How To File Homestead Exemption Palm Beach County

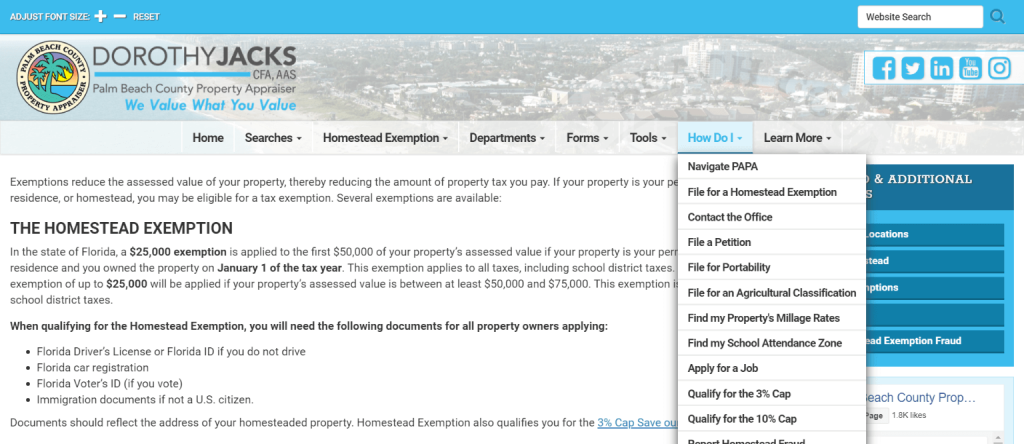

You must be a permanent resident of Florida on January 1 of the initial application year. Homestead exemption is a constitutional benefit of a 50000 exemption from the propertys assessed value.

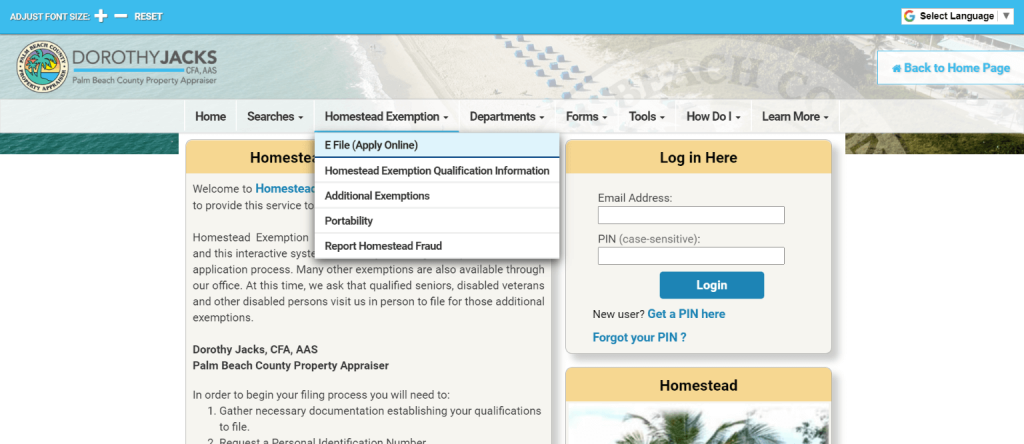

Complete the application online click here.

How to file homestead exemption palm beach county. Technically to qualify for Floridas homestead exemption you only have to live in the home as your permanent and legal residence on Jan. Page and on most property appraisers websites. I wish to proceed with reporting an improper homestead exemption.

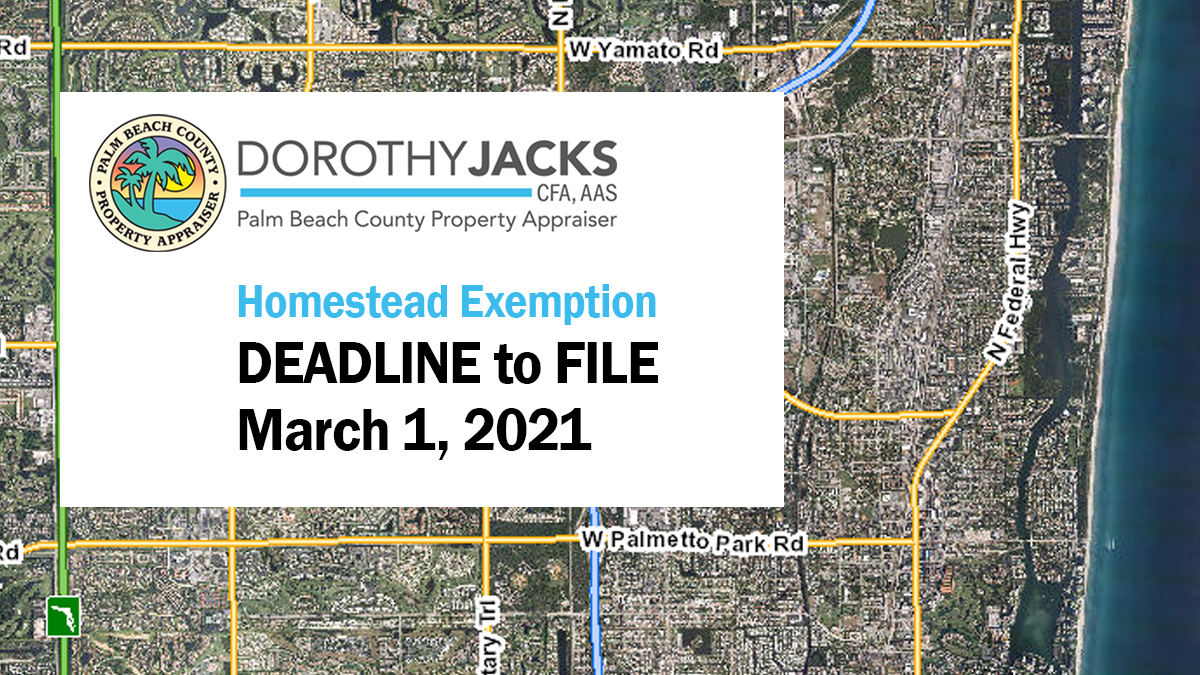

The PIN is good for two weeks or until MARCH 1 2022. For more information about applying for homestead exemption call the Bay County Property. It does not discriminate on the basis of disability in the admission or access to or treatment or employment in its services programs or activities.

Complete the form including having it notarized and drop off at one of our Service Centers or mail to the Palm Beach County Property Appraisers Office Exemption Services 1st Floor 301 N. Florida Drivers License or Florida ID if you do not drive 2. Contact your local property appraiser if you have questions about your exemption.

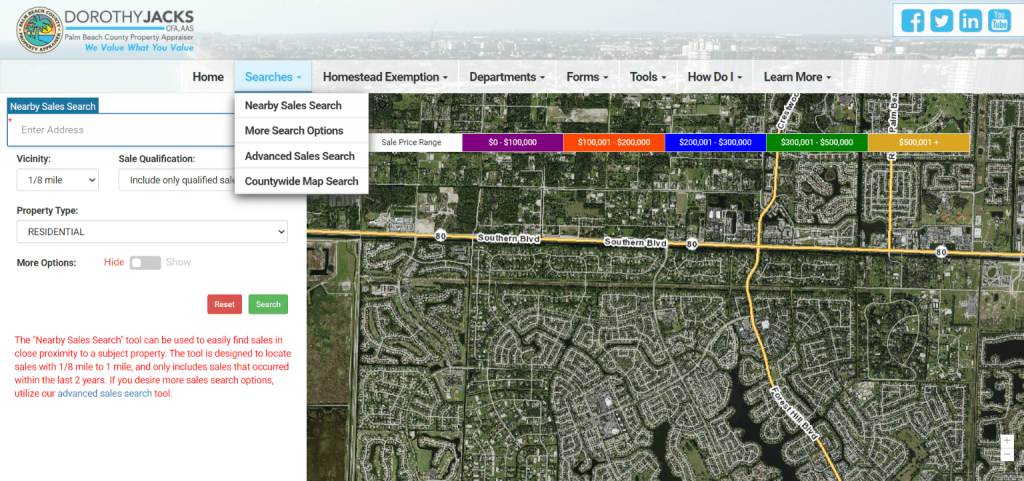

Request a Personal Identification Number PIN for secure application processing. When you file for homestead exemption you must provide a copy of your recorded property Deed Drivers License Social Security Card and Voter Registration Card. Olive Ave West Palm Beach FL 33401.

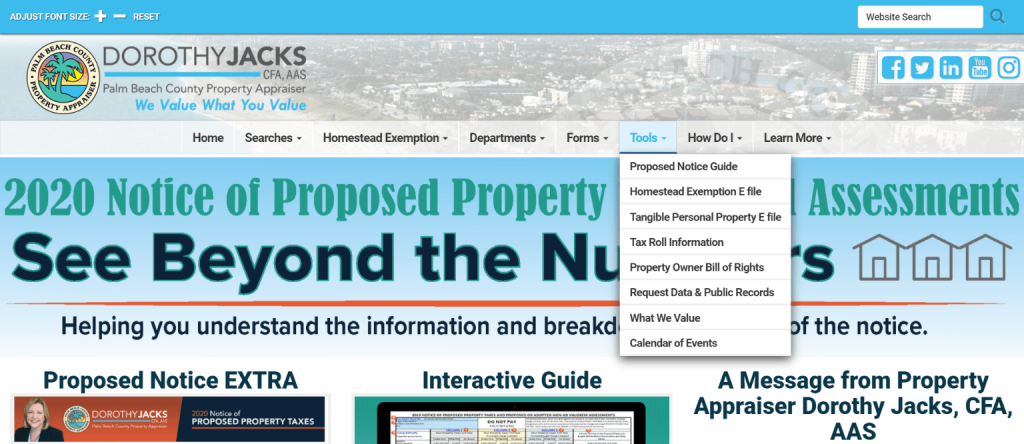

The Palm Beach County Property Appraisers Office is committed to compliance with the Americans with Disabilities Act ADA and WCAG 20 and WCAG 21. BEGIN THE FILING PROCESS NOW. You may apply anytime throughout the year.

Immigration documents if not a US. Click here for county property appraiser contact and website information. You may download a domicile form or obtain one at any Clerk of the Circuit Court Comptroller location.

You can file for homestead exemption from January 1 to March 1 at the Bay County Property Appraisers Office located at 860 W. File the signed application for exemption with the county property appraiser. Bring the form to a Clerks office location to be recorded.

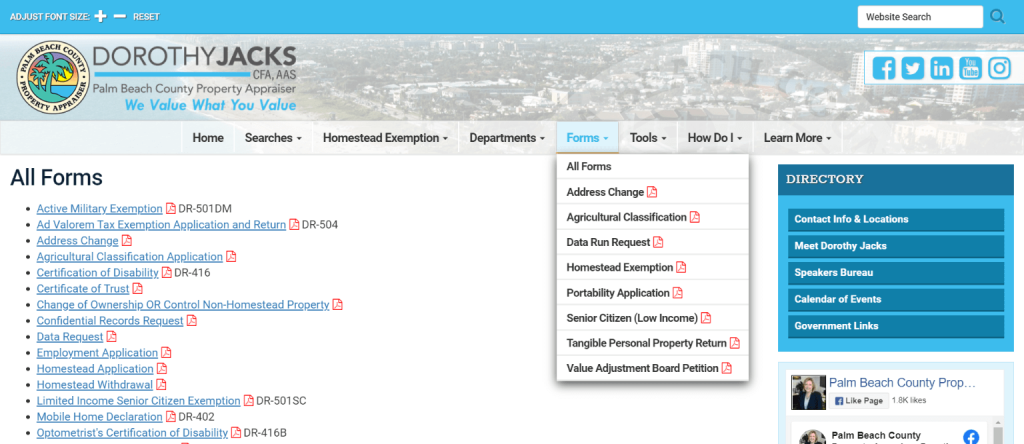

When qualifying for Homestead Exemption you will need the following documents for all owners applying at the Palm Beach Property Appraiser. Log in to online filing. The application for homestead exemption Form DR-501 and other exemption forms are on the Departments forms.

You will need to locate your property by. For homeowners who are full-time Florida residents their property offers several ways to save money. Instead contact this office by phone at 561-355-2866 or in writing to.

It is not necessary to reapply for the original Homestead Exemption benefit. I have read the notice above and understand that my e-mail address and contact information will become public record. You must bring some form of legal identification if you need your document notarized.

It is granted to those applicants with legal or beneficial title in equity to real property as recorded in official records who are bona fide Florida residents living in a dwelling and making it their permanent home on January 1 of the taxable year. Apply for Portability when you apply for Homestead Exemption on your new property. Homestead Exemption- Filing Online Palm Beach County Property Appraisers Office Your PIN will be sent to your e-mail address.

Florida car registration 3. Exemption Compliance Team Palm Beach County Property Appraiser 301 N. Request a Personal Identification Number.

Applications received after March 1 will be for the following year. Now the day you close on a home in Palm Beach County you can E file for a homestead exemption on the PAPA website without the deed. West Palm Beach FL The Palm Beach County Property Appraisers Office PAO has made it easier to E file for a homestead exemption on the Property Appraiser Public Access PAPA website.

The property appraiser has a duty to put a tax lien on your property if you received a homestead exemption. Olive Ave West Palm Beach FL 33401 Visit one of our five service centers to file in person. You can apply at the Property Appraisers office for the exemption at any time during the year but you must apply by March 1 of the qualifying year.

April 15 is a date that many people associate with filing taxes so its a good time to think about how to reduce your tax burden. For any questions contact our. The PIN and your email address will be used as your authorization and electronic signature for filing a Homestead exemption on your property.

Signature property appraiser or deputy Date Entered by Date. Print it out and mail to the Palm Beach County Property Appraisers Office Exemption Services 1st Floor 301 N. 1 of the qualifying year.

Homestead Property Tax Exemption. Every person who has legal title to a residential property and lives there permanently qualifies for Homestead Exemption. If our office denies your portability application you will have an opportunity to file an appeal with Palm Beach Countys Value Adjustment Board.

All homestead exemption applications must be submitted by March 1. Olive Avenue 1st Floor West Palm Beach FL 33401. Gather necessary documentation establishing your qualifications to file.

Florida Voters ID if you vote 4.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home