Property Tax Grant County Arkansas

Assessed value is equal to 20 of the appraised value of a property. The median property tax in Arkansas is 53200 per year for a home worth the median value of 10290000.

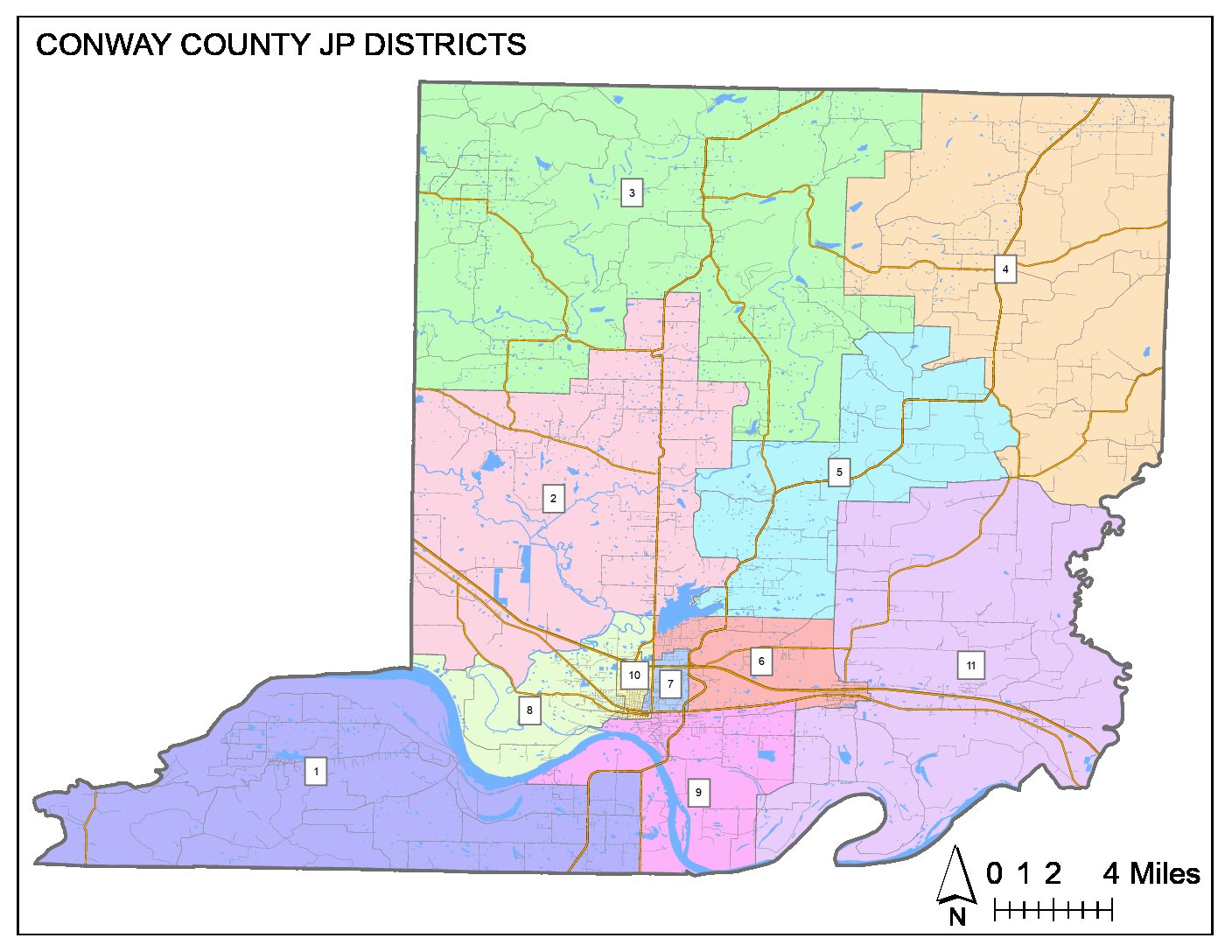

County Assessor Conway County Ar

County Assessor Conway County Ar

No penalty will be assessed for online payments made before the deadline.

Property tax grant county arkansas. Pay-by-Phone IVR 1-866-257-2055. County Tax Information Click on the image below to find your tax information and pay on line. For example a home that has a market value of 100000 would have an assessed value of 20000.

Your property tax bill. Grant County collects fairly low property taxes and is among the lower 25 of all counties in the United States ranked by property tax collections. Back to top Property Tax Home.

School districts in Grant County had an average millage of 3933 and city governments averaged 338 mills. You can contact the Grant County Assessor for. Assessor Grant County Assessor 101 West Center St Room 102 Sheridan AR 72150 Phone.

NE Elbow Lake MN 56531-4400. This site was created to give taxpayers the opportunity to pay their taxes online. Grant County Government Indiana Treasurer Tiffany N Griffith 401 S.

In Grant County the 2019 average total property tax millage was 5001 or a tax rate of 5001 for every 1000 dollars of assessed property. Rm 229 Marion IN 46953 765 668-6556 Office hours. Appealing your property tax appraisal.

Property Taxes Mortgage 2538100. Grant County 10 2nd St. Under provisions of the Arkansas Code Annotated heshe is responsible for collecting all property taxes during the established installment periods after the.

Go to County Personal Property and Real Estate Tax Payments 310. The deadline for accepting online tax payments is October 15. So tax rates only apply to that 20000.

Information on your propertys tax assessment. It has also allowed the fair board to purchase property located on Highway 167 North as the future site of the Grant County Fair Grounds. Checking the Grant County property tax due date.

Grant County Mapping The duties of the Assessor is to appraise and assess all real property between the first Monday of January and July 1st and all personal property between January 1st and May 31st ACA 26-26-1408 and26-26-1101. Be sure to pay before then to avoid late penalties. Paying your property tax.

Counties in Arkansas collect an average of 052 of a propertys assesed fair market value as property tax per year. Have your Tax Statements andor your Notice of Assessments Sent to your email ever year. Tax Forfeiture PropertiesFor Immediate Sale Contact Information.

052 of home value. Grant County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Grant County Arkansas. The median property tax also known as real estate tax in Grant County is 44000 per year based on a median home value of 9660000 and a median effective property tax rate of 046 of property value.

Tax amount varies by county. Grant County Property Tax Collections Total Grant County Arkansas. Search Arkansas Assessor and Collector records online from the comfort of your home.

One important note about assessed value in Arkansas is that it cannot increase by more than 5 in any one year. In general the county collector collects taxes for the county and collects municipal county school library and improvement district taxes and turns them over to the county treasurer. Want to avoid paying a 10 late penalty.

Grant County Tax Collectors Office Ray Vance- Collector Susan Whitehead-Chief Deputy Collector 101 West Center Room 108 County Courthouse Sheridan AR 72150 870-942-4315. Welcome to the Grant County Tax Collector ePayment Service Site. Payment of Taxes ONLINE Free Real Estate and Tax information search and a website link to the.

Reporting upgrades or improvements. Property Taxes No Mortgage 1839800. The Grant County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Grant County Arkansas.

101 W Center StThe Grant County Assessors Office is located in Sheridan Arkansas. The AcreValue Grant County AR plat map sourced from the Grant County AR tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

The Grant County government had a millage of 90. A Secure Online Service of Arkansasgov. - 200- Fair Association--The 200 voluntary tax is used to help fund the programs of the Grant County Fair and the expenses for the up keep of the fair grounds.

Search Grant County property tax and assessment records by owner name parcel number address or parcel type. The statewide property tax deadline is October 15. County Township Information Map.

Online payments are available for most counties. Sign up now by. These records can include Grant County property tax assessments and assessment challenges appraisals and income taxes.

Grant County Property Tax. List of Arkansas counties that currently offer online payments of personal property and real estate taxes. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books.

Welcome Grant County Arkansas Est 1869

Chicot County Arkansas Wikipedia

Chicot County Arkansas Wikipedia

Randolph County Arkansas Wikipedia

Randolph County Arkansas Wikipedia

Arkansas County Arkansas Wikipedia

Arkansas County Arkansas Wikipedia

Treasurer Mississippi County Ar

Treasurer Mississippi County Ar

Randolph County Arkansas Wikipedia

Randolph County Arkansas Wikipedia

Logan County Arkansas Arcountydata Com Arcountydata Com

Logan County Arkansas Arcountydata Com Arcountydata Com

Jefferson County Arkansas Genealogy Familysearch

Jefferson County Arkansas Genealogy Familysearch

Ginseng Program Arkansas Department Of Agriculture

Ginseng Program Arkansas Department Of Agriculture

Welcome Grant County Arkansas Est 1869

Map 1800 To 1899 Available Online Arkansas Library Of Congress

Map 1800 To 1899 Available Online Arkansas Library Of Congress

Snap E T Providers Arkansas Department Of Human Services

Snap E T Providers Arkansas Department Of Human Services

Grant County Property Tax A Secure Online Service Of Arkansas Gov

Grant County Property Tax A Secure Online Service Of Arkansas Gov

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home