Property Tax In Ohio By County

It has been an ad valorem tax meaning based on value since 1825. Located in central Ohio Stark county has property taxes far lower than most of Ohios other urban counties.

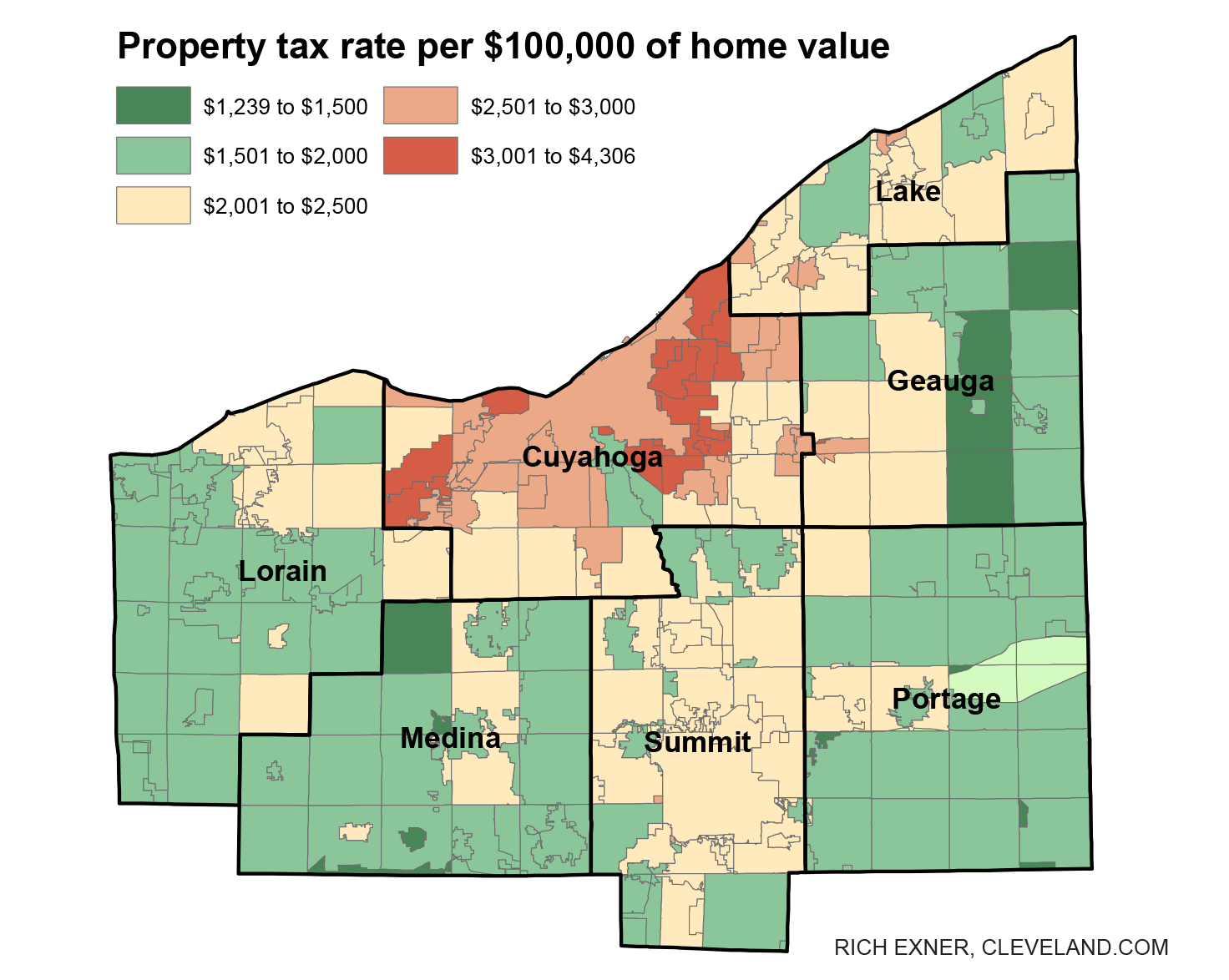

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

A state lawmaker announced legislation to cap annual property tax increases at five percent for households at or below their countys median income.

Property tax in ohio by county. Our goal is to help make your every experience with our team and Ohios tax system a success. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. At that rate taxes on a home worth 100000 would be 2020 annually.

FILE - A home in Franklin County Ohio. Box 188 Wheeling WV 26003 304 234-3688. And taxes on manufactured homes are due in March and July.

The Ohio County Commission is here to serve the residents and businesses of Ohio County. In-depth Ohio County IN Property Tax Information. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio.

32312 manufactured homes ORC. The Lucas County average effective property tax rate is 202 which ranks as the fourth-highest rate in Ohio. However this material may be slightly dated which would have an impact on its accuracy.

Median property tax is 183600. Any errors or omissions should be reported for investigation. Mill - Property tax is measured in mills.

136 of home value. Taxes Athens County - OH - Tax makes every effort to produce and publish the most accurate information possible. Contact us today to let us know how we can help you.

Tax Rate - The property tax rate paid by a business or individual supports the schools libraries townships municipalities career technical schools park system and county-wide services. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors.

This interactive table ranks Ohios counties by. Taxes on real estate are due in January and June of each year. Tax information is provided by the Ohio County Assessors Office.

105 Main Street Painesville OH 44077 1-800-899-5253. In fact the countys average effective property tax rate is just 142. Ohio County Sheriffs Tax Office 1500 Chapline St.

Tax amount varies by county. Here you can quickly look up and pay your real estate taxes set up a monthly prepayment plan to make it easier to tackle your taxes and find contact information for our departments. 89 rows Ohio.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Summit County Fiscal Office Kristen M. In accordance with the Ohio Revised Code the Hamilton County Treasurer is responsible for collecting three kinds of property taxes.

Therefore each mill generates 1 of taxes for every 1000 of a propertys assessed value. Please do not hesitate to contact us with questions or any suggestions for how we can better serve you. Thanks for visiting our site.

Stark County Photo credit. A mill means 11000. No warranties expressed or implied are provided for the data herein its use or.

The rate includes voted millage and 10 mills of un-voted taxes guaranteed by the Ohio. Wood County Ohio - AccuGlobe Internet. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

Cuyahoga County Administrative Headquarters 2079 East Ninth Street Cleveland OH 44115 216 443-7400. 450306 and personal property ORC. Ohio County Tax Office.

The real property tax is Ohios oldest tax.

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Pin By Rebecca Bauer On Waterfalls Within A Day S Drive Buckeye Ohio Youngstown

Pin By Rebecca Bauer On Waterfalls Within A Day S Drive Buckeye Ohio Youngstown

Anderson Township Trustees Announced Today They Have Purchased Property That Allows Access To The Ohio Riverfront To Develop A Public Ohio River Township Ohio

Anderson Township Trustees Announced Today They Have Purchased Property That Allows Access To The Ohio Riverfront To Develop A Public Ohio River Township Ohio

Penneast Won T Pay Property Taxes In Pa Paying Taxes Property Tax Tax

Penneast Won T Pay Property Taxes In Pa Paying Taxes Property Tax Tax

Kane County Property And Tax Information Tax Kane County

Kane County Property And Tax Information Tax Kane County

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Did You Know De Homeowners Age 65 Are Eligible For A Tax Credit Against Regular School Property Taxes Of Up To 400 Detaxfa Tax Delaware Retirement Benefits

Did You Know De Homeowners Age 65 Are Eligible For A Tax Credit Against Regular School Property Taxes Of Up To 400 Detaxfa Tax Delaware Retirement Benefits

Knox County Ohio Residential Property Tax Appraisals Decline Mount Vernon Ohio Homes Knox County Ohio Knox County Mount Vernon Ohio

Knox County Ohio Residential Property Tax Appraisals Decline Mount Vernon Ohio Homes Knox County Ohio Knox County Mount Vernon Ohio

Property Tax Appeals Process Property Tax Tax Estate Tax

Property Tax Appeals Process Property Tax Tax Estate Tax

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Modria Is Mecklenburg County S On Line Property Tax Dispute Resolution System How To Use The System Faq S By Nina H Mecklenburg County Property Tax Homeowner

Modria Is Mecklenburg County S On Line Property Tax Dispute Resolution System How To Use The System Faq S By Nina H Mecklenburg County Property Tax Homeowner

Donald Payne The Impact Of Changes In Property Value Property Values Ohio Real Estate Property Valuation

Donald Payne The Impact Of Changes In Property Value Property Values Ohio Real Estate Property Valuation

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home