Veterans Property Tax Exemption Nyc

Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief STAR program. The exemption provides a basic property tax exemption of either 10 or 15 percent of assessed value as adopted by the municipality to veterans who served during the Cold War period.

It S Easy To Apply For Property Tax Exemptions Fnyhc

It S Easy To Apply For Property Tax Exemptions Fnyhc

Parents of soldiers who died in the line of duty Gold Star parent can get a reduction to their property tax.

Veterans property tax exemption nyc. Both exemptions reduce the assessed value of the recipients property before taxes are assessed on it. You will also need to provide one of the following. Documents on this page are provided in pdf format.

These benefits can lower your property tax bill. Armed Forces including veterans who have served in the US. Veterans Property Tax Exemptions Application can be obtained by the Suffolk County Veteran Service Agency.

The Veterans Exemption helps veterans and their family members reduce their property taxes. NY State Veterans Tax Exemptions. Obtaining a veterans exemption is not automatic If youre an eligible veteran you must submit the initial exemption application form to your assessor.

The property must be the veterans primary residence. To be eligible for the Veterans Exemption the property must be your primary residence. The exemption applies to county city town and village taxes.

The spouse of a qualified veteran. For the Clergy Exemption you dont have to live on the property to get the exemption but you must be a resident of New York State. There are three different property tax exemptions available to veterans who have served in the U.

Veteran Exemption The veterans exemption is available to eligible veterans of foreign wars expeditionary medalists honorable discharges spouseswidow ers of veterans and Gold Star parents. Proof of service discharge under honorable conditions. There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces.

This exemption is not available to those veterans currently receiving either the eligible funds or. The surviving spouse of a qualified veteran who has not remarried. Exemptions may apply to school district taxes.

THE CURRENT VETERANS EXEMPTION LAW State law provides that Nassau County veterans applying for the first time for a Veterans Real Property Tax Exemption shall receive an exemption based on the type of service they rendered to their country during wartime. Veterans Property Tax Exemption NYC Department of Finance. This exemption is called the Alternative Veterans Exemption.

Thanks to changes in city and state law the Alternative Veterans and Eligible Funds tax exemptions have been expanded and will now apply to. The SCHE DHE STAR and Veterans exemptions have primary residence requirements. To be eligible the property must be your primary residence and you must be.

Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. The Eligible Funds exemption is for veterans who bought homes using eligible funds including pensions bonuses insurance and mustering out pay. A veteran who served during one of the Qualified Service periods of war or conflict.

The City of New York offers tax exemptions and abatements for seniors veterans clergy members people with disabilities and other homeowners. You are a qualified disabled Veteran under Federal Title 38 Part III Chapter 39 or You qualify for and apply for Congressional Medal of Honor custom plates or. New York veterans may be eligible for one of three property tax exemptions for a veteran-owned primary residence.

The Form DD-214 is usually used to indicate discharge under honorable conditions. New York State currently offers eligible veterans a choice to apply for one of three property tax exemptions for their primary residence. Most of the exemptions are not specifically aimed at disabled veterans but additional discounts or considerations apply for those with VA-rated disabilities.

Eligible veterans whod like to get property tax relief in NYS should submit a property tax exemption application to the assessor. Qualified Veterans spouses or their un-remarried surviving spouses. Apply online by March 16th for benefits to.

These exemptions are managed by the NYS Department of Finance and Taxation and administered by county and municipal tax assessors. Through the New York State Department of Motor Vehicles DMV Veterans can qualify to be exempt from registration fees and vehicle plate fees if. Veterans can receive one of the three following exemptions.

Army Navy Air Force Marines and Coast Guard. Information on the exemption can be obtained by calling their town tax assessor s office. Babylon Tax Assessors Office at 631 957-3014 Brookhaven Tax Assessors Office 631 451-6300.

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Nonprofits Skirt Taxes For Subsidized Housing News4jax Wjxt Property Tax Estate Tax Tax Attorney

Nonprofits Skirt Taxes For Subsidized Housing News4jax Wjxt Property Tax Estate Tax Tax Attorney

Http Www Nyc Gov Portal Apps 311 Literatures Dof Ownersexemptappl 09 05 2013 Pdf

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

Disabled Veterans Personal Property Tax Exemption Virginia Property Walls

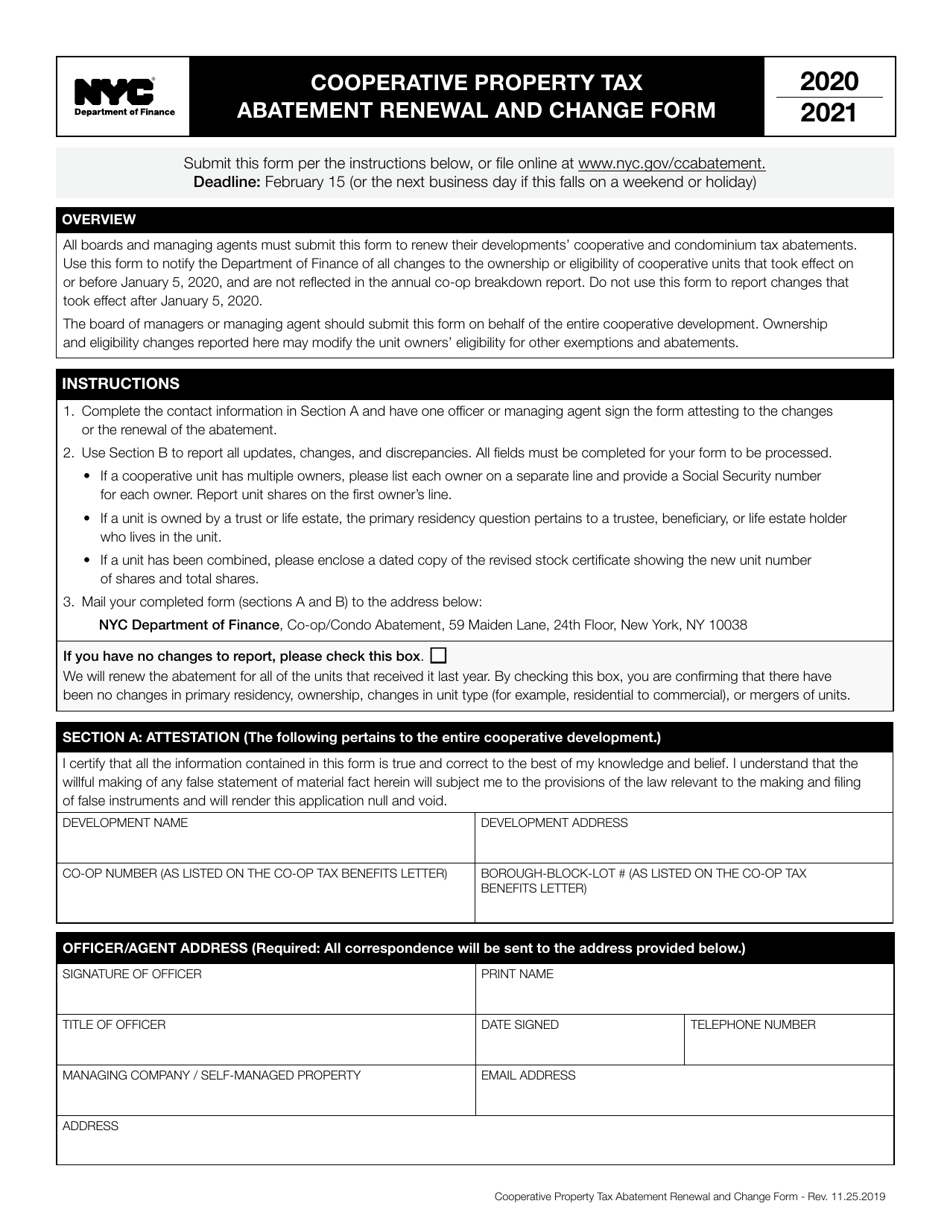

2021 New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

2021 New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

What Is The Enhanced Star Property Tax Exemption In Nyc Youtube

What Is The Enhanced Star Property Tax Exemption In Nyc Youtube

Veterans Property Tax Exemption By State Pro Tips

Veterans Property Tax Exemption By State Pro Tips

Andre On Twitter Roam Data Mobile

Andre On Twitter Roam Data Mobile

Access Your Benefits For Caregivers Of Veterans Veteran Caregiver Benefit

Access Your Benefits For Caregivers Of Veterans Veteran Caregiver Benefit

If You Want To Hire An Immigration Lawyer You Must Have Complete Guide About Immigration Lawyers Read Out Immigration Law Immigration And Customs Enforcement

If You Want To Hire An Immigration Lawyer You Must Have Complete Guide About Immigration Lawyers Read Out Immigration Law Immigration And Customs Enforcement

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

6 Facts Every Homeowner Should Know About Property Taxes Las Vegas Review Journal

6 Facts Every Homeowner Should Know About Property Taxes Las Vegas Review Journal

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home