Who Qualifies For Homestead Exemption In Sc

Otherwise you would normally have to use the federal exemption which is set at 155675 for 2013-2016. What is the Homestead Exemption Program.

What The Interest Rate Increase Means For Homebuyers Fairway Interest Rates Mortgage Interest Rates Home Buying

What The Interest Rate Increase Means For Homebuyers Fairway Interest Rates Mortgage Interest Rates Home Buying

The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind.

Who qualifies for homestead exemption in sc. The Homestead exemption takes care of up to the first 50000 of the fair market value of the taxpayers dwellinghome. This exemption does not include county taxes on real property. To qualify for the Homestead Exemption you hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you are the beneficiary of a trust that holds title to your primary legal residence.

The SCDOR Exempt Property section determines if any property real or personal qualifies for exemption from local property taxes in accordance with the Constitution and general laws of South Carolina. Do I qualify for the Homestead Exemption Program. A homestead exemption is a legal mandate that shields a homeowner from the loss of his or her home usually due to the death of a home-owning spouse a debilitating illness or if.

This program exempts the first 50000 value of your primary home. You must also be one of the following. If youve lived in your home in South Carolina for at least 40 months over 3 years than you qualify for the South Carolina homestead exemption.

The Homestead Exemption credit exempts the first 50000 of the value reducing your yearly taxes due. Who qualifies for homestead exemption in SC. Homestead Exemption The Homestead Exemption is a program designed to help the elderly blind and disabled.

Those age 65 and over the blind the disabled or surviving spouses may be eligible for a 50000 deduction from the Assessors market value appraisal for their legal residence. The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind. The Homestead Exemption is a program designed throughout the state of South Carolina for taxpayers who are 65 years old or older totally and permanently disabled or legally blind.

The homestead exemption is not to be confused with Legal Residence. Are there any exemptions for active duty or retired military. It must also be registered and titled in the service members name to qualify for 100 exemption if ownership is jointother than spouse only 50 of the exemption will apply.

Real Estate taxation is a year in arrears meaning to be exempt for the current year you must be the owner of. If you are the surviving spouse of person who was qualified or could have been qualified for the Homestead Exemption at the time of his death and you are the owner of the home you may also receive the exemption. 65 years of age.

The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind. What other property tax exemptions are available for the disabled. If you are not the sole owner of the.

How is the SC Department of Revenue involved in the exemption process. You are the surviving spouse of a qualified Homestead recipient. As of December 31 preceding the tax year of the exemption I Was a legal resident of South Carolina for one year.

48-5-40 LGS-Homestead-Application for Homestead Exemption To be granted a homestead exemption. If statements 1 2 and 3 are true you are qualified to receive the Homestead Exemption. Generally a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence as of January 1 of the taxable year.

If statements 1 2 and 3 are true you are qualified to receive the Homestead Exemption. One of the criteria to qualify for homestead exemption in South Carolina is by December 31 of the year prior to application residents must be 65 years old be legally blind or. Surviving Spouse Benefit The surviving spouse of a qualified or potentially qualified Homestead recipient may also receive the benefit if.

In 2007 legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under SC Code of Laws Section 12-43-220 c. Most property tax exemptions are found in South Carolina Code Section 12-37-220. The Homestead Exemption credit continues to completely exempt the value of 50000 for all purposes except for school operating purposes already exempted by the new 2007 legislation.

In order for your mobile home to qualify it must be your primary residence. As of December 31 preceding the tax year of the exemption you were a. I hold complete fee simple title or life estate to my primary residence.

Homestead Exemption Pickens County Taxpayer S Association

Homestead Exemption Pickens County Taxpayer S Association

What Is Homestead Exemption James Gay S Blog Banksouth Mortgage

What Is Homestead Exemption James Gay S Blog Banksouth Mortgage

Https Www Kershaw Sc Gov Home Showdocument Id 5091

Taking It A Step Further Home Fortification Tactics The Prepared Page Fortification Home Defense Home Security Systems

Taking It A Step Further Home Fortification Tactics The Prepared Page Fortification Home Defense Home Security Systems

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Best Map Of Sandestin And 30a Beaches Map Of Scenic 30a And South Walton Florida 30a In 2021 Map Of Florida Beaches 30a Beach Map Of Florida

Https Www Newberrycounty Net Sites Default Files Uploads Departments Auditor Id 1618 Pdf

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

Your 2019 Guide To Filing Your Homestead Exemption Bhgre Homecity

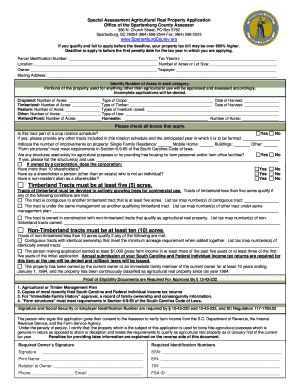

Homestead Exemption Spartanburg Sc Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Spartanburg Sc Fill Online Printable Fillable Blank Pdffiller

South Carolina Launches No Cost Solar Program Solar Panels Solar Solar House

South Carolina Launches No Cost Solar Program Solar Panels Solar Solar House

6 Things To Know About Homestead Exemptions Newhomesource

Https Www Aikencountysc Gov Reference Tau Homestead Pdf

Ten Tips To Prevent A Barn Fire Homesteading Best Barns Barn

Ten Tips To Prevent A Barn Fire Homesteading Best Barns Barn

How Capital Gains Tax Works Capital Gains Tax Capital Gain Federal Income Tax

How Capital Gains Tax Works Capital Gains Tax Capital Gain Federal Income Tax

Https Dor Sc Gov Resources Site Lawandpolicy Advisory 20opinions Rr97 18 Pdf

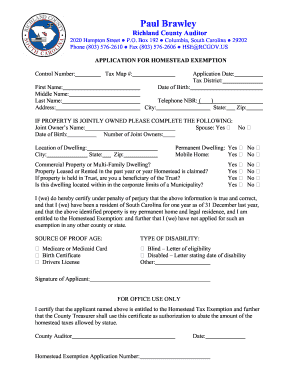

Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

Homestead Exemption Fill Out And Sign Printable Pdf Template Signnow

This Video Discusses The Homestead Exemption Laws You Can View More Videos About What Do You Need To Know Abou Texas Real Estate Real Estate Studying Library

This Video Discusses The Homestead Exemption Laws You Can View More Videos About What Do You Need To Know Abou Texas Real Estate Real Estate Studying Library

40 Projects For Building Your Backyard Homestead A Hands On Step By Step Sustainable Living Guide Walmart Backyard Farming Urban Chicken Farming Backyard

40 Projects For Building Your Backyard Homestead A Hands On Step By Step Sustainable Living Guide Walmart Backyard Farming Urban Chicken Farming Backyard

2018 Guide To Maine Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive West Virginia

2018 Guide To Maine Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive West Virginia

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home