Property Tax Bill Maricopa County

Payment Options View all options for payment of property taxes. The Assessor does not.

Real Property Records Placer County List Of Jobs Job Hunting

Real Property Records Placer County List Of Jobs Job Hunting

Maricopa County Treasurer Tax Guide.

Property tax bill maricopa county. The chart below is based on average property taxes paid by Goodyear residents. Tax Area CodesRates Search the tax Codes and Rates for your area. Compute property tax bills.

The property tax levy increased by 4527721 to 75415664 Overall expenditures are 127137866 FY 2021 CIP budget is 894 Million Five-year CIP projected to be 4430 Million Flood Control District Highlights See the Secondary Tax Flood Control section of your Tax Bill for more information. Search the history of tax payments for your property. Please allow 5-7 business days for the payment to post to the Treasurers database.

Locates and identifies all taxable property in Maricopa County and further identifies the ownership. Your Parcel Number Examples. In-depth Maricopa County AZ Property Tax Information.

The notice is not a property tax bill. If you have signed a contract for delinquent taxes or have delinquent or late taxes you need to call the office at 209966-2621 for a payment amount. Look Up Your Tax Bill You Will Need Your Parcel Number to View Your Tax Bill Maricopa County Assessor.

Please note that the mailing address you have with the Assessors Office may not be the same as the mailing address for your tax bill maintained by the Treasurers Office. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars. The Assessors Office mails these notices to all property owners on or before March 1 annually.

The Maricopa County Treasurers Office hereby disclaims liability for any damages direct or indirect arising from use of or reliance upon this information. Arizona is ranked 874th of the 3143 counties in the United States in order of the median amount of property taxes collected. Maricopa County Treasurer Understanding Your Tax Bill.

Recommended Settings Adobe Reader available free of charge from Adobe Systems is required to view some content on this site. The Assessors duty is to locate identify and equitably assess all property in Maricopa County. Maricopa County Treasurer Address.

301 West Jefferson Street. Please make payments with the following payee information. Use Tax Account number and APN Assessors Parcel Number to reference your payment.

Your mailing address as of mid-August with the Treasurers Office should reflect where you will be in September as that is when the Treasurers Office will mail your tax bill whose first half will be due by October 1st. According to the Office of the Maricopa County Assessor this is the physical location of the property being represented by this bill. Recommended Settings Adobe Reader available free of charge from Adobe Systems is required to view some content on this site.

PO Box 52133 Phoenix AZ 85072-2133 Account. The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

You can make a payment for taxes due online. The Business Personal Property Unit assists in the assessment of this type of property. The Maricopa County Treasurers Office hereby disclaims liability for any damages direct or indirect arising from use of or reliance upon this information.

How does the City calculate its property tax rate. The number is composed of the book map and parcel number as defined by the Maricopa County Assessors Office. Your property tax bill lists each agencys tax rate and the exact amount that each agency receives.

Mobile Application Pinal County Property Tax mobile application for Apple and Android. The Maricopa County Treasurers Office calculates and mails property tax bills in September. ACCEPT TERMS OF USE below.

Establishes a value for all property subject to property taxation. E-Check payments will be accepted for current taxes only. What do I need to do when I receive my notice.

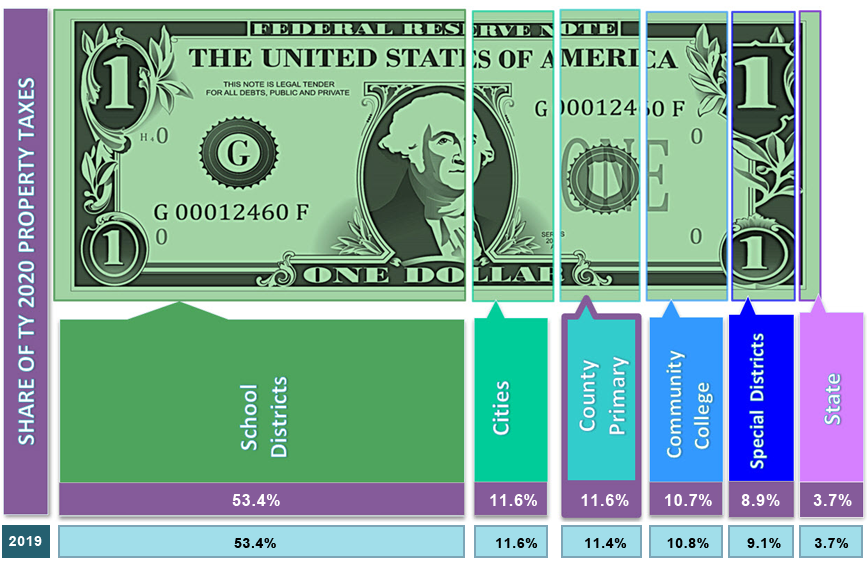

Lists the values of all property on the assessment roll. The School District taxes are the largest portion of the property taxes followed by cities the county the community college districts special districts and the State. Maricopa County collects on average 059 of a propertys assessed fair market value as property tax.

Business Personal Property can include assets such as tables desks Computers machinery. Visit the Maricopa County Treasurers Office for information on reading and understanding your tax bill. Parcel Split History View the history of Land Parcel splits.

The Maricopa County Supervisors control only a small portion of the property tax bill. Apply all legal exemptions.

Https Www Clerkofcourt Maricopa Gov Home Showdocument Id 1652

Https Www Mcassessor Maricopa Gov File News 2021 Key 20terms 20and 20faq Pdf

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Real Estate Contract Real Estate Contract Real Estate Buying Selling Real Estate

Lucas Asks Jackson County Judge To Extend Expand Eviction Moratorium Kshb Jackson County Maricopa County Platte County

Lucas Asks Jackson County Judge To Extend Expand Eviction Moratorium Kshb Jackson County Maricopa County Platte County

Car Payment Contract Template New 10 Best Of Free Payment Agreement Letter Sample Payment Agreement Contract Template Letter Templates

Car Payment Contract Template New 10 Best Of Free Payment Agreement Letter Sample Payment Agreement Contract Template Letter Templates

Retirement Planning Financial Planning For Retirement 401k Retirement Plans Retirement Planner How To Plan Estate Planning

Retirement Planning Financial Planning For Retirement 401k Retirement Plans Retirement Planner How To Plan Estate Planning

Strawberry Az Payson Az Arizona Travel Northern Arizona

Strawberry Az Payson Az Arizona Travel Northern Arizona

Faq Regarding Your Property Tax

Faq Regarding Your Property Tax

Http Www Scottsdaleaz Gov Asset78364 Aspx

Chuckie English Chicago Outfit Chicago Mobster

Chuckie English Chicago Outfit Chicago Mobster

Daily Cartoon Commercial Real Estate Real Estate Investing Real Estate Investor

Daily Cartoon Commercial Real Estate Real Estate Investing Real Estate Investor

Optimist Park Ne Home For Sale Arizona Real Estate Tempe Zillow

Optimist Park Ne Home For Sale Arizona Real Estate Tempe Zillow

Installment Payment Plan Agreement Template Inspirational Partial Payment Installment Agreement Form Contract Template Payment Agreement Letter Templates

Installment Payment Plan Agreement Template Inspirational Partial Payment Installment Agreement Form Contract Template Payment Agreement Letter Templates

Http Www Scottsdaleaz Gov Asset78364 Aspx

Examples Web Design Agency Web Development Agency City

Examples Web Design Agency Web Development Agency City

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home