Effective Property Tax Rates By State

State and local governments need to meet their financial obligations one way or another and a low effective property tax rate can often mean that other tax rates like sales or income taxes. Example General Tax Rate.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

ATTOM Data Solutions 2020 property tax analysis showed that 323 billion in property taxes were levied on single-family homes in 2020 up 54 percent from 2019.

Effective property tax rates by state. In the US the median owner-occupied home value is 222041 with an effective. New Jersey has the highest effective rate at 238 and is followed closely by Illinois. The General Tax Rate is a multiplier for use in determining the amount of tax levied upon each property.

53 rows State Abreviation Effective Propert Tax Rate Property Tax Rev General Sales Individual. Household Annual State Local Taxes on Median US. Read on to learn which states had the highest and lowest effective property tax rates.

This rate is used to compute the tax bill. Annual Taxes on Home Priced at State Median Value. The states average effective rate is 242 of a homes value compared to the national average of 107.

The average American household spends 2375 annually on real estate property taxes and according to the National Tax Lien Association more than 14 billion in property taxes. Property tax percentage of. Household Difference Between State US.

While property taxes are levied in different ways based on local and state laws a helpful way to compare tax burdens across locations is to calculate an effective property tax rate which is. It is expressed as 1 per 100 of taxable assessed value. Hawaii sits on the other end of the spectrum with the lowest effective rate of 030 percent.

Assessed Value 150000 x General Tax Rate 03758 Tax Bill 5637. New Jersey has the highest effective rate on owner-occupied property at 221 percent followed closely by Illinois 205 percent and New Hampshire 203 percent. Illinois 195 median tax bill of 3995.

New Hampshire 194 5100. Effective Total State Local Tax Rates on Median US. Owning property in any of the states plus the District of.

Effective Real-Estate Tax Rate. Annual Taxes on 2175K Home State Median Home Value. General Tax Rates by County and Municipality.

It was the largest tax hike in four years. Avg Annual State Local Taxes on Median State Household Adjusted Overall Rank based on Cost of Living Index 1. 52 rows Property Taxes by State A Complete Rundown Effective Property Tax Rates by State.

With an average effective rate of 028 the least expensive state for property taxes is Hawaii surprisingly. Effective tax rate median owner-occupied home. Other states that have high effective property tax rates include.

States Without Property Taxes. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value.

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Kansas Ranked In Bottom 5 For Its State And Local Tax Rates The Sentinel

Kansas Ranked In Bottom 5 For Its State And Local Tax Rates The Sentinel

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

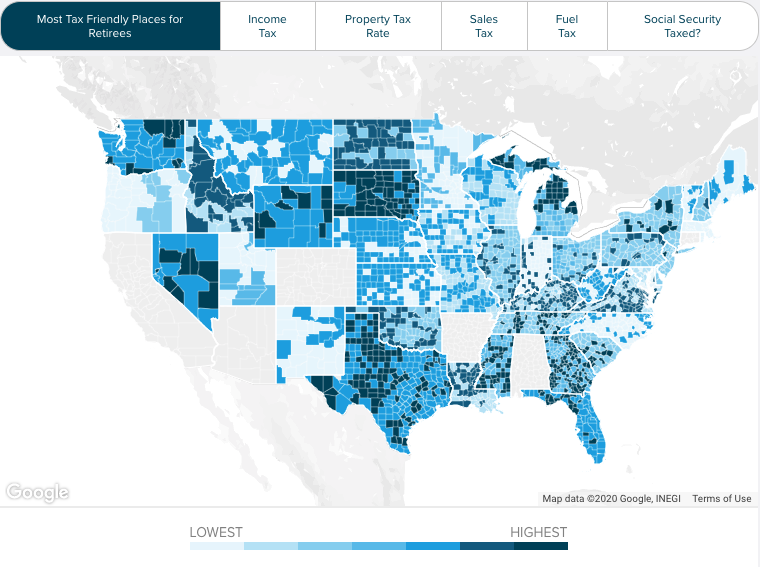

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Arizona Income Tax Calculator Smartasset

Arizona Income Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

The Hidden Costs Of Owning A Home

The Hidden Costs Of Owning A Home

Understanding California S Property Taxes

Understanding California S Property Taxes

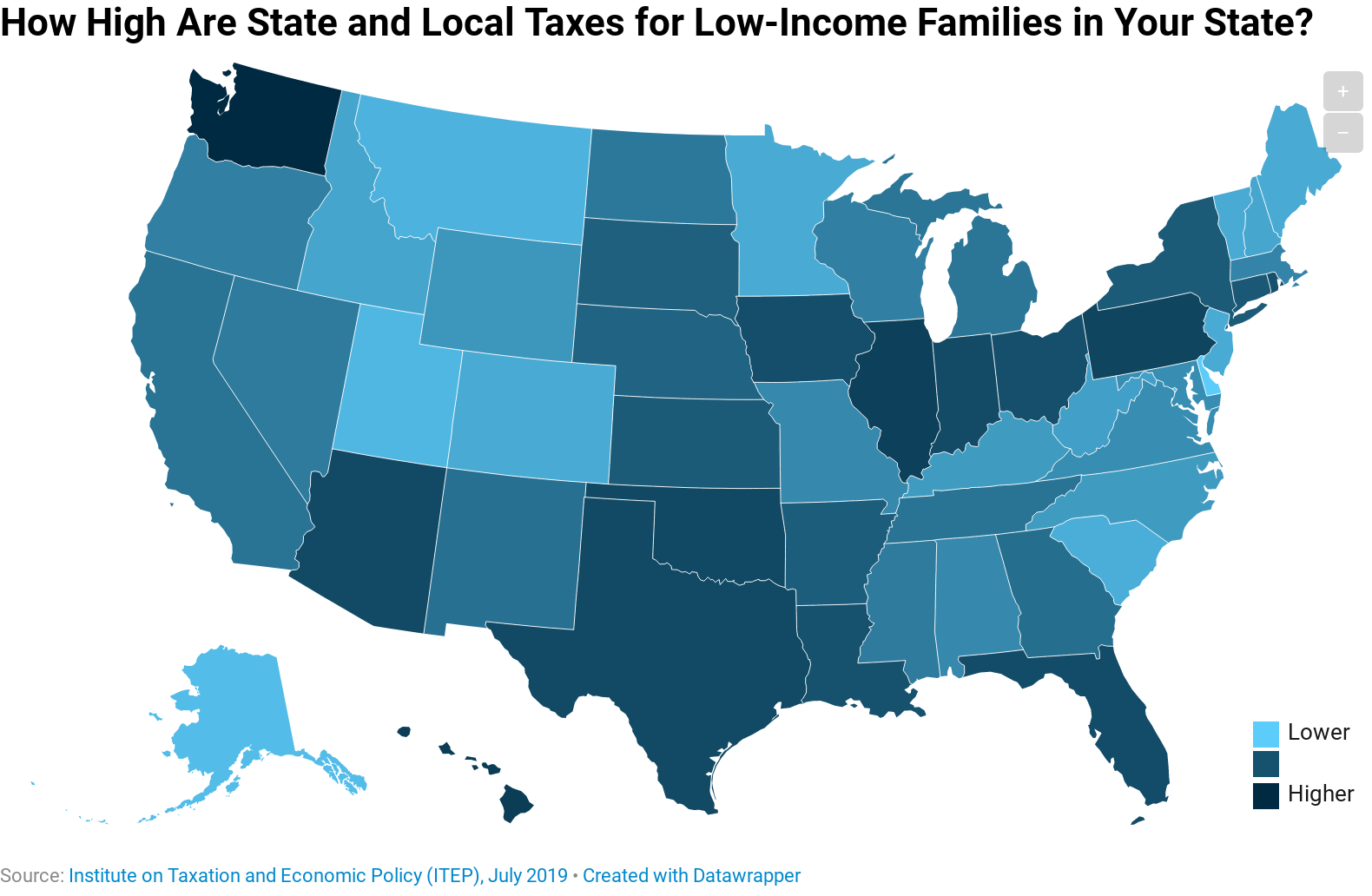

Which States Have The Highest Tax Rates For Low Income People Itep

Which States Have The Highest Tax Rates For Low Income People Itep

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

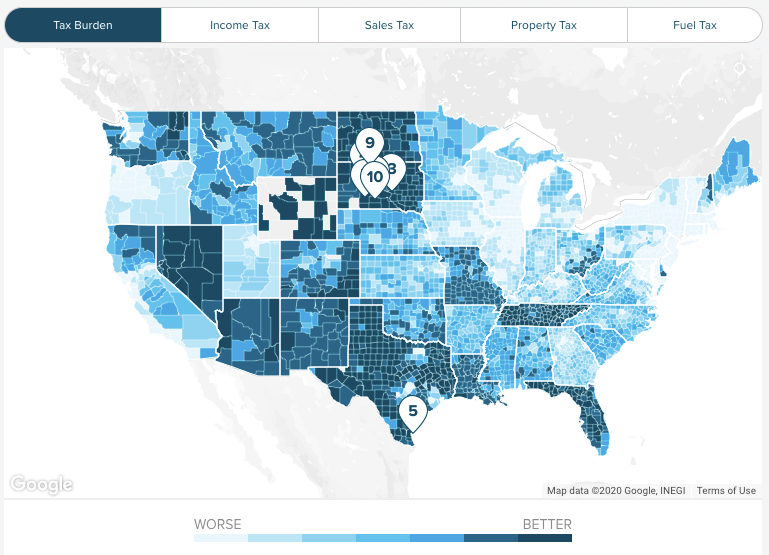

Arizona Property Tax Calculator Smartasset

Arizona Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home