Property Tax Rates In Tennessee By County

Counties in Tennessee collect an average of 068 of a propertys assesed fair market value as property tax per year. Generally if you conduct business within any county andor incorporated municipality in Tennessee then you should register for and remit business tax.

Property Taxes By State Property Tax Property States

Property Taxes By State Property Tax Property States

Northeast Tennessees Sullivan County has property tax rates just below the state average.

Property tax rates in tennessee by county. For more details about the property tax rates in any of Tennessees counties choose the county from the interactive map or the list below. 96 rows Tennessee Property Taxes by County. City of lookout mtn 20900 hamilton county 27652 48552 city of signal mtn 18866 hamilton county 27652 46518 county tax levy per 100 dollars general fund 15050 assessment on real and personal school fund 12503 property for the year 2020 district road fund 00099 total 27652.

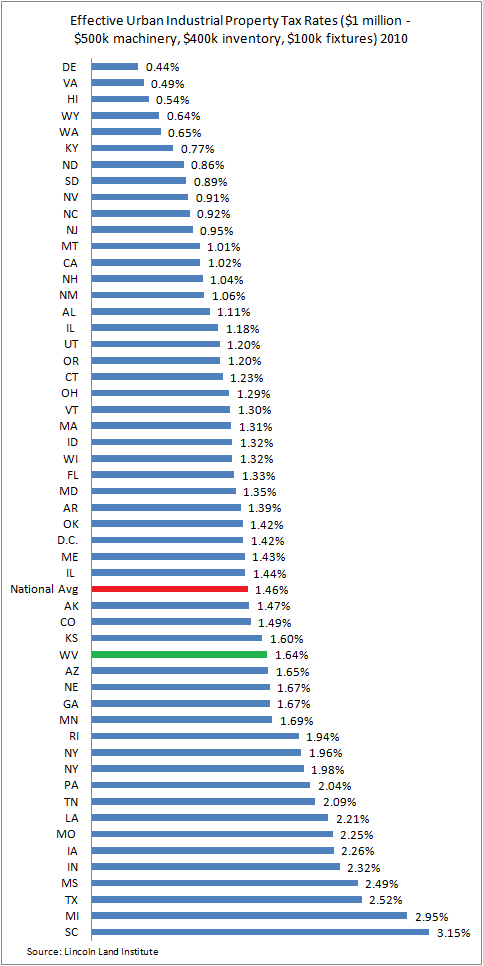

10 rows 2019 Tennessee Property Tax Rates. Links are provided at the bottom of this page for the counties not included here which are Bradley Chester Davidson Hamilton Hickman Knox. That is far less than half the national average which is 2578.

Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. 068 of home value. The example below is for a typical residential property with an Appraised Value of.

2 days agoNashville Mayor John Cooper has announced that Davidson County property owners will see a large tax rate cut adding that the 34 property tax increase will now be. Dramatic variations in county property tax bases across Tennessee with the lowest in Lake County generating 9023 on one cent of its property tax rate to Davidson County Metro Nashville-Davidson generating more than 2 million on one cent of its property tax rate. Tennessee has 95 counties with median property taxes ranging from a high of 187900 in Williamson County to a low of 33300 in Decatur County.

The countys average effective property tax rate is 069 while the state average is 064. Comptroller of the Treasury Jason E. The state business tax and the city business tax.

This table illustrates the dramatic variations in county property tax bases across Tennessee with the lowest in Lake County generating 9424 on one cent of its property tax rate to Davidson County Metro Nashville-Davidson generating more than 32 million on one cent of its property tax rate. The property taxes are collected by county trustees and city collecting officials. 3788 per 100 of assessed value or 03788.

250000 and with the 2020 GSD Tax Rate. The ASSESSED VALUE is 50000 25 of 200000 and the TAX RATE has been set by your county commission at 2262 per hundred of assessed value. Data on this site exists for 84 of Tennessees 95 counties.

Tennessee has one of the lowest median property tax rates in the United States with only nine states collecting a lower. To figure the tax simply multiply the assessed value 50000 by the tax rate 2262 per hundred dollars assessed. County assessors of property appraise real estate for assessment purposes and assess tax on tangible personal property used or held for use in business.

2869 SSD 829 CO 204. Homeowners in Washington County pay a median property tax of just 1060 annually. County City SpecialSchoolDistrict CountyRate CityRate.

For more detail regarding the county property tax go the CTAS website at. The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000. With a few exceptions all businesses that sell goods or services must pay the state business tax.

The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value. Business tax consists of two separate taxes. The county commission and city governing bodies determine local property tax rates.

But as Nashvilles Mayor John Cooper broke on News4 Friday morning that rate is. The information presented on this site is used by county Assessors of Property to assess the value of real estate for property tax purposes. Tax amount varies by county.

Multiply the Appraised Value times the Assessment Ratio. Franklin Only not in FSSD 04176. County collected 100 of property taxes.

50000 100 500 x 2262 113100 rounded or 25000 x 02262 113100. NASHVILLE TN WSMV - Nashville property owners recall last summer when the property tax rate went up to 34. These tax rates vary depending on the level of services provided and the total value of the countys tax base.

Submit a report online here or. 2809 SSD 829 CO 198.

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State County Lowest Property Taxes In The Us Mapped

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

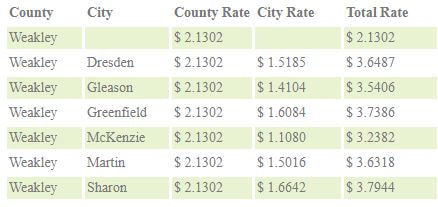

Weakley County Assessor Of Property Tax Rates

Weakley County Assessor Of Property Tax Rates

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Pin On Facepost Posts You Are Linked To Resources

Pin On Facepost Posts You Are Linked To Resources

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

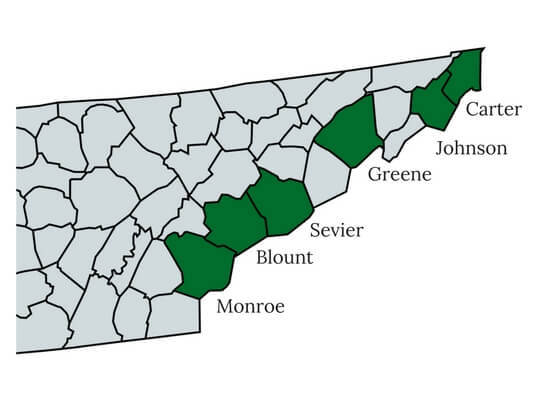

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

High Child Care Costs Keep American Parents Out Of The Workforce Child Care Prices Family Child Care Childcare Teacher

High Child Care Costs Keep American Parents Out Of The Workforce Child Care Prices Family Child Care Childcare Teacher

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tennessee Property Taxes By County 2021

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home