Pay Property Taxes Franklin County Ohio

Franklin County Treasurer Website Safe Secure. Because real estate taxes can be deducted on the property owners federal income tax many taxpayers pay all of their tax charges by December 31 of each year.

Payments of property taxes can be made via mail but must be postmarked April 30 2020.

Pay property taxes franklin county ohio. Real Estate Tax Payments may be made in-person at our office. Second-Half Real Estate Tax Payments Due. 2nd Half Collection Each year tax bills are mailed in mid-May and payments.

Tax bills are mailed each year in mid-December with payment due on or before January 20th or the first following business day if the 20th falls on a weekend or holiday. Please note you cannot use home equity line of credit checks or money market account to make an online payment. Search for a Property Search by.

The Franklin County Treasurers Office wants to make paying your taxes as easy as possible. Franklin County Treasurer 373 South High Street 17th floor Columbus OH 43215-6306 Office hours are Monday through Friday 800 AM. The due date for the first-half 2021 real estate collection is Wednesday January 20 2021.

Be sure that your check includes. 4th Ave Pasco WA outside the security building. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

The following provides you with information on property tax payments. Please note that the Franklin County Treasurers Office collects real estate taxes for the previous year during the current year. If either January 20th or June 20th occurs on a weekend the due date will be changed to the next business day following the 20th.

211420 parcels are paid by a mortgage company the owner may never see a bill unless they go online. SECOND-HALF COLLECTION The due date for the second-half real estate collection is. If you are remitting for both Ohio and school district income taxes you must remit each payment as a separate transaction.

Real Estate Tax Information Real Estate Tax Inquiry. Office Closed in Observance of Memorial Day. Real Estate Tax Due Dates.

Register Pay via. 123 Main Parcel ID Ex. However it may take 2-4 business days for processing.

Office Closed in Observance of Juneteenth. Real Estate property taxes are due semi-annually each January 20th and June 20th. The County assumes no responsibility for errors in the information and does not guarantee that the.

View or Change on the Treasurers Website. Pay your real estate taxes online by clicking on the link below. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office.

16516 parcels are in our monthly budget pay program. New application provides a simple search by your parcel owner name or property address. Yearly median tax in Franklin County The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300.

We accept cash personal check money order cashiers check or certified check. Pay taxes online Your payment will be considered accepted and paid on the submitted date. If you have recently satisfied or refinanced your mortgage please visit the above link to review your tax mailing address to ensure you receive your tax bill and.

Cheryl brooks sullivan. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment. Visit treasurerfrankincountyohiogov and look for the box that says Pay Taxes Online Credit card payments have a processing fee of 23 per.

N HIGH ST NORTH ST. 213018 parcels are mailed out to the owner for payment. Franklin County Real Estate Tax Inquiry Real Estate Tax Payments.

Franklin County collects on average 167 of a propertys assessed fair market value as property tax. John Smith Street Address Ex. In addition a payment drop box is available at the parking lot of the Courthouse 1016 N.

Get information on a Franklin County property and view your tax bill. DUBLIN OH 43017. Envelopes to put your payment in are available inside the security building.

1st Half Collection Each year tax bills are mailed in mid-December and payments are due on or after January 20th or the first following business day if the 20th falls on a weekend or a holiday. Use this inquiry search to access Franklin Countys real estate tax records. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site.

There are 427110 parcels in Franklin County. Franklin County Real Estate Tax Payment.

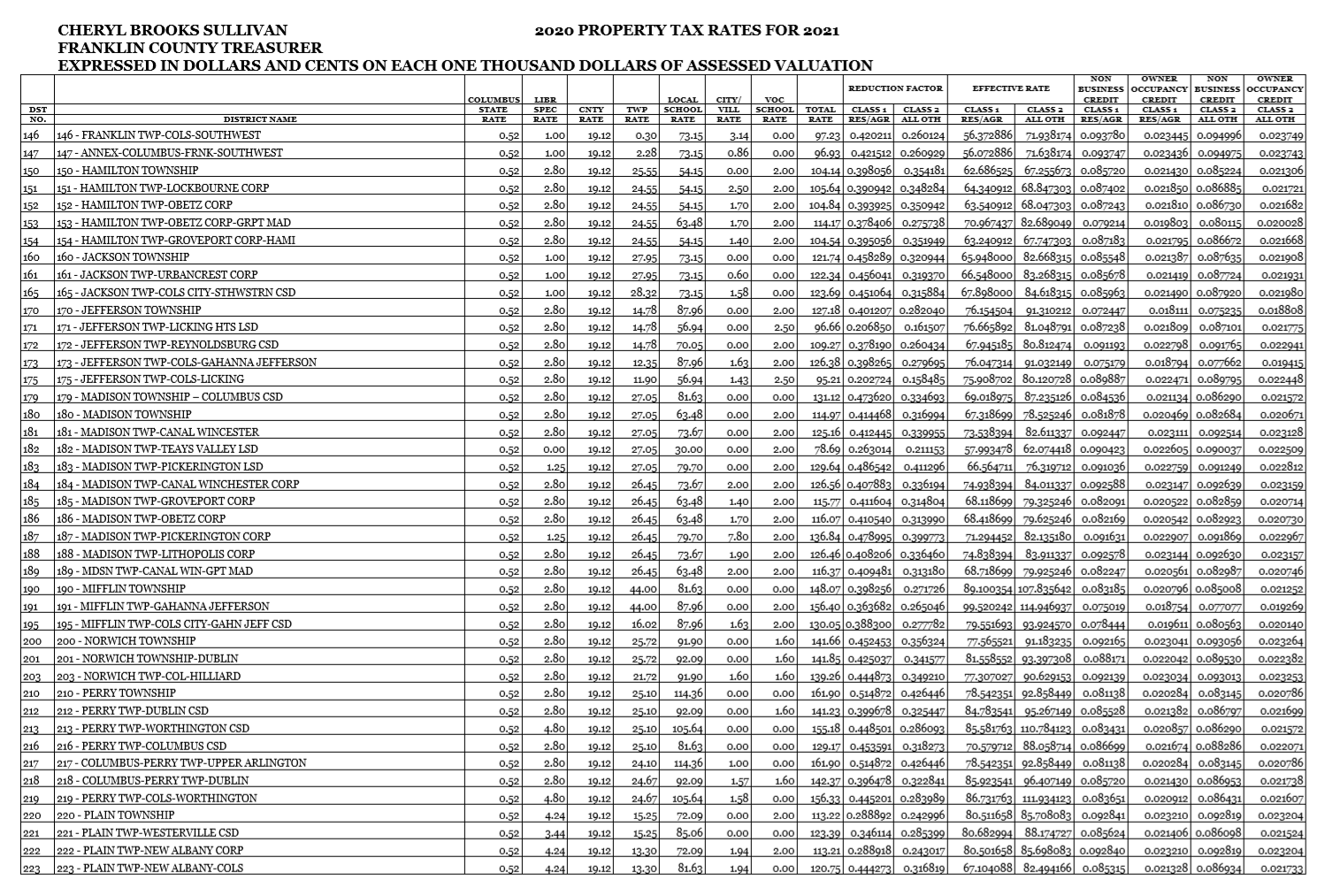

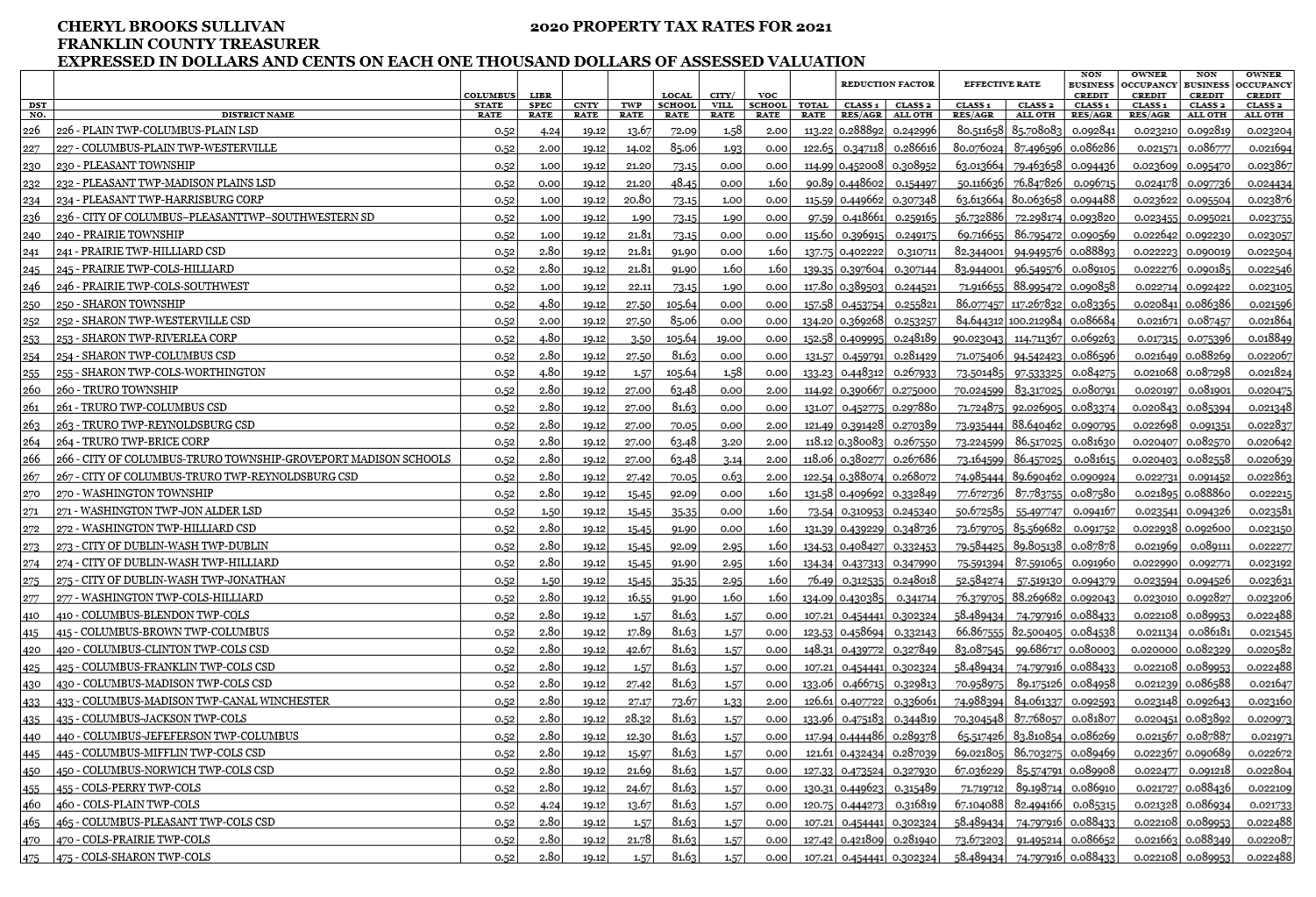

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

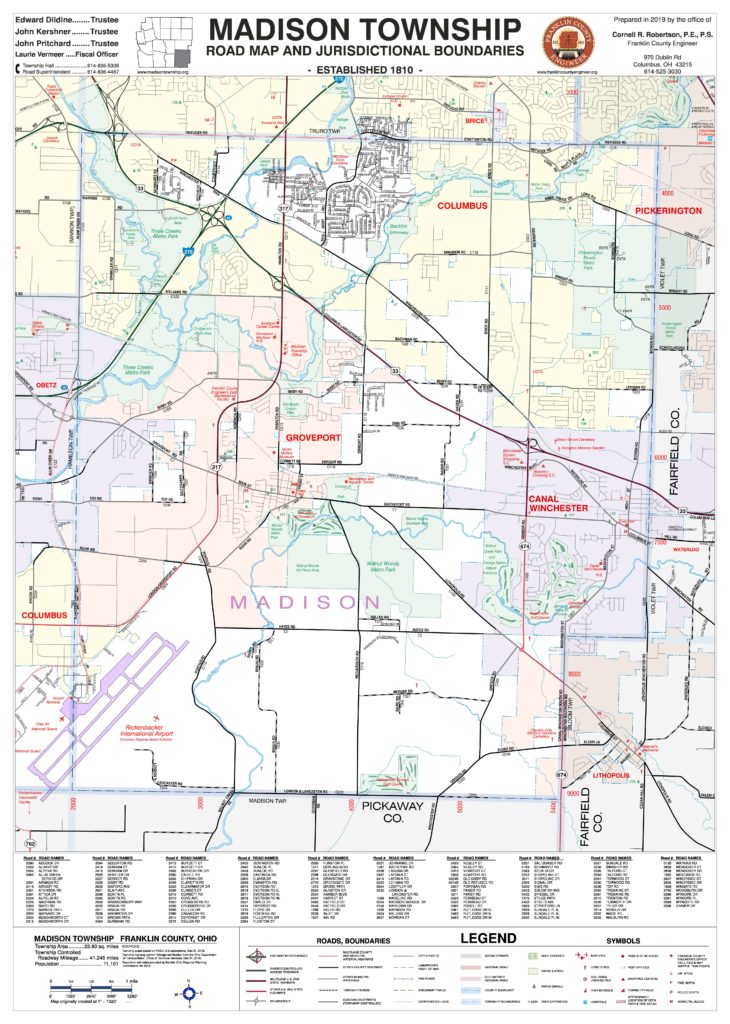

Franklin County Engineer S Office

Franklin County Engineer S Office

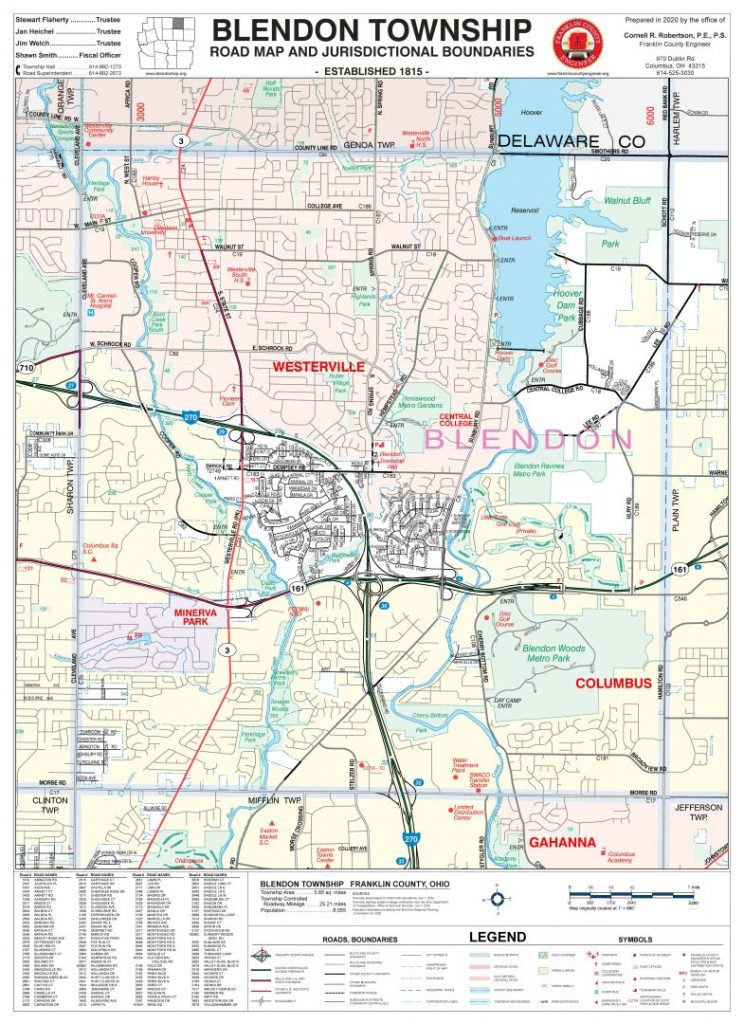

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

1883 Property Ownership Plat Map Of Mifflin Township Franklin County Ohio Columbus And Ohio Map Collection

1883 Property Ownership Plat Map Of Mifflin Township Franklin County Ohio Columbus And Ohio Map Collection

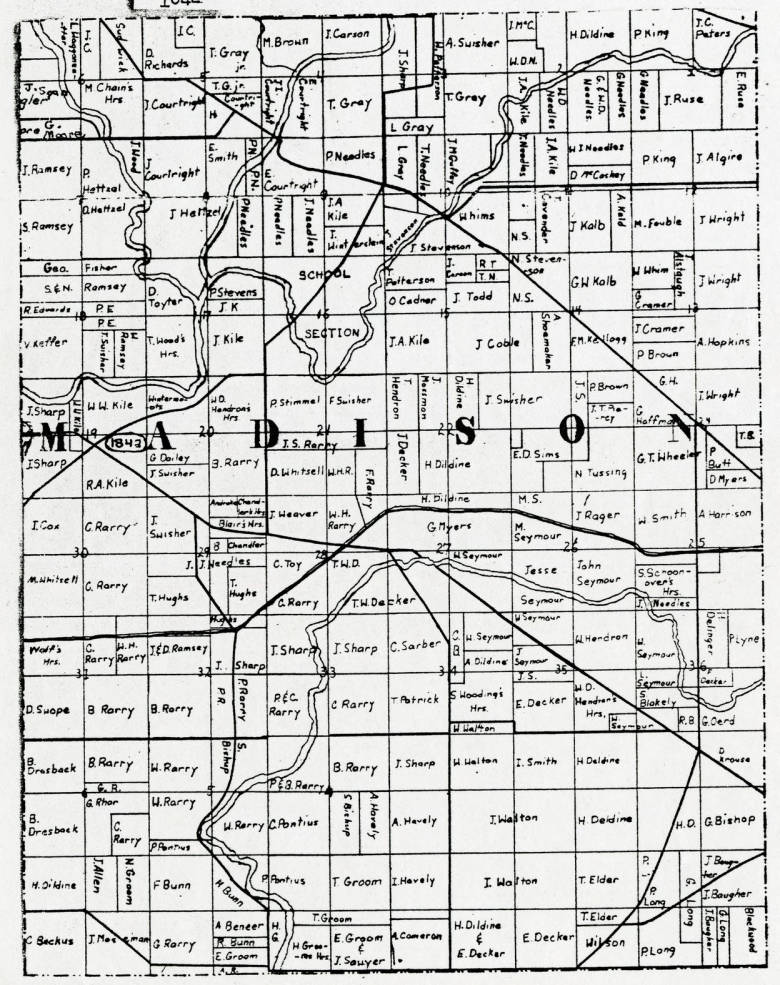

1842 Property Ownership Plat Map Of Madison Township Franklin County Ohio Columbus And Ohio Map Collection

1842 Property Ownership Plat Map Of Madison Township Franklin County Ohio Columbus And Ohio Map Collection

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

1895 Map Of Reynoldsburg Truro Township Franklin County Ohio Columbus And Ohio Map Collection

1895 Map Of Reynoldsburg Truro Township Franklin County Ohio Columbus And Ohio Map Collection

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Map Of Franklin Co Ohio Library Of Congress

Franklin County Auditor Tax Estimator

Franklin County Auditor Tax Estimator

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home