Do I Need To File Dc Tax Return

The minimum payable tax is 250 if gross DC. Receipts are 1 million or less.

Irs Postpones April 15 U S Tax Deadline To May 17

Irs Postpones April 15 U S Tax Deadline To May 17

If you need even more time to complete your 2020 federal returns you can request an extension to Oct.

Do i need to file dc tax return. If you are certain that you cannot file your District of Columbia return by the deadline you needed to file extension Form FR-127 on or by April 15 2021. State Income Tax Return for the current or previous Tax Year you need to complete Form D-40. Maryland residents who work in Delaware must file tax returns with both states.

Or otherwise receive income from sources within DC. You must file a DC Individual Income tax return if. You lived in the District of Columbia for 183 days or more during the taxable year even if your permanent.

Form D-40 is used for the Tax Return and Tax Amendment. If the filing due date falls on a weekend or holiday sales tax is generally due the next business day. You were a resident of the District of Columbia and you were required to file a federal tax return.

Your permanent residence was in the District of Columbia for either part of or the full taxable year. 15 by filing Form 4868 through your tax professional tax software or using the Free File link on IRSgov. You can prepare a 2020 Washington DC.

Do I have to file a DC income tax return. DCfreefile is a free federal and state income tax preparation and electronic filing program offered to taxpayers based on income and other qualifiers. You must file a DC tax return if.

If you live in the District of Columbia and you are filing a Form. You must file a DC tax return if. To ensure you can file both your federal and state returns for free please access these Free File products from our website.

Your permanent residence was in the District of Columbia for either part of or the full taxable year. You were a resident of the District of Columbia and you were required to file a federal tax return. In Washington DC you will be required to file and remit sales tax either monthly quarterly or annually.

Must file Form D-20 with the DC. You probably wont have to file a return in the nonresident state if your resident state and the state in which youre working have reciprocity but these agreements typically cover only earned income what you collect from actual employment. Taxpayers should pay their federal income tax due by.

You were a resident of the District of Columbia and you were required to file a federal tax return. To avoid dual taxation you can get a credit for taxes paid to Delaware andor a locality in Delaware by completing Maryland Form 502CR and filing it with your Maryland income tax return. Corporations that carry on or engage in a business or trade in DC.

Sales tax returns are always due the 20th of the month following the reporting period. The extended tax return due date is October 15 2021. Filing Form 4868 gives taxpayers until Oct.

Mailing Addresses for Tax Returns. A resident is an individual domiciled in DC at any time during the taxable year. Use Form D-40B Non-Resident Request for Refund available by visiting httpotrcfodcgovnode379192.

This gives you 6 more months to file your return not to pay. If you need to change or amend an accepted Washington DC. You are not required to file a DC return if you are a nonresident of DC unless you are claiming a refund of DC taxes withheld or DC estimated taxes paid.

15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. You will have to file a DC franchise tax return regardless of where your office is located if your business is engaging in or carrying on of any trade business profession vocation or calling or commercial activity in the District of Columbia including activities in the District that benefit an affiliated entity of the taxpayer the performance of the functions of a public office and the leasing of real or personal property in the District of Columbia. We are currently experiencing higher than normal wait.

This interview will help you determine if youre required to file a federal tax return or if you should file to receive a refund. 1000 if they exceed 1 million. You lived in the District of Columbia for 183 days or more during the taxable year even if your permanent residence was outside the District of Columbia.

The first payments were up to 1200 person and 500 per qualifying child. Office of Tax and Revenue. In 2020 the IRS issued two Economic Impact Payments as part of the economic stimulus efforts.

Individual Income and Franchise Tax Extensions - Learn more hereImportant District of Columbia Real Property Tax Filing Deadline Extensions - Learn more here. These Where to File addresses are to be used ONLY by TAXPAYERS AND TAX PROFESSIONALS filing individual federal tax returns in the District of Columbia during Calendar Year 2021. Reporting and paying taxes on unearned income might still require filing a return.

Https Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Page Content Attachments Clean 20hands 20webinar 20presentation 20public 20and 20businesses Pdf

Https Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Page Content Attachments Clean 20hands 20webinar 20presentation 20public 20and 20businesses Pdf

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Prepare And Efile Your 2020 2021 Washington Dc Tax Return

Prepare And Efile Your 2020 2021 Washington Dc Tax Return

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

3 17 10 Dishonored Check File Dcf And Unidentified Remittance File Urf Internal Revenue Service

Faqs On Tax Returns And The Coronavirus

Faqs On Tax Returns And The Coronavirus

What Is A Schedule C Tax Form H R Block

What Is A Schedule C Tax Form H R Block

The Dc Office Of Tax Revenue Otr Mytaxdc Twitter

The Dc Office Of Tax Revenue Otr Mytaxdc Twitter

What Tax Forms Do I Need To File Taxes Credit Karma Tax

What Tax Forms Do I Need To File Taxes Credit Karma Tax

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Tax Returns Are Due May 17 For Most Filers Wusa9 Com

Tax Returns Are Due May 17 For Most Filers Wusa9 Com

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Irs Delays Start Of Tax Filing Season To Feb 12

Irs Delays Start Of Tax Filing Season To Feb 12

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

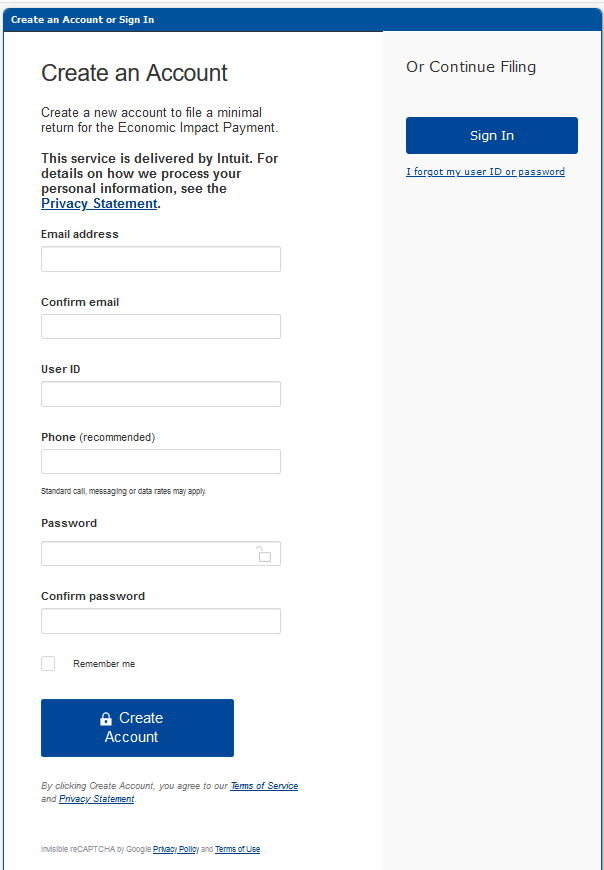

How To Fill Out The Irs Non Filer Form Get It Back Tax Credits For People Who Work

How To Fill Out The Irs Non Filer Form Get It Back Tax Credits For People Who Work

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home