How Do I Look Up A Tax Lien In Ohio

Finally the Ohio Attorney Generals Offices Public Records Request Policy contains the Offices. Those who use bank loans to buy property.

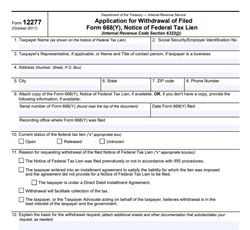

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio.

How do i look up a tax lien in ohio. Title Examinations that offers thorough information on judgments liens and bankruptcies on every transfer within a 42-year time period. Since tax lien records are public domain you can lookup lien information online anonymously. You can find out if you have a tax lien against you a few ways.

The majority of liens will be found in general index. The government cost for producing the standard ALS database listing CD is 13000. Other states and counties do not have such information online.

First you can either contact the IRS or your state franchise board and secondly you can use the resources of an online public records website. Here is a video that can give you all the information above in a more visual fashion if that is what you need to see. To begin your search for a Lien please click here to access our search site.

Once a lien is placed against a property the sale of that property will become problematic. Ohio Real Title Agency offers a quick turnaround time of 24 to 48 hours with reports delivered via fax mail or electronically via email. The Freedom of Information Act FOIA authorizes government agencies to recover the costs associated with processing requests for records.

A lien is a document that gets attached to assets or property when a creditor is trying to collect payment. In the video linked below Ted discusses the list of tax lien certificate states and some investment advantages of investing in tax lien certificates. Delinquent Taxes and Tax Lien Sales Jefferson County Treasurer Jefferson County Court House 301 Market Street Suite 104 Steubenville OH 43952 Phone.

TP Name and Address. The Finder is a service offered by the Office of Information and Technology OITDepartment of Administrative Services. Removing liens is complicated and for instance if the property is subject to a mortgage it must be paid completely in order for liens to be cleared.

This information may be searchable by address or owner name or lists of upcoming sales may be posted. If you have questions or concerns about information listed on The Finder please contact. When a tax lien is sold the property owner receives notification by certified mail with the name of the Lien Purchaser.

Lien Satisfaction Information Instructions If you havent received a notice of satisfaction from the party with the lien usually the Ohio Attorney Generals office then you should contact them first to get more information about obtaining the satisfaction. OIT Service Desk 614-644-6860 or 877-644-6860 or email. Just remember each state has its own bidding process.

The AGs Office has. Lien releases are sent to debtors and it is their responsibility to file the releases with the appropriate county officials such as the Clerk of Courts andor the County Recorder. If you do not have this information it is available across the hall in the Real Estate Transfer office with the property address or on AREIS Online.

740 283-8572 Free Search. Each lien record in the extracted file contains multiple fields including. The Liens filed at the Recorders Office are those that are required by law to be filed here.

Creditors use liens to collect on debts. Tax liens are sold in large bundles to qualified financial institutions. If you want to look up an individuals lien records you might be wondering how to get started so that you can reach your goal.

You may also contact the Montgomery County Treasurers Office at 937-225-4010. How can I find out if I have a tax lien against me. If you did not file the releases then the liens will still appear on your credit report.

Code 14943 B 2 The Ohio Attorney Generals Office strives for openness and transparency and values its responsibilities under the Ohio Public Records Act to maintain its records in an organized and efficient manner. Our goal is to help make your every experience with our team and Ohios tax system a success Jeff McClain. Our team can make the Property Lien Search process easier and more efficient for lenders municipalities consumers and realtors.

Liens on Record at the Recorders Office. The Recorders Office is just one of many locations where Liens may be filed. BMV Locations BMV Fees Find A Deputy Registrar Ohio EPA Check Information Next Of KinEmergency Contact Program The Childrens Save Our Sight Program Ohio Commercial Online Registration System Military Plates Issuance Information FAQ Contact Us.

Tax deed sales are the forced sale of a property at a public auction. Some states and counties have online information about foreclosures tax lien sales and tax deed sales. Free Lien Search Tax Liens Personal Liens Property Liens.

Call us to obtain a duplicate lien release if needed. If you do not see a tax lien in Ohio OH or property that suits you at this time subscribe to our email alerts and we will update you as new Ohio tax liens are published. Our records are set up by name so you will need the current owners name and the date purchased.

Check your Ohio tax liens rules.

Irs Tax Liens And Tax Lien Certificates Levytaxhelp Com

Irs Tax Liens And Tax Lien Certificates Levytaxhelp Com

How To Remove Tax Liens From Your Credit Report Updated For 2021

How To Remove Tax Liens From Your Credit Report Updated For 2021

Tax Liens And Your Credit Report

Tax Liens And Your Credit Report

When And Where To File Your Tax Return In 2018 Tax Return Tax Internal Revenue Service

When And Where To File Your Tax Return In 2018 Tax Return Tax Internal Revenue Service

Tax Lien Solutions Federal Tax Lien Relief Lifeback Tax

Tax Lien Solutions Federal Tax Lien Relief Lifeback Tax

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Irs Tax Lien Notice Of Irs Tax Lien

What Is A Tax Lien Credit Karma Tax

What Is A Tax Lien Credit Karma Tax

Which States Are The Best For Buying Tax Liens Alternative Investment Coach

Tax Lien Investing Pros And Cons Youtube

Tax Lien Investing Pros And Cons Youtube

How To Remove Tax Liens From Your Credit Report 3 Easy Steps

How To Remove Tax Liens From Your Credit Report 3 Easy Steps

What Is An Irs Tax Lien And How Does It Affect Me

What Is An Irs Tax Lien And How Does It Affect Me

Government Tax Lien Certificates And Tax Foreclosure Sale Properties

Irs Form 12277 Tips And Guidelines For When To Use This Form

Irs Form 12277 Tips And Guidelines For When To Use This Form

Irs Federal And State Tax Lien Help Genesis Tax Consultants

Irs Federal And State Tax Lien Help Genesis Tax Consultants

Tax Liens And Your Credit Report

Tax Liens And Your Credit Report

How To Buy State Tax Lien Properties In Florida Real Estate Get Tax Lien Certificates Tax Lien And De Arkansas Real Estate Ohio Real Estate Texas Real Estate

How To Buy State Tax Lien Properties In Florida Real Estate Get Tax Lien Certificates Tax Lien And De Arkansas Real Estate Ohio Real Estate Texas Real Estate

Labels: lien

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home