Vermont Property Tax Rates By Town 2020

These rates will be published. Below are listed the FY2020-2021 Property Tax rates for towns in Chittenden County.

A Single Family Home With Endless Potential Get It Before It S Gone Homesforsale Coldwellbankerlegacyrealtors Homessan House House Styles Home And Family

A Single Family Home With Endless Potential Get It Before It S Gone Homesforsale Coldwellbankerlegacyrealtors Homessan House House Styles Home And Family

TOWN FY18 Tax Rate FY19 Tax Rate Change in Homestead.

Vermont property tax rates by town 2020. 2017 and 2018 Income Tax Withholding Instructions Tables and Charts. Search Real Estate In Vermont. 2020-21 Property tax bills were mailed to property owners on August 15th 2020.

260 rows The town tax rate tables and resources below are for the current 2020-2021 property. Taxes may be paid upon receipt or can be paid by the due dates on the bill. The FY21 2020 2021 property tax year non-homestead education tax rate income yield and homestead property yield were set by the Legislature during the 2020 legislative session.

The statewide non-homestead formerly called non-residential tax rate is 1628 per 100 of property value. Disabled veterans who own their homes may be eligible for a property tax exemption. The homestead property yield is 10998 which goes with a base rate of 100 per 100 of property value.

The major types of local taxes collected in Vermont include income property and sales taxes. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Counties in Vermont collect an average of 159 of a propertys assesed fair market value as property tax per year.

2020 Income Tax Return Booklet. The countys average effective property tax rate is 170 good for second-lowest in the state. The median property tax in Vermont is 344400 per year for a home worth the median value of 21630000.

You must apply through the Vermont Office of Veterans Affairs by May 1 of each year. If youre looking for low property taxes in Vermont Franklin County is one of your best bets. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land.

If you are wondering about a town you do not see listed please give our team a call at. Here is a list of current state tax rates. The exemption reduces the assessed value of your home lowering your property taxes.

These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large. FY2021 Education Property Tax Rates - as of 2122021. Massachusetts property real estate taxes are calculated by multiplying the propertys value by.

Vermont Property Tax Rates. Vermont Property Tax Rates. Sign Up for myVTax.

Vermont has one of the highest average property tax rates in the country with only seven states levying higher property taxes. Property Tax Exemption for Disabled Veterans. The first installment must be paid no later than September 15 2020 and the second installment must be paid no later than March 15 2021.

Albans the largest city in the county the total municipal rate is about 26265. The Town Treasurer plays a vital role in the management of the finances of the Town. Vermont School District Codes.

This information has been collected from local town clerks offices and while it is deemed reliable rates are subject to change and are not guaranteed. He or she is responsible for keeping the Towns accounts investing money received by the Town with approval of the select board keeping a record of taxes and other monies received and paying orders from officials authorized by law to draw orders on Town accounts. 260 rows This is the final education tax rate set for this town.

261 rows Tax Rate Nonresidential Tax Rate CLA Addison. Tax Rates and Charts. Town Tax Rates for 2020 Fiscal Year End June 30 2021.

UPDATED AUGUST 20 2020.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

November 2020 Newsletter Defining Inflation Financial Charts Financial Markets Financial Asset

November 2020 Newsletter Defining Inflation Financial Charts Financial Markets Financial Asset

Tax Sale Due Diligence Tips Investing Tax Tips

Tax Sale Due Diligence Tips Investing Tax Tips

2020 Housing Market Predictions A Snapshot Housing Market Predictions Economic Research

2020 Housing Market Predictions A Snapshot Housing Market Predictions Economic Research

2021 State Guide To Scattering Ashes Vermont Edition Vermont States Scattered

2021 State Guide To Scattering Ashes Vermont Edition Vermont States Scattered

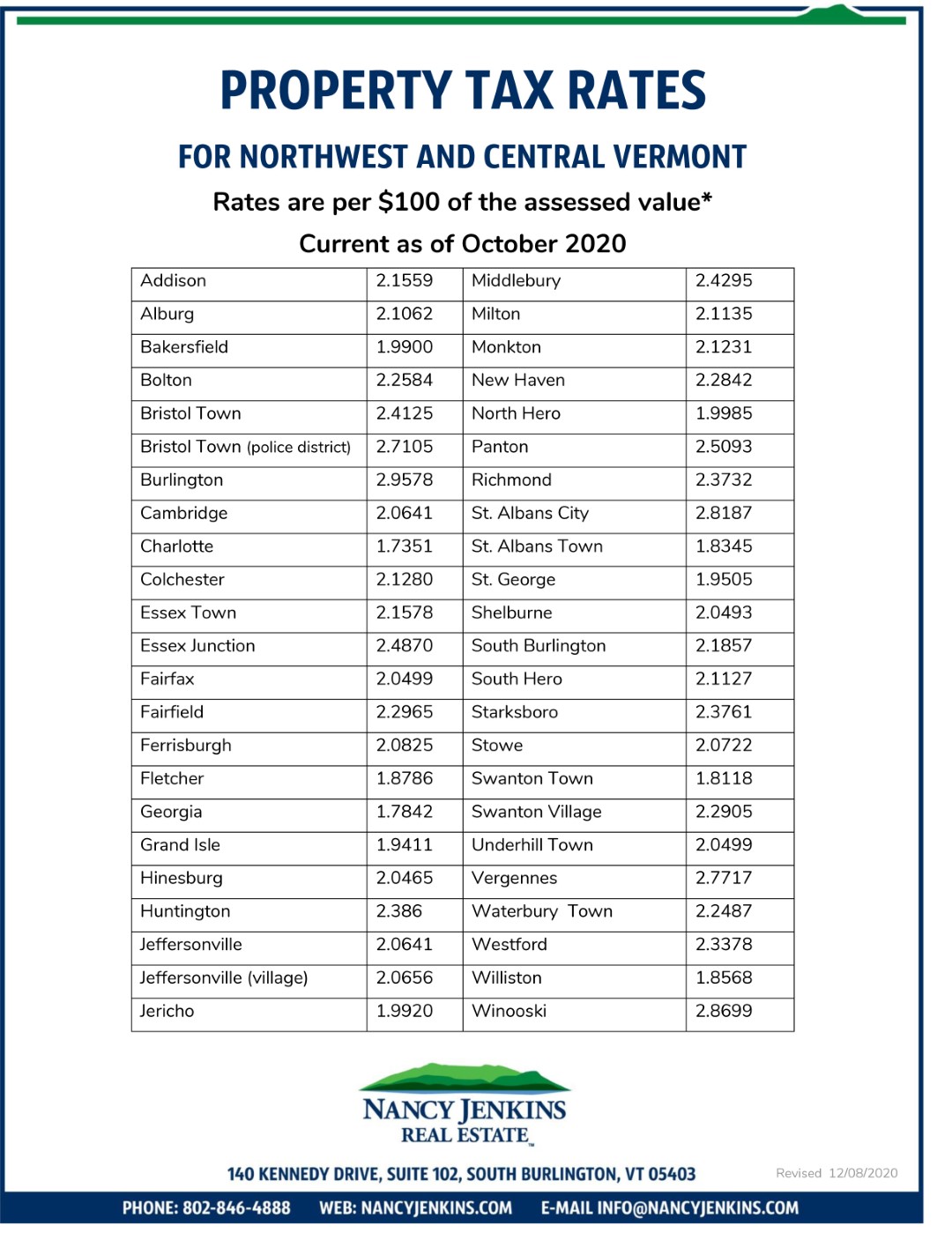

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Property Tax Rates Nancy Jenkins Real Estate

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

25 Best Places To Retire Best Places To Retire Best Retirement Cities Retirement Locations

25 Best Places To Retire Best Places To Retire Best Retirement Cities Retirement Locations

Infographic Of The Day Visualizing Household Income Distribution In The U S By State Household Income Income Oil Jobs

Infographic Of The Day Visualizing Household Income Distribution In The U S By State Household Income Income Oil Jobs

Court Letter Format Beautiful 4 Court Notice Letter Letter Templates Free Letter Templates Printable Letter Templates

Court Letter Format Beautiful 4 Court Notice Letter Letter Templates Free Letter Templates Printable Letter Templates

709 Quarry Rd Chester Vt 05143 Zillow Maine House Zillow Stone Fireplace

709 Quarry Rd Chester Vt 05143 Zillow Maine House Zillow Stone Fireplace

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

The Dudley Settlement In 2020 Construction Cost Road Construction Abington

The Dudley Settlement In 2020 Construction Cost Road Construction Abington

Net Neutrality Index What Do Americans Do Online Vivid Maps Net Neutrality United States Map United States

Net Neutrality Index What Do Americans Do Online Vivid Maps Net Neutrality United States Map United States

Best States For Retirement 2021 Moneyrates Com Retirement South Dakota States

Best States For Retirement 2021 Moneyrates Com Retirement South Dakota States

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home