New Home Buyers Tax Credit Ontario

You or your spouse. Amount you paid back to date.

Minimum Credit Score Required To Get A Mortgage In Canada Canada Wide Financial Mortgage Loans Refinance Mortgage Credit Score

Minimum Credit Score Required To Get A Mortgage In Canada Canada Wide Financial Mortgage Loans Refinance Mortgage Credit Score

Note that if a home is gifted to a person as long as all other requirements are met the person can still qualify for the home buyers tax credit.

New home buyers tax credit ontario. The First Time Home Buyer Tax Credit is a non-refundable tax credit that helps homeowners recover closing costs such as legal expenses and inspections. This new non-refundable tax credit is based on a percentage of 5000. The First-Time Home Buyers Tax Credit is a 5000 non-refundable tax credit.

Ontario First Time Home Buyers When you pay land transfer tax on your home purchase as a first-time home buyer in Ontario you will be eligible to receive a rebate on a portion of the amount up to 4000. Social Security number or your IRS Individual Taxpayer Identification Number. You received a First-Time Homebuyer Credit.

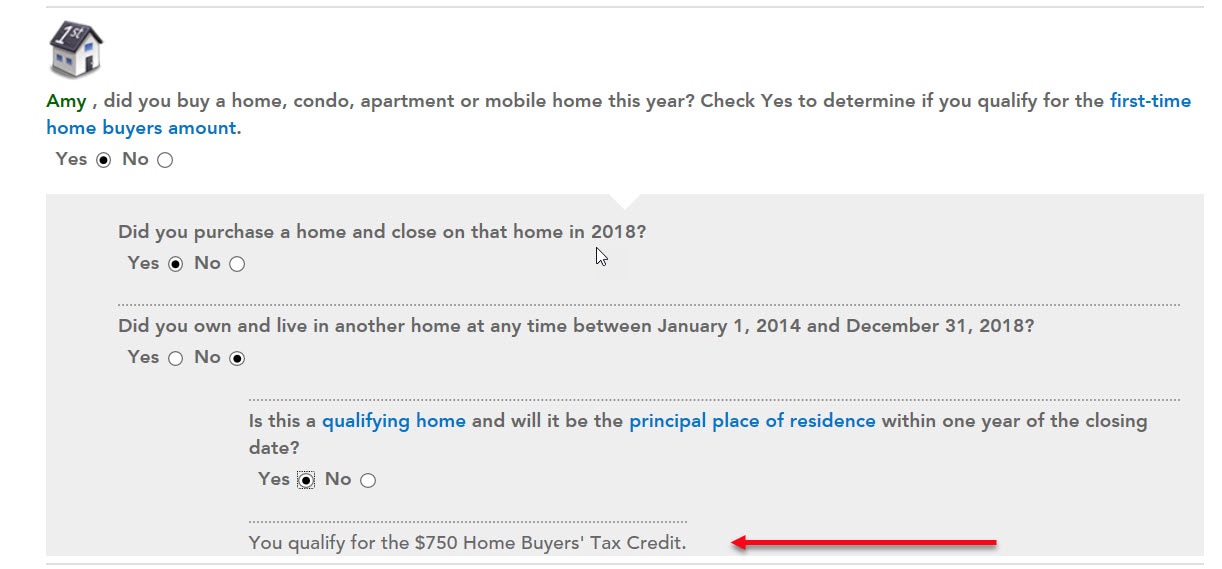

Therefore for homes purchased in 2021 you will get a credit of 750 calculated as 5000 x 15 when you file your taxes next year. BC requires its home buyers to pay a Property Transfer Tax PTT when purchasing a new home. Home Buyers Plan HBP.

First-time home buyers tax credit If you are buying a home for the first time you can claim a non-refundable tax credit of up to 750. For an eligible individual the credit will provide up to 750 in federal tax relief. This tax credit was up to 7500 for first-time homebuyers which was very exciting at the time.

You are a first-time home. First-time buyers can claim up to 5000 for the purchase of a qualifying home on their personal tax return. Go to our First-Time Homebuyer Credit Account Look-up to receive.

The First-time Home Buyers Tax Credit was introduced as part of Canadas Economic Action Plan to assist Canadians in purchasing their first home. You or your spouse or common-law partner purchased a qualifying home. The Home Buyers Amount offers a 5000 non-refundable income tax credit amount on a qualifying home acquired during the year.

The credit applies to a maximum of 5000 in closing costs which would result in a credit of 750. The tax is valued at. Ontario New Housing Rebate TheHST in Ontariois 13 in which GST is 5 and the provincial sales tax is 8.

For houses located in Ontario you may be eligible to claim the Ontario new housing rebate if you are not eligible to claim the new housing rebate for some of the federal part of the HST only because the fair market value of the housing exceeds 450000. You or your spouse or common-law partner acquired a qualifying home. The FTHBC must be claimed in the year the home is purchased.

An Ontario new housing rebate will be available up to the applicable maximum of 24000 regardless of the fair market value as long as all of the other. You can claim 5000 for the purchase of a qualifying home in the year if both of the following apply. Canadian homeowners have several home tax deductions that they can claim.

First-Time Home Buyers Credit This program is through the Government of Canada and it provides a 15 per cent income tax credit towards closing cards for eligible applicants. The person who gifted the home is deemed to have disposed of it and may have to report a capital gain. The HBTC is not available until the subsequent tax year.

The home buyers tax credit is calculated using the lowest personal income tax rate for the year ie. You cannot have owned property anywhere in the world previously to qualify. The amount of rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6300.

You did not live in another home owned by you or your spouse or common-law partner in the year of acquisition or in any of the four preceding years first-time home buyer. Go to the Home Buyers Amount webpage to see if you are eligible. The Home Buyers Amount HBA is a non-refundable credit that allows first-time purchasers of homes and purchasers with disabilities to claim up to 5000 in the year when they purchase a home.

The new homeowners tax credit that many filers are familiar with is the First-Time Homebuyer Credit which was passed in 2008 under HERA or the Housing Economic and Recovery Act under Obama. Eligibility Rules for the Home Buyers Tax Credit. If youre buying a home for the first time claiming the first-time homebuyer credit can land you a total tax rebate of 750.

It is designed to help recover closing costs such as legal expenses inspections and land transfer taxes. To be eligible for the Home Buyers Tax Credit you must meet both of these criteria. 1 on the first 200000 2 on the balance up to and including 2000000.

Balance of your First-Time Homebuyer Credit. While 750 isnt a life-changing amount of money it can make buying your first home. The Home Buyers Tax Credit at current taxation rates works out to a rebate of 750 for all first-time buyers.

Why Should I Have A Buyer Agent Key To Real Estate Find House Condo Real Estate Properties For Sale I First Time Home Buyers Buyers Agent Buyers

Why Should I Have A Buyer Agent Key To Real Estate Find House Condo Real Estate Properties For Sale I First Time Home Buyers Buyers Agent Buyers

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

Lihtc Infographic Low Income Housing Infographic Tax Credits

Lihtc Infographic Low Income Housing Infographic Tax Credits

Tax Credits Rebates For First Time Home Buyers In Toronto First Time Home Buyers Moving To Toronto Real Estate Tips

Tax Credits Rebates For First Time Home Buyers In Toronto First Time Home Buyers Moving To Toronto Real Estate Tips

London Ontario Private Mortgages Investment Services Mortgage Lowest Mortgage Rates

London Ontario Private Mortgages Investment Services Mortgage Lowest Mortgage Rates

Mortgage Company Process Infographic Mortgage Process Home Buying Process Mortgage Info

Mortgage Company Process Infographic Mortgage Process Home Buying Process Mortgage Info

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Us Real Estate Real Estate Infographic

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Us Real Estate Real Estate Infographic

First Time Home Buyers Tax Credit Cibc

First Time Home Buyers Tax Credit Cibc

Where Do I Claim The Home Buyers Amount

Where Do I Claim The Home Buyers Amount

Seller S Market 101 Real Estate Advertising Real Estate Home Buying Process

Seller S Market 101 Real Estate Advertising Real Estate Home Buying Process

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Can First Time Home Buyers Get A Tax Credit

Can First Time Home Buyers Get A Tax Credit

7 Questions To Ask Your Mortgage Lender First Home Buyer Buying First Home Home Mortgage

7 Questions To Ask Your Mortgage Lender First Home Buyer Buying First Home Home Mortgage

Mortgage Broker London Ontario Lowest Mortgage Rates Investment Services Mortgage Brokers

Mortgage Broker London Ontario Lowest Mortgage Rates Investment Services Mortgage Brokers

The Homeowners Guide To Tax Credits And Rebates

The Homeowners Guide To Tax Credits And Rebates

First Time Home Buyers Tax Credit Hbtc H R Block Canada

First Time Home Buyers Tax Credit Hbtc H R Block Canada

How To Claim The 8000 Tax Credit First Time Home Buyer Home Decor Home Decor Catalogs Diy Home Decor

How To Claim The 8000 Tax Credit First Time Home Buyer Home Decor Home Decor Catalogs Diy Home Decor

First Time Home Buyers Tax Credit Loans Canada

First Time Home Buyers Tax Credit Loans Canada

Ontario Land Transfer Tax Rebate Doubled To 4k For First Time Homebuyers Citynews Real Estate Prices Real Estate Home Ownership

Ontario Land Transfer Tax Rebate Doubled To 4k For First Time Homebuyers Citynews Real Estate Prices Real Estate Home Ownership

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home