Do Seniors Have To Pay Property Taxes In Florida

Certain property tax benefits are available to persons 65 or older in Florida. Information is available from the property appraisers office in the county where the applicant owns a homestead or other property.

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Construction for older family member.

Do seniors have to pay property taxes in florida. Of course there are qualifying rules for all these tax breaks and the first of these is your age. The Senior Exemption is an additional property tax benefit available to home owners who meet the following criteria. Longtime residents seniors may qualify for an exemption if they have lived in Florida for 25 years or more or are 65 years of age or older AND who meet certain income thresholds AND have a home worth less than 250000.

WFLA The Florida Property Tax Exemptions for Senior Citizens Amendment or Amendment 5 will change Floridas current homestead tax exemption language. Taxes are deferred as long as the homeowner owns the property and are then paid from the proceeds if the home is sold during the owners life or when the owner dies. In fact some counties or municipalities may allow senior citizens with income below a certain level to exempt the entire value of their property from taxes.

You can possibly reduce your property tax burden for your Florida home if you meet one or more of the following requirements. As noted these exemptions are generally reserved for those who are age 65 or older. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year.

If you construct living quarters in your home for a parent or grandparent who is at least 62 years old and that person actually continues living there you can apply annually to either have the added value of your home be made exempt from property tax or to have 20 knocked off the total whichever is less. The age for qualifying varies from 62 in California Georgia and Oregon to age 70 in Arizona South Dakota and Florida. A board of county commissioners or the governing.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Eligibility for property tax exemptions depends on certain requirements. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Only one spouse must typically be 65 or over if youre married and you own your property jointly. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. Every state has some sort of property-tax benefit for seniors often referred to as a homestead exemption although the eligibility age varies.

Further benefits are available to property owners with disabilities senior citizens veterans and active duty military. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. The property must qualify for a homestead exemption At least one homeowner must be 65 years old as of January 1 Total Household Adjusted Gross Income for everyone who lives on the property cannot exceed statutory limits.

Florida senior residents who are 65 years old or older and have an annual income below 20000 can get a seniors property tax exemption of up to 50000 Disabled veterans Florida veterans are exempt from paying property taxes if they. In some Florida counties senior citizens age 65 and over could qualify for an additional homestead exemption of up to 50000. Property taxes are quite possibly the most widely unpopular taxes in.

Add-ons to a home that were specifically. The amendment changes the code so senior. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

Property Tax Exemptions Available In Florida Kin Insurance

Property Tax Exemptions Available In Florida Kin Insurance

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Real Estate Taxes City Of Palm Coast Florida

Real Estate Taxes City Of Palm Coast Florida

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

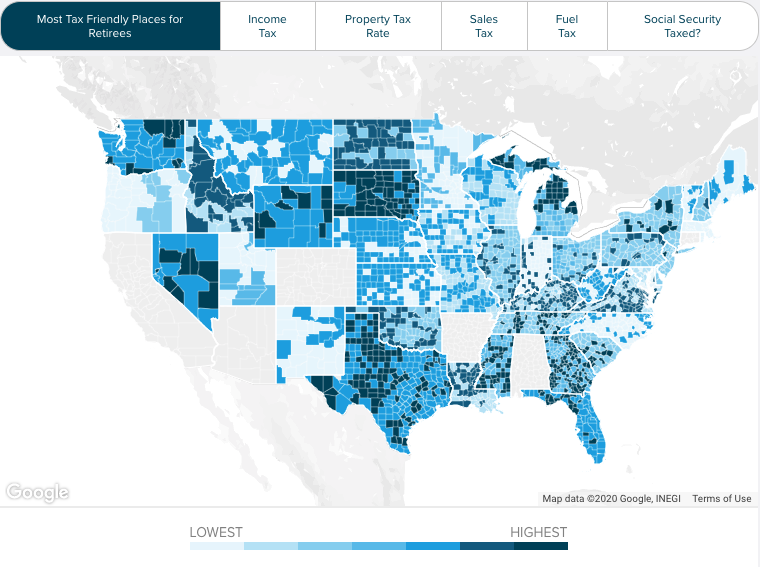

Florida Retirement Tax Friendliness Smartasset

Florida Retirement Tax Friendliness Smartasset

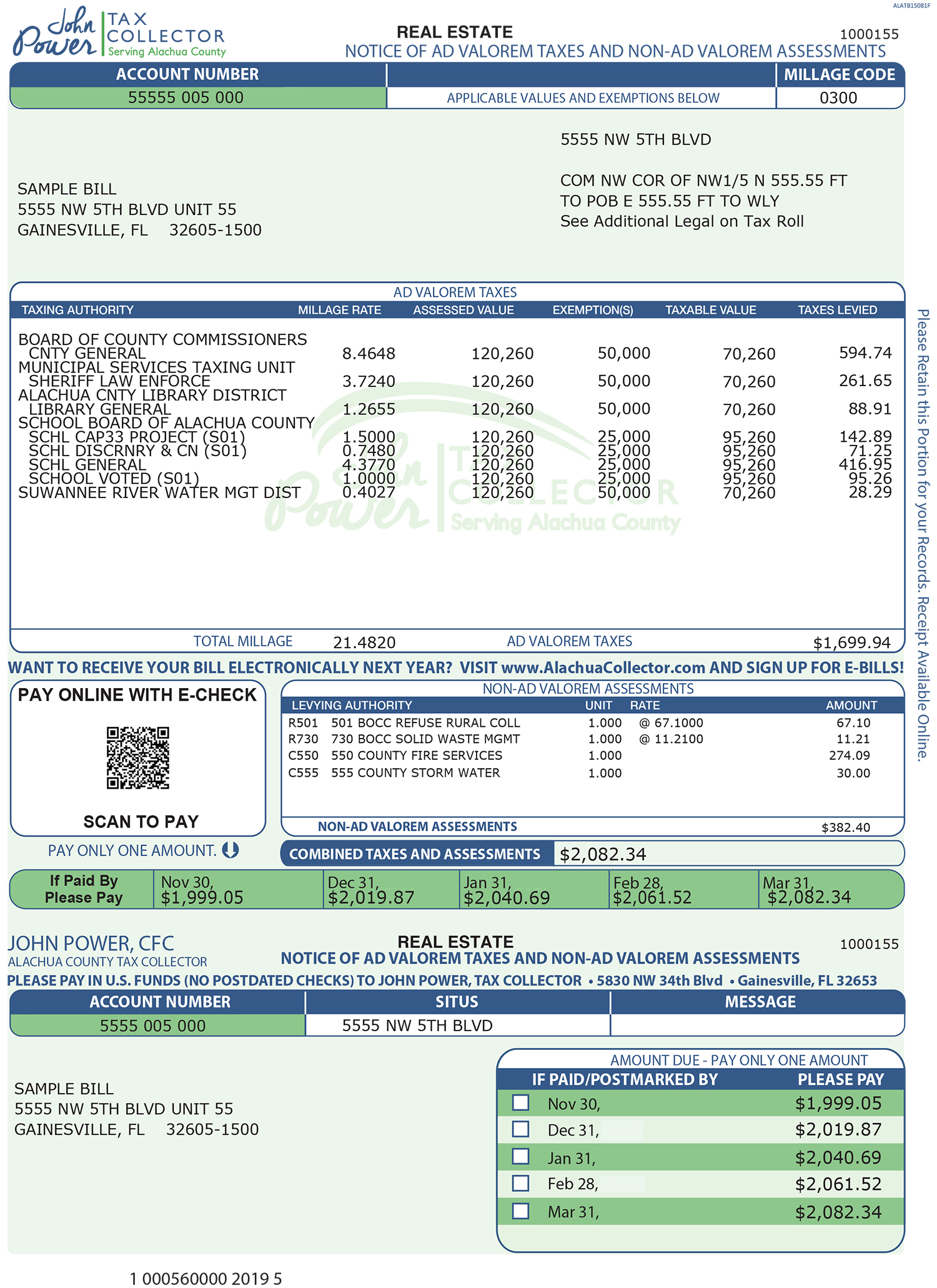

A Guide To Your Property Tax Bill Alachua County Tax Collector

A Guide To Your Property Tax Bill Alachua County Tax Collector

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Tax Breaks For Seniors In Florida Property Walls

:max_bytes(150000):strip_icc()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

How To Cut Your Property Taxes Credit Com

How To Cut Your Property Taxes Credit Com

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Understanding Your Property Tax Bill Clackamas County

Understanding Your Property Tax Bill Clackamas County

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home