What Is Property Tax Used For In Ireland

If you own a residential property in Ireland you are liable for payment of Local Property Tax. In addition Ireland only charges a corporate tax rate of 625 for revenue tied to a companys patent or intellectual property.

India S Aurangabad Municipal Corporation Amc On 3 June 2018 Announced It Will Conduct A Survey Of All Properties Within Its Munic Surveys Property Aurangabad

India S Aurangabad Municipal Corporation Amc On 3 June 2018 Announced It Will Conduct A Survey Of All Properties Within Its Munic Surveys Property Aurangabad

If it intends to use the goods solely to make taxable supplies then it can claim the VAT as input tax subject to the normal recovery rule including partial exemption.

What is property tax used for in ireland. Irelands taxation rate for corporations is 125. If these were ordered for delivery to Ireland the basic price would be reduced to 22638 ex VAT. Any new property or property that has previously been unused will be exempt from this property tax until 2016.

These are some real examples. A half year charge applied in 2013 with a full year charge applying in 2014 and thereafter. It is set against the backdrop of a number of EU directives.

The movement of own goods the other way from Northern Ireland to Great Britain does not have the same requirement to account for output tax unless an actual supply takes place. CAT is a tax charged on money or property that is gifted to or inherited by someone. LPT was introduced from 1st July 2013 and is collected by the Revenue Commissioners.

The report known as the Coffey report was released in September 2017. Who is liable for LPT and or Household Charge. UK property tax revenue accounts for more than one-tenth of total taxes around 125 from the use transfer and ownership of property in the UK.

The rate is 018 of the market value of any property valued up to 1 million with a rate of 025 above 1 million. If you earn interest on savings then you pay a tax on the interest called Deposit Interest Retention. Capital Acquisitions Tax CAT is sometimes also known as Inheritance Tax in Ireland.

This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. Is your property liable for Local Property Tax LPT. If you receive income from renting out a property or from another source that qualifies as rental income it is taxable.

When you buy a property in the UK over a certain threshold you. Calculation of Import Duty In Ireland. For example if the declared value of your items is 22 EUR in order for the recipient to receive a package an additional amount of 506 EUR in taxes will be required to be paid to the destination countries government.

The recipient is responsible for the tax on the gift or inheritance. Revenue does not value properties for LPT purposes but provides guidance on how to value your property see Valuing your property below. Example 1 A pair of Nike trainers made in China selling on Amazon UK for 27166 including UK VAT.

The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system. Fitness or childcare facilities provided for use by employees of the employer. The LPT is a self-assessment tax so you calculate the tax due based on your own assessment of the market value of the property.

Coffey Report Recommendations The Department of Finance commissioned an independent report on Irelands corporate tax system in 2016. Liable persons must pay their LPT liabilities on an annual basis. This is different to the UK where the estate of the deceased is liable for the tax.

New or unused property purchased from a builder or developer. There are two forms of property tax in the UK. Revenue offers a range of methods for paying the tax.

Duty of 169 is added and then Irish VAT of 23 on top bringing the final price to 32550. Local Property Tax LPT is a tax payable on the market value of residential properties in Ireland. From mid-July 2013 a local property tax was introduced for residential properties.

Taxes are deducted monthly from the gross salary by the employers on behalf of the employees. If the full value of your items is over 22 EUR the import tax on a shipment will be 23. You may have to pay Capital Acquisitions Tax on any gift or inheritances that you receive.

Generally speaking youll pay either 20 or 40 tax on your net rental income depending on your personal circumstances marital status how much youre charging tenants whether you have other forms of income etc. Local Property Tax LPT LPT is a self-assessed tax charged on the market value of residential properties in the State. An annual self-assessed Local Property Tax LPT charged on the market value of all residential properties in Ireland whether rented or occupied is now in force in Ireland.

Property Tax Relief For At Least The Next Three Years In 2020 With Images Property Tax Mirrored Sunglasses Sunglasses

Property Tax Relief For At Least The Next Three Years In 2020 With Images Property Tax Mirrored Sunglasses Sunglasses

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

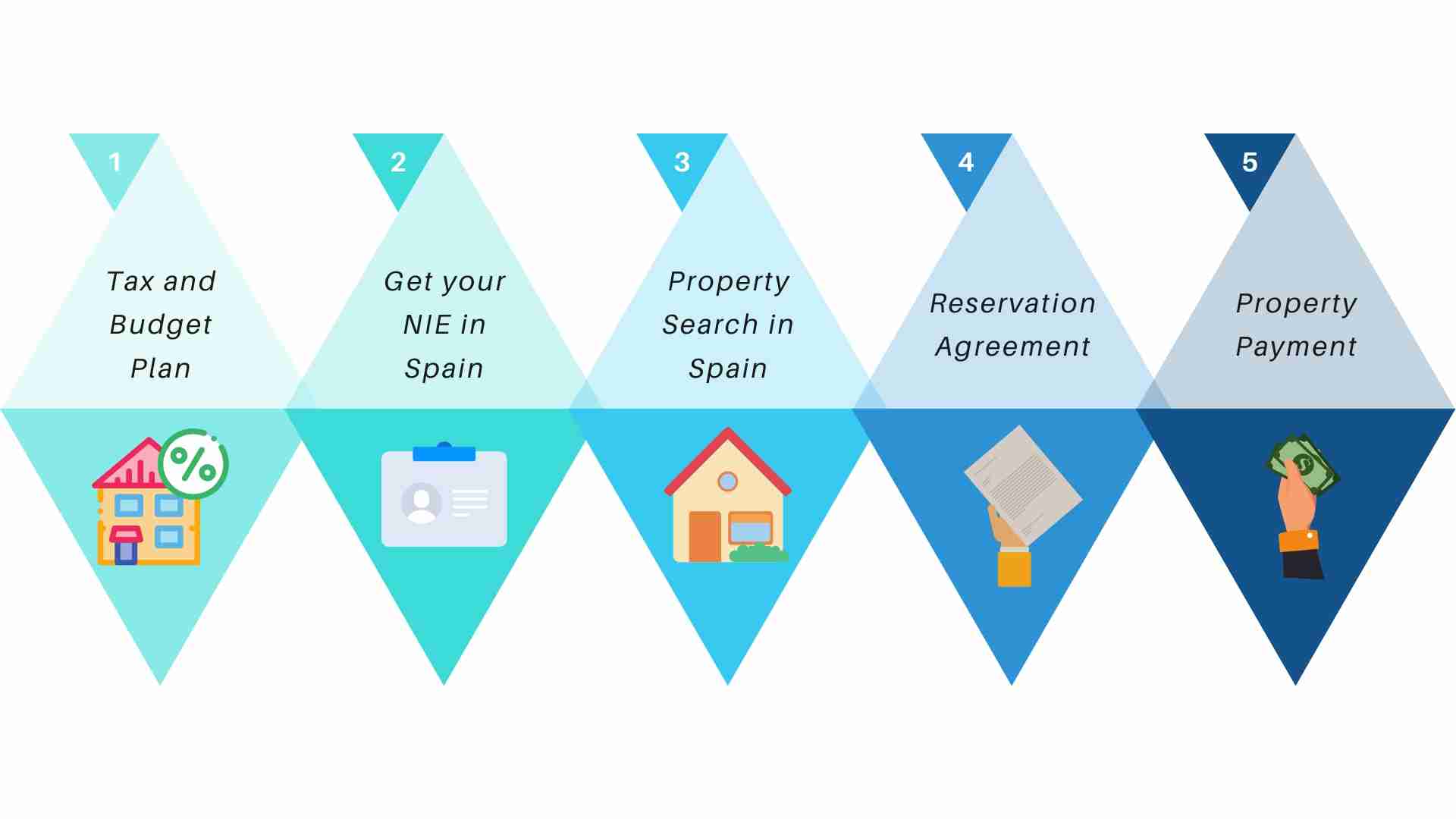

Buying A House In Spain In 2021 Requirements Process And Costs

Buying A House In Spain In 2021 Requirements Process And Costs

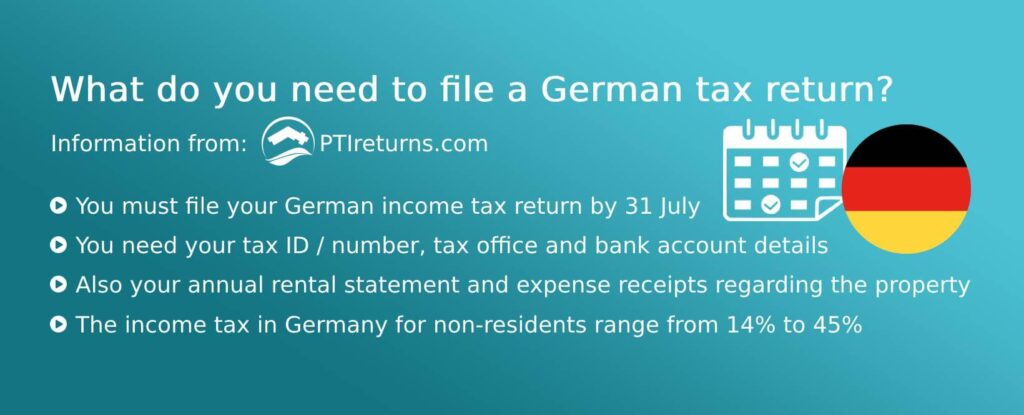

How Much Property Tax Do I Have To Pay On German Rental Income

How Much Property Tax Do I Have To Pay On German Rental Income

The Hidden Costs Of Owning A Home

The Hidden Costs Of Owning A Home

10 Things You May Not Know About The Local Property Tax

10 Things You May Not Know About The Local Property Tax

India S Kolkata Municipal Corporation Is Undertaking Efforts To Make People Aware Of The New Property Taxation Municipal Corporation Property Tax New Property

India S Kolkata Municipal Corporation Is Undertaking Efforts To Make People Aware Of The New Property Taxation Municipal Corporation Property Tax New Property

:max_bytes(150000):strip_icc()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

.png) States Sales Taxes On Software Tax Foundation

States Sales Taxes On Software Tax Foundation

How Much Property Tax Do I Have To Pay On German Rental Income

How Much Property Tax Do I Have To Pay On German Rental Income

I Buy A Property In France What Taxes Should I Pay Cabinet Roche Cie

I Buy A Property In France What Taxes Should I Pay Cabinet Roche Cie

Spanish Property Taxes For Non Residents Spanish Property Insight

Spanish Property Taxes For Non Residents Spanish Property Insight

I Buy A Property In France What Taxes Should I Pay Cabinet Roche Cie

I Buy A Property In France What Taxes Should I Pay Cabinet Roche Cie

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home