How Do I Get A Personal Property Tax Receipt Jefferson County Mo

You may obtain a duplicate of your original property tax receipt for free online. You will need your Account Number to proceed with payment.

Https App Auditor Mo Gov Repository Press 2016085970087 Pdf

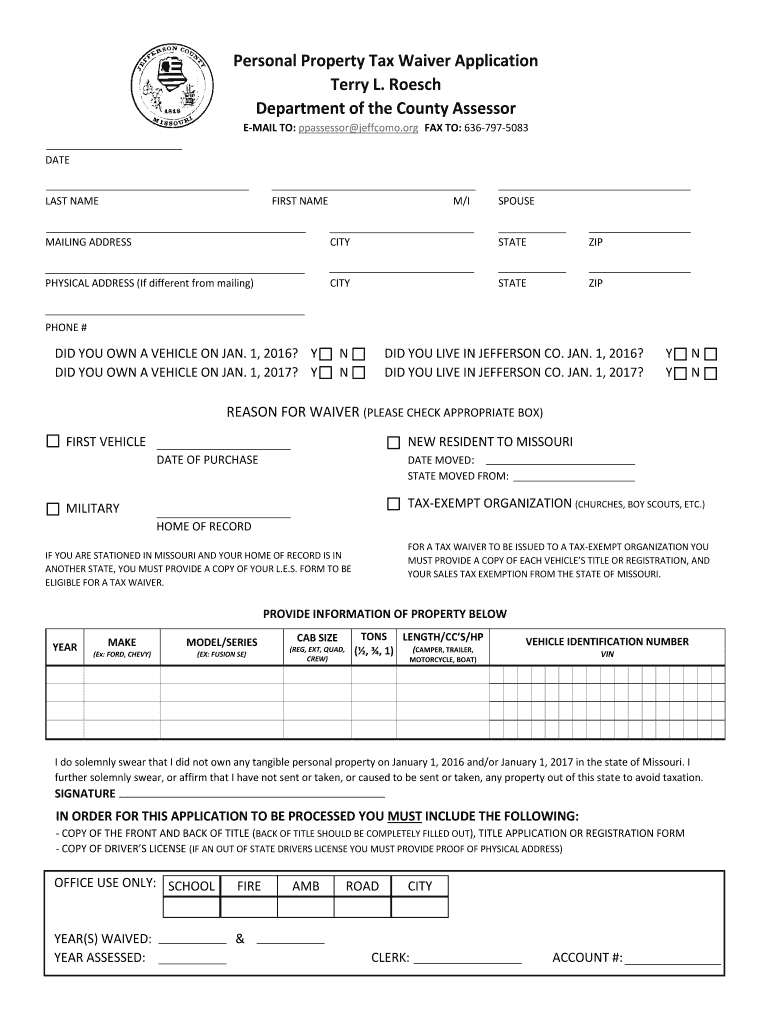

Waivers are only issued if you did not own a vehicle the vehicle on January 1st of the current year or if you lived in another state.

How do i get a personal property tax receipt jefferson county mo. Once your account is displayed you can select the year you are interested in. Personal property is assessed valued each year by the Assessors Office. Want to avoid paying a 10 late penalty.

Larry Vincent Collector Courthouse Annex Building 311 E High Street Room 100 Jefferson City MO 65101 Phone. Tax filing season is March 1st - October 15th of each. There is a 1 fee for each duplicate receipt.

Pay-by-Phone IVR 1-866-257-2055. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. Receipt available for current or past two years.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. CollectorAssessor Drop Box in front of the County Administration Building at. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. To obtain your property tax receipt visit the Online Payment Program. You may obtain a duplicate of your original property tax receipt from our office.

Please note that personal property account numbers begin with the letter. Information and online services regarding your taxes. Online payments are available for most counties.

Property values are assessed and paid locally. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Online Payments Receipts.

Anyone who has paid Cole County personal property taxes may get a duplicate tax receipt. Search for your account by account number address or name and then click on your account to bring up the information. The Collectors office then sends out the bills.

Jefferson County does not receive any portion of this convenience fee. The Office collects the main sources of revenue for public schools. The Collectors Office mails tax bills during November.

Taxes not paid in full on or before December 31 will accrue penalties and late fees. To obtain a paper copy of a tax receipt please submit a written request with your name account number address and a 1 statutory fee by check or money order via one of the following methods. Your paid receipt will be mailed.

A complete listing of collectors and assessors can be found at the Directories tab. If taxes are due you may pay online using the button below. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees.

You will also need proof of insurance renewal for or purchase information. You may click on this collectors link to access their contact information. Our mission is educating taxpayers on laws and their responsibility on paying taxes.

The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. The Assessors office assesses property both real estate and personal property. If you did not file a Personal Property Declaration with your local assessor and did not receive a Personal Property bill you will need to file.

You may also obtain a duplicate of your original property tax receipt from our offices. Therefore the processing fee is charged in addition to the tax amount due. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232.

Be sure to pay before then to avoid late penalties. Motorized vehicles boats recreational vehicles owned on January 1st of that year. Jefferson County Property Tax Inquiry.

We collect over a quarter of a billion dollars each year and distribute the collections to nearly 40 local taxing districts such as schools cities the library etc. The County Clerk uses their assessed values and the taxing district levies to calculate the tax bills. Your assessment list is due by March 1st of that year.

The Collectors Office mails tax bills during November. Obtain a paid personal property tax receipt from the County Collectors Office or a tax waiver from the County Assessors Office. Personal property tax is collected by the Collector of Revenue each year on tangible property eg.

The County Tax Collector collects taxes related to property real estate special improvement district municipal liens business personal. Site Criteria OPTIONAL House Number Low House Number High Street Name. Personal Property Tax Lookup And Print Receipt.

Therefore you will need to contact your local county collector andor assessor regarding changes of address payment and billing tax receipts and all other questions regarding your account. Property Taxes and Tax Receipts. Parcel Search Personal Property Search.

The handling or convenience fees included in these transactions are being paid to the third party vendor NCR Payments formerly JetPay Inc not to the Missouri Department of RevenueThis includes their right to electronically debit a service charge in the amount of 2500 if applicable for processing of an Insufficient Funds or Closed. Additional information may be found under Taxpayer. Taxes paid online will be credited to your account the next business day.

If you need an immediate receipt for license renewal do not pay online. Pay Online leaving dormogov webspace. If a tax bill is not received by the second week in December contact the Collectors Office at 573 634-9124.

Louis City in which the property is located and taxes paid. The statewide property tax deadline is October 15. Obtaining a property tax receipt.

Http Www Gentrycountylibrary Org Pdf 20cem 20files Obits 20of 20surrounding 20counties Pdf

Https Www Colecounty Org Documentcenter View 5081 Local Court Rules Final Revised 1 2020

Https Stlouiscountymo Gov St Louis County Government County Council Council Journals Journal Of The County Council 12152020

Pay Personal Property Tax Jefferson County Mo Property Walls

Pay Personal Property Tax Jefferson County Mo Property Walls

Https Stlouiscountymo Gov St Louis County Government County Council Council Journals Journal Of The County Council 9232020

1889 Tax Bill Cassville Mo Missouri Barry County For P Tranthum 80 Acres County Missouri Bills

1889 Tax Bill Cassville Mo Missouri Barry County For P Tranthum 80 Acres County Missouri Bills

Pay Personal Property Tax Jefferson County Mo Property Walls

Pay Personal Property Tax Jefferson County Mo Property Walls

Https Stlouiscountymo Gov St Louis County Government County Council Council Journals Journal Of The County Council 12082020

Http Mogenweb Org Mercer Pdf Files Mer Mo Quer Pdf

Plato Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Festus Missouri Mo 63048 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Pay Personal Property Tax Jefferson County Mo Property Walls

Pay Personal Property Tax Jefferson County Mo Property Walls

Festus Missouri Mo 63048 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Offers To Buy Madison And St Clair Counties From Cash Strapped Illinois Nextstl

Missouri Offers To Buy Madison And St Clair Counties From Cash Strapped Illinois Nextstl

Jefferson County Circuit Court Forms Fill Online Printable Fillable Blank Pdffiller

Jefferson County Circuit Court Forms Fill Online Printable Fillable Blank Pdffiller

Https Www Jeffcomo Org Documentcenter View 11318 April 6 2021 Sample Ballot Pdf

St Louis Mo March 5 2017 Stlrealestate News If You Re Someone Who Is Looking For Good Schools Affordable Living St National Building St Louis Home Buying

St Louis Mo March 5 2017 Stlrealestate News If You Re Someone Who Is Looking For Good Schools Affordable Living St National Building St Louis Home Buying

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home