Property Tax Washington State Vs Texas

In 1798 Revolutionary War hero Paul Reveres property tax rate was 6 ouch. Attorney Generals Office The Washington State Attorney Generals Office has some helpful information if you are facing foreclosure on your property.

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

Income Tax by State.

Property tax washington state vs texas. 0862 of a percent to be. See property tax exemptions and deferrals for more information. Based on this chart Oregon taxpayers pay 84 of their total income to state and local taxes.

Washington taxpayers pay 82. 52 rows The state property tax contributes 3008 towards the overall income. Where does your property tax go.

Property taxes make up at least 94 percent of the states General Fund which. In New Hampshire property taxes generate 38 of state revenues. Voter-approved property taxes imposed by school districts.

New census data on state taxes across the US. State property taxes Overall the effective property tax rate for homeowners is 12 in the US. King County collects the highest property tax in Texas levying an average of 506600 156 of median home value yearly in property taxes while Terrell County has the lowest property tax in the state collecting an average tax of 28500 067 of.

Heres an updated look at housing costs when buying a home in Washington State versus Oregon in 2021. 1373 average rate per 1000 of assessed value 128 Real Estate Excise Tax. Use this tool to compare the state income taxes in Washington and Texas or any other pair of states.

State funding for certain school districts. 03 Included in the 84 sales tax 062 flat rate payroll tax. However the above chart provides a rather crude measurement of comparative state and local tax burdens since everybody is.

The overall tax burden in Florida is the 4th lowest of the 50 states while Texas comes in at 13 according to a study by Wallethub. Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one. Washington and Oregon are alike in many ways but when it comes to how we tax ourselves were more like mirror images.

On a median home of 178600 thats an annual tax bill of 2149. The study looked at the combined burden of state and local excise individual income property and sales taxes. Show that Oregon.

Overall Tax Burden Florida Versus Texas. For income taxes in all fifty states see the income tax by state. Before analyzing the states with the highest taxes in this category we must mention the nine states without income tax whatsoever Washington Nevada Texas.

Deferral of property taxes Depending on your income you can defer property tax payments. Real and Personal Property Tax. This tool compares the tax brackets for single individuals in each state.

At the statewide level home values in Washington and Oregon are not too far off from each other. Another essential factor that affects the state tax burden rankings is the income tax. The exact property tax levied depends on the county in Texas the property is located in.

In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019. For real-estate property tax rates we divided the median real-estate tax payment by the median home price in each state. For more information about the income tax in these states visit the Washington and Texas income tax pages.

Today Boston has among the lowest city property tax rates in the nation. State Local Retail Sales Tax. For example while the state of Washingtons citizens dont pay income tax they still end up spending over 8 of their annual income on sales and excise taxes.

As of 2019 according to the Census Bureau. Property taxes imposed by the state. Buying a Home in Washington vs.

Lets take a closer looking at how buying a Washington home compares to buying a home in Oregon. We then used the resulting rates to obtain the dollar amount paid as real-estate tax on a house worth 217500 the median value for a home in the US. State Rate 65 Vancouver Rate 19 Total.

1907 average rate per 1000 of assessed value. He paid 75 in property taxes on his Boston home valued at 1250.

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Taxes How Much Are They In Different States Across The Us

Property Taxes How Much Are They In Different States Across The Us

The States Where People Are Burdened With The Highest Taxes Zippia

The States Where People Are Burdened With The Highest Taxes Zippia

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

How School Funding S Reliance On Property Taxes Fails Children Npr

How School Funding S Reliance On Property Taxes Fails Children Npr

States That Won T Tax Your Retirement Distributions Retirement Budget Retirement Income Tax

States That Won T Tax Your Retirement Distributions Retirement Budget Retirement Income Tax

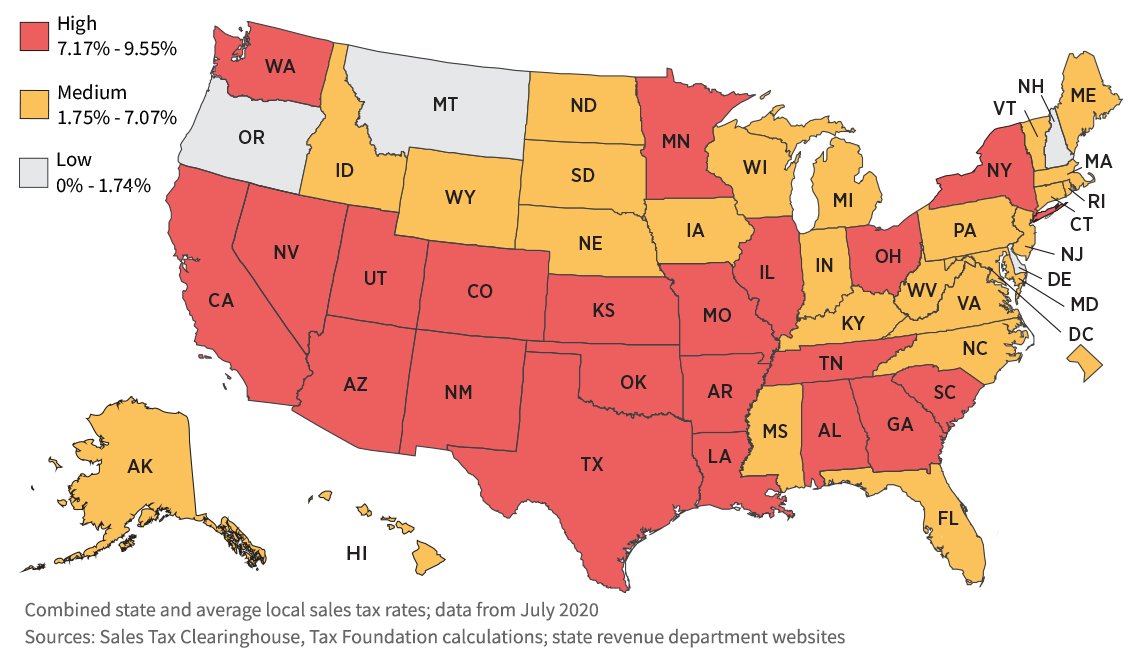

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

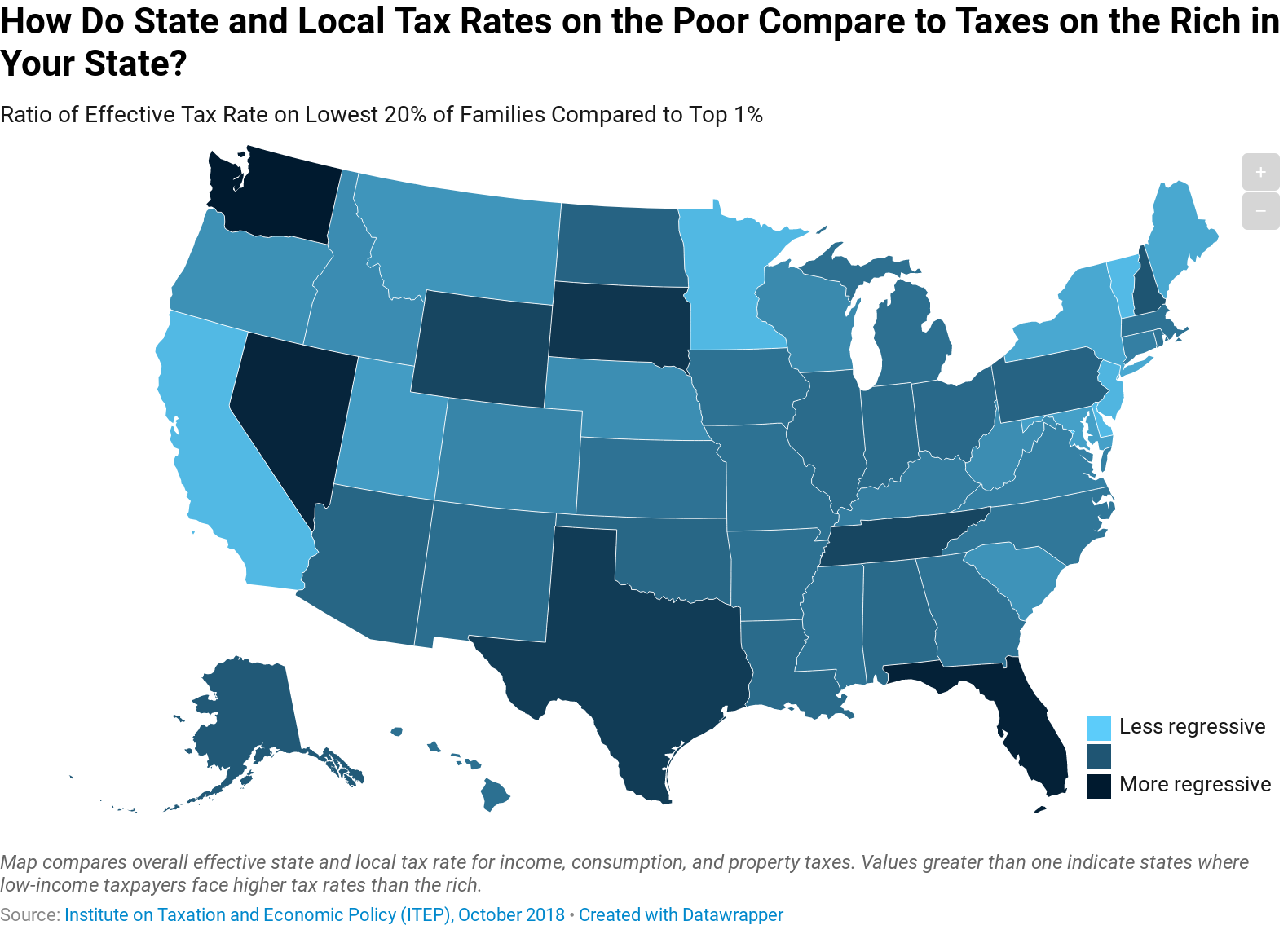

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

Labels: property, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home