Senior Citizen Real Estate Tax Freeze New Jersey

The state has two programs that are supposed to help seniors with the costs. Since this exemption is based on total household income it must be renewed annually.

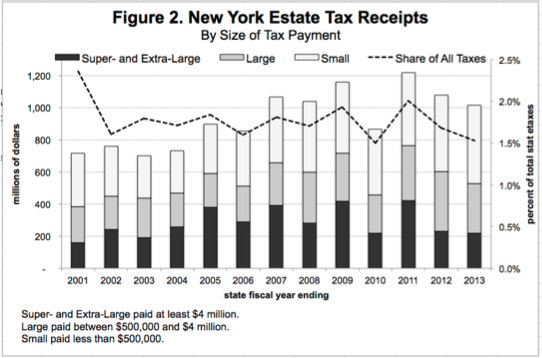

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of 65000 or less in calendar year 2019.

Senior citizen real estate tax freeze new jersey. The applicant must be the owner of record and use the residence as his or her principal residence. These forms are also available in Spanish and Chinese. Use these form to apply for the Senior Citizen Real Estate Tax Freeze.

Senior Citizen Assessment Freeze Homeowners who are 65 years of age or older and have a maximum total household income of 65000 or less can freeze the assessed value of their property. There are certain income and residency eligibility requirements information for which you could find at httpswwwstatenjustreasurytaxationptreligibilityshtml But. Exemption must be applied for before July 1st of each year and requires a household income below 65000.

The Senior Freeze Property Tax Reimbursement program reimburses eligible New Jersey residents who are senior citizens or disabled persons for property tax increases on their principal residence home. It is not a tax freeze or a tax reduction and does not protect against increased taxes due to tax rate increases. Visit Requirements for Resuming Eligibility for more information.

If you qualify and have not received this application call 1-800-882-6597. For more information visit the NJ Division of Taxation Website. Alternate documents to send as proof can be found in the Senior Freeze FAQ.

A surviving spouse must be at least 55 years old and not re-married. Qualified Senior Citizens can freeze the equalized assessed value of their property for as long as they remain eligible. We in New Jersey have one of the highest property taxes in the nation.

If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. The Senior Freeze provides limited-income seniors with protection against real estate tax increases due to rising property values.

July 29 2019 Joseph Bamat Department of Revenue Senior Tax Freeze helps thousands of low-income Philadelphians save money on their property taxes. Property Taxes Site Fees. If you moved from one New Jersey property to another and received a reimbursement for your previous residence for the last full year you lived there you may qualify for an exception to re-applying to the Senior Freeze Program.

Complete this questionnaire to. Form PTR-2 is a personalized application that is not available online. The Senior Freeze program started in 1997 and it reimburses eligible senior citizens and.

Lets go over the eligibility rules to qualify for the Senior Freeze in New Jersey. The verification form is your proof of property taxes due and paid. You also may qualify if you are a surviving spouse or civil union partner.

Call the Senior Freeze Information Line at 1-800-882-6597 for more information. A senior citizen must be over 65 as of December 31 of the pre-tax year. A Senior Freeze Exemption provides property tax savings by freezing the equalized assessed value EAV of an eligible property.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. On Thursday Montclair officials announced the township is sending applications for the states Senior Freeze property tax reimbursement program to. The money would go to the Homestead credit for about 580000 senior disabled or low-income homeowners and the Senior and Disabled Citizens Property Tax Freeze which offsets property taxes for.

They can expect to save the same amount or more every year. The claimant must be the owner and permanent resident in the dwelling and a legal resident of New Jersey. In New Jersey seniors who own real estate are eligible for their property taxes to be reimbursed to them directly from the state Division of Taxation.

The City of Philadelphia will freeze your Real Estate Tax if you meet certain age and income requirements. In 2019 more ten thousand homeowners saved an average of 568 with Senior Tax Freeze. The Property Tax Reimbursement Plan also called the Senior Freeze and the Homestead Benefit Program.

New Jersey Senior Property Tax Freeze and Ownership of Property. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

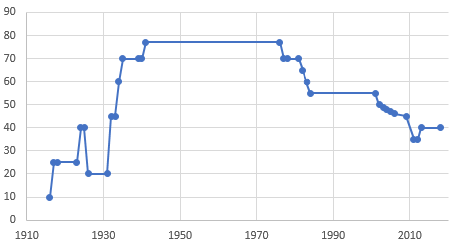

Estate Tax In The United States Wikiwand

Estate Tax In The United States Wikiwand

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Nj Senior Freeze Property Tax Reimbursement Access Wealth

Nj Senior Freeze Property Tax Reimbursement Access Wealth

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Tax Assessor Chester Township Nj

Tax Assessor Chester Township Nj

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax In The United States Wikiwand

Estate Tax In The United States Wikiwand

Mark Fernald Why Your Property Taxes Are So High

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Www State Nj Us Treasury Taxation Pdf Ptr 15 Ptr1 Pdf Pdf Finance 15th

Www State Nj Us Treasury Taxation Pdf Ptr 15 Ptr1 Pdf Pdf Finance 15th

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home