Why Does My Property Tax Go Up Every Year

A 270000 higher assessed property value leads to roughly 3000 more in property tax a year. Once a property is sold the taxable value resets back to the SEV which has no cap.

Florida Property Tax H R Block

Florida Property Tax H R Block

Your local state or federal government laws may change causing property taxes to spike.

Why does my property tax go up every year. By 2027 these tax increases will impact nearly all Americans except for the extremely wealthy. This process can cause a significant tax increase on the following year after buying a home. The assessed value of a.

An increase in your escrow payment is usually due to a rise of your tax property. Your property taxes increased. The first way your property taxes could increase is done by your local property property taxing authorities.

This can include improvements made in. This is risky because theres no guarantee the assessed value of your property will go down and it could go up which would mean youd owe even more. Your property taxes increased.

In most places in the US there are two ways the amount you pay in property taxes could increase. The tax is generally due on an annual basis and the amount fluctuates based on changes to your property value. On a regular basis usually every year the town assessor reassesses the value of your house.

If you add additional coverage or lower your deductible you might also see a rise in your premium. If your monthly mortgage payment includes the amount you have to pay into your escrow account then your payment will also go up if your taxes or premiums go up. You will likely have at least one of these authorities but could have several.

You have an escrow account to pay for property taxes or homeowners insurance premiums and your property taxes or homeowners insurance premiums went up. Here are the usual culprits if your escrow payment goes up. Check your monthly mortgage statement.

There are several things that make your property taxes go up. The Times found that the Tax Cuts and Jobs Act will cause automatic stepped tax increases every two years beginning in 2021. Heres why your property taxes may be so high and what you can do if they keep going up each year.

Sloppy bookkeeping or clerical errors may result in a bigger escrow payment. Rising property taxes can put a strain on your budget. However I got reset back to my original purchase price plus an extra 18 increase for the latest calendar year.

Prop 13 usually allows for only a 2 maximum property tax increase per year. The first way can be done every year the second generally only every few years. Property tax is based on your town state or municipalitys tax rate as well as your property value.

And with some states assessing and raising property taxes every year that can leave a lot of pent-up frustration. Changes to either of these tend to be what drives property taxes up. In other words if your home is worth more your tax bill will go up too.

Any work valued at 10000 in one year or 25000 within five consecutive years can trigger a new assessment and increase your propertys taxable value. This was particularly true in 1943 when the first permanent income tax was signed into law. Two things determine property taxes.

This is called uncapping a propertys taxable value. However that temporary tax policy counted on the automatic increases coming next year. Your servicer made a mistake.

The value of your neighborhood could rise a sign. The rate at which. If you ever want to know what tyranny looks like this is it.

Property taxes usually ride on the coattails of property values. Every year we all see just how much we owe making taxes harder to sustain politically. Property taxes are calculated using two very important figuresthe tax rate and the current market value of your property.

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Have You Ever Thought Your Property Taxes Were Too High As It Turns Out You Can Fight Them And Win Here S How I Property Tax Saving Money Refinance Mortgage

Have You Ever Thought Your Property Taxes Were Too High As It Turns Out You Can Fight Them And Win Here S How I Property Tax Saving Money Refinance Mortgage

6 Things Every Homeowner Should Know About Property Taxes Property Tax Homeowner Saving Money Frugal Living

6 Things Every Homeowner Should Know About Property Taxes Property Tax Homeowner Saving Money Frugal Living

2019 20 Sacramento County Property Assessment Roll Tops 179 Billion

2019 20 Sacramento County Property Assessment Roll Tops 179 Billion

Long Island Index Infographic Property Tax Investment Property

Long Island Index Infographic Property Tax Investment Property

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax Appeal Tips To Reduce Your Property Tax Bill

How To Fly For Free When Paying Property Taxes Property Tax Free Flights Tourist

How To Fly For Free When Paying Property Taxes Property Tax Free Flights Tourist

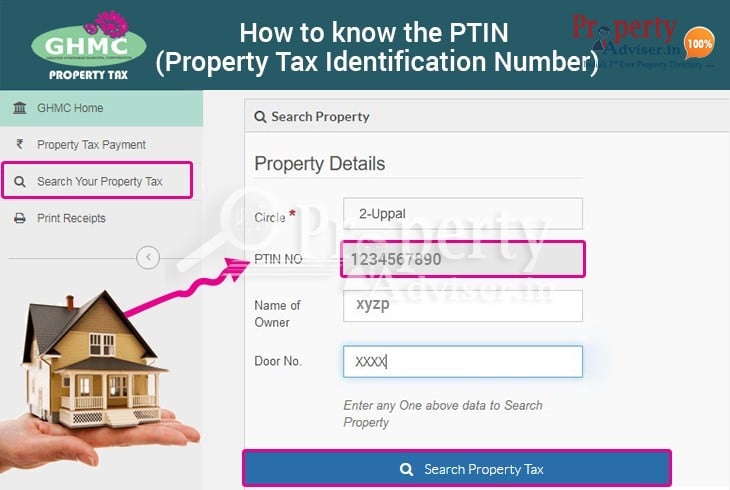

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Account Suspended Mortgage Interest Real Estate Infographic Mortgage Debt

Account Suspended Mortgage Interest Real Estate Infographic Mortgage Debt

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Property Tax Assessments And How They Re Calculated Rocket Mortgage

Property Tax Assessments And How They Re Calculated Rocket Mortgage

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg) Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

A Guide On Property Tax Property Tax Tax Refund Tax Consulting

A Guide On Property Tax Property Tax Tax Refund Tax Consulting

Pin By Jacie Robinson On Jobs Paying Taxes Income Tax Only In America

Pin By Jacie Robinson On Jobs Paying Taxes Income Tax Only In America

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home