Average Property Tax Columbus Ohio

However tax rates vary significantly between Ohio counties and cities. Craig D-Columbus announced legislation to cap annual property tax increases at five percent for households at or below their countys median.

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in.

Average property tax columbus ohio. 53 rows States with the lowest property tax rate are ranked lowest whereas states with the highest. The State Department of Taxation Division of Tax Equalization helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work. Yearly median tax in Franklin County.

There are more than 600 Ohio cities and villages that add a local income tax in addition to the. Multiply the market value of the property by the percentage listed for your taxing district. The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300.

Here are the numbers for Ohio. Front Street building to drop. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

Per capita property taxes. The average effective property tax rate in Ohio is 148 which ranks as the 13th-highest in the US. 614 645-7193 Customer Service Hours.

On average homes in Columbus sell after 36 days on the market compared to 41 days last year. Rates range from 0 to 4797. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected.

City of Columbus Income Tax Division 77 N. Although determining your property taxes may seem as simple as multiplying the value of your property by the millage rate it. A simple percentage used to estimate total property taxes for a property.

On average a person living in Columbus can expect to pay 2029 percent in property taxes each year. At that time the state government imposed a half-mil property tax which is equivalent to 050 per 1000 of taxable property value. Taxation of Real Property is Ohios oldest tax established in 1825 and is an ad valorem tax based on the value of the full market value of each property.

Census data NerdWallet has crunched. For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300. Whitehall - 100000 x 172 172000.

Ohio has a progressive income tax system with six tax brackets. COLUMBUS Ohio WSYX Senator Hearcel F. Hilliard - 100000 x 208 208000.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Monday through Friday 900 am. Property owners making up to 100 of the area median income would be eligible.

In Franklin County the area median income is 58700 for a one-person household and 83800 for a. Are subject to the real property tax. Effective property tax rate.

The average home price is 124000 and many are much more expensive. There were 1218 homes sold in. Home values in Columbus can be high.

The highest rates are in Cuyahoga County where the average effective rate is 244. Due to the COVID-19 pandemic the Division is currently closed to the public. Franklin County collects on average 167 of a propertys assessed fair market value as property tax.

Front Street 2nd Floor. Overview of Ohio Taxes. Delinquent tax refers to a tax that is unpaid after the payment due date.

Columbus - 100000 x 148 148000. The taxable value is 35 percent of true market value except for certain land devoted exclu sively to agricultural use. Tax Base Ohio Revised Code 571303 571501 The real property tax base is the taxable assessed value of land and improvements.

89 rows Average property tax in Ohio counties Taking US. 167 of home value. In March 2021 Columbus home prices were up 159 compared to last year selling for a median price of 220K.

Taxpayers may use the secure drop box located in the lobby of the 77 N. Taxes for a 100000 home in. That is approximately 2029 per year if you own a house valued at 100000.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

The States That Are Winning And Losing In The Us Real Estate Game Renting A House States Rent

The States That Are Winning And Losing In The Us Real Estate Game Renting A House States Rent

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

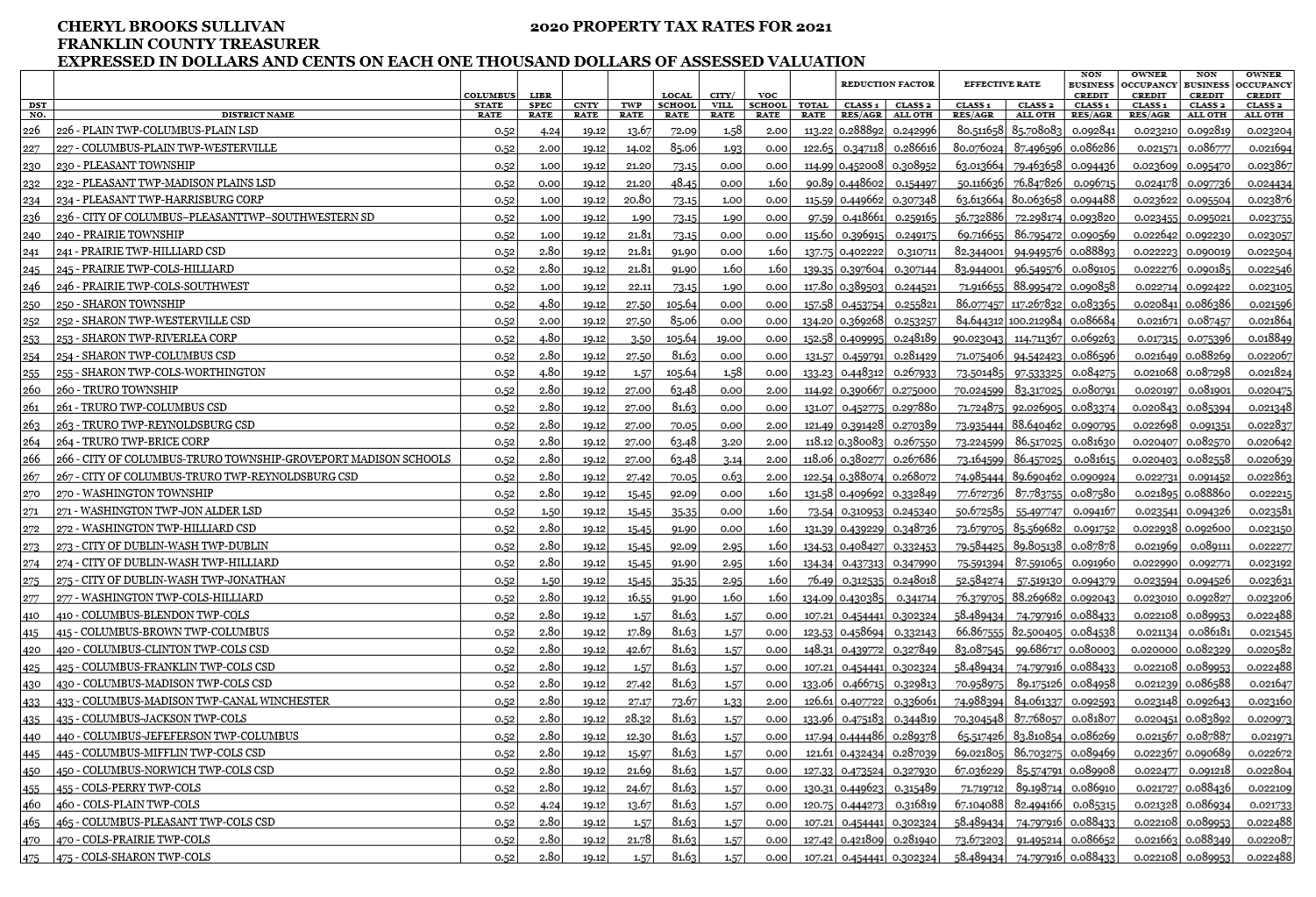

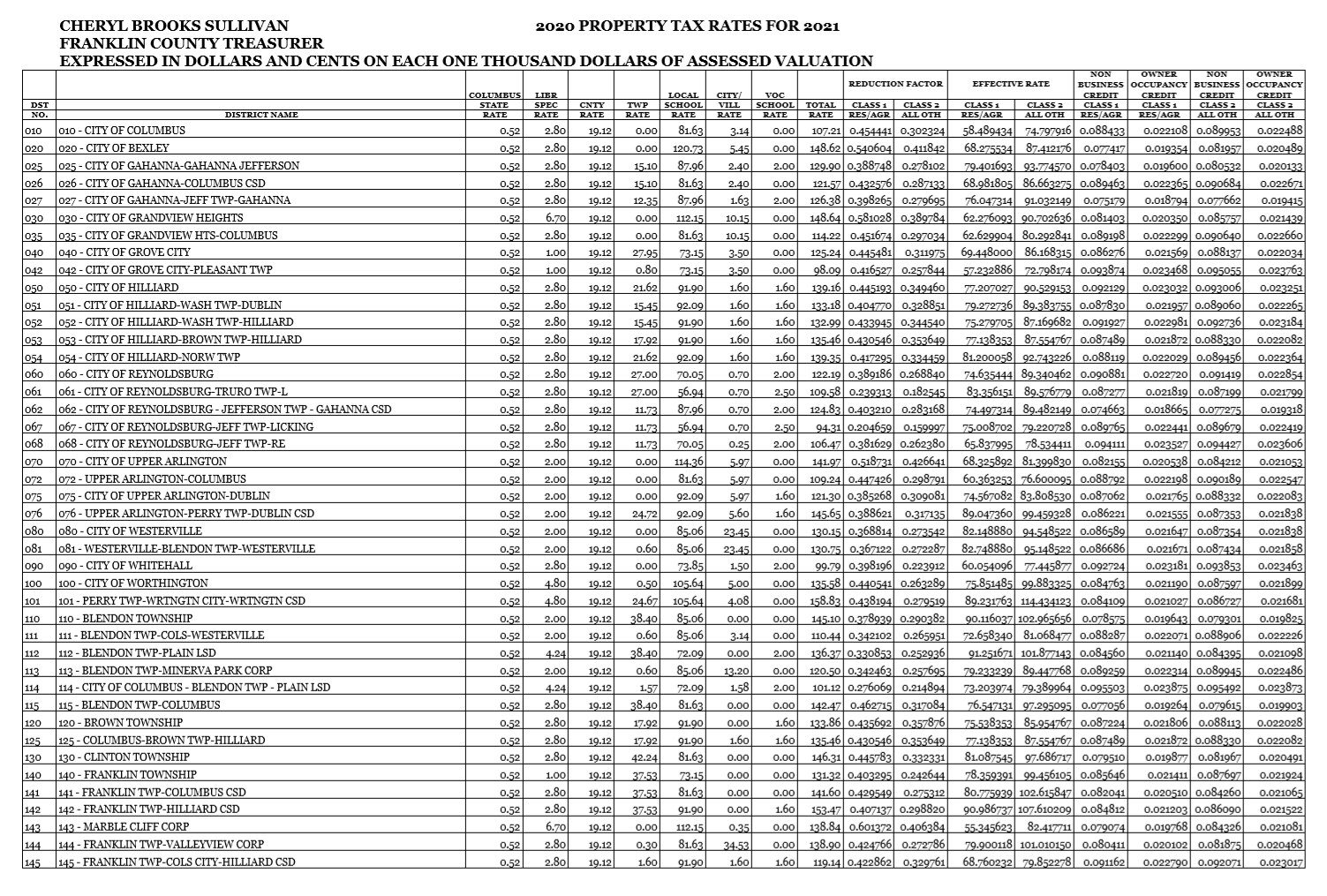

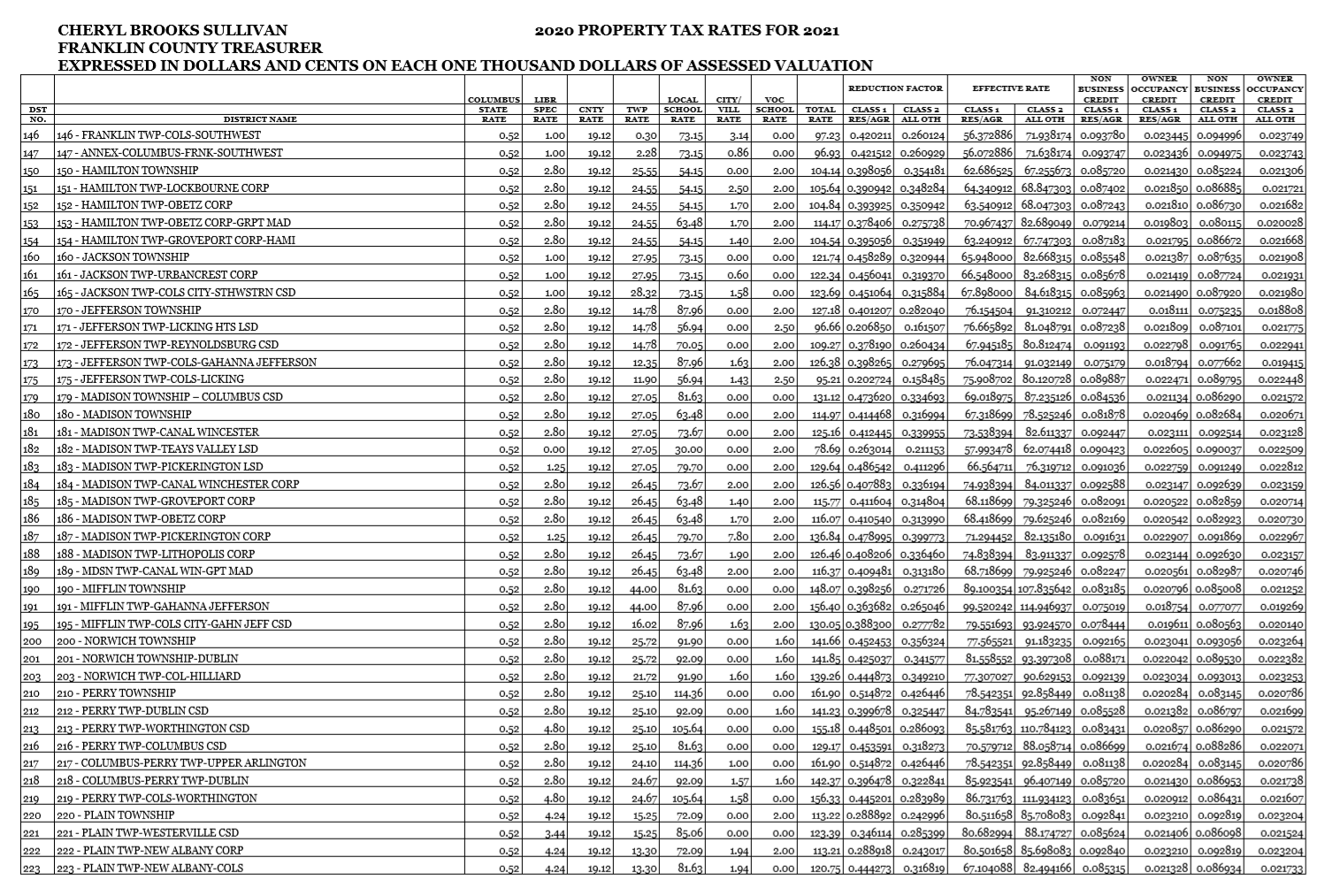

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

With The Storm Last Night And Prediction Of Thunderstorms Majority Of This Week If Your Building Or Home Suffers Damage Call Swartz Storm Get The Job Damaged

With The Storm Last Night And Prediction Of Thunderstorms Majority Of This Week If Your Building Or Home Suffers Damage Call Swartz Storm Get The Job Damaged

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

2020 Housing Market Predictions Realtor Com Housing Market Real Estate Marketing Commercial Real Estate Marketing

2020 Housing Market Predictions Realtor Com Housing Market Real Estate Marketing Commercial Real Estate Marketing

Florence S Village At The Mall Sold To Private Investor Commercial Real Estate Real Estate News Commercial Property

Florence S Village At The Mall Sold To Private Investor Commercial Real Estate Real Estate News Commercial Property

Become One Of The 87 And Let S Navigate The Real Estate Market Together Keller Williams Real Estate Real Estate Real Estate Agent

Become One Of The 87 And Let S Navigate The Real Estate Market Together Keller Williams Real Estate Real Estate Real Estate Agent

Auto Insurance Premums By State Car Insurance Tips Car Insurance Auto Insurance Quotes

Auto Insurance Premums By State Car Insurance Tips Car Insurance Auto Insurance Quotes

Clean Up Your Yard By Getting Rid Of These 10 Things Home And Garden Garden Yard

Clean Up Your Yard By Getting Rid Of These 10 Things Home And Garden Garden Yard

2839 Sq Ft For Sale In Cleveland Oh Land Century House Styles Selling Real Estate Cleveland

2839 Sq Ft For Sale In Cleveland Oh Land Century House Styles Selling Real Estate Cleveland

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Usa Map

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Spring Valley Subdivision Market Analysis November December 2018 Clermont Clermont Florida Florida Real Estate

Spring Valley Subdivision Market Analysis November December 2018 Clermont Clermont Florida Florida Real Estate

12 Important Things To Know Before Buying Investment Property In 2021 Concrete House Buying Investment Property Investment Property

12 Important Things To Know Before Buying Investment Property In 2021 Concrete House Buying Investment Property Investment Property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home