Property Tax Rates In Jacksonville Fl

The tax rate for the Beaches was set at 81512 per every 1000 of taxable value and the city of Baldwin at 96312 per every 1000 of taxable value. Business owners and home owners are subject to the same millage rate within a given tax district except where exempted by Florida Statutes or local ordinances.

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

See how 2020s millage rates and tax levies compare to those of the previous year.

Property tax rates in jacksonville fl. Millage rate Tax amount. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. If you own property and do not receive a bill you are still obligated to pay the tax.

The Jacksonville City Council on Tuesday voted 11-6 against an attempt to tentatively boost the property tax rate by 2 percent. Income Taxes. The rate remains unchanged at 114419 per every 1000 of taxable property value.

The time and dates are listed on the Notice of Proposed Property Taxes mailed to property owners in mid-August. Property Tax Rate. The tax rate for the urban service districts 2-4 the Beaches was set at 81512 per every 1000 of taxable value and the city of Baldwin will see a rate of 96312 per every 1000 of taxable value.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. In-depth Duval County FL Property Tax Information. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value.

Median annual property tax bills in the Sunshine State follow suit as its 2035 mark is over 500 cheaper than the US. GS - City of Jacksonville. 184366 - 50000.

The citys property tax rate would stay at 114419 mills which is about 1144 in taxes per 1000 of taxable property value. Property tax bills are mailed to owners of record in November for the current year. The rate remains at 114419 per every 1000 of taxable property value.

Average property taxes for the state in 2010 were 1791 per property. Nonetheless property tax burdens in the city are just slightly higher than average. In fact the rate of return on property tax liens investments in Jacksonville Florida can be anywhere between 15 and 25 interest.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Visit the Florida Department of Revenues Property Tax Data Portal to view similar information. A tax of 18 mills typical of Duval County on a value of 10000000 is 180000.

Tax rates are set by the Taxing Authorities. The property tax rate for the city of Jacksonville will remain at. Review the distribution of taxes levied by property type for the 2020 Certified Tax Roll.

1074 The property. Inquire about your property on the link below or contact the Tax Collector by phone or email. At a 083 average effective property tax rate property taxes in Florida rank below the national average which currently stands at 107.

There are non-Government. A tax of one mill on 1000 of value is 100. One mill is 11000 of a dollar which is 110 th of 1 cent.

700 The total of all sales taxes for an area including state county and local taxes. Taxing Districts for Duval County. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected.

Tax Rates for Jacksonville FL Sales Taxes. The results displayed are the estimated yearly taxes for the property using the last certified tax rate without exemptions or discounts. Jacksonville GS or USD1 Jacksonville Beach USD2 Atlantic Beach USD3 Neptune Beach USD4 Baldwin USD5.

Investing in tax liens in Jacksonville Florida is one of the least publicized but safest ways to make money in real estate. This means that there are a high number of residents in Jacksonville FL who have an assessed value of their property that is much lower than its actual value. 000 The total of all income taxes for an area including state county and local taxes.

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

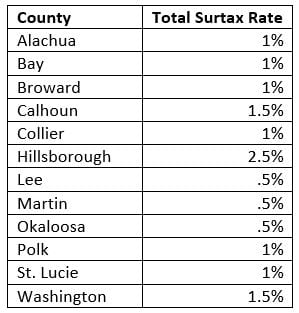

Changes Ahead The 2019 Sales Tax Rates Are Out James Moore

Changes Ahead The 2019 Sales Tax Rates Are Out James Moore

City Council Leaves Property Tax Rates Unchanged Jax Daily Record Jacksonville Daily Record Jacksonville Florida

City Council Leaves Property Tax Rates Unchanged Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Only 1 State Has Lower Property Taxes Than Alabama Wake Up Call Al Com

Only 1 State Has Lower Property Taxes Than Alabama Wake Up Call Al Com

Jacksonville Property Tax Rate Likely Remains Unchanged For 2019 20 Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Jacksonville Property Tax Rate Likely Remains Unchanged For 2019 20 Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Realestate Realtor Househunting Homebuying Homebuyer Newhome Construction Build Jacksonville Florida Home Buying Realtor School Home Buying Process

Realestate Realtor Househunting Homebuying Homebuyer Newhome Construction Build Jacksonville Florida Home Buying Realtor School Home Buying Process

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Duval County Property Tax Records Duval County Property Taxes Fl

Duval County Property Tax Records Duval County Property Taxes Fl

Florida Property Tax H R Block

Florida Property Tax H R Block

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting Secured Income Group

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting Secured Income Group

Mortgage Affordability Mortgage Subtraction Finance

Mortgage Affordability Mortgage Subtraction Finance

Centrally Located Redevelopment Opportunity Sfh San Diego Real Estate Investment Property Private Lender

Centrally Located Redevelopment Opportunity Sfh San Diego Real Estate Investment Property Private Lender

Best Buy Cities Where To Invest In Housing In 2017 Where To Invest Investing Cool Things To Buy

Best Buy Cities Where To Invest In Housing In 2017 Where To Invest Investing Cool Things To Buy

Property Tax Maui Maui Real Estate Property Tax Maui

Property Tax Maui Maui Real Estate Property Tax Maui

Labels: jacksonville, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home