Los Angeles County Property Tax Questions

Information on property tax exemptions exclusions value reviews and formal appeals of appraised value. We accept major credit card and debit card payments over the telephone.

Death Of Real Property Owner Los Angeles County Office Of The Assessor

Death Of Real Property Owner Los Angeles County Office Of The Assessor

Thank you for your cooperation and patience.

Los angeles county property tax questions. We are located on the first floor in Room 122. Auctions of Tax Defaulted property are generally held twice a year. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at 8888072111 or 2139742111 press 1 2 and then press 9 to reach an agent Monday Friday 800am.

If you are a single veteran with assets of less than 5000 a married veteran with assets of less than 10000 or an unmarried surviving spouse of an eligible veteran you may apply for the Veterans Exemption of 4000 applied to the assessed property value. 105 or less of the market value of the original property if a replacement property was purchased or newly constructed within the first year after the sale of the original property or 110 or less of the market value of the original property if a replacement property was purchased or newly constructed within the second year after the sale of the original property. Property tax assessments and reassessments.

The Office of the Los Angeles County Assessor will consider the execution and. Questions about tax payments or bills are directed to the Treasurer and Tax Collector at ttclacountygov. Los Angeles County GIS maps plat maps and property boundaries.

Just follow these simple steps. Statistics show that about 25 of homes in America are unfairly overassessed and pay an average of 1346 too much in property taxes every year. Please call 213893-7935 or visit us at 225 N.

The AuditorController website will help you to find contact information concerning Direct Assessments found on your County of Los Angeles Property Tax Bill. Click the button below to submit your property tax related questions or comments to the public service staff of the appropriate department. The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments.

Anyone who can legally own property can bid on a property. You should not mail your payments to any other addressProperty tax payments must be received or USPS postmarked by the delinq uency date to avoid penalties. Delinquent Unsecured Tax information is only available by telephone or in person.

Excluding Los Angeles County Holidays 2139742111. You will need the Assessors Identification Number AIN Year and Sequence from your Secured Property Tax Bill to use this system. If you have any questions on the issuance and mailing of your Unsecured Property Tax Bill or the collection of your Unsecured Personal Property Taxes you may contact the Unsecured Property Tax Section at unsecuredttclacountygov or 1213 893-7935 between 800 am.

We are located on the first floor in Room 122. You must mail property tax payments to the Los Angeles County Treasurer and Tax Collector Post Office Box 54018 Los Angeles CA 90054- 0018. Pacific Time Monday through Friday excluding Los Angeles County holidays.

Assessed value of your property. This portal has additional information about the four County departments involved in the property tax process providing answers for your property tax questions. Please call 213893-7935 or visit us at 225 N.

Delinquent Unsecured Tax information is only available by telephone or in person. Save time pay online by electronic check or creditdebit card. Los Angeles County does not sell Certificates of Tax Liens nor does any other County in California at this time.

Auditor-Controller The Los Angeles County Auditor-Controller adds direct assessments to the Tax Roll then applies the General Tax Levy 1 and Voted Indebtedness voter bonded tax rates to the value on the Tax Roll. Toll-free 8888072111 press 8 2139743838. To appeal the Los Angeles County property tax you must contact the Los Angeles County Tax Assessors Office.

Los Angeles County property tax appeals and challenges. To pay by telephone call toll-free 1 888 473-0835. Si necesita asistencia en Español por favor llame gratis al 1888807-2111 y oprima 2 al escuchar el.

Information on valuations and taxes can be obtained by entering the Assessor Identification Number from a property tax bill. Los Angeles County CA property tax payments and due dates. County of Los Angeles.

Hill Street Los Angeles CA 90012. Decline in Value Proposition 13 caps the growth of a propertys assessed value at no more than two percent a year. Are You Paying Too Much Property Tax.

Property owners may contact the Department of Assessment for questions about. Services - Administrative Services Management Services Personnel Payroll Special Investigations Assessment Services Exemptions Mapping Ownership Services Information Technology Division Central Processing Major Personal Property Major Real Property and Outside Sales Desk. Hill Street Los Angeles CA 90012.

Do you have questions about.

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

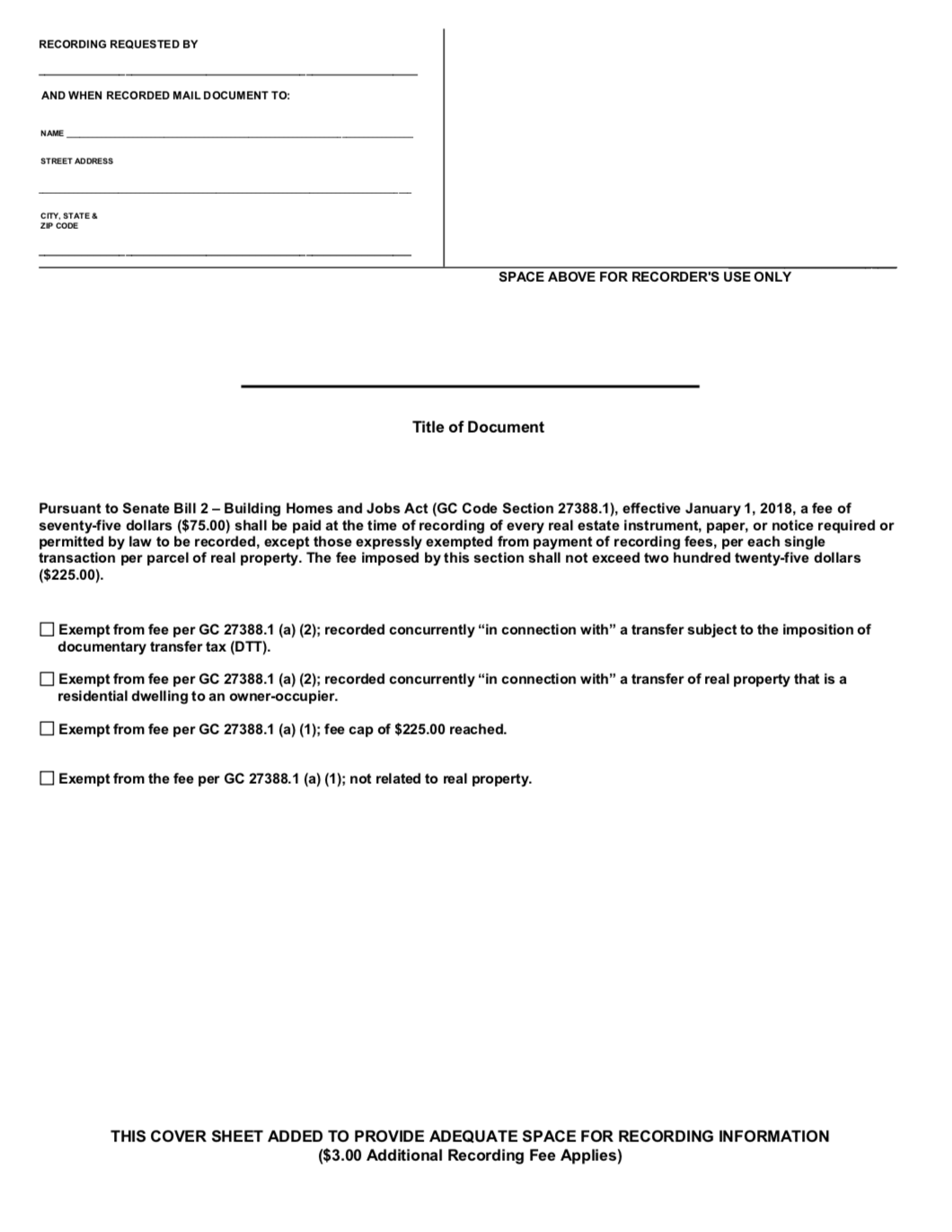

Los Angeles County Recorder Cover Sheet Levelset

Los Angeles County Recorder Cover Sheet Levelset

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

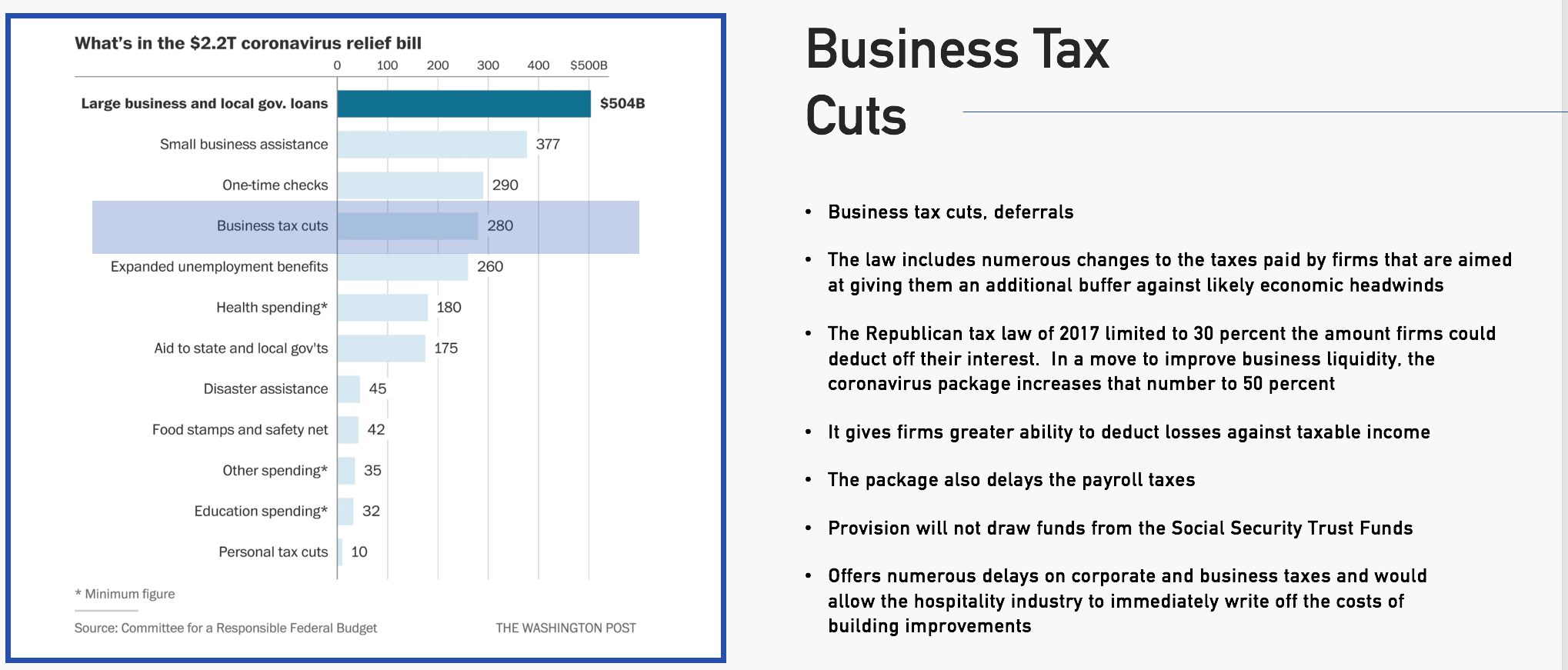

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Ca Quitclaim Deed Los Angeles County Complete Legal Document Online Us Legal Forms

Ca Quitclaim Deed Los Angeles County Complete Legal Document Online Us Legal Forms

Understanding California S Property Taxes

Understanding California S Property Taxes

Pay Property Tax Bill Online County Of Los Angeles Papergov

Https Ttc Lacounty Gov Wp Content Uploads 2020 10 Ptmsuserguide Pdf

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Https Ttc Lacounty Gov Wp Content Uploads 2020 10 Ptmsuserguide Pdf

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Property Taxes Overview Los Angeles County Office Of The Assessor

Property Taxes Overview Los Angeles County Office Of The Assessor

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home