How Do I Find My Assessor's Identification Number

The Assessors Identification Number or AIN is the main indexing system used for property tax purposes. The Assessor has developed the Property Assessment Information System PAIS to enhance Internet services to the public.

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

The purpose of subscribing to the Assessors online database is to be able to access the information from your own computer at your convenience.

How do i find my assessor's identification number. Find Property on Map. Its generally best to omit the trailing street type AV RD ST etc as you may not have a standard two-character. Your Property Index Number PIN is printed on your tax bill your property closing documents and deed and notices from the Assessors office such as your assessment notice.

Real Property Appeal Form. The parcel number is clearly marked and it can be found next to your name as the property owner. Currently you may research assessment information for individual parcels print Assessor maps and search for sales within the past two years.

Taxpayers can locate the PIN on any original tax bill. You will need your street address or fourteen-digit parcel number in order to bring up your map. The three or four sets are all separated by a hyphen.

Enter PIN to see property details. Address Change Form. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill.

Visit Assessors Parcel Maps. Many states offer online access to assessment records that may be searched by property address property id number and sometimes by owner name. Please contact us with your.

Your property account identification number is located above your name and address on your assessment notice. The Comptrollers office does not have access to your local property appraisal or tax information. The first portion of a street name may be used.

The SSA will issue social security numbers SSN and the IRS is responsible for issuing all other taxpayer identification numbers. In the example above the property account indentification number ACCT consists of the county code 01 the assessment district 02 and account number 123456. Street name is required and is not case sensitive.

Look for the information in the following format. The easiest way to find the parcel number for a property you own is to simply look on your annual property tax bill. However please note that obtaining this property information is free of charge either by visiting any of our Assessor regional offices where you may use our PDB terminals or you may call us at 213-974-3363 to obtain property ownership information directly by phone.

Taxpayers will need their Assessors Identification Number AIN and as stated above their PIN to access their payment history. The AIN is a ten-digit number assigned to each piece of real property and is used on tax bills and correspondence to identify real property. The ten-digit AIN 1234-056-789 is made up of a four-digit Mapbook Number a three-digit Page Number and a three-digit Parcel Number.

You will need to have your basic identifying information for the website such as your name address and tax ID number. Street numbers and direction NSEW are optional. Street names should conform to the Official Address Guide for Pima County.

Taxpayers using their Personal Identification Number or PIN can access the past three years of their Secured Property Taxes Payment History. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. Your taxpayer identification number will either have been issued by the Social Security Administration SSA or by the IRS this depends on what kind of TIN is required for your tax return see above.

Some states include mapping applications whereby one may view online maps of the property and surrounding areas. Important Due Dates. Most questions about property appraisal or property tax should be addressed to your countys appraisal district or tax assessor-collector.

You can locate your parcel number on your valuation notice tax bill deed or by calling our office at 916 875-0700. How Can We Help You. To protect your privacy we do not display party name information in the results of any searches you perform via this web site.

California Government Code 625421 prohibits the display of home addresses or telephone numbers of any elected or appointed official on the Internet by any state or local agency without first obtaining the written. Parcel identification number or. Results may include owner name tax valuations land characteristics and sales history.

If your county does not have a website you can usually go directly to the physical office of your county assessor or your property tax department office.

Unsecured Property Tax Los Angeles County Property Tax Portal

Unsecured Property Tax Los Angeles County Property Tax Portal

Contact The Assessor Los Angeles County Office Of The Assessor

Contact The Assessor Los Angeles County Office Of The Assessor

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

Notice Of Delinquency Los Angeles County Property Tax Portal

Notice Of Delinquency Los Angeles County Property Tax Portal

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Payment Activity Notice Los Angeles County Property Tax Portal

Payment Activity Notice Los Angeles County Property Tax Portal

Unsecured Prior Year Bill Los Angeles County Property Tax Portal

Unsecured Prior Year Bill Los Angeles County Property Tax Portal

Https Ttc Lacounty Gov Wp Content Uploads 2020 10 Ptmsuserguide Pdf

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Apn In Real Estate Finding Parcels Organization Usefulness

Apn In Real Estate Finding Parcels Organization Usefulness

Contact The Assessor Los Angeles County Office Of The Assessor

Contact The Assessor Los Angeles County Office Of The Assessor

Pay Property Tax Bill Online County Of Los Angeles Papergov

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

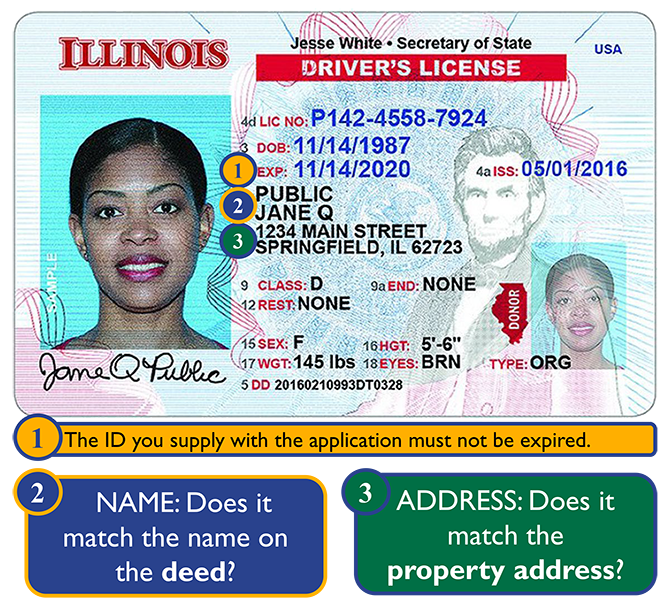

Id Guide Cook County Assessor S Office

Id Guide Cook County Assessor S Office

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home