Shares Vs Property Graph Uk

Shares vs property. If you have a 100000 of cash or equity in your home you can buy a 400000 investment property.

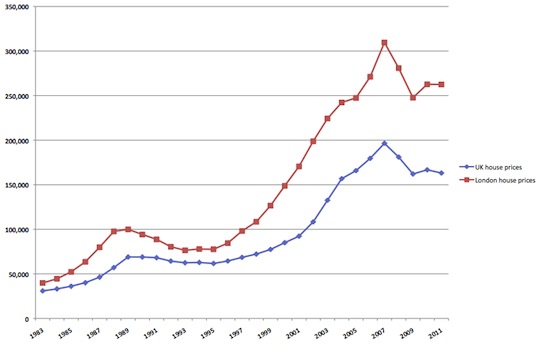

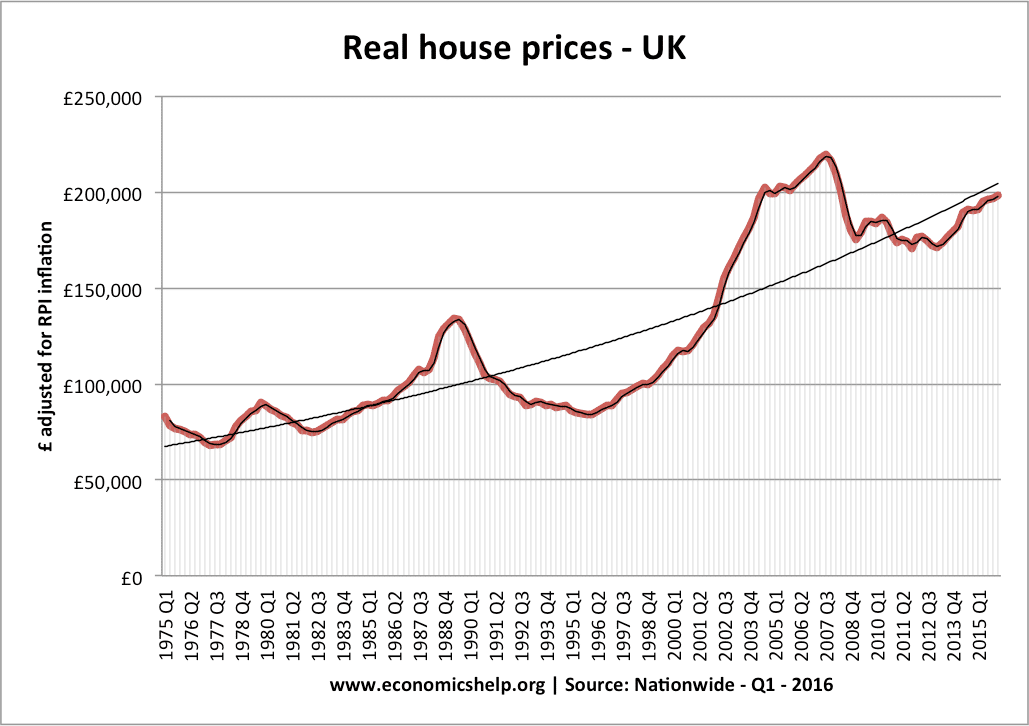

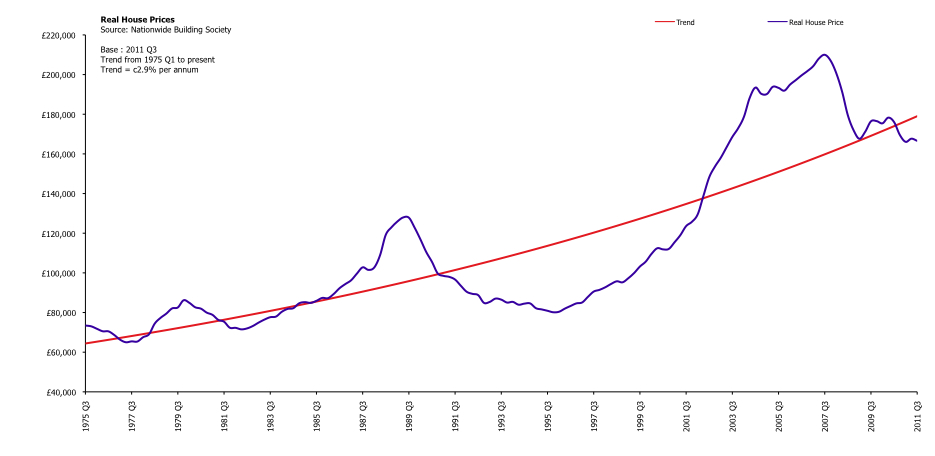

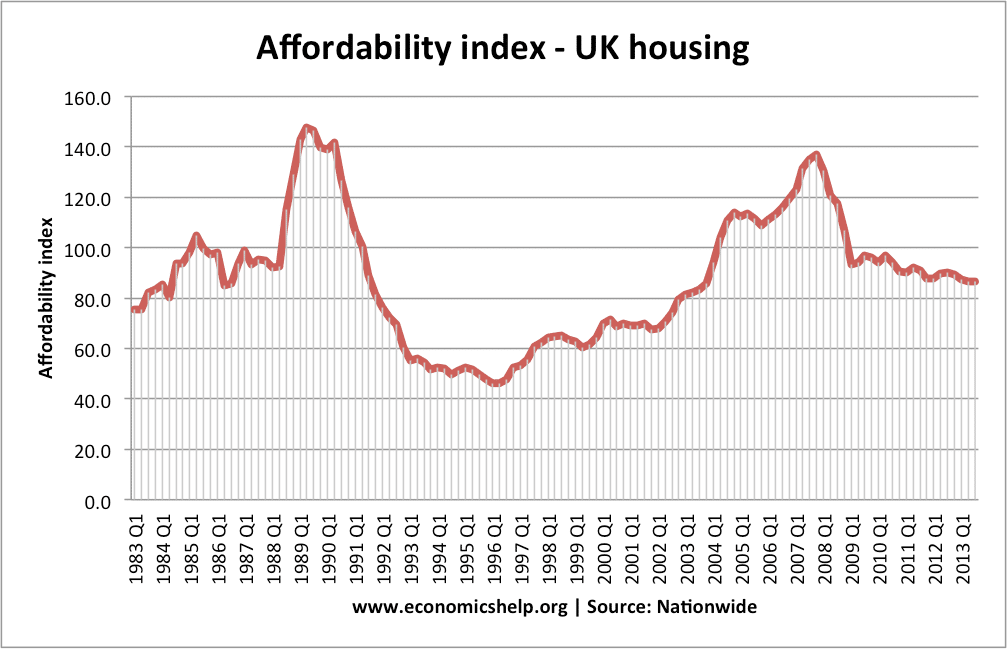

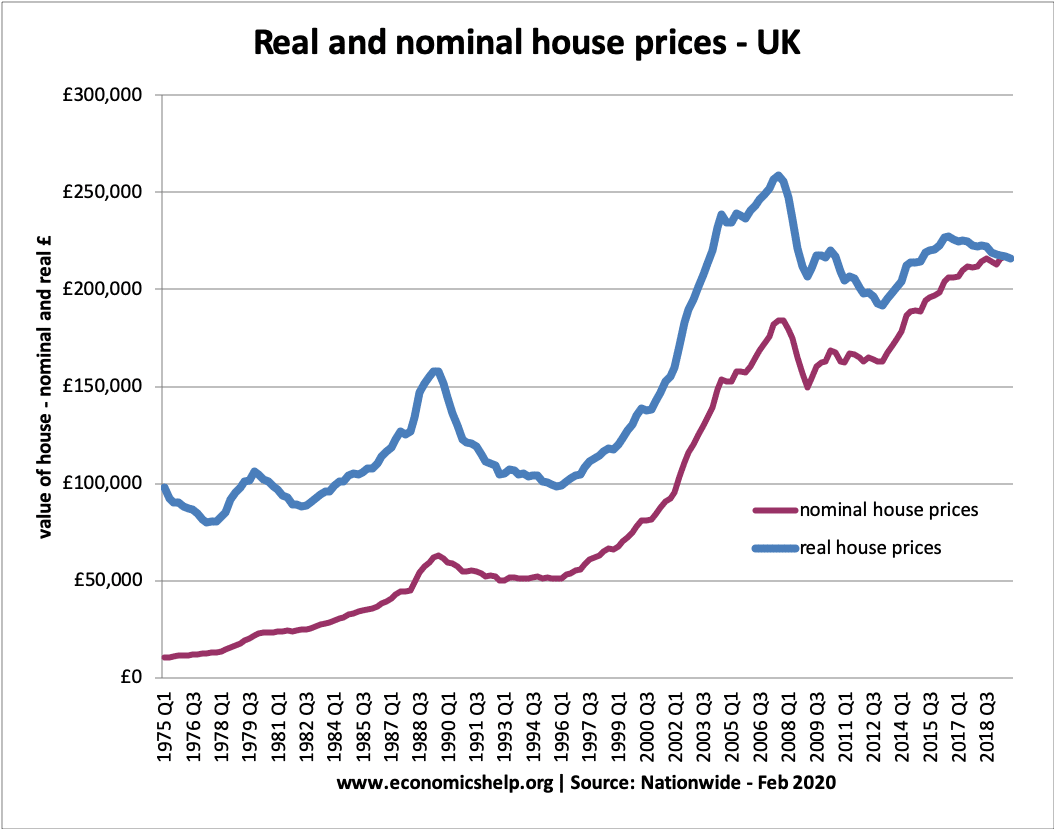

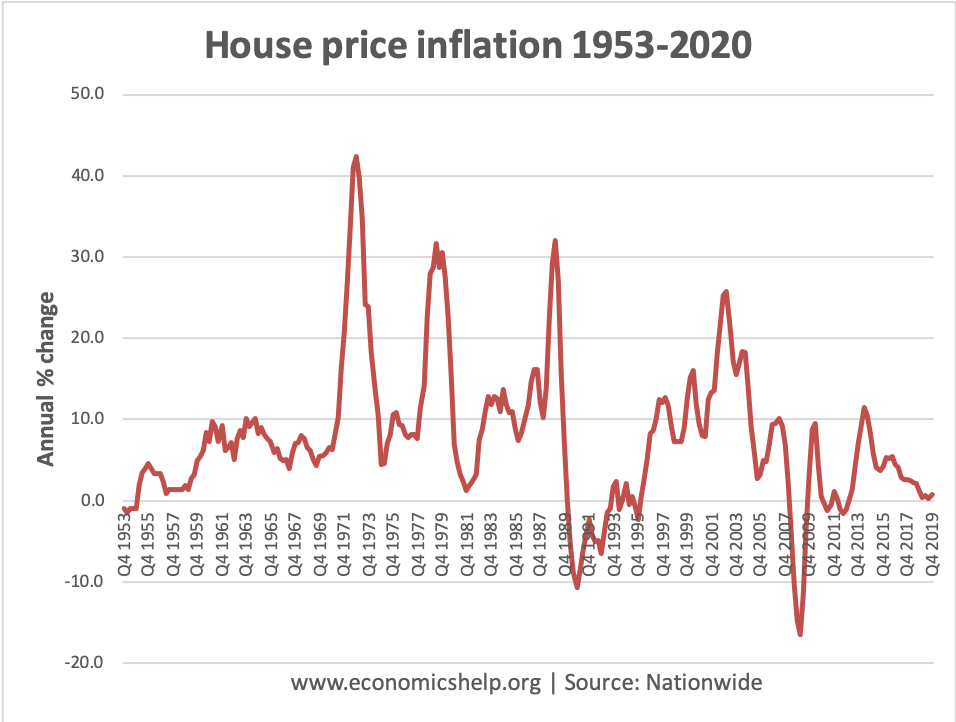

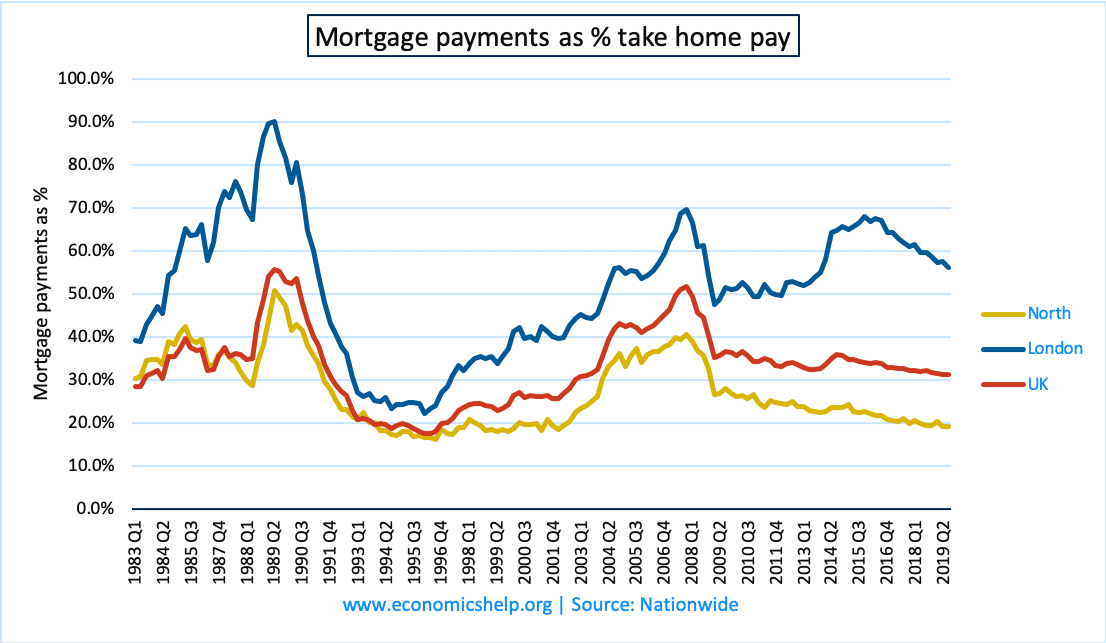

Uk Housing Market Economics Help

Uk Housing Market Economics Help

The graph below charts Property Verses Share growth over a 20 year period.

Shares vs property graph uk. The graph right shows UK asset class returns with income reinvested since 1899 as calculated by Barclays for its Equity Gilt Study 2016. The main difference often cited by people assessing property as an investment compared to stocks and shares is that at least a property is a tangible asset that you can see touch and to some extent work with to increase the value. Where do I invest.

H eres some handy data on historical asset class returns for the UK. Property or shares - which is best for income. That means theoretically that your 80000 deposit has.

However the legion of keen Aussie property investors may be surprised to learn that investing in shares remains the winning strategy especially when dividends are taken into account. Shares have easily outperformed property since the credit crunch stunned markets in 2007 the latest performance figures show even despite. The perpetual housing boom is over.

We said we couldnt answer that. As you can see equities shares have done much better than gilts UK government bonds over the long-term. Now thats a topic that can spark fiery debate among investors.

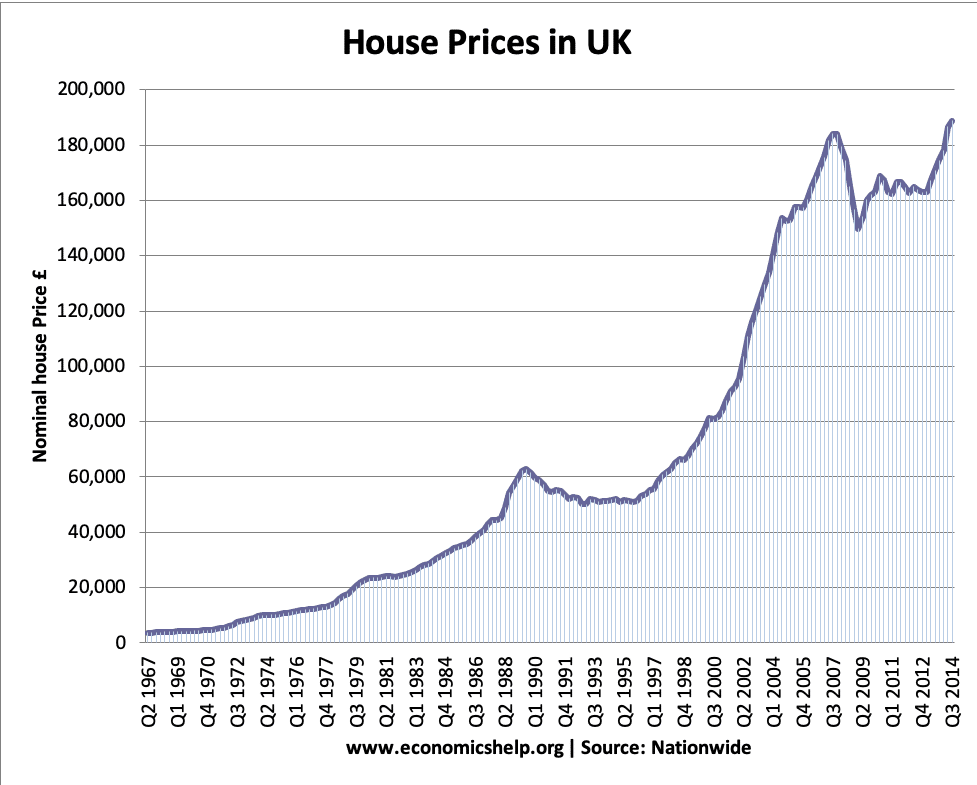

Uk equities have delivered 1433 per cent growth during the past three decades or 99 per cent each year - but only if you steadily reinvested all your dividends. Property prices will be flat next year and the next 10 years in property should look very different from the past 10. These are heady days for UK property prices and the London Stock Exchange.

Thats despite average national property values falling 69 per cent over the last year albeit with lots of regional variation. Since 1952 UK property prices have appreciated 774 per year. Capital growth aside lets look at other factors you should take into consideration.

Comparing by historic returns. Diehard fans of each will gladly tell you that the other one is a stupid place to put your money but most. If property prices rise 5 in a year then great your property is now worth 420000 on paper.

Dominic Rowles looks at the factors to consider before investing in property and explores whether the stock market could provide a. For the first time in a long while according to property website. The graph shows nominal asset class returns.

A couple of things to note. For the purpose of this example we will assume that income from share dividends and rental income is taxed at the same rate. Stocks and shares as an investment.

So by being a little more selective with your shares you have returned more than 2200 compared to a 332 gain in property. This may sound modest against the property price gains - but the house prices numbers did not take into account inflation. Give us a break.

View the FTSE All Share chart the FTSE All Share constituent companies and their current price and intraday movement. When considering property investment compared to investing in shares Mr Sloan said the leverage you can get from buying an investment property makes it the clear better option. Official data shows the average UK inflation rate for the last 40 years has been 44.

To get the total return figures we need to add the price increase of the asset to any income it makes. So a 7 annual gain is reduced to less than 3.

Historical Uk House Prices Monevator

Historical Uk House Prices Monevator

.png) Property Vs Shares The Long Term Verdict Westpac

Property Vs Shares The Long Term Verdict Westpac

.png) Property Vs Shares The Long Term Verdict Westpac

Property Vs Shares The Long Term Verdict Westpac

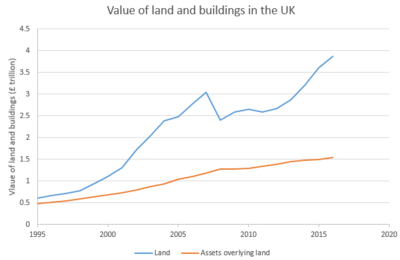

Uk Housing Market Economics Help

Uk Housing Market Economics Help

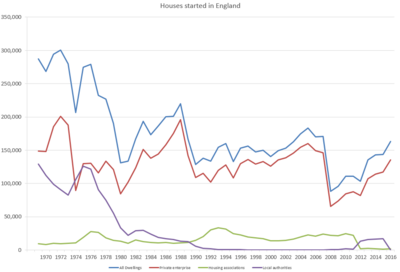

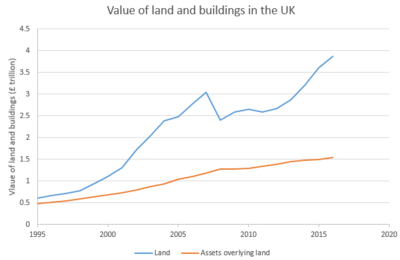

Why Are Uk House Prices So High Economics Help

Why Are Uk House Prices So High Economics Help

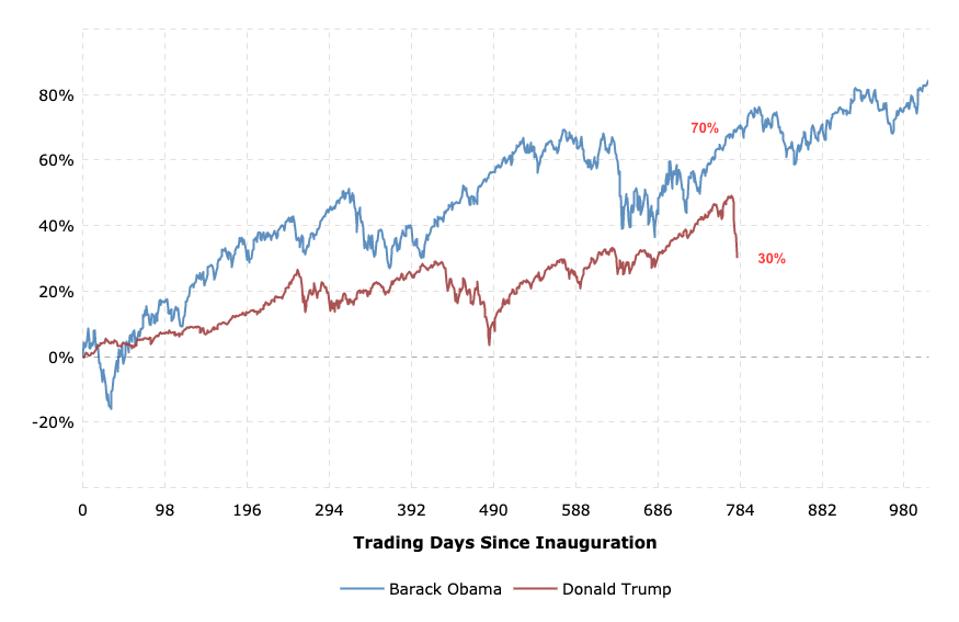

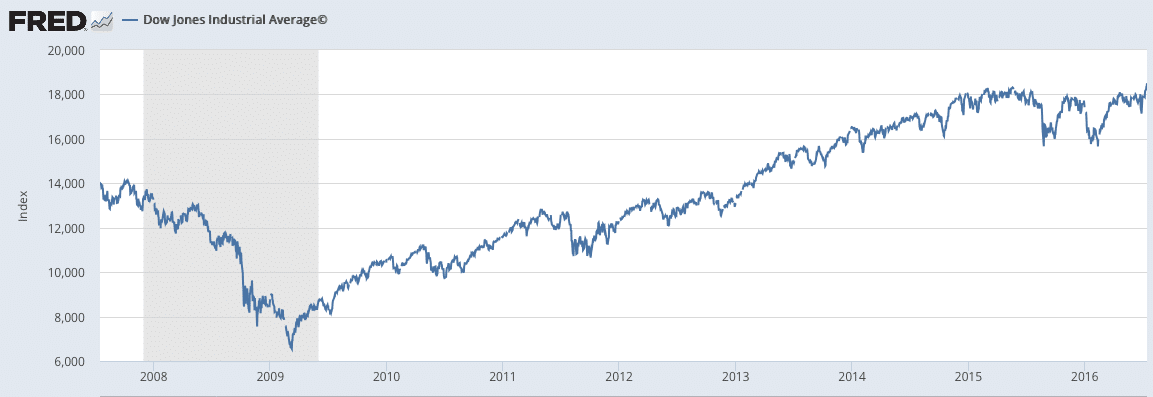

Four Charts Comparing Trump S Vs Obama S Stock Market Returns

Four Charts Comparing Trump S Vs Obama S Stock Market Returns

Historical Uk House Prices Monevator

Historical Uk House Prices Monevator

.png) Property Vs Shares The Long Term Verdict Westpac

Property Vs Shares The Long Term Verdict Westpac

Factors Affecting Supply And Demand Of Housing Economics Help

Factors Affecting Supply And Demand Of Housing Economics Help

The Housing Market May Be Crashing But Homebuilder Stocks Like These 5 Are Stable

The Housing Market May Be Crashing But Homebuilder Stocks Like These 5 Are Stable

Here S How The Stock Market Has Performed Before During And After Presidential Elections

Here S How The Stock Market Has Performed Before During And After Presidential Elections

Housing In The United Kingdom Wikipedia

Housing In The United Kingdom Wikipedia

Bank Of England Finally Admits High House Prices Are Determined By Finance Not Supply And Demand Positive Money

Bank Of England Finally Admits High House Prices Are Determined By Finance Not Supply And Demand Positive Money

Uk Housing Market Economics Help

Uk Housing Market Economics Help

Uk Housing Market Economics Help

Uk Housing Market Economics Help

Relationship Between Stock Market And Economy Economics Help

Relationship Between Stock Market And Economy Economics Help

Uk Housing Market Economics Help

Uk Housing Market Economics Help

Uk Housing Market Economics Help

Uk Housing Market Economics Help

Housing In The United Kingdom Wikipedia

Housing In The United Kingdom Wikipedia

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home