How To Pay Property Tax Franklin County Ohio

Pay Franklin County Ohio property taxes online using this service. Franklin County Clerk of Courts 345 S.

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

To avoid late fees penalty and interest be sure to file by the due date of MAY 17 2021.

How to pay property tax franklin county ohio. When using this method to make a payment you will be provided a confirmation number. Franklin County Real Estate Tax Inquiry Real Estate Tax Payments. We can assist you Monday-Friday 830 am 500 pm.

Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property. 167 of home value. Please keep in mind that there is a convenience fee charged by Point Pay the provider of credit card payment services to Hamilton County.

However it may take 2-4 business days for processing. You can pay using a debit or credit card online by visiting ACI Payments Inc. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300.

1st Floor Columbus OH 43215. Your payment will be posted within minutes of transaction approval. The only changes to a propertys value outside of the three year cycle would be due to.

4 Pay the court costs in cash certified check or money order made payable to the Franklin County Clerk of Courts in person or by mail at the following address. Pay taxes online Your payment will be considered accepted and paid on the submitted date. Pay Ohio Property Taxes Online On time ACI Payments Inc.

4th Ave Pasco WA outside the security building. Pay your real estate taxes online by clicking on the link below. Payments can be made by personal check certified check money.

Please note that it usually takes the County Treasurer 2-4 days to process your payment once it. Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. Keep this number with your tax records.

Franklin County Real Estate Tax Payment. The real estate tax collection begins with the assessment of the real estate parcels in Franklin County. 1-877-768-4775 You will need to know your parcel zip code bill number tax year and tax account number in order to make a payment by phone.

1st Quarter is due April 15. The extension does not apply to estimated payments. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Franklin County Tax Appraisers office.

The County assumes no responsibility for errors in the information and does not guarantee that the data is free from errors or inaccuracies. Cheryl brooks sullivan. To pay your Hamilton County property taxes with Visa MasterCard or American Express contact Point Pay online or by phone.

The following provides you with information on property tax payments. Yearly median tax in Franklin County. We can be reached at 937 746-9921.

Franklin County collects on average 167 of a propertys assessed fair market value as property tax. Please note you cannot use home equity line of credit checks or money market account to make an online payment. Envelopes to put your payment in are available inside the security building.

You may even earn rewards points from your card. The median property tax on a 15530000 house is 211208 in Ohio. This payment method charges your credit card Discover Visa MasterCard or American Express.

Through our fully secured website you can pay by credit or debit card with an additional convenience fee or for free by electronic check. Makes it easy to pay Ohio property taxes using your favorite debit or credit card. New application provides a simple search by your parcel owner name or property address.

Include a copy of the notice of satisfaction with your payment. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Franklin County Treasurer Website Safe Secure. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work conducted by each County. Use this inquiry search to access Franklin Countys real estate tax records.

The Franklin County Treasurers Office wants to make paying your taxes as easy as possible. The median property tax on a 15530000 house is 259351 in Franklin County. In addition a payment drop box is available at the parking lot of the Courthouse 1016 N.

Our Budget Payment Program allows you to be billed monthly for your real estate taxes. Delinquent tax refers to a tax that is unpaid after the payment due date. Payments of property taxes can be made via mail but must be postmarked April 30 2020.

Its fast easy secure and your payment is processed immediately. The Treasurers Office offers several methods of payment for real estate taxes. To Pay by Phone CALL.

Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143.

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

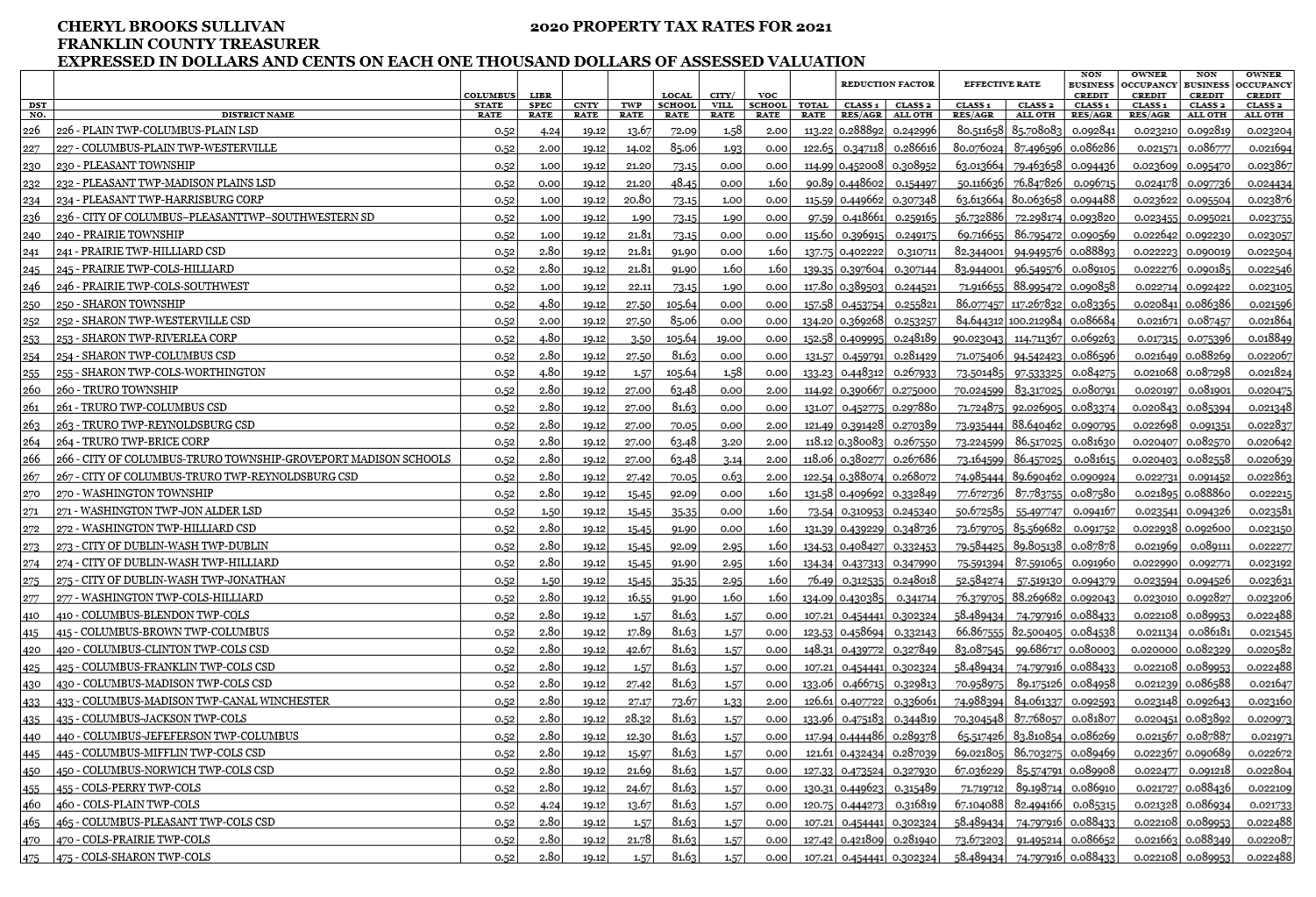

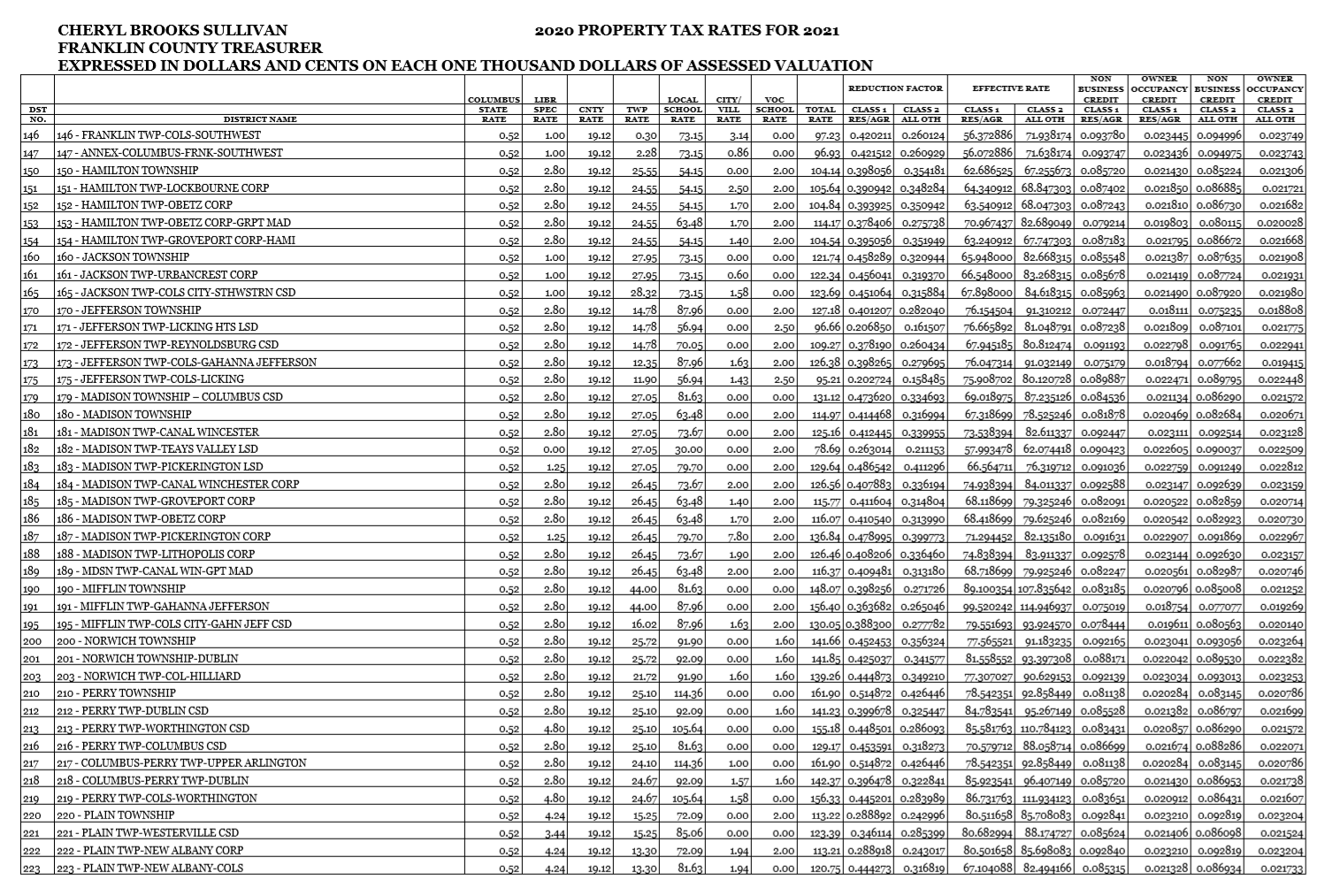

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Treasurer Property Search Property Search Franklin County Tax Reduction

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

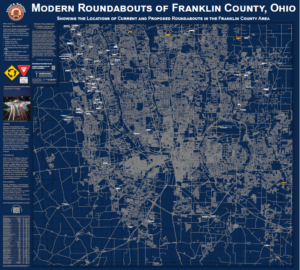

Franklin County Engineer S Office

Franklin County Engineer S Office

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

1883 Property Ownership Plat Map Of Mifflin Township Franklin County Ohio Columbus And Ohio Map Collection

1883 Property Ownership Plat Map Of Mifflin Township Franklin County Ohio Columbus And Ohio Map Collection

Franklin County Auditor Tax Estimator

Franklin County Auditor Tax Estimator

Maps Franklin County Engineer S Office

Maps Franklin County Engineer S Office

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

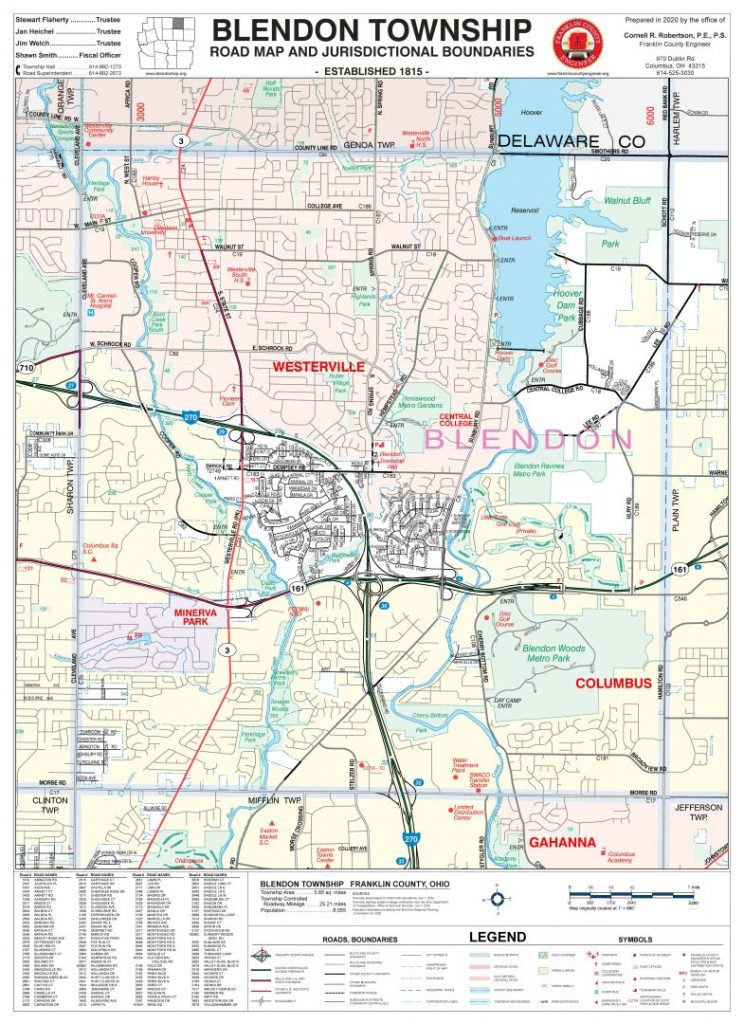

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Map Of Franklin Co Ohio Library Of Congress

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Labels: franklin

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home