Franklin County Auditor Commercial Property

The process takes between two and two-and-a-half years for a. Page 13 - Browse 407 Franklin County New York properties for sale on Lands of America.

-- No Data --.

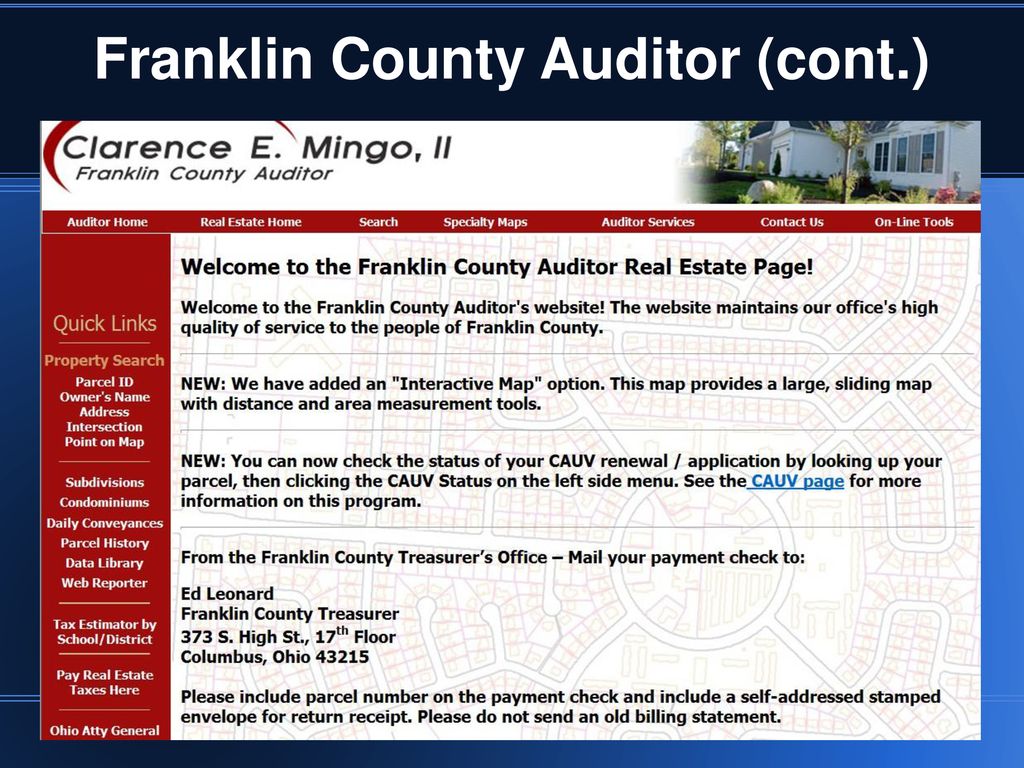

Franklin county auditor commercial property. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. Compare properties browse amenities and find your ideal property in Franklin County New York. The Auditors office handles a wide variety of important responsibilities that affect all of Franklin Countys residents and businesses.

Nassau County Clerks Office. If you believe that your property tax valuation is not accurate you can appeal the county auditors value by filing a complaint against valuation with the county board of revision. Franklin County Ohio conducted its triennial update for tax year 2014.

Update for Properties in Franklin County Ohio. To receive it though you must fill out an application. Welcome to Franklin County Property Appraisers Website.

Franklin County Health Department Announces Vaccination POD on Friday Mar 25. And services to all Franklin County residents. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site.

Transfer Tax Conveyance Fee Calculator. Click here for more information or call the Franklin County Auditors Office at 614 525-6271. Address of any residential property owned in another state the legal name of the trust if applicable 2019 federal or state income tax returns for all owners.

His request denied Franklin County Auditor Michael Stinziano is moving ahead with the triennial update of property values even though he believes more time would have been helpful for residents and the process. The Clerks Office provides property-related services and forms including. Look up property assessments online.

The office also sets values for every real estate parcel in the county for property taxes. The auditor or his qualified appraiser is required to view and appraise every property in the county for this purpose. To enroll in the CAUV please file an application with the Franklin County Auditors office between the first Monday in January and before the first Monday in March of the tax year for which you seek CAUV.

The requests to delay were based on COVID-19 related economic uncertainties a rising unemployment rate and unpredictability among residential and commercial property owners. You are entitled to a 25 reduction in property taxes on the home that serves as your primary residence. One of the main responsibilities of the Franklin County Auditors office is maintaining and updating all records that are related to real estate.

By reducing the value the program can substantially reduce property taxes for working farmers. Any Ohio property owner who has engaged in commercial agriculture for the past three years may qualify for the program. The appraisal division is charged with annually reviewing the properties which have been found to have changed or are no longer appraised at their fair market value.

Welcome to the Franklin County Property Appraisers website. If you were not required to file a 2019 income tax return you will need the following additional information for all property owners. The total value of approximately 1000 acres of commercial land and property recently listed for sale in New Yorks Franklin County was almost 11 million.

Total wages salaries and tips. Located in Northern New York 1697-square-mile Franklin County is one of the ten biggest counties in the Empire State. This site has been prepared as a public service to give you an overview of the purpose and responsibilities of the Property Appraisers Office.

In Franklin County that fee is 3 per every 1000 of the sale price with a 3 minimum and a 050 per parcel transfer tax. 2021 Franklin County Adopts Countinuity of Operations Plan for Public Health Emergencies. Access local real estate records.

The Franklin County Auditors Office is a leader in public service and provides quality cost-effective information. High St 21st Floor Columbus Ohio 43215 Get Directions. Assesses property values that determine property taxes.

This includes the 1 per 1000 fee set by the state and the 2 per 1000 set by the Franklin County Board of Commissioners who last. Throughout Ohio there is a Transfer Tax and Conveyance fee on real property and manufactured homes. The office licenses our dogs as required by state law.

4 Any inquiry regarding placement of commercial antennas or use of towers on County properties should be immediately directed to the Director of the Division of Information and Support Services including contacts received by departments or agencies which have direct custody and control of the property or location.

Https Www Columbusrealtors Com Clientuploads Documents Presentations 20 0528 Slides Auditorstinzianovaluationupdate Pdf

Franklin County Auditor Looks To Suspend Property Assessments Columbus Business First

Franklin County Auditor Looks To Suspend Property Assessments Columbus Business First

Franklin County Auditor Appraisal

Franklin County Auditor Appraisal

Franklin Co Ohio Auditor Property Search Property Walls

Franklin Co Ohio Auditor Property Search Property Walls

Franklin County Treasurer Property Search

Franklin County Treasurer Property Search

Labels: commercial, county, franklin, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home