authority to extend the April 10 property tax delinquent deadline we can cancel late-payment charges Taxpayers able to pay e-mail taxinfotaxcccountyus visit http. Accuracy of the information may be affected by pending payments or corrections.

Property Taxes Due Dec. Deadline for timely filing of affidavits and claims for exemptions late after 500 PM. Contra Costa County.

The Contra Costa County Tax Collectors Office mailed this years security property tax bills later than usual due to the COVID-19 pandemic so it has extended the due date for the first installment from Nov. Posting occurs at minimum weekly. Pay Early to Avoid Penalties.

Posting occurs at minimum weekly. Due Dates The First Installment of taxes is due and payable on November 1st and will become delinquent if not paid by 5 pm or the close of business whichever is later on December 10th. A postmark before midnight is considered timely for real property including Veterans and.

10 In Contra Costa County Bay Area Every Bay Area county has no-contact alternatives for getting that payment in on. Thereafter a 10 penalty will be added. Todays Date is 03292021.

First installment of secured taxes is due and payable.

West Contra Costa Unified School Board Votes To Lay Off Up To 300 Workers In June Edsource

West Contra Costa Unified School Board Votes To Lay Off Up To 300 Workers In June Edsource

Https Www Cccleanwater Org Userfiles Kcfinder Files Cccpw 20gi 20plan Final 07 29 19 Pdf

Contra Costa County Ca Official Website

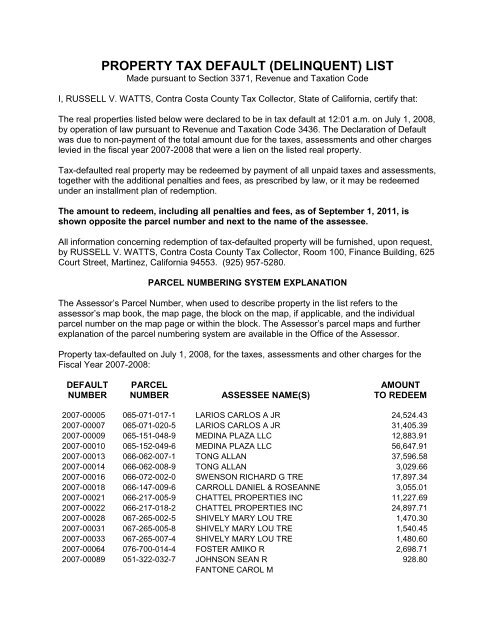

Property Tax Default Delinquent List Contra Costa County

Property Tax Default Delinquent List Contra Costa County

Contra Costa County Ca Official Website

Contra Costa County Secured Property Tax Property Walls

Contra Costa Country Fillable Court Forms Fill Online Printable Fillable Blank Pdffiller

Contra Costa Country Fillable Court Forms Fill Online Printable Fillable Blank Pdffiller

Contra Costa County Assessor Issues Important Warning To Taxpayers Contra Costa Senior Legal Services

Contra Costa County Micro Enterprise Relief Fund Renaissance Center Renaissance Center

Contra Costa County Micro Enterprise Relief Fund Renaissance Center Renaissance Center

Job Opportunities Sorted By Job Title Ascending Employment Opportunities Contra Costa Superior Court

Job Opportunities Sorted By Job Title Ascending Employment Opportunities Contra Costa Superior Court

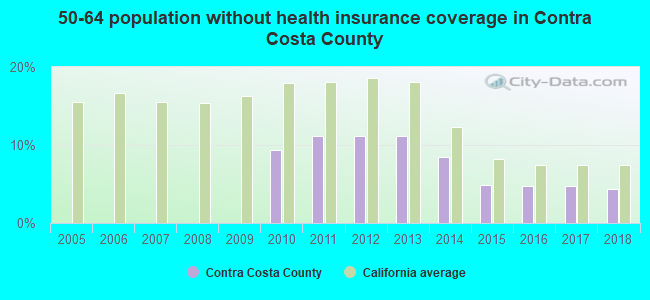

Contra Costa County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Contra Costa County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

State Moves Contra Costa To Most Restrictive Covid 19 Purple Tier Antioch Herald

Contra Costa County Ca Official Website

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce

Contra Costa County Policy Protection Map Greenbelt Alliance

Contra Costa County Board Of Supervisors Prepare To Place Half Cent Sales Tax On November Ballot East County Today

Contra Costa County Board Of Supervisors Prepare To Place Half Cent Sales Tax On November Ballot East County Today

Pay Property Taxes Contra Costa County Property Walls

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce

Coronavirus Updates The Business Assistance Program Lafayette Chamber Of Commerce

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home